Chapter 1: Survivor's guide - the short form

The EaaS transformation – from integrated producers to Platforms…

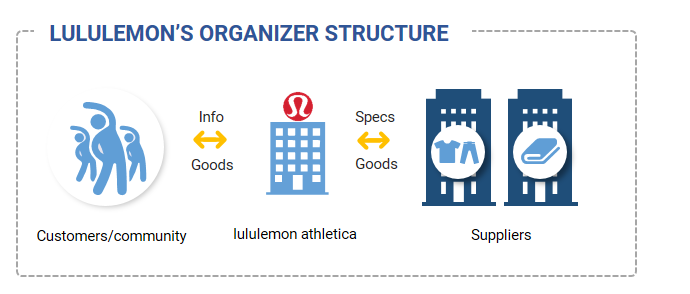

…and the transformation from boutiques to Organizers

The competitive value of data

Is there sufficient data to analyze?

Are the insights gained from the data novel and valuable enough to be of competitive benefit?

Is the data-derived strategy difficult to copy without the data?

Is the data sufficiently scarce or hard enough to collect that competitors cannot replicate the analysis in normal course?

Final thoughts

Chapter 2: Disruption's evolutionary roots

Why do we focus on disentanglement?

Disentanglement and disruption: a deeper dive using case studies

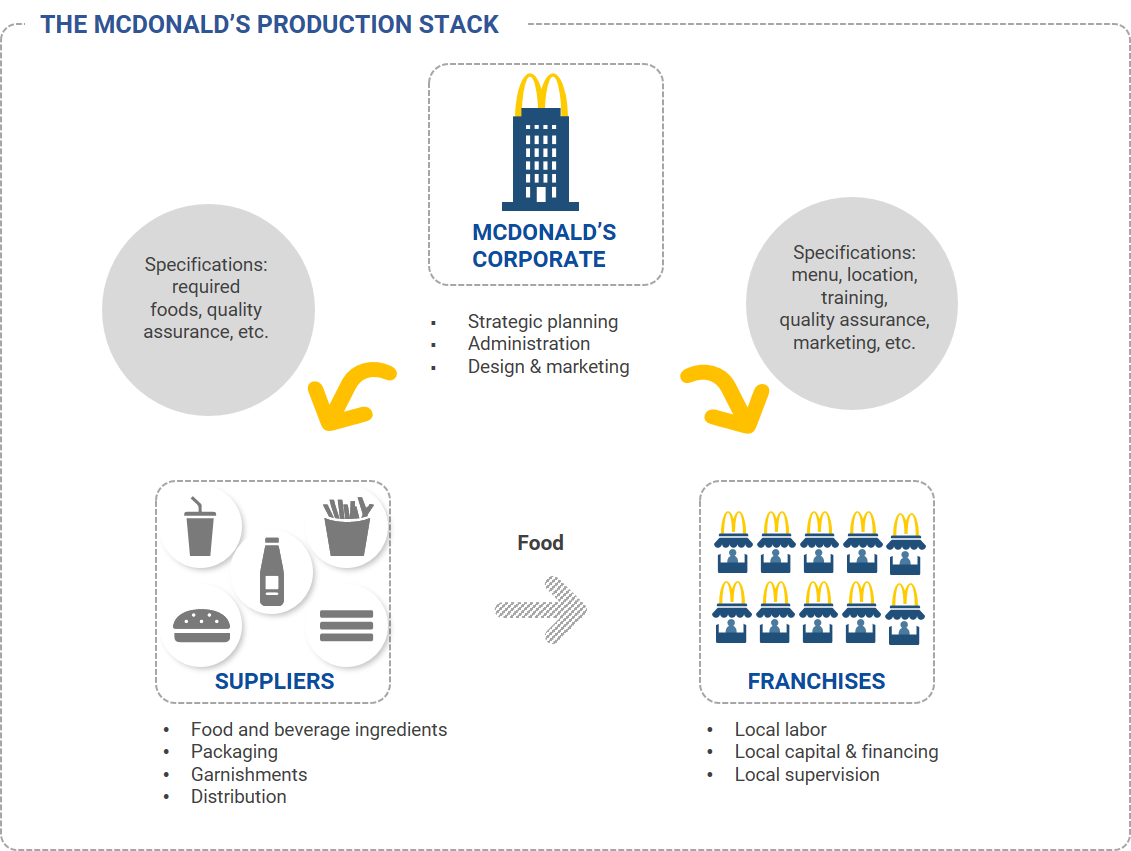

Case study 1: McDonald’s

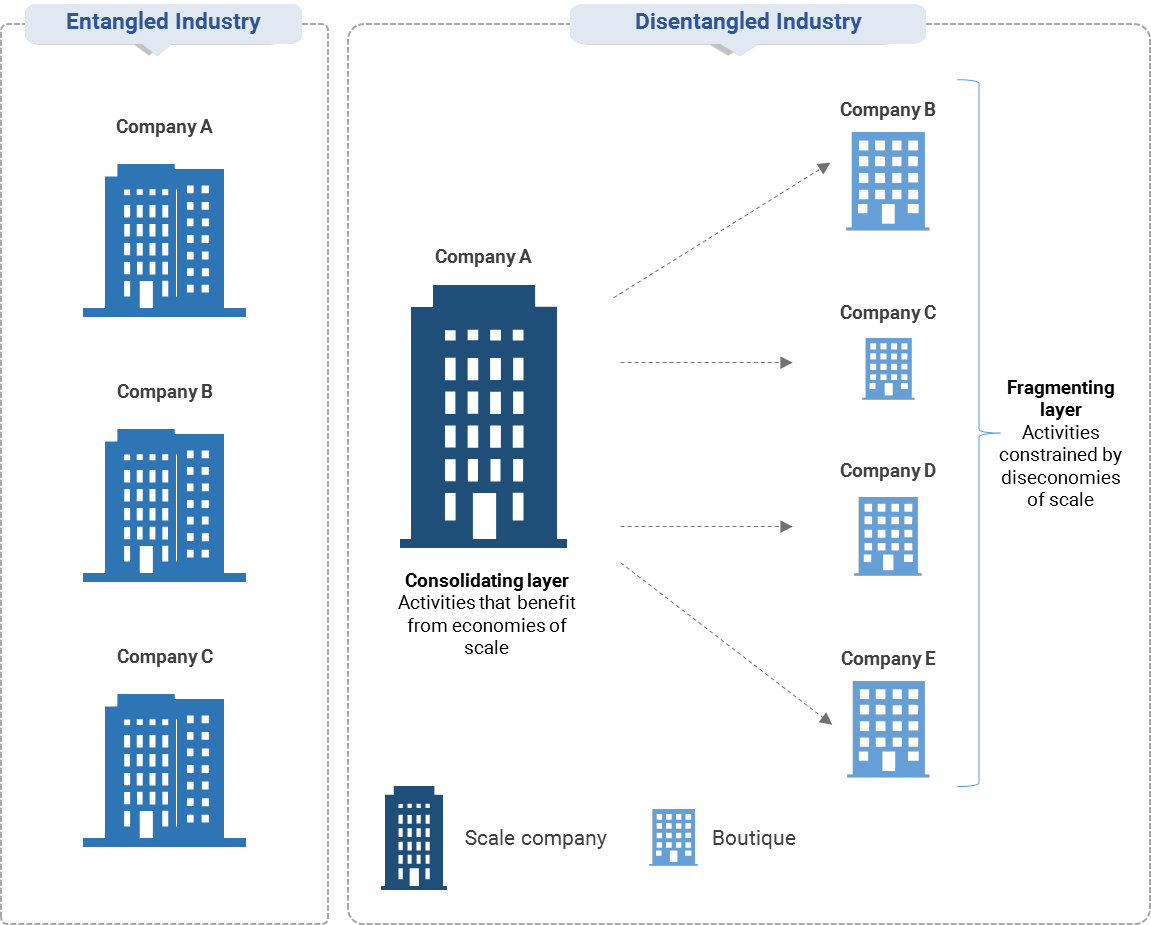

Industry disentanglement

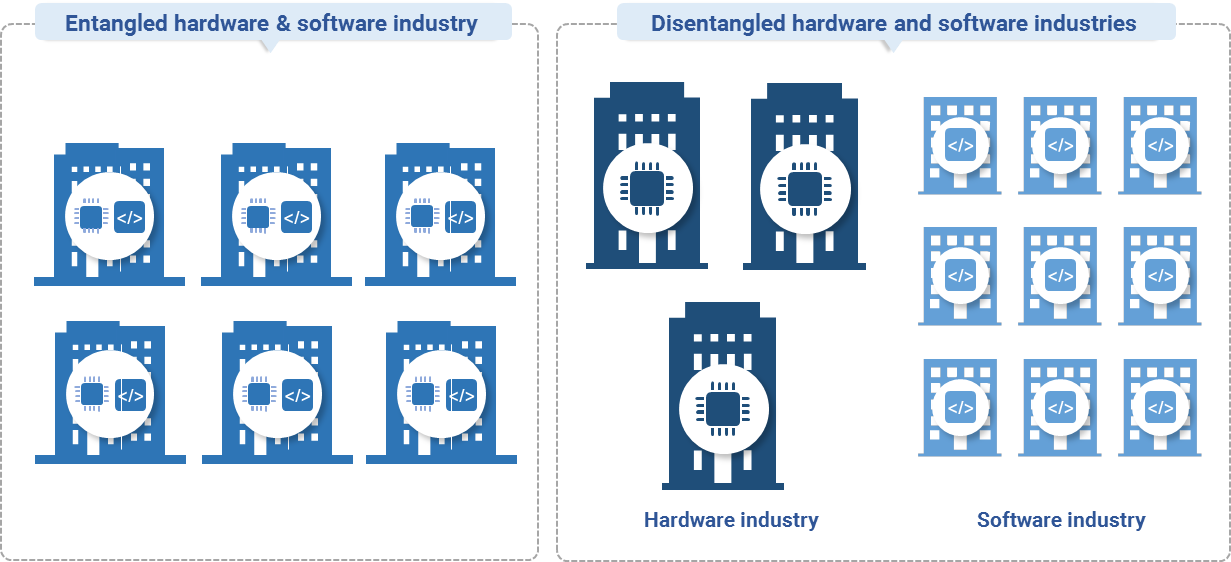

Case study 2: firmware (IBM)

The super accelerant: making change cheaper

Case study 3: user standards – Windows and iOS

Exhibit 4: Intuitive user interfaces make switching between competing products easier

