- Intro

- Executive Summary

- The Audience Opportunity

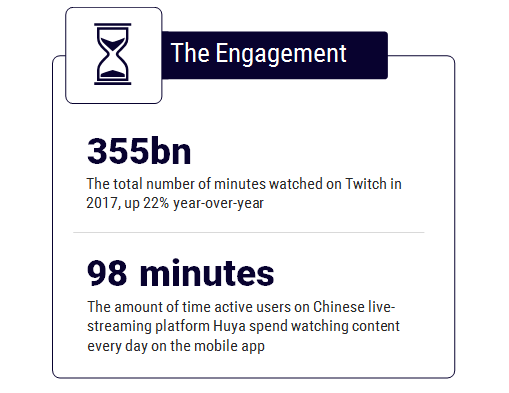

- eSports Can Extend Franchise Life and Drive Audience & Engagement

- League Infrastructure Will Create Opportunities for Direct Monetization

- Fortnite and the "Moneymaker Effect"

- A New Paradigm for Distribution

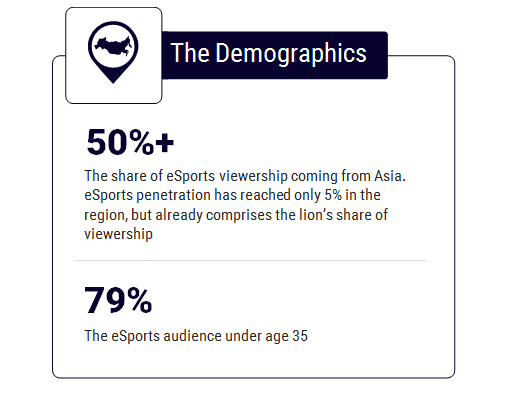

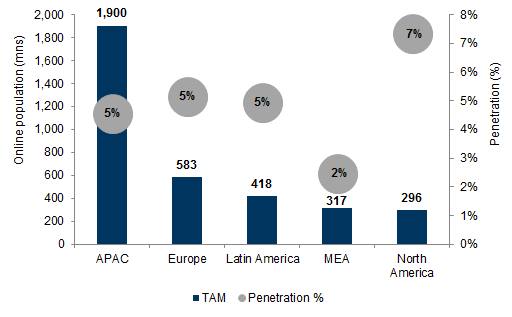

- Asia is Leading the Way for eSports Globally

- New Platforms for eSports

- The Venture Landscape

Executive Summary

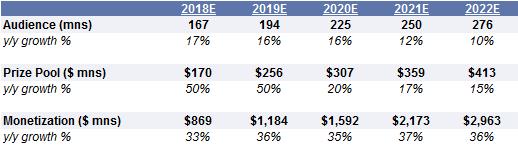

The Audience Opportunity

Exhibit 2: Twitch and YouTube Gaming have a larger audience than many entertainment platforms

Exhibit 3: The eSports audience is similar to the average of large professional sports leagues

Exhibit 4: We estimate LoL finals cumulative viewership was comparable to other major sports finals

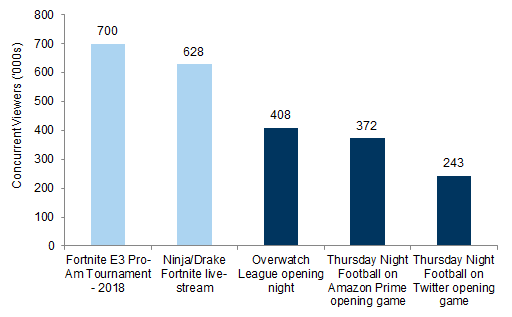

Exhibit 5: The Overwatch World League's opening night viewership surpassed Thursday Night Football's streaming debuts

