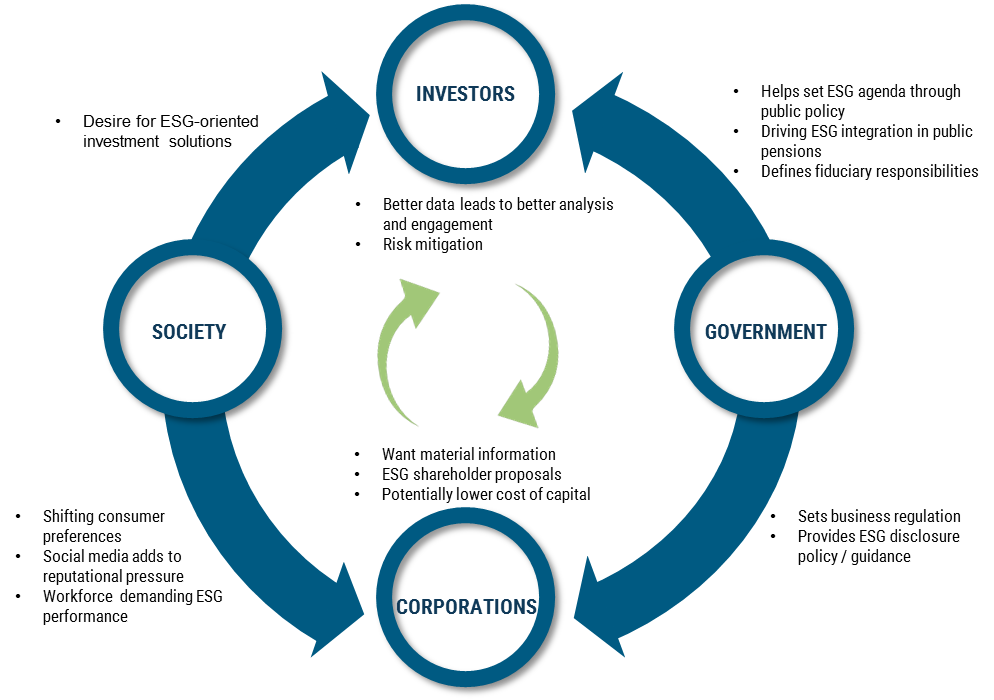

Momentum from social media to CEOs, activism to AUM

ESG AUM accelerating for mutual funds and ETFs, approaching $1 trillion. Global dedicated ESG/SRI fund AUM grew 29% in 2017 v. 10% in 2016, while ESG ETF flows are on pace to grow ~250% from last year.

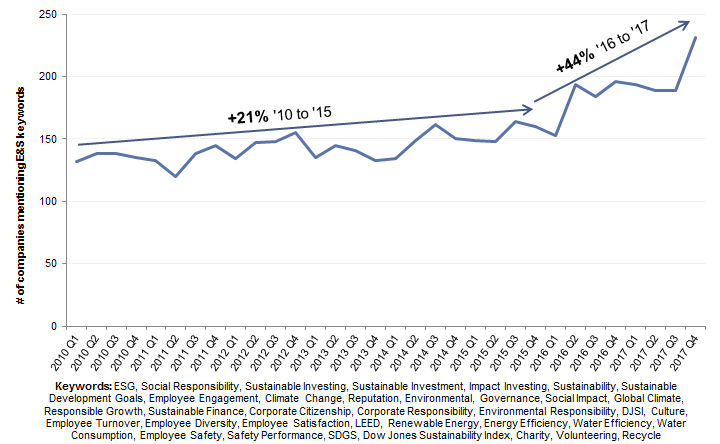

Nearly half of S&P 500 companies addressed ESG topics in 4Q conference calls. We provide a catalog of notable company quotes from a diverse set of corporates including Best Buy, Cognizant, Ingersoll Rand, Marriott, P&G and others.

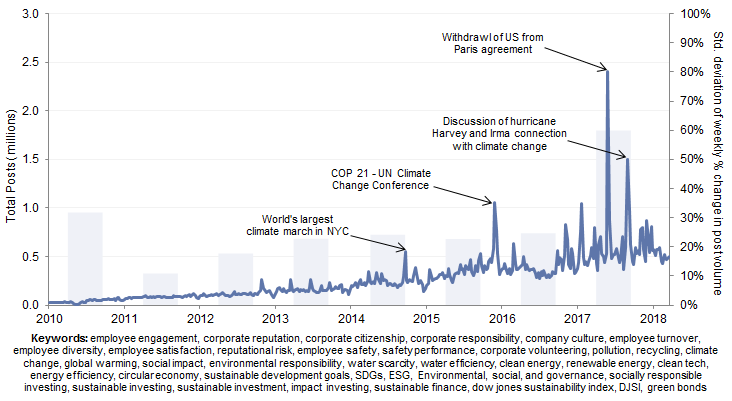

Society's rallying call on ESG topics are getting louder. Twitter posts mentioning ESG topics grew 19x over the last five years and are becoming more 'trendable' - spikes in activity more than doubled in 2017 vs. 2016 as measured by weekly standard deviation.

