Executive Summary

Section I: Investors Value Persistence

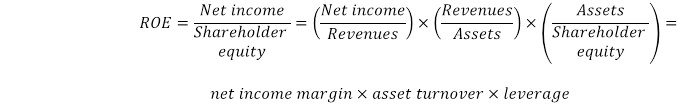

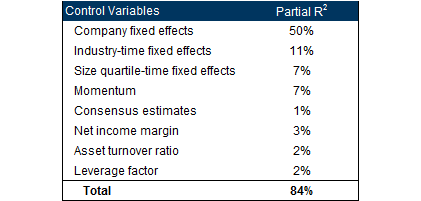

A closer look at the model

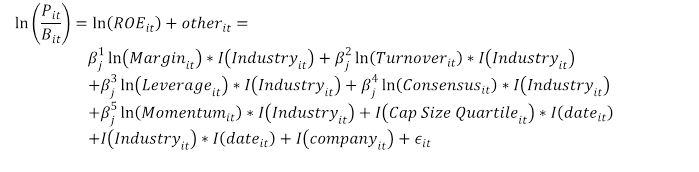

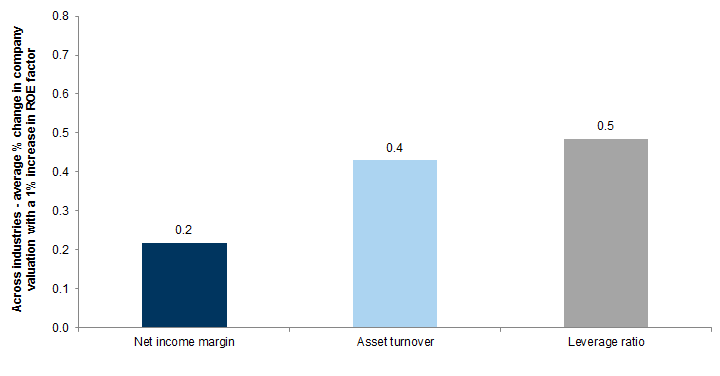

The findings: persistence matters

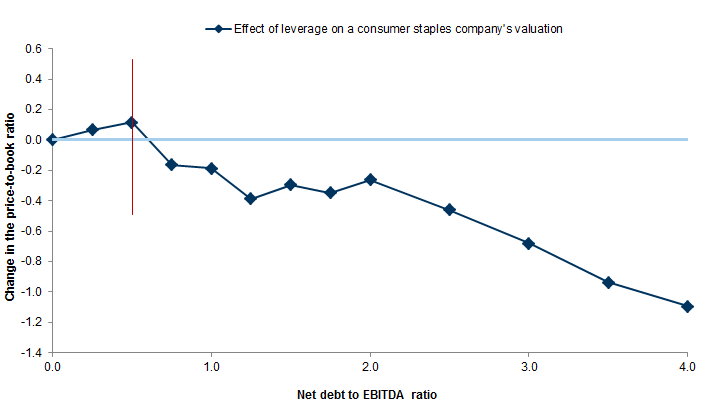

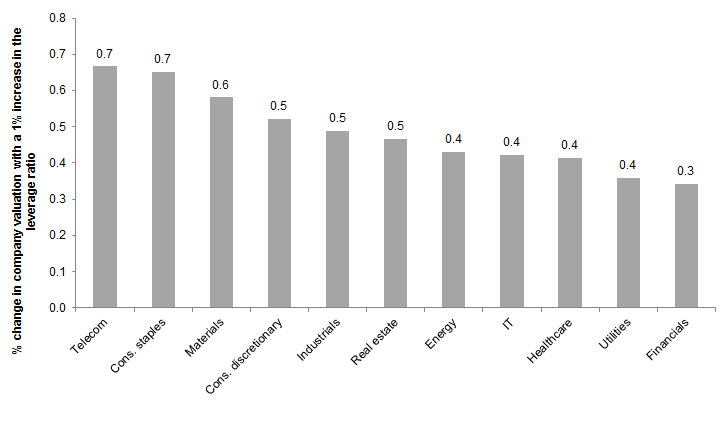