Exhibit 6: APAC's TAM is nearly 4x that of any other region

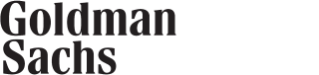

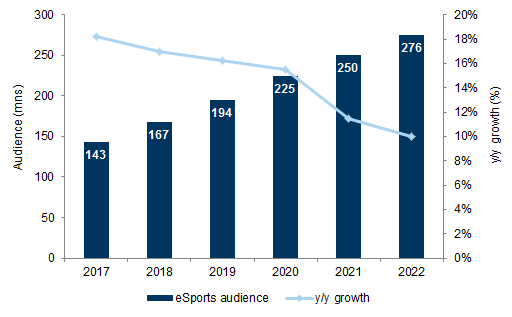

Exhibit 7: We expect the eSports audience to grow at a 14% 5-year CAGR

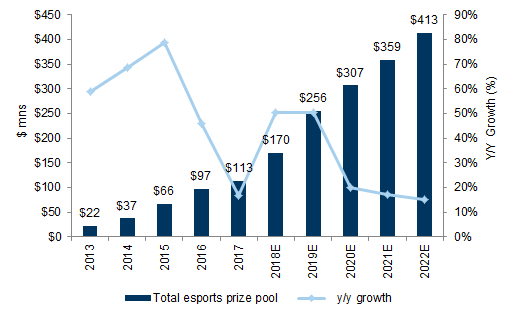

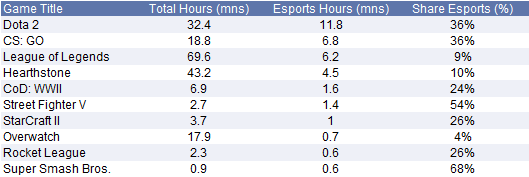

Exhibit 8: Dota 2 has the largest prize pool of all eSports titles

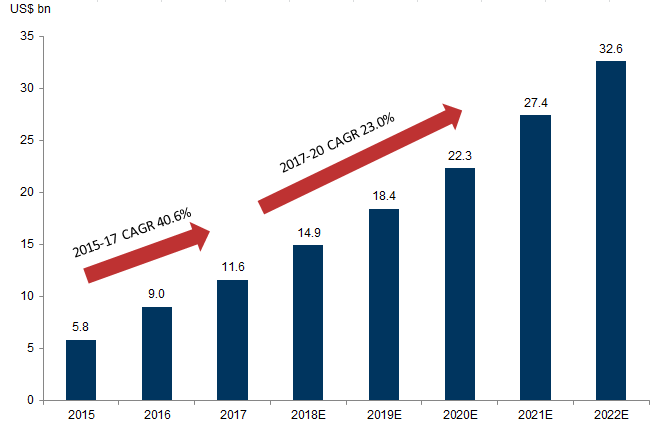

Exhibit 9: We estimate the eSports prize pool will grow at a 30% 5-year CAGR between 2017 and 2022E

eSports Can Extend Franchise Life and Drive Audience & Engagement

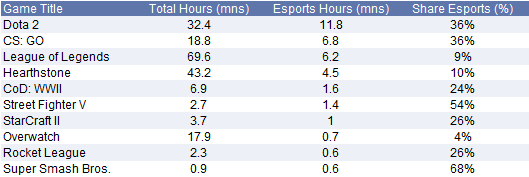

Exhibit 10: Seven of the top 15 eSports titles...

Exhibit 11: ...Are also among the top 15 highest monetizing PC & console titles in-game

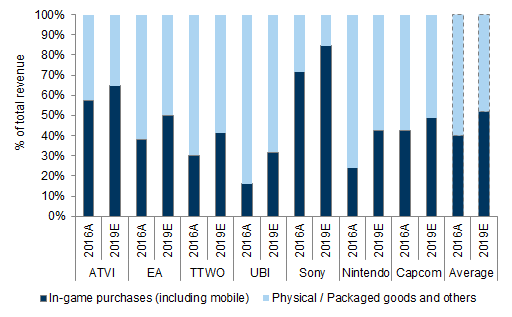

Exhibit 13: In-game revenue (including mobile) should reach 52% of total revenue on average in 2019E

