- Intro

- Big Oils can lead a profitable path towards Big Energy and a 2° C scenario

- From Big Oils to Big Energy in 10 charts

- Energy mix: Big Oils have a major part to play in the global low carbon transition

- From Big Oils to Big Energy, a de-carbonization path compliant with a 2° C scenario

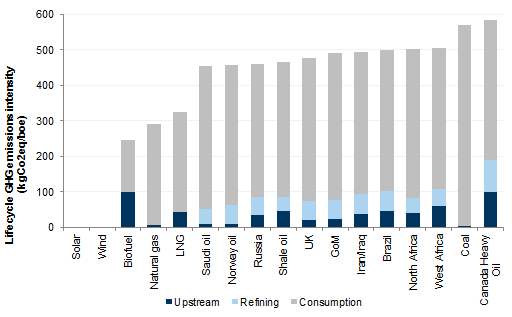

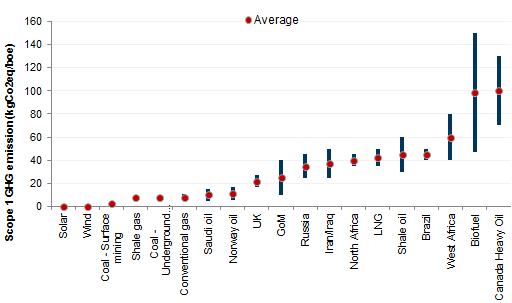

- High GHG emissions in the oil & gas industry are driven by oil exposure, especially in oil sands, mature fields and West Africa

- The path to de-carbonization can yield higher returns

- The key levers of lower reported carbon emissions in more detail

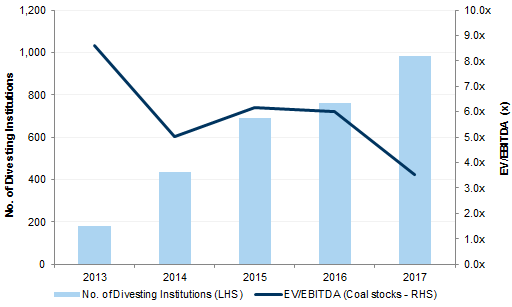

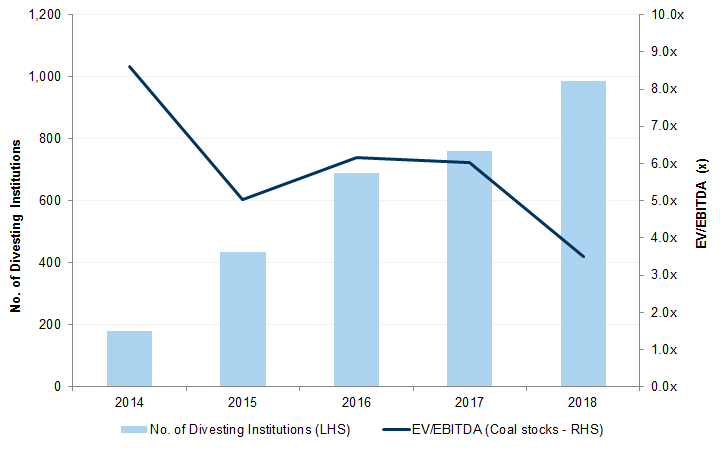

- A clear de-carbonization strategy should help Big Oils address the concerns of the fossil fuel divestment movement

- Appendix

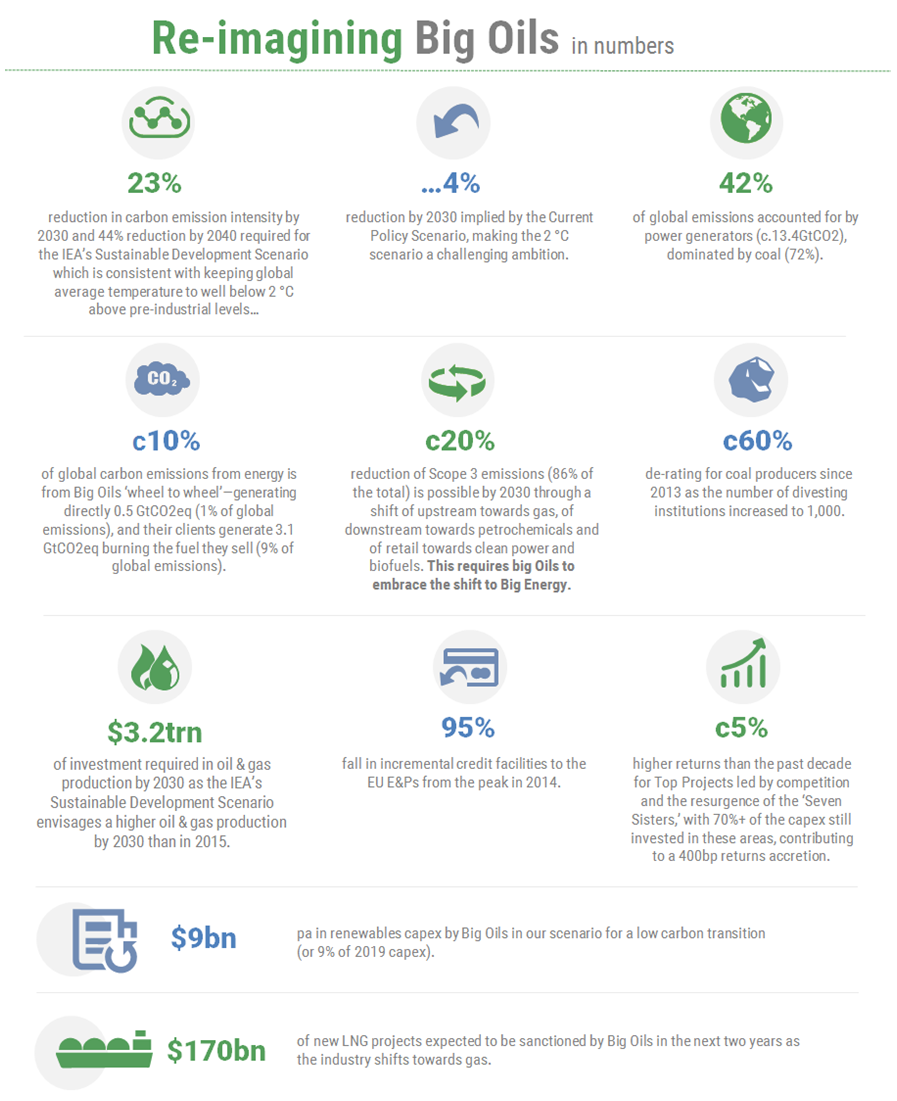

Big Oils can lead a profitable path towards Big Energy and a 2° C scenario

Low carbon: Some context around climate change and greenhouse gas (GHG) emissions