From user standards to user-integrated production processes

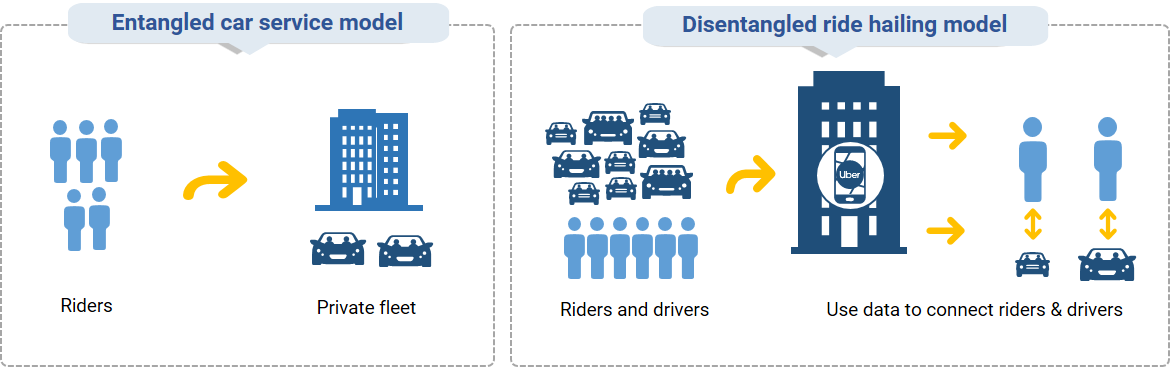

Case study 4: ride-hailing services

ISO 9000 quality standards

Chapter 3: Perfecting Platforms

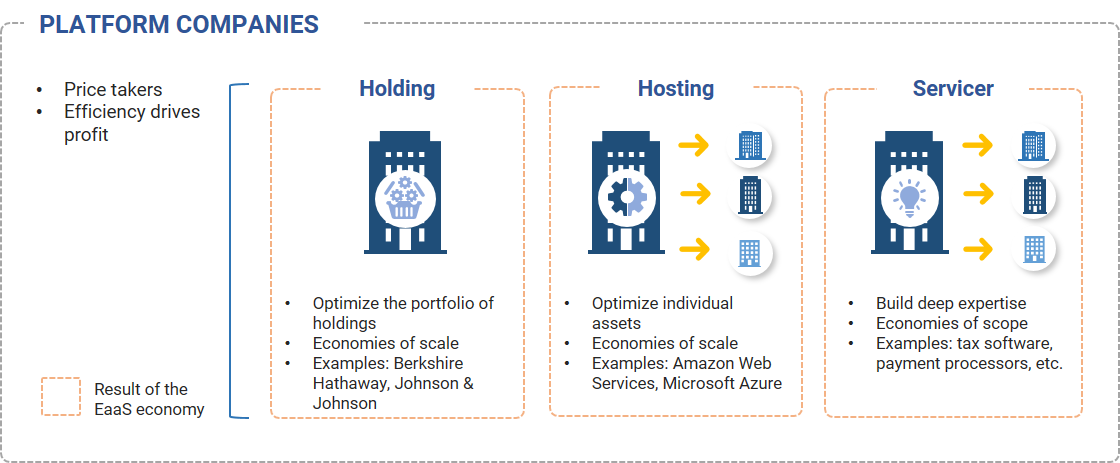

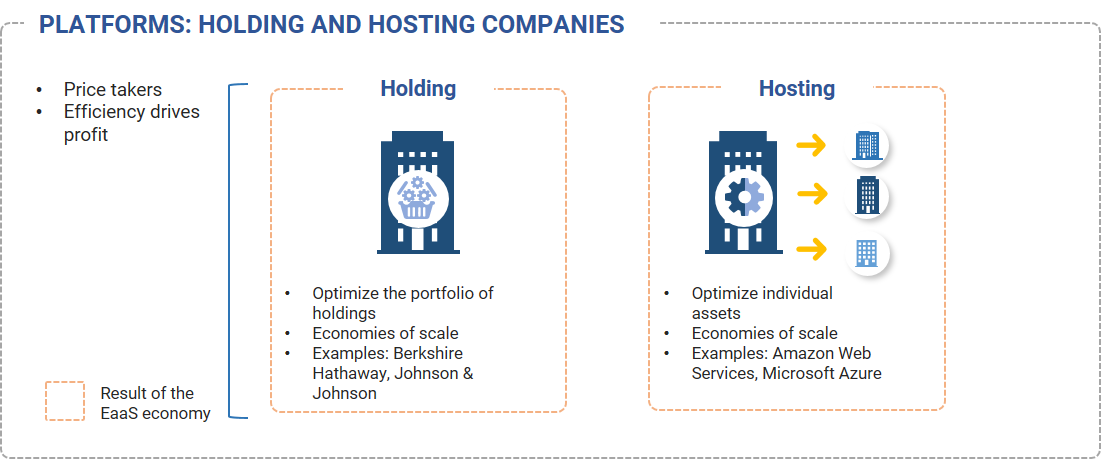

Holding companies focus on owning diversified portfolios of assets and prioritize managing these portfolios in their entirety, rather than each of the underlying assets independently. Examples: Berkshire Hathaway, Johnson & Johnson.

Hosting companies focus on having a diversified customer base, which allows them to manage their individual assets as efficiently as possible. Hosting companies