Exhibit 14: Sales & Marketing as a % of revenue is declining for ATVI/EA

League Infrastructure Will Create Opportunities for Direct Monetization

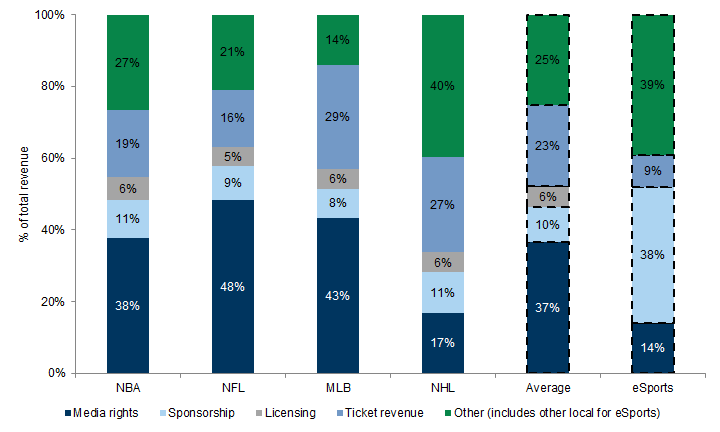

Exhibit 15: eSports dramatically under-index on monetization relative to established sports leagues

Exhibit 16: 37% of revenue in traditional professional sports is derived from media rights

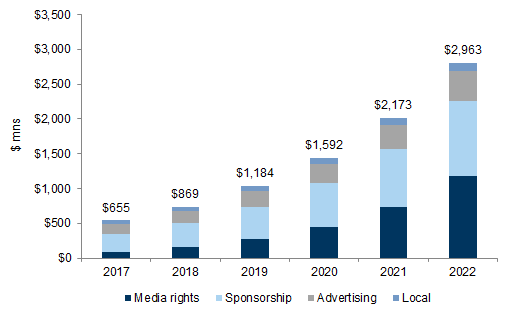

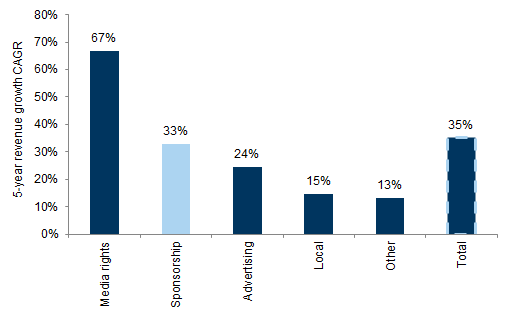

Exhibit 19: We forecast eSports revenue growing at a 35% 5-year CAGR through 2022E

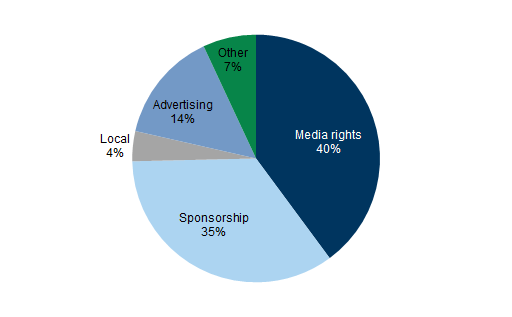

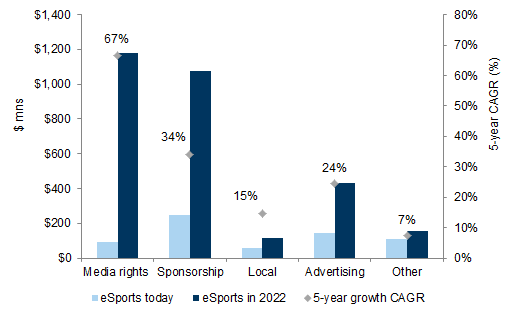

Exhibit 20: We forecast media rights revenue will grow at a 67% 5-year CAGR, driving overall eSports revenue growth

Overwatch is a team-based, multi-player, first-person-shooter video game published by Blizzard Entertainment, a subsidiary of Activision Blizzard.

League of Legends is a multi-player online battle arena (MOBA) video game published by Riot Games, which is majority-owned by Tencent.