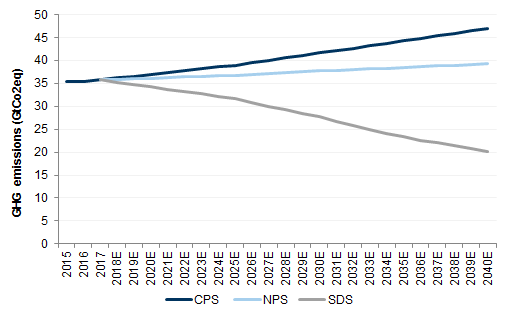

Big Oils directly generate only 1% of the world's GHG emissions, but influence 10% of 'well-to-wheel' and 'well-to-wire' emissions

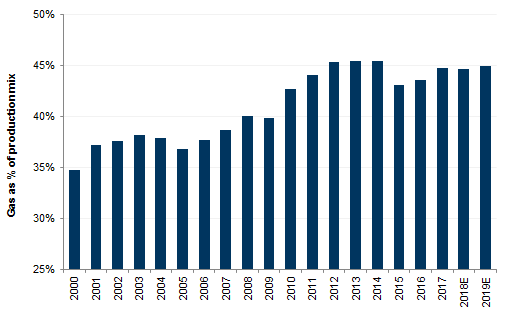

Big Oils have a major role to play in de-carbonization, as 'Big Energy', in an evolving competitive landscape

Key parts of the oil value chain may end up financially stranded and under-invested, leading to higher prices at the pump in the 2020s

From Big Oils to Big Energy in 10 charts

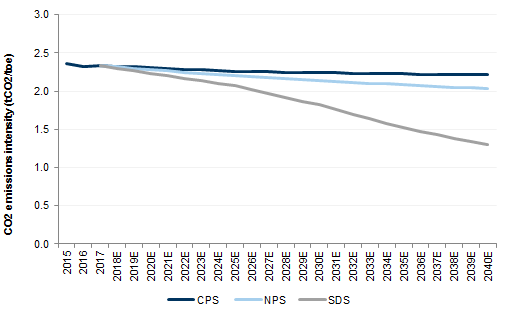

Exhibit 2: The IEA lays out an aggressive 23% carbon intensity reduction by 2030 (SDS) consistent with a 2° C ambition

Exhibit 3: We estimate that Big Oils can deliver an equivalent 20%+ reduction in GHG by 2030 in their direct operations...

Exhibit 4: ...and on a ‘well to wheel’ basis, transforming themselves into ‘Big Energy’

Exhibit 5: This strategic shift will be important to avoid investor divestments, as suffered by the coal industry...

Exhibit 6: ...and may leave the higher carbon parts of the energy chain financially stranded and under-invested...

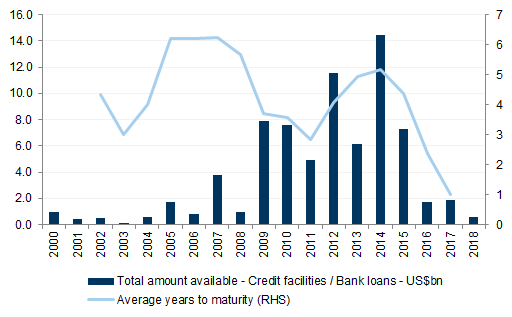

Exhibit 7: ...as financing for independent long-cycle oil & gas developers dries up

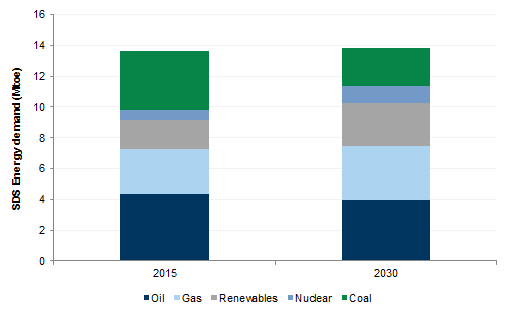

Exhibit 8: Even the IEA’s most ambitious low-carbon scenario requires more oil & gas production by 2030...

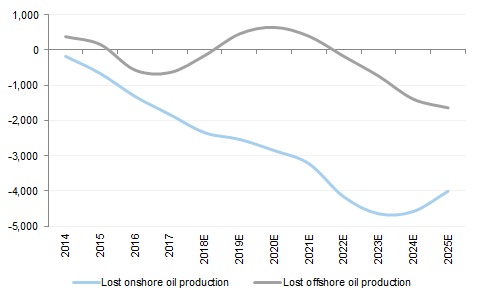

Exhibit 9: ...but the industry’s shift of capital away from oil is already creating a 6 mn bls/d gap in the 2020s...