seek to achieve high levels of physical asset utilization by distributing usage across as wide a customer base as possible. Examples: Amazon Web Services, Microsoft Azure.

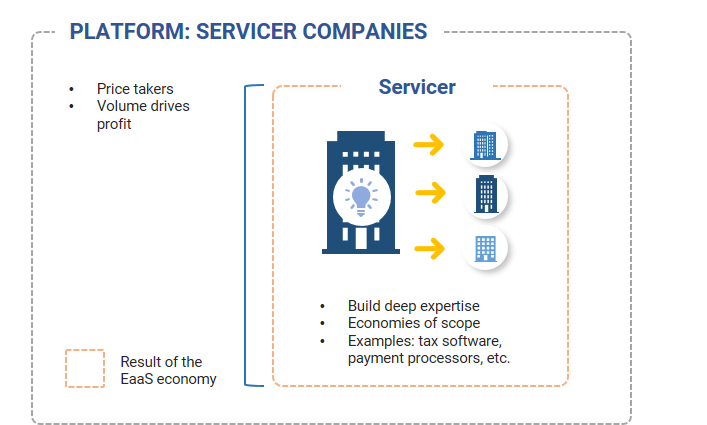

Servicers focus on providing their customers with some form of intellectual capital in a plug-and-play form, which allows Servicers to scale at very low marginal costs. Servicers seek to leverage this intellectual capital as much as possible and seek to expand their businesses by finding new customer types – but only ones that do not create diseconomies of scale by having unique customization requirements. Examples: tax software providers, payment processors.