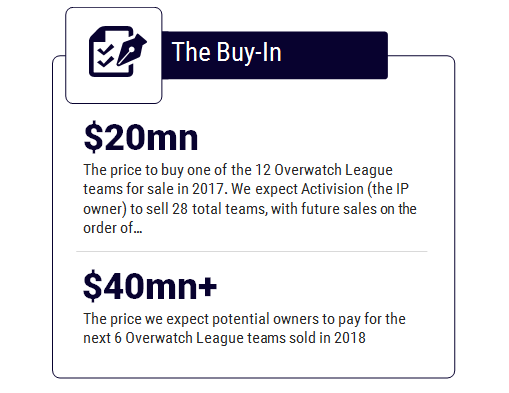

IP Ownership. Both Activision and Tencent (through Riot Games) own the IP around which the leagues are formed. This gives them the ability to control the structure of the league and participate in league revenue streams, along with team owners. Also, both Activision and Tencent sold teams to investors - $20mn / team (link) for the initial cohort of teams for the Overwatch League and $10mn / team for LoL North America League - which raised the revenue necessary to build league infrastructure. Generally, both Activision and Tencent targeted team owners that are current owners of other pro sports teams (Robert Kraft, Jeff Wilpon, etc), to leverage their knowledge of how to generate local revenue streams, which along with national distribution / sponsorship revenue can help to generate financial returns.

No relegation. In past iterations of eSports leagues, teams were not guaranteed a fixed spot in the league; if a team was underperforming, it could be replaced without recourse - a process known as relegation. Importantly, the team sales for OWL and the LoL leagues guaranteed permanent spots in the league for owners, as is true for all major sports leagues in North America. Also, each team has a permanent regional home, which should help generate local fan interest and create opportunities for the local revenue streams that on average represent 53% of major sports league revenue.

Player salaries. In addition to having teams in fixed locations, players are also guaranteed salaries, which makes it easier for those players to stay with a team and train for gameplay, as opposed to the prior model of just playing for prize money with mixed results. We believe the prospect of salaries will attract more aspiring eSports players to the pro ranks, increasing the quality of gameplay and fan interest.

Media rights. With the creation of established eSports leagues, we have seen landmark distribution deals. For example, Activision signed a two-year $90mn deal with Twitch to distribute the Overwatch League in North America. In China, Activision signed non-exclusive deals with ZhanQi TV, Panda TV, and NetEase CC for an undisclosed amount (likely much less than the Twitch deal, given non-exclusive terms).

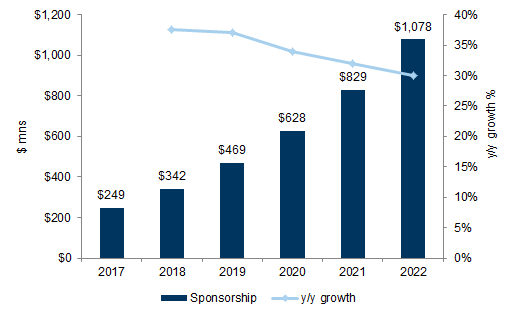

Local sponsorship. Overwatch League now has five major sponsors, including Toyota, HP, Intel, T-Mobile, and Sour Patch Kids, while the North American League of Legends League has sponsorship agreements with Geico, Nissan, and Axe. Other than distribution, we believe sponsorship will be the next largest contributor to league-level revenue. About 79% of the eSports audience is below the age of 35, according to data from NewZoo, making it a coveted demographic for brands. We have been very encouraged to see sponsorship move from just endemic brands (e.g. PC/console hardware manufactures) to major consumer brands in key verticals like automotive and consumer products. Increasingly, we believe Chief Marketing Officers (CMOs) will take notice of the growing eSports audience, and will seek out exposure through local and league-level sponsorship deals.