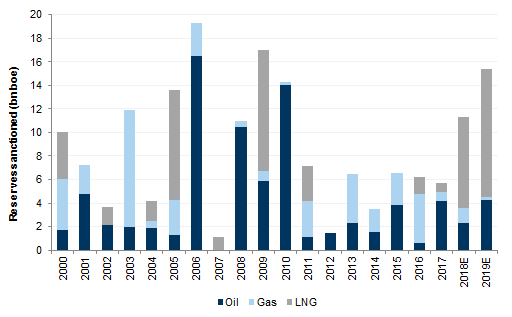

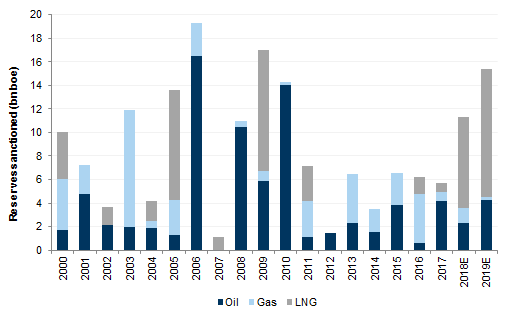

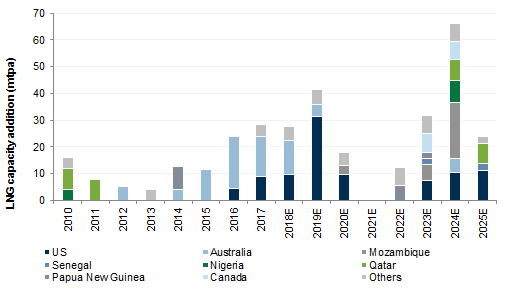

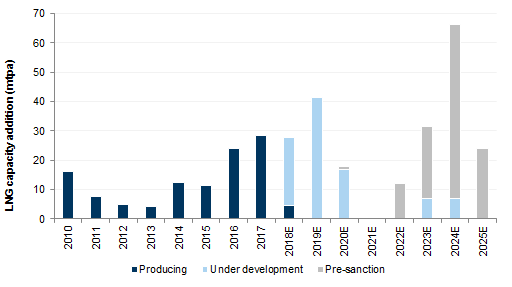

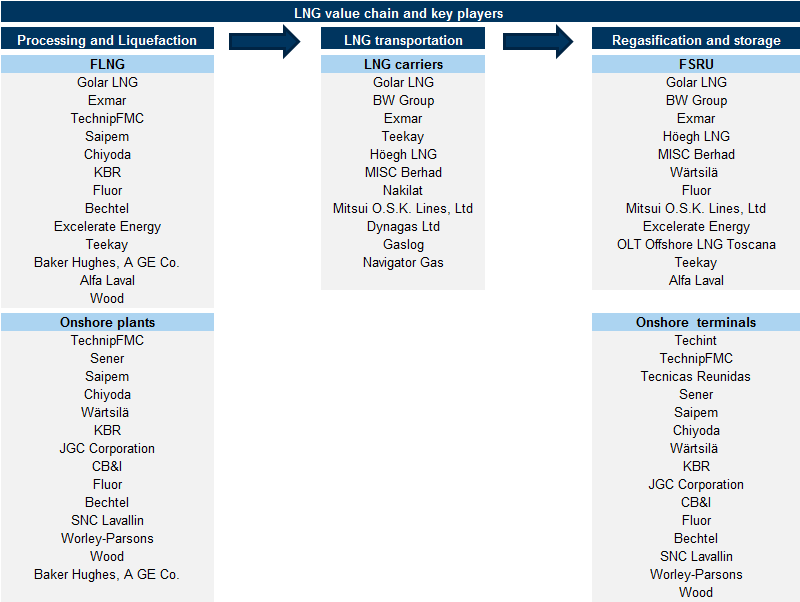

Exhibit 10: ...while creating an upcoming LNG construction boom...

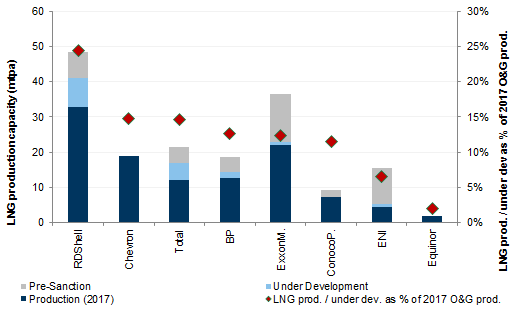

Exhibit 11: ...led by Big Oils, as they shift hydrocarbon production towards global gas

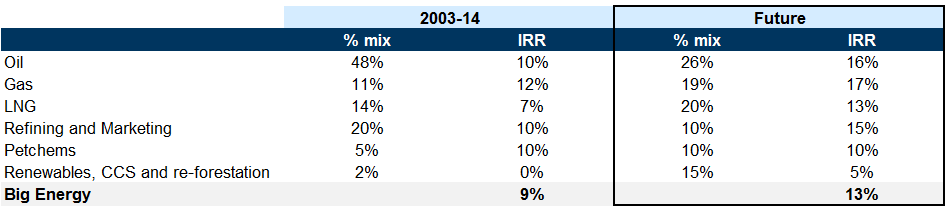

Exhibit 12: A more concentrated, under-financed oil & gas industry provides Big Oils with improving corporate returns, including the dilution from low carbon investments

Current Policies (CPS): The Current Policies Scenario excludes the realisation of announced, new policy targets and considers only the impact of those policies and measures that are firmly enshrined in legislation as of mid-2017. In addition, where existing policies target a range of outcomes, the assumption in the Current Policies Scenario is that the least ambitious end of this range is achieved. In this way, the scenario provides a cautious assessment of where momentum from existing policies might lead the energy sector in the absence of any additional impetus from governments.

New Policies (NPS): The New Policies Scenario aims to provide a sense of where today’s policy ambitions seem likely to take the energy sector. It incorporates not just the policies and measures that governments around the world have already put in place, but also the likely effects of announced policies, as expressed in official targets or plans.

Sustainable Development (SDS): The Sustainable Development Scenario takes a fundamentally different approach from those discussed above. While the Current Policies and New Policies scenarios start with certain assumptions about policies and see where they lead the energy sector, the Sustainable Development Scenario starts with a certain vision of where the energy sector needs to go and then works back to the present.

Exhibit 13: Carbon intensity is expected to fall by 23% by 2030 (vs 2017)...