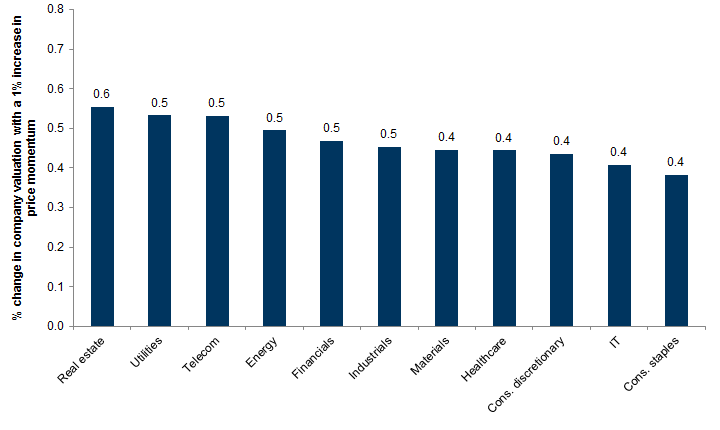

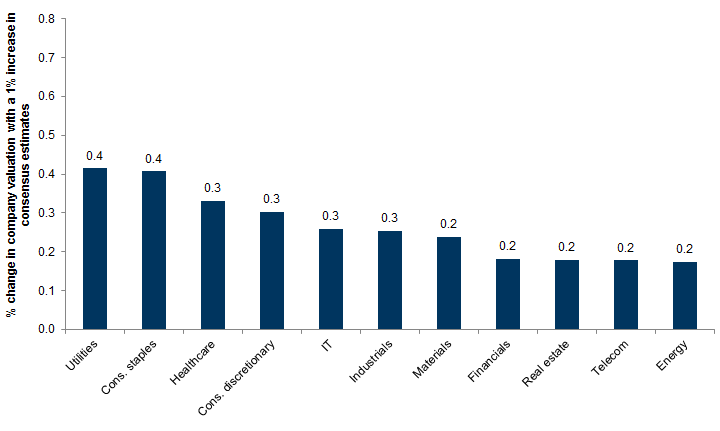

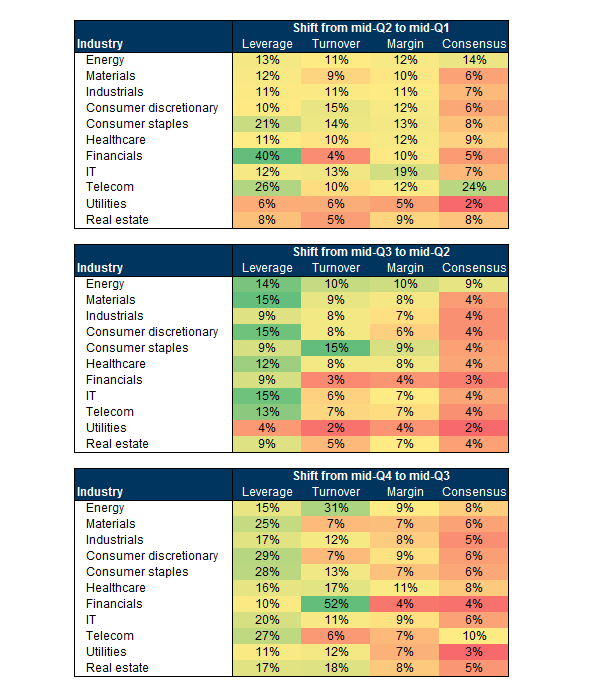

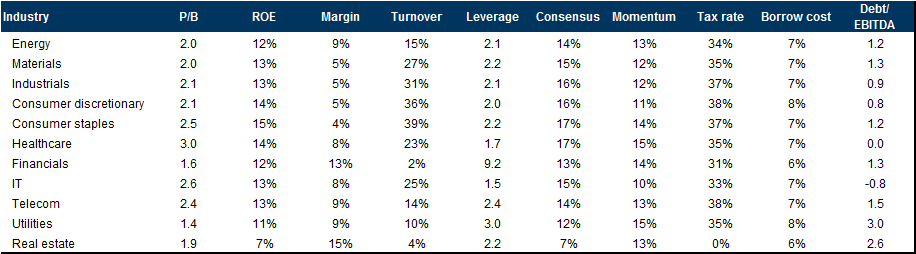

Exhibit 1: Across industries, the market tends to pay the most for incremental improvements in leverage

Exhibit 2: Relationship between market-based valuation coefficients and persistence