In-game revenue. Lastly, we believe the leagues will also be able to generate revenue through in-game monetization. Aside from eSports, we expect in-game monetization will reach ~50% of total industry revenue by 2019, as video game publishers have invested in long-term player engagement through regular content updates, thereby creating opportunities for player investment in game. We believe eSports will be another driver of engagement for players, and for the Overwatch League, we expect Activision will sell virtual items associated with League events, another source of league revenue.

Pro sports leagues are investing in eSports as well

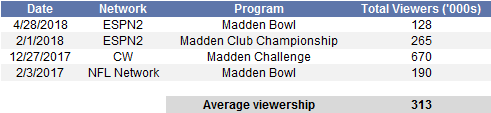

Exhibit 22: On average, total TV viewership for Madden eSports events has been around 313k

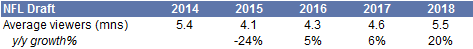

Exhibit 23: The 2018 NFL Draft had the highest average viewership of any draft on record

Fortnite and the "Moneymaker Effect"

Exhibit 24: Fortnite is currently the most popular game on Twitch

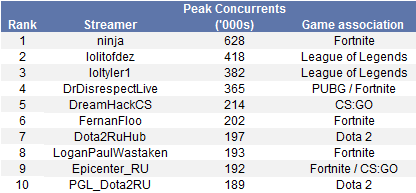

Exhibit 25: Ninja's stream of Fortnite is the highest ever for an individual's channel

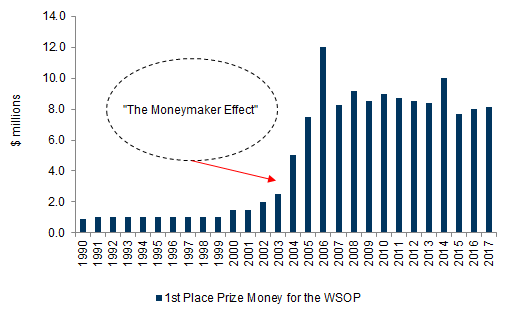

The Moneymaker Effect

Exhibit 26: The "Moneymaker effect" caused an inflection in growth for poker

Exhibit 27: The Ninja / Drake live-stream coincided with accelerating growth for Fortnite