Exhibit 14: ...and by 44% by 2040 under the IEA's most ambitious scenario (SDS)

Energy mix: Big Oils have a major part to play in the global low carbon transition

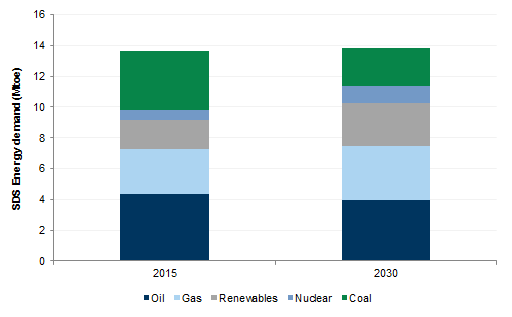

Exhibit 15: Under the SDS scenario, demand for coal is expected to decline by 36% by 2030

Exhibit 16: Oil & gas is expected to be broadly flat as part of the energy mix

From Big Oils to Big Energy, a de-carbonization path compliant with a 2° C scenario

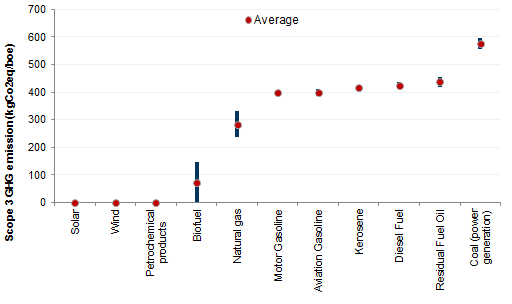

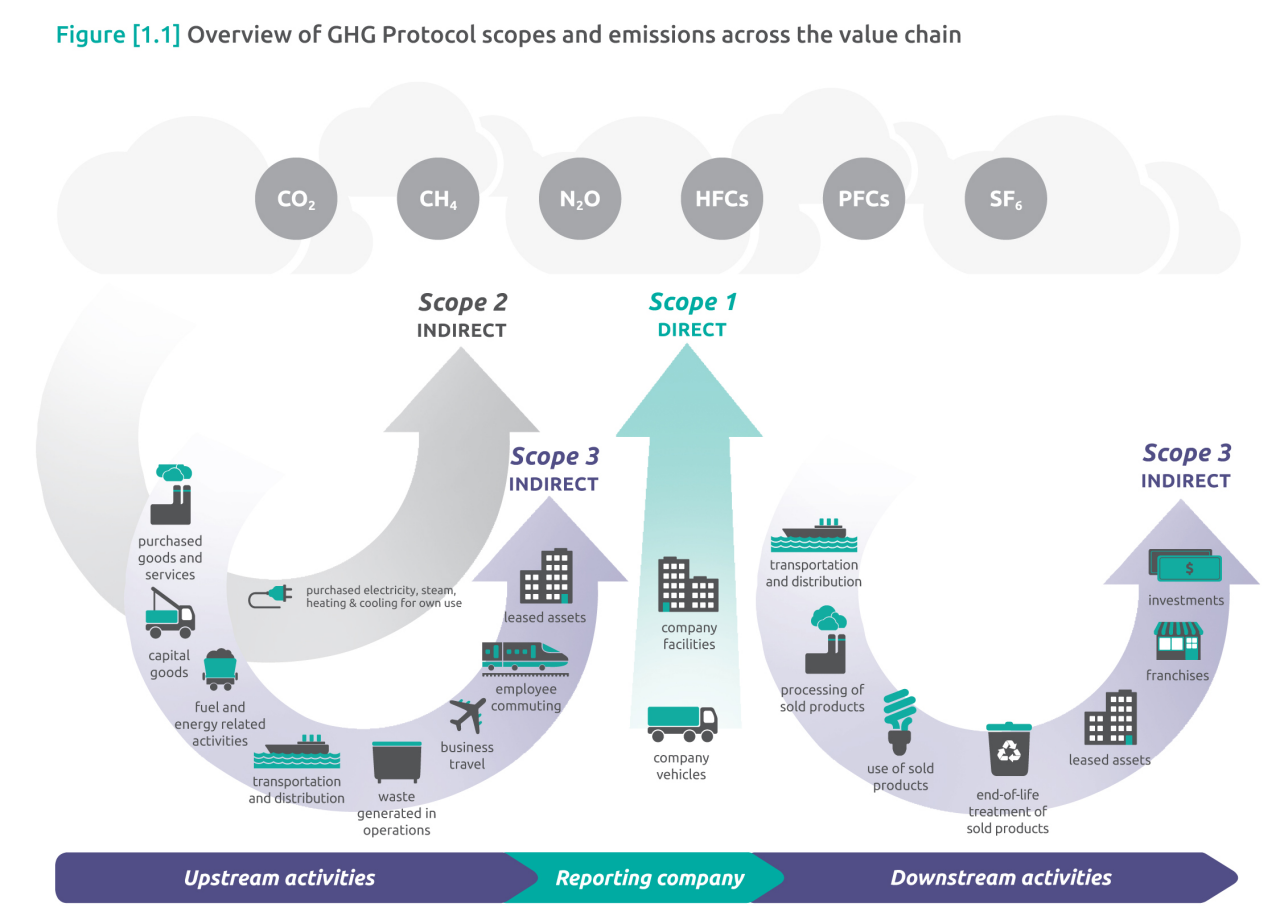

A deep dive into the GHG reduction initiatives on scope 1, 2 and 3

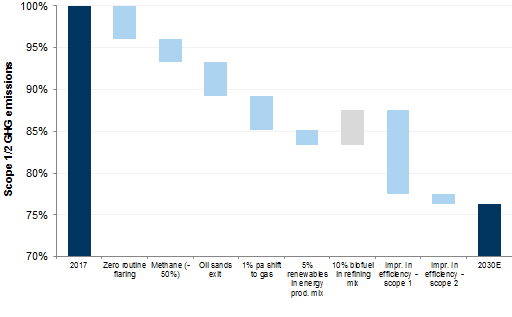

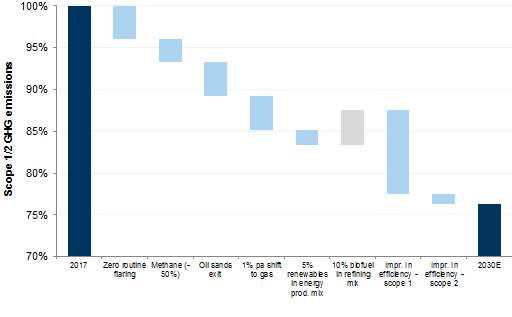

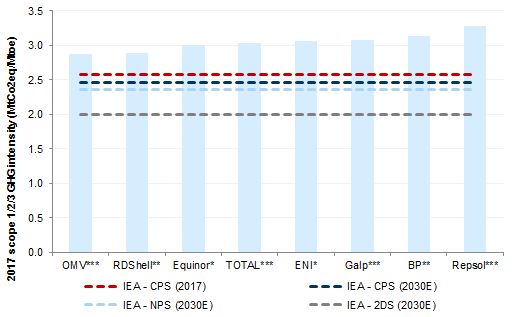

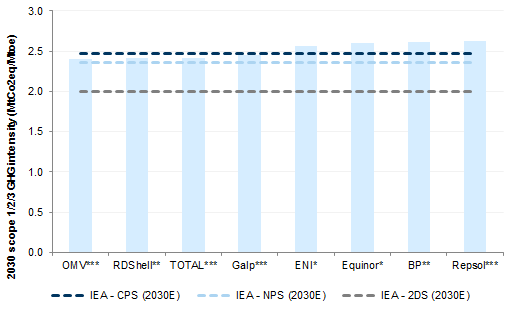

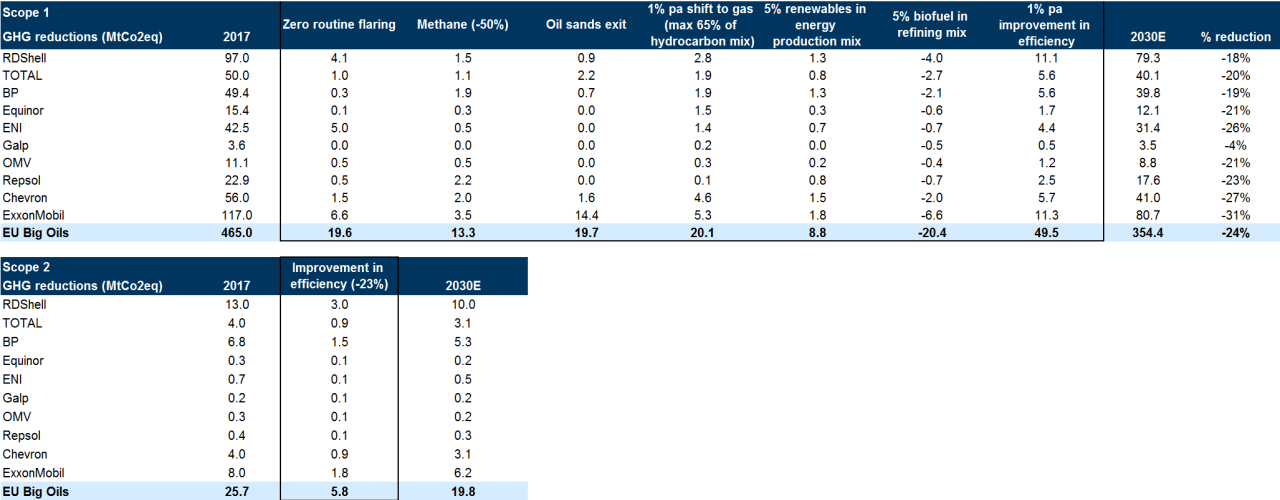

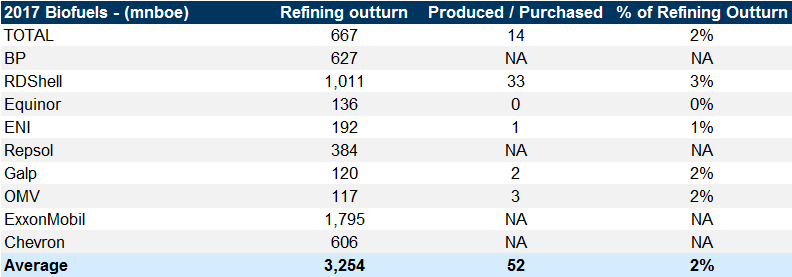

Scope 1 emission reduction (13% of total) depends on both process and mix changes and we see six main areas of action: (1) reduction in flaring; (2) reduction of methane emissions; (3) exit from highly carbon-intensive extraction processes (such as Canadian oil sands); (4) improvement in overall production efficiency (helped by disposing of older fields and refineries); (5) production shift towards gas (although LNG does not have materially lower scope 1 CO2 emissions than conventional oil); (6) an expansion in renewable production capacity. An increase in biofuel production would actually increase the scope 1 CO2 intensity, although it has lower well-to-wheel emissions. Overall we believe that scope 1 and 2 GHG emissions could be lowered by c.24% by 2030 following the adoption of all these initiatives, achieving a reduction in carbon intensity in line with the IEA's SDS.

Scope 2 emission reduction (1% of total): we assume that the carbon intensity of third-party power and heat acquired to run the operations improves in line with the average improvement in power generation laid out by the IEA's SDS. It could actually improve faster if Big Oils used only renewables and gas to power their own operations (for instance Shell's decision to source hydro power for its Canada LNG development).