Platforms: a closer look at Holding versus Hosting companies

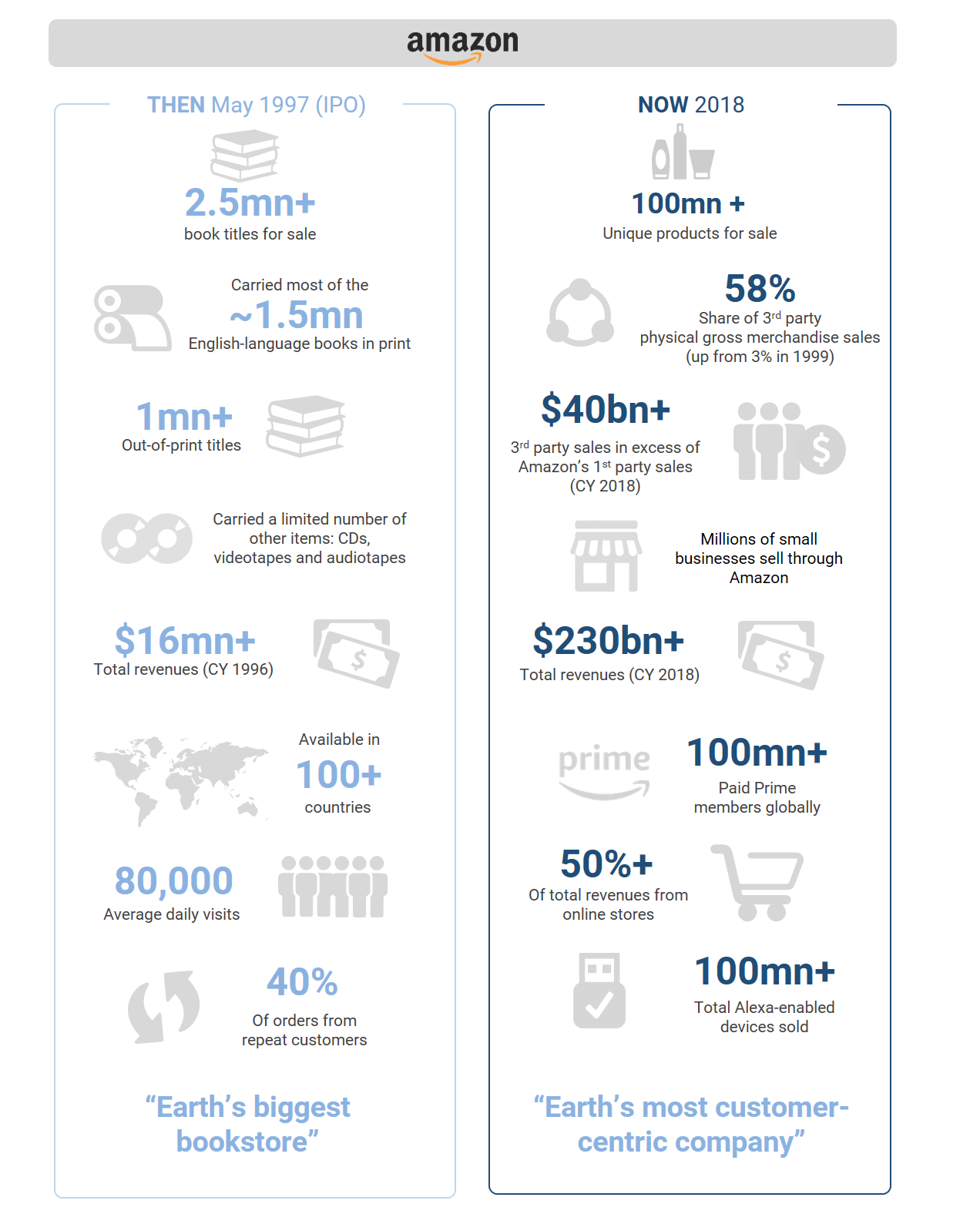

Case study 5: Amazon’s retail services business

Case study 6: Berkshire Hathaway

Case study 7: the pharmaceutical industry

Servicer companies: exploiting economies of scope

Case study 8: Payroll software

Case study 9: payment processors

Case study 10: Qualcomm

Case study 11: cable versus programming

Concluding thoughts

Chapter 4: Niche after niche - Organizers

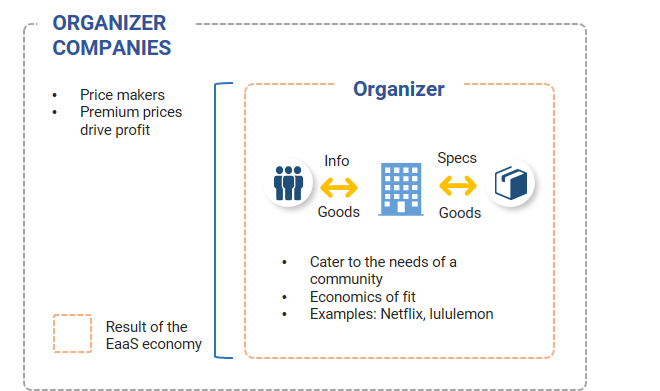

How Organizers create sustainable competitive advantages