The industry breakdown

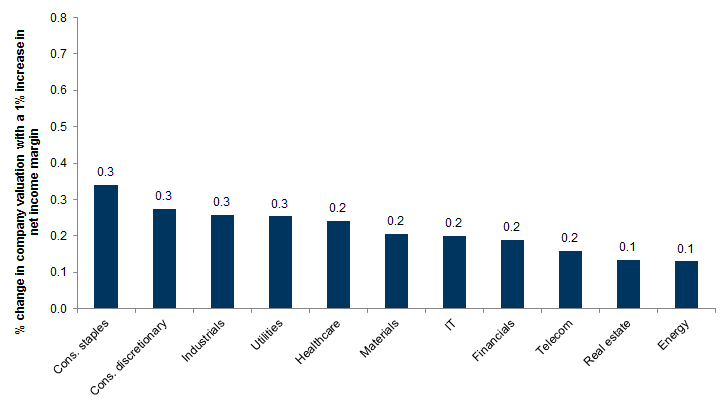

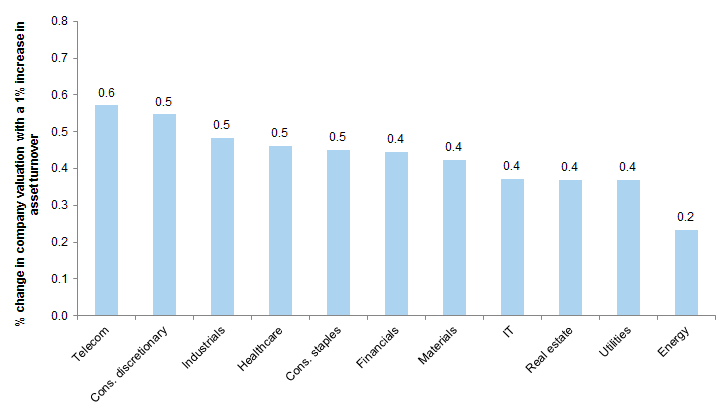

Exhibit 8: How story affects companies' valuations, by industry

The multiple effect

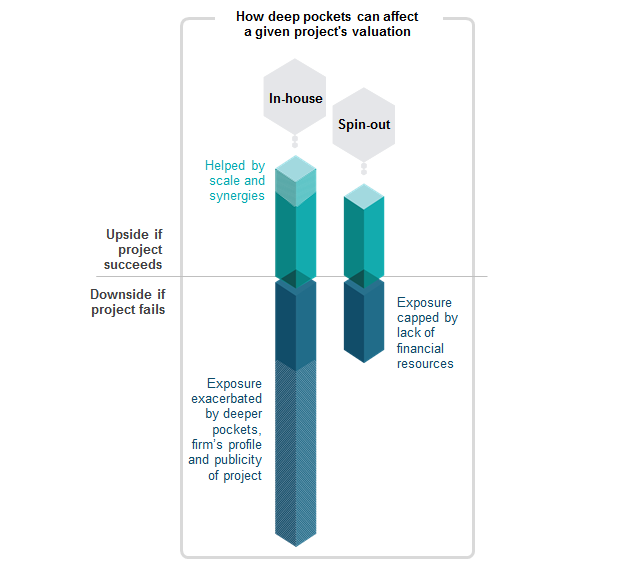

Section II: Deep Pocket Risk

Valuing hope

Two options examples

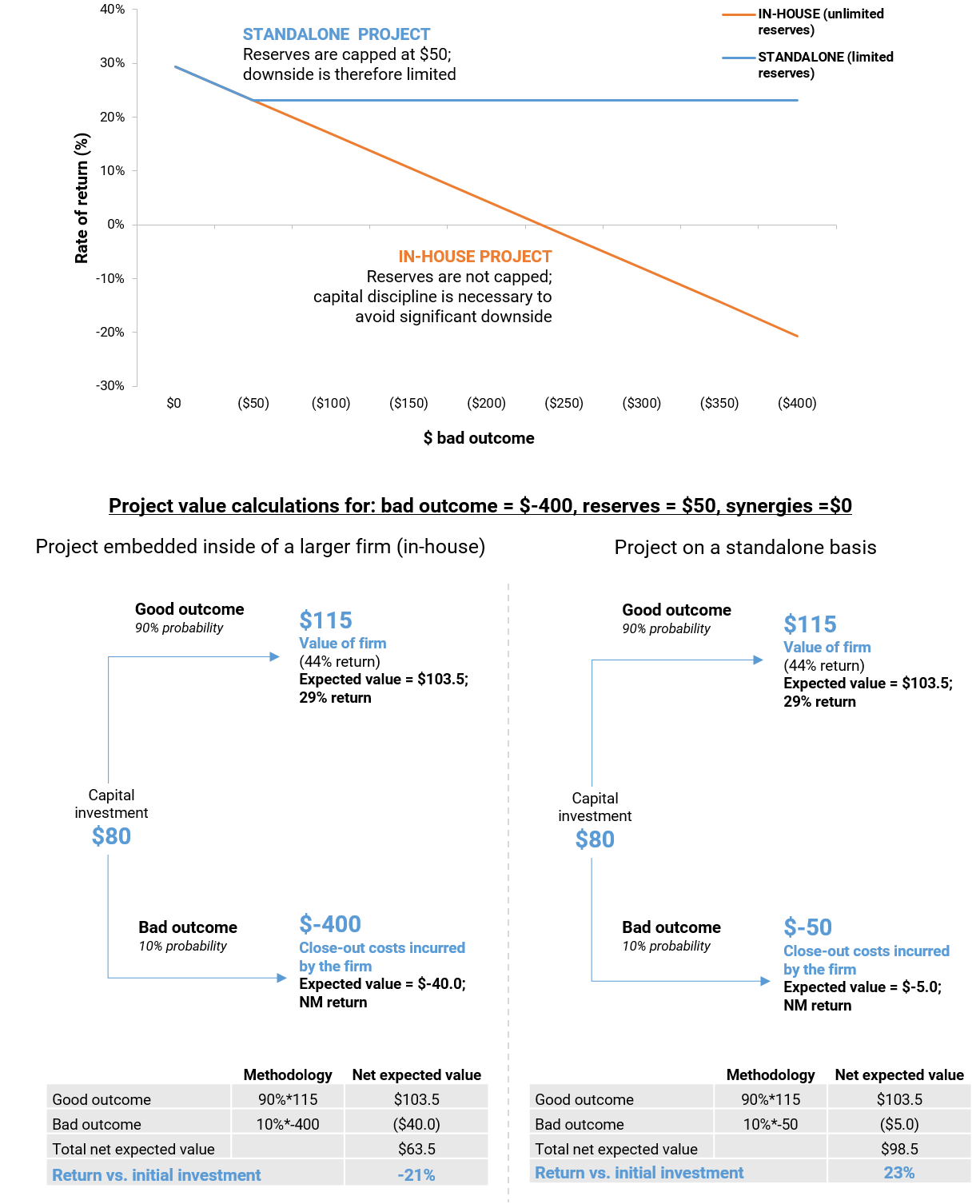

Example 1: Deep pocket risk

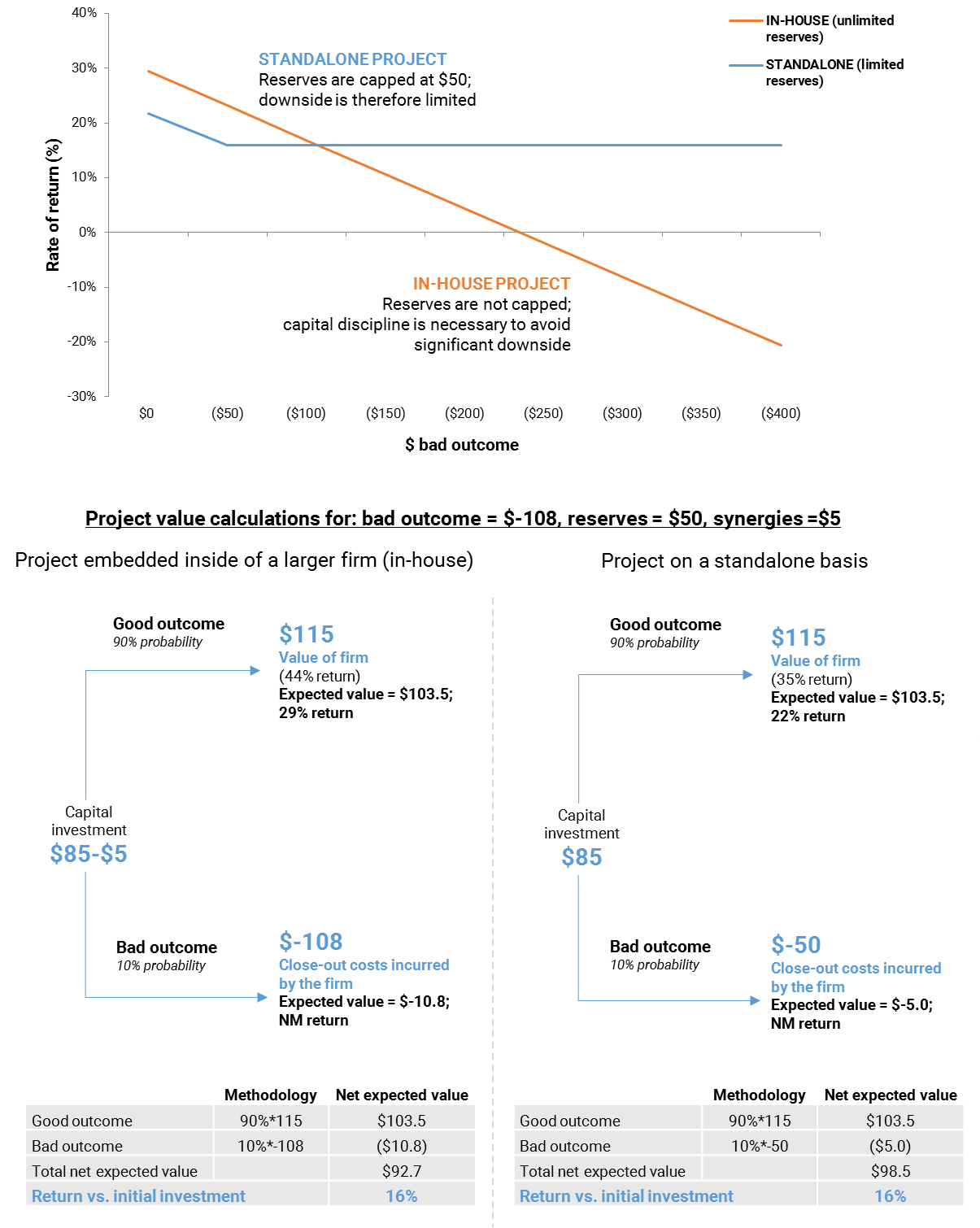

Example 2: Spinning out

A final note on optimizing segment reporting

Aggregate businesses with similar drivers to create segments that are easy to forecast using simple models;

Separate reporting for business lines that tend to be lumpy (and thus harder to forecast) from business lines that tend to be predictable, so that the lumpy segments don’t hurt investors’ overall ability to forecast firm results;

Break out new businesses to give the market better insights into the related spending and associated potential returns, and to eliminate the need for investors to have to guess at these businesses’ results near-term.

Appendix I: More Detail on the Numbers

Appendix II: Segment Reporting - Two Examples