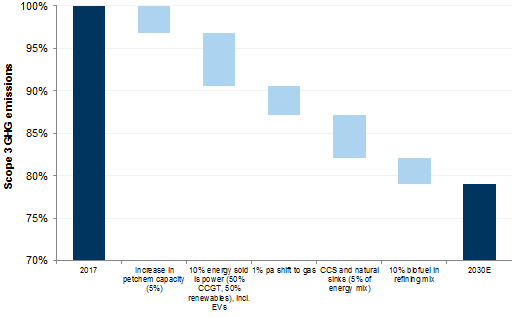

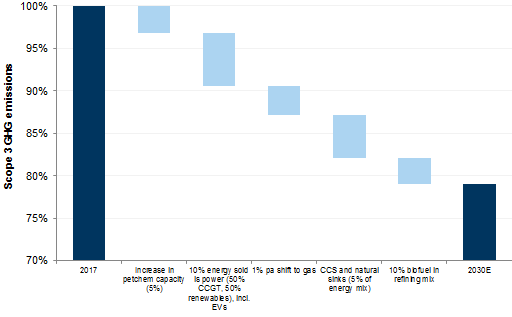

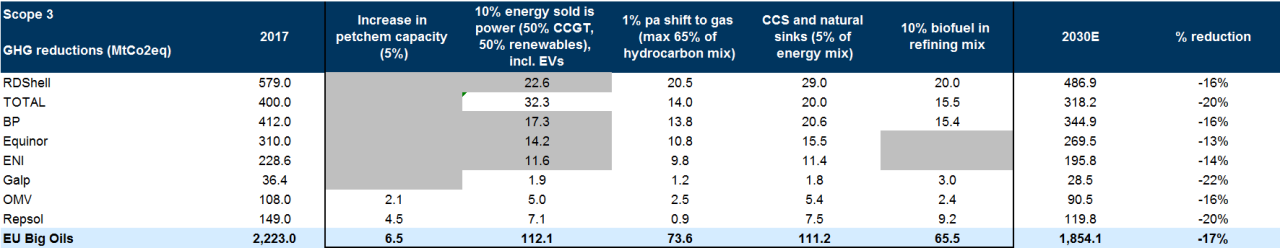

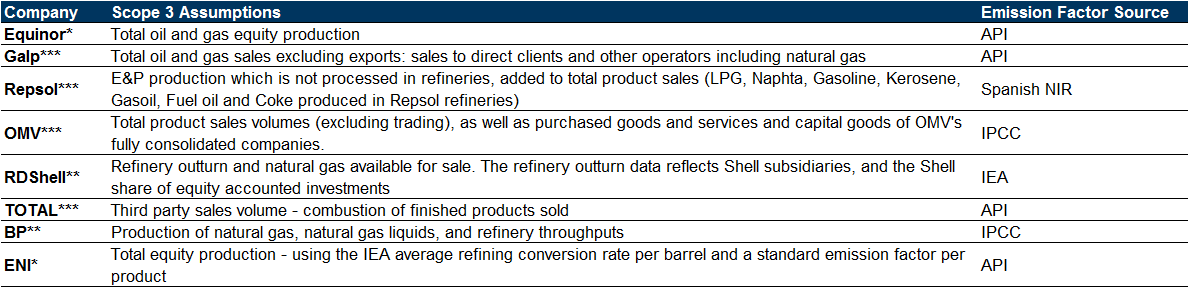

Scope 3 emission reduction (86% of total): these emissions are the most important, as they constitute 80%+ of well-to-wheel emissions, but Big Oils have the least control over them, as they are generated by their customers and not directly. The accounting of scope 3 matters, as the levers available to reduce the GHG intensity change according to whether it is calculated at production, refining throughput or final sales. Final sales offer more options of lower-carbon product diversification, especially if the intensity is calculated including the petrochemical output (where carbon is not burned, but sequestered in the materials produced). In Exhibit 18, we take the broadest definition, although we do discuss the company-specific reporting and commitments in the section below 'Big Oils and GHG reduction'. We see five main areas of action that can drive scope 3 carbon intensity reduction and the move of Big Oils towards Big Energy: (1) the shift of production from oil towards gas (including LNG); (2) the shift of downstream oil from refining to petrochemicals; (3) an expansion downstream in gas (similar to what Big Oils have always had in oil, with production/refining/retail marketing) to gas & power retail, including power supplied through CCGTs and renewables; (4) increased sales of biofuels; (5) carbon capture and natural sinks (re-forestation), to reduce net emissions. If Big Oils use all these levers, on our estimates they can achieve a c.21% reduction in scope 3 carbon intensity, allowing an overall 'well-to-wheel' reduction in line with the IEA SDS ambitions.

Exhibit 17: Scope 1/2 GHG emissions intensity can be reduced by c.24% by 2030...

Exhibit 18: ...while scope 3 can be cut by c.21%, through a mix change of the energy products produced and sold

While Big Oils can show emission reductions in line with the SDS, the intensity is likely to remain above society

Exhibit 19: Big Oils product mix implies that they have a higher well-to-wheel carbon intensity than the broader economy...

Exhibit 20: ...while the bigger improvements are likely to be achieved by companies with a large marketing business

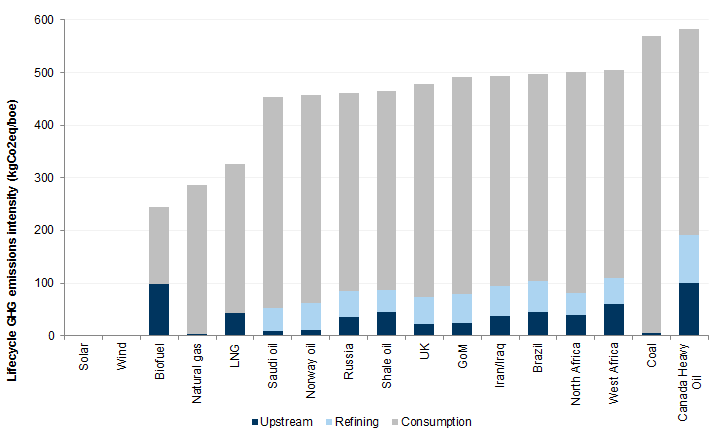

High GHG emissions in the oil & gas industry are driven by oil exposure, especially in oil sands, mature fields and West Africa

Exhibit 21: Saudi Oil stands out for the lowest carbon intensity in oil ...

Exhibit 22: ...while gas has the lowest intensity at consumption

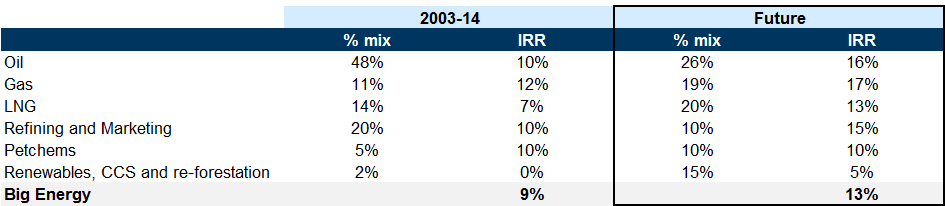

The path to de-carbonization can yield higher returns

Tight financing, financially stranded assets and a more concentrated industry structure to lift Big Oils returns in the low carbon age

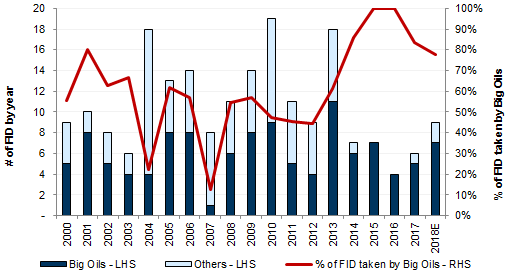

Big Oils rise again as the industry consolidates

Exhibit 25: Capital availability for independent oil & gas producers has shrunk materially...