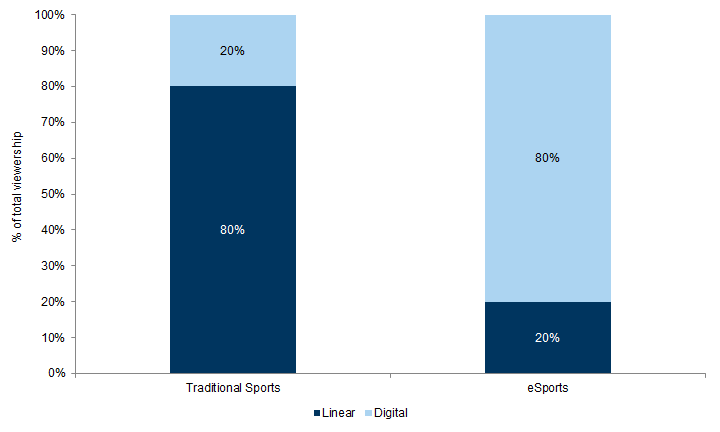

A New Paradigm for Distribution

How eSports distribution is monetized by leading OTT platforms

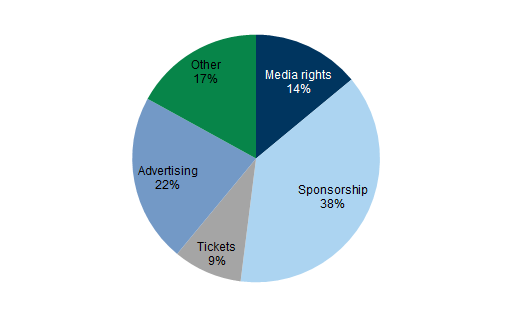

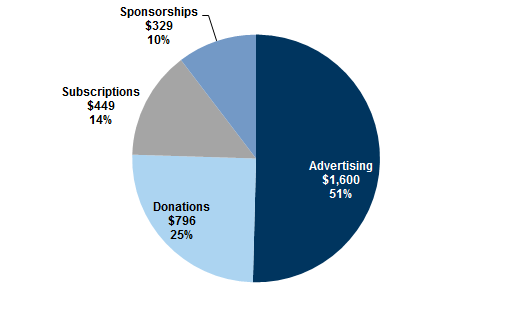

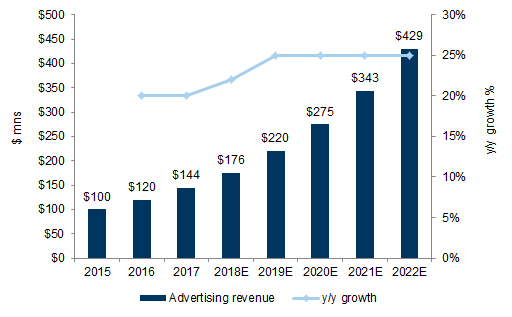

Exhibit 29: Advertising represented 51% of overall Gaming Video Content gross revenue in 2017A

Exhibit 30: We expect eSports gross advertising revenue will grow at a 25% CAGR from 2018E to 2022E

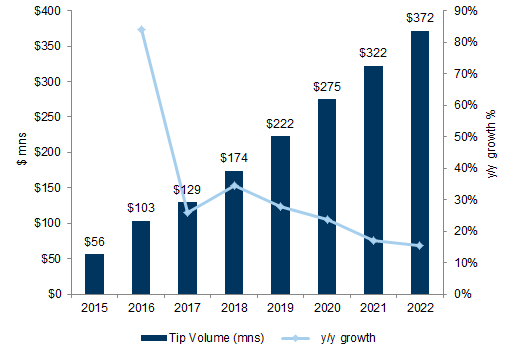

Exhibit 34: We expect the tipping market in the U.S. will reach $372mn in 2022E

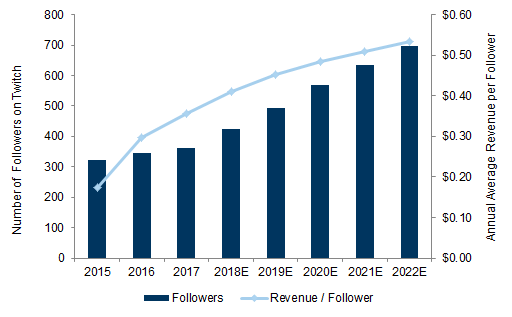

Exhibit 35: We expect annual revenue per follower to rise due to improving engagement

Exhibit 36: We believe sponsorship revenue will grow to over $1bn by 2022...

Exhibit 37: ...and will grow at the second fastest CAGR among eSports revenue streams

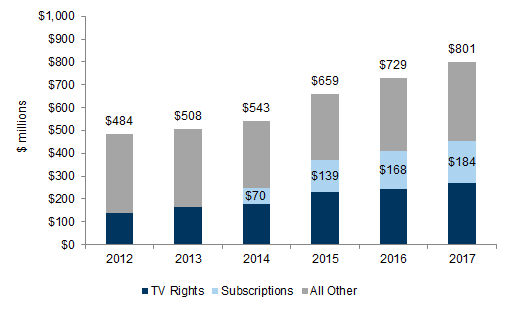

Exhibit 38: Subscriptions have risen steadily to 23% of total revenue for the WWE in 2017