Gizmos = AR1 (rho1=0.8, sigma1=1)

Widgets = AR1 (rho2=0.1, sigma2=1)

Firm A, which reports gizmos and widgets separately: b1 = 0.75, b2 = 0.12, R2=0.39

Firm B, which reports gizmos and widgets together in one segment: b = 0.56, R2=0.31

f1 = AR1 (rho1=0.8, sigma1=1)

f2 = AR1 (rho2=0.1, sigma2=1)

y1 = f1 + noise

z1 = f1 + noise

y2 = f2 + noise

z2 = f2 + noise

Segment1 = y1 + z1

Segment2 = y2 + z2

Segment1 = y1 + y2

Segment1 = z1 + z2

Firm A: b1 = 0.69, b2 =-0.02, R2=0.32

Firm B: b1 = 0.52, b2 = 0.41, R2=0.21

- 1 ^ This is consistent with the market-based valuation (MBV) approach that we employed in the Wavefronts framework introduced in 2004. See: Strongin S., Segal L., Timcenko A., Vaidya J., Weisberger N., Wilson D., “Introducing Wavefronts: A new way of trading macro equity views,” April 2004.

- 2 ^ See: Ling A., Strongin S., Lanstone M., Murti A.N., Segal L., “Goldman Sachs Energy Group: Essential Valuation,” September 2000.

- 3 ^ Using price-to-tangible book does not alter the results substantially.

- 4 ^ For each industry in our sample, we regressed price-to-book ratios on a set of net debt to EBITDA dummies. We focus on the 2010-2018 sample period because we find it to be most relevant to today’s market. Company fixed effects and quarterly time-fixed effects are also included to isolate the impact of leverage. Although the turning point varies by industry, all industries share a particular pattern – which is that the market is willing to pay for leverage for as long as it is probable that it can be sustained. However, the market quickly becomes unwilling to pay for more leverage at the point when additional debt becomes unsustainable.

- 5 ^ The results of our analyses are broadly robust and remain consistent regardless of changes in the sample period or whether industry models are estimated separately.

- 6 ^ The coefficient we observe is largely consistent with a three participant model – fundamental traders, momentum traders and mean reversion traders, where there are essentially equal payoffs available for all three types of traders.

The Global Markets Institute is the research think tank within Goldman Sachs Global Investment Research. For other important disclosures, see the Disclosure Appendix.