Heavyweights enter the ring as investor activism on ESG picks up. Environmental and social shareholder proposals represented 41% of all documented shareholder proposals in 2017, up from 33% in 2016 including contributions from BlackRock, Vanguard, Fidelity, Capital Group and others.

Decibels rising

1) Society's voice growing louder

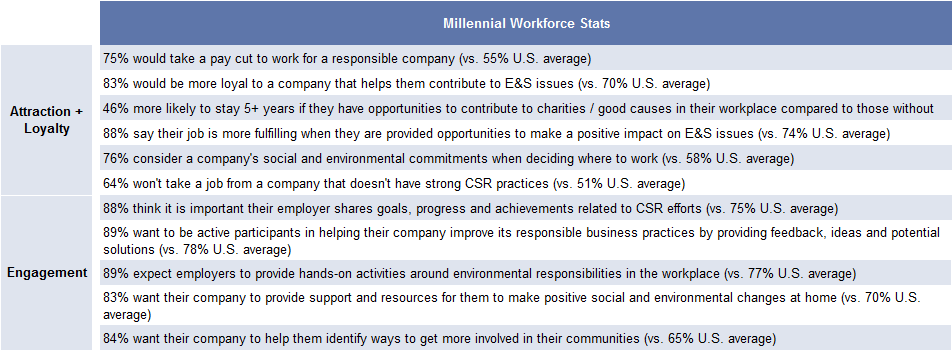

Changing demands from the workforce

Exhibit 3: ESG initiatives can make workers more engaged and more loyal

2) ESG finally arriving on the quarterly earnings call

Sample Corporate Quotes from 4Q 2017 earnings

3) Investment giants awaken to meet the demand

Rising tide for ESG AUM. We identify two sources for measuring the size and growth of ESG AUM that we believe offer more focused and accurate assessments than some commonly cited measures. Each of these point to accelerating growth of assets in the space. Global ESG/SRI open-ended funds (including exclusionary screens) saw 29% AUM growth in 2017 vs. 10% in 2016, with total global AUM reaching $900 bn by the end of February 2018 according to Morningstar. Excluding funds with negative screens not core to the investment strategy, total global ESG fund AUM grew 37% in 2017 to $445 bn, while in the first two months of 2018, ESG ETFs have seen inflows of $1.3 bn compared to $3.2 bn for all of 2017 according to Bloomberg. We note that these numbers don't include SMAs or funds that integrate ESG but market it as such, suggesting these numbers provide a floor for total ESG AUM with the overall value likely being much larger.

More from ETFs and green bonds. Based on data from BlackRock, 22 and 18 ESG ETF's were launched in 2016 and 2017, respectively, compared to a combined 24 over the previous 10 years. Furthermore, green bond issuances are expected to exceed $250 bn in 2018, up 60% and eclipsing $155 bn in 2017 according to Moody's.

Cost of capital now directly being tied to ESG performance in some cases. We have identified four publicly disclosed cases of banks directly linking loan margins to corporate ESG performance for Danone, Royal Phillips, Olam International and Unibail-Rodamco. For example, a $2 bn syndicated credit facility for Danone will be directly adjusted, up or down, based on 1) sales from their sustainably certified ('B Corp') subsidiaries and 2) third-party independent ESG scores. This ultimately links ESG directly to the cost of capital and should spur ESG disclosure looking forward, in our view.

ESG is directly impacting credit ratings, as agencies integrate ESG factors into their risk assessment and ratings methodologies. For example, S&P Global Ratings had 106 cases between July 2015 and August 2017 where environmental and climate concerns directly impacted a company's rating through either an upgrade, downgrade, outlook revision or CreditWatch placement.[1]

Environmental and Social shareholder proposals rising. E&S proposals made up around 41% (345) of all shareholder proposals (approx. 827) in 2017, up from 33% (299 E&S, 916 total) in 2016.[2] A preview of the 2018 proxy season shows similar rates of E&S proposals filed compared to last year.[3] While average support remained low at 21.4%, this has increased from 19.7% in 2016. Proposals included topics addressing climate change, diversity, wage gaps, sustainability reporting, supply chain impacts, etc. The number of proposals that received majority support has also increased, with 6 proposals being passed in 2017, up from 4 in 2016.[4]

The largest asset managers are flexing their muscle on ESG issues. Four of the ten largest asset managers voted for E&S proposals for the first time in 2017, including Fidelity and Capital Group, along with BlackRock and Vanguard who both voted against Exxon Mobil and Occidental on climate proposals. Each of the latter organizations have committed to adding additional ESG resources, with BlackRock saying they will double the size of their investment stewardship team over the next three years to "foster even more effective engagement" with companies.

Recent asset manager acquisitions point to arms race in ESG expertise. Beyond the steady growth of internally incubated ESG expertise, we also observe the outright acquisition of specialized ESG investment shops in select cases, including tie-ups of Eaton Vance with Calvert Investments, Impax with Pax World, and La Française with Inflection Point Capital Management.