Exhibit 26: ...pushing the industry to consolidate, with FIDs taken back into the hands of the 'Seven Sisters'

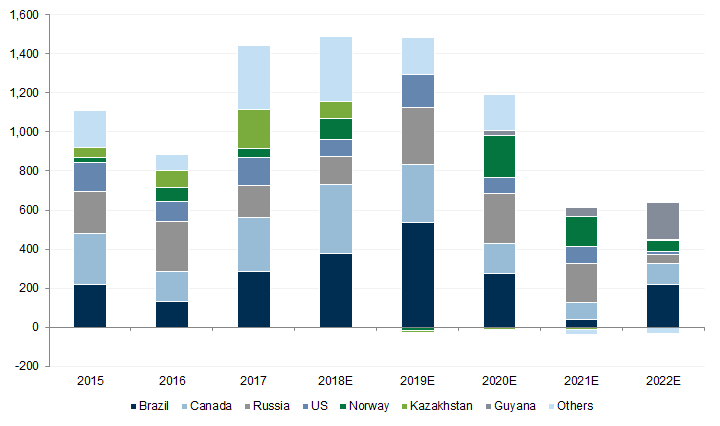

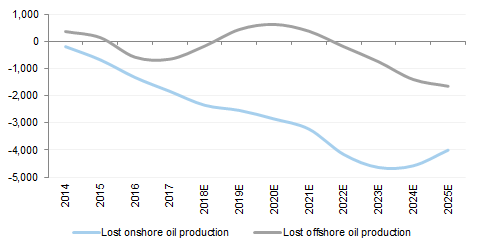

Underinvestment in oil mega-projects is likely to be structural and will impact production after 2020

Exhibit 27: Projects sanctioned in 2011-14 currently deliver steady production growth through 2020...

Exhibit 28: ...but FIDs postponements leave a 5.6 mn b/d oil production shortfall by 2025

The key levers of lower reported carbon emissions in more detail

Scope 1/2: Improvement in efficiency in operated assets will drive most of the GHG emissions reduction

Scope 3: A broad range of initiatives available, from renewables to natural sinks

Increase petrochemical capacity by 5% vs. refining output.

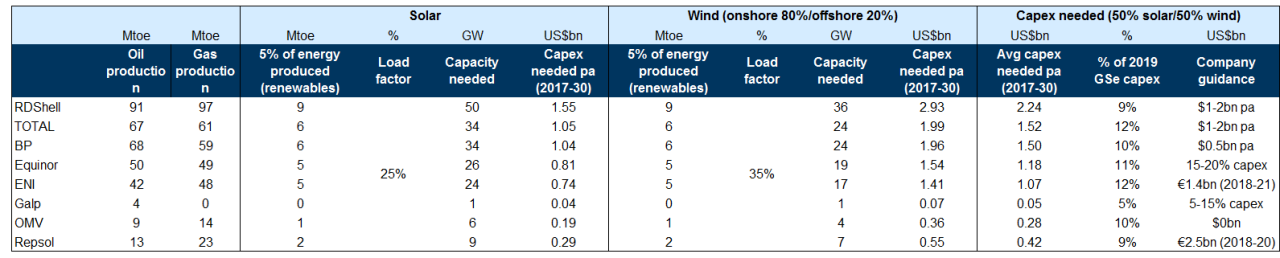

Build an integrated value chain in power, with power sales equivalent to 10% of energy sold, assuming 50% is fuelled by CCGT plants (gas-fired) and 50% by renewables (wind, solar).

1% per annum production shift to gas from oil, with max 65% gas in the hydrocarbon mix.

Carbon capture & natural sinks, assuming they can offset 5% of total CO2 emitted.

Increase the share of biofuels in the refined products sale mix by 10%.

The five key levers of scope 3 emission reduction

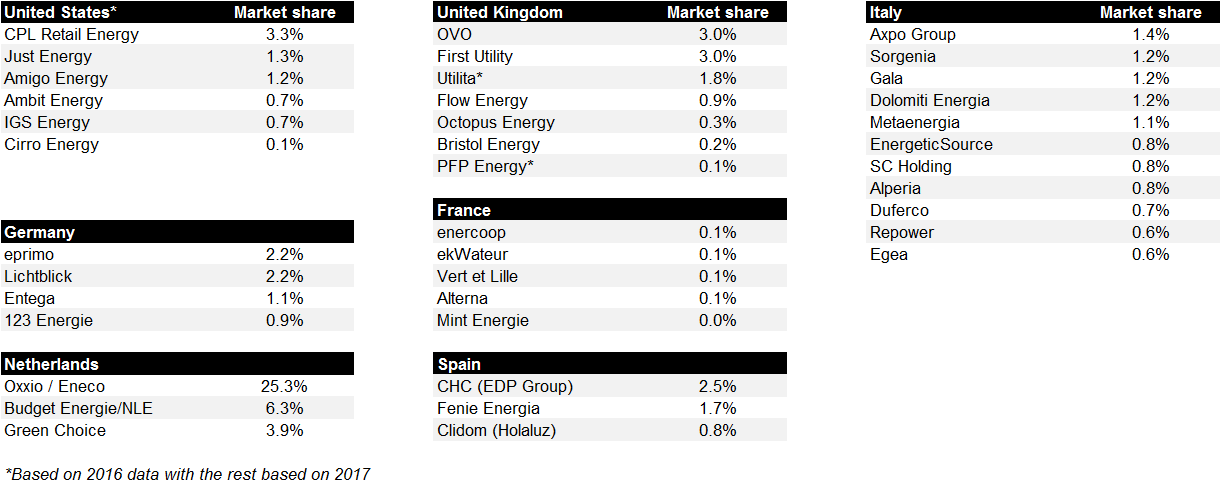

Exhibit 34: Spain's solar LCOE is c.45% below forwards and will keep declining

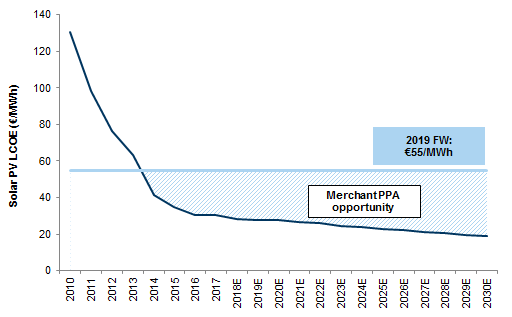

Exhibit 35: We expect costs for offshore wind to decrease by 80% by 2030E vs. 2016