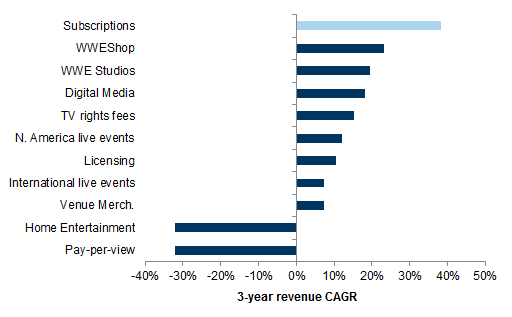

Exhibit 39: Subscriptions are the WWE's fastest source of revenue growth

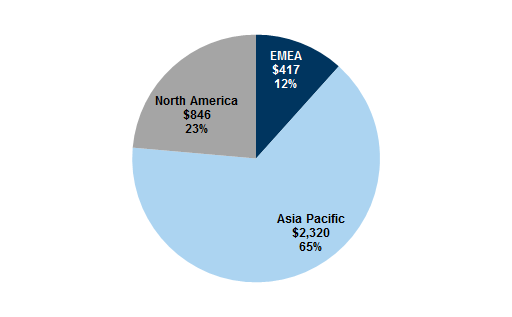

Asia is Leading the Way for eSports Globally

China - The Largest eSports market in the world

Japan has specific issues for eSports

Spread of eSports stymied by cash prize limits imposed under Act against Unjustifiable Premiums and Misleading Representations

Several eSports organizations merged into single entity, JeSU, in 2018

Japanese game companies active in eSports space overseas

Plenty of potential in Japanese IP, especially in fighting games

New Platforms for eSports

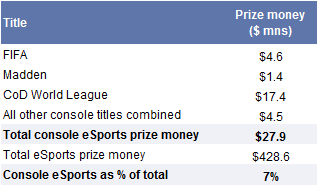

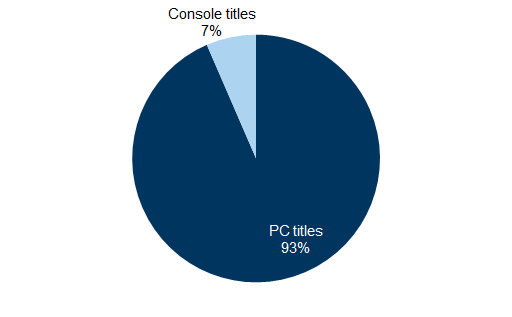

Exhibit 43: Console eSports prize money represents only 7% of the total to date

Exhibit 44: ...while PC titles represent the other 93%

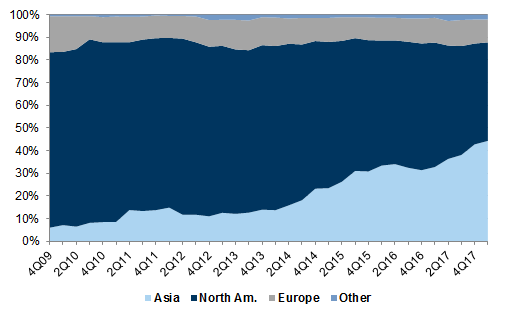

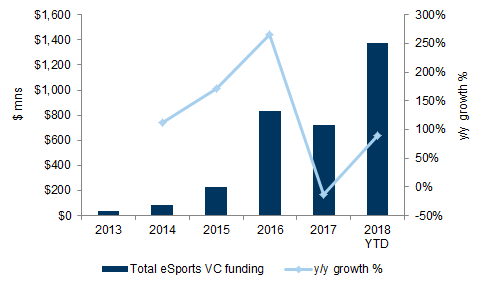

The Venture Landscape

Venture investments in eSports are accelerating

Exhibit 45: APAC dominates the eSports venture landscape...

Exhibit 46: ...consistent with APAC growing as a % of overall total global VC investment

Exhibit 47: eSports vc funding has grown 90% y/y in 2018 YTD...

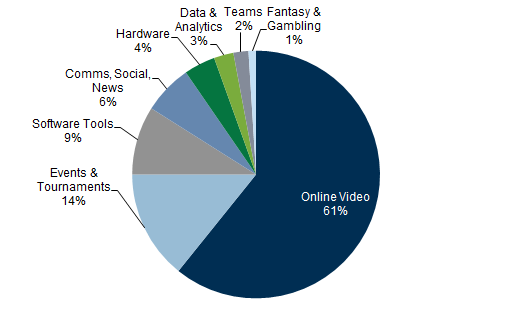

Exhibit 48: Online Video is the largest funding category to date

Logos disclosure

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.