Investor ESG quotables - it's not just BlackRock

4) Governments and IGO's pressing ahead

38 of the top 50 economies have or are developing some sort of government-led ESG disclosure guidelines for corporations according to PRI. While most of these are voluntary or comply-or-explain they help raise awareness and offer guidance for structuring corporate disclosure on ESG topics.[5] Most notably the EU has enacted the mandatory Non-Financial Reporting Directive (NFRD) for large companies (500 or more employees) to disclose non-financial information and discuss social and environmental topics in their annual reports starting in 2018.

The US DOL provided ESG guidance on ERISA fiduciary duty requirements that clarified ESG considerations as important in their own right to a fiduciary's "primary analysis of the economic merits of competing investment choices". The guidance further stated that "the Department does not believe ERISA prohibits a fiduciary from addressing ETIs or incorporating ESG factors in investment policy statements or integrating ESG-related tools, metrics and analyses to evaluate an investment’s risk or return..."[6] This marked a change from previous guidance that raised questions as to the fiduciary suitability of ESG integration.

The European Commission took steps to steer capital towards sustainable long-term investments by establishing the High-Level Expert Group (HLEG) to develop recommendations for key financial system stakeholders including banks, insurance companies, asset managers, pensions, credit raters, consultants and investment banks. The final report and priority actions recommended by the HLEG include "establishing an EU sustainability taxonomy... clarifying investor duties to extend the time horizons of investment and bring greater focus on environmental, social and governance (ESG) factors into investment decisions, [and] upgrading disclosures to make sustainability opportunities and risks transparent" [7] The Commission has already enacted actions plans based on the HLEG's recommendations, including proposing the inclusion of ESG factors in the mandates of the European Supervisory Authorities (ESA).[8]

193 countries agreed upon the 17 Sustainable Development Goals (SDGs) set forth by the UN on September 25, 2015. The SDGs provide objectives covering a wide range of environmental, social and economic issues including poverty, hunger, health, education, climate, gender equality, water, energy, sanitation and social justice. Each goal has specific targets, 169 in total, to be achieved by 2030. A range of investors have taken action to make the SDGs investable while select companies have begun addressing relevant goals through their operations and sustainability initiatives.

The world's largest pension fund takes a strong stance. Japan's Government Pension Investment Fund with US$1.4 tn of assets under management now requires external asset managers to incorporate ESG. GPIF’s size and focus on ESG integration is having a material impact on investor stewardship and engagement with ESG, including for passive asset managers. On March 13, 2017, GPIF issued a call for applications from managers of passive Japanese equities that included a review of stewardship activity policies from applicants.

Beyond the earnings call: Disclosure, strategy and activism

ESG data gaps are shrinking. Disclosure on quantifiable metrics (energy usage, CO2 emissions, employee turnover, injury rates, etc.) incorporated in our E&S scoring framework has increased every year since 2010, rising from 26% of the MSCI ACWI universe in 2010 to 37% in the latest completed reporting cycle ('15-16).

Sustainability in communication of long-term strategy. Through the Strategic Investor Initiative Forum, CEOs from over 20 large public companies including Unilever, Aetna, Medtronic, Johnson & Johnson, IBM, Becton Dickinson, UPS, 3M and Delphi have proactively presented their long-term strategy and ESG initiatives directly to shareholders, a trend that we expect to continue to progress.

Growing corporate activism on environmental and social issues. From Walmart's voluntary wage increases and stricter limits on gun sales, to CVS dropping tobacco and removing chemicals of concerns from hundreds of its products, to Shell disclosing its plan for a 2-degree scenario, the examples of corporates proactively addressing key E&S issues that are core to their operations and long-term strategy are proliferating.

Additional corporate quotes from 2016/2017 earnings

- 1 ^ S&P Global Ratings, How Does S&P Global Ratings Incorporate Environmental, Social, And Governance Risks Into Its Ratings Analysis, Nov, 2017

- 2 ^ Shareholder Proposal Developments During the 2017 Proxy Season, Harvard Law School Forum, July 12, 2017

- 3 ^ Proxy Preview 2018, As You Sow, the Sustainable Investments Institute, and Proxy Impact, www.proxypreview.org

- 4 ^ Environmental and Social Proposals in the 2017 Proxy Season, Harvard Law School Forum, Oct 2017

- 5 ^ Global Guide to Responsible Investment Regulation, Principles for Responsible Investment, 2016

- 6 ^ Interpretive Bulletin Relating to the Fiduciary Standard Under ERISA in Considering Economically Targeted Investments, Doc # 80 FR 65135, Department of Labor, Oct 25th 2015

- 7 ^ Sustainable finance, EU Commission, https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance_en

- 8 ^ Sustainable finance: Commission's Action Plan for a greener and cleaner economy, European Commission, March 08, 2018, http://europa.eu/rapid/press-release_IP-18-1404_en.htm

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.