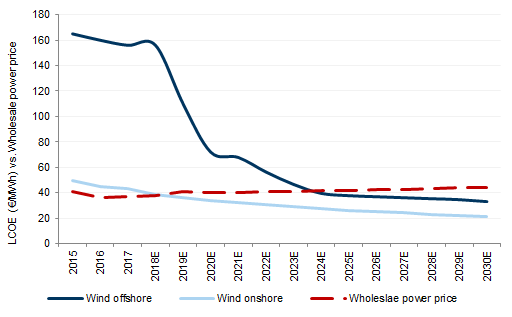

Exhibit 36: Gas has been a growing part of Big Oils' energy mix, now at c.45% of total production

Exhibit 37: After 4 years of under-investments, we are entering a new LNG construction phase

There is a gap in LNG supply growth in 2020-23, signalling an incoming tight market

Exhibit 38: We are coming towards the end of this wave of LNG supply growth...

Exhibit 39: ...with the second wave to add capacity from 2023, although still largely uncommitted

The separation and capture of CO2, from gaseous emissions to achieve a high purity stream, achievable through industrial techniques typically classified as pre-combustion, post-combustion and oxy-fuel capture.

The subsequent transport of captured CO2, from its production site to suitable geological formations for storage. Typically transport occurs through pipelines.

The storage of CO2 through various forms, primarily in deep geological formations which may be former oil & gas fields, saline formations or depleting oil fields. When CO2 is injected into an oil field to recover oil reserves, the method is known as Enhanced Oil Recovery (EOR). Ocean and mineral storage options also exist.

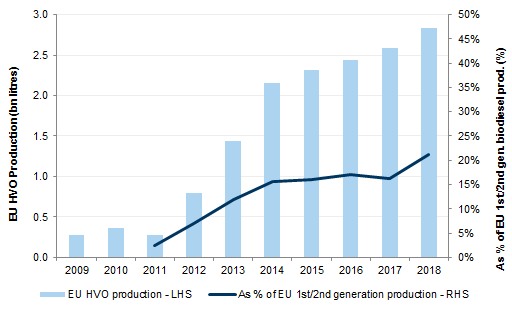

Exhibit 43: HVO is growing fast...

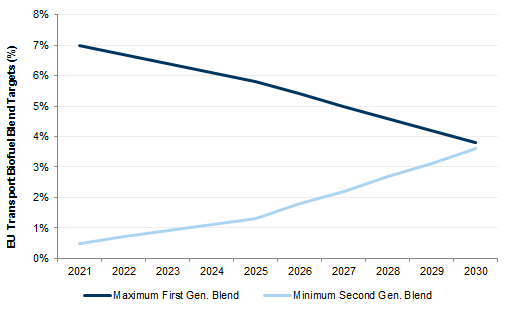

Exhibit 44: ...supported by favourable legislation in the EU

A clear de-carbonization strategy should help Big Oils address the concerns of the fossil fuel divestment movement

Big Oils can meet the IEA 2DS, with a cleaner and more profitable portfolio

Tight financing conditions create high barriers to entry; markets conditions favour the 'Seven Sisters'

Appendix

Appendix A

Scope 1 (direct emissions) occurs from the companies' owned or operated assets, including flaring, venting and fugitive emissions from oil & gas production facilities.

Scope 2 (indirect emissions) refers to emissions from purchased and consumed energy including electricity to run companies' operations.

Scope 3 (indirect emissions), for the oil & gas industry, would refer to GHG emissions arising from the combustion of refined products; i.e. diesel, gasoline, kerosene among the most common fuel burned for transportation purposes.

Appendix B

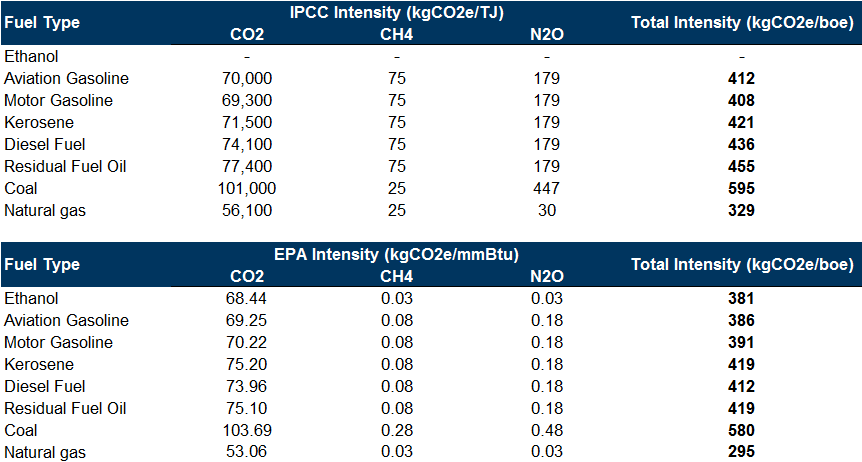

IPCC: The Intergovernmental Panel on Climate Change is a body set up under the guidance of the United Nations with the sole purpose of providing the world with a scientific view of climate change and its potential impacts. It provides a detailed library of emission factors both at an aggregate product level, and on a per activity basis.

EPA: The US Environmental Protection Agency is a federal government agency with the mission to protect human and environmental health. Under the AP-42 the agency discloses a compilation of accurate, up to date emission factors.

Appendix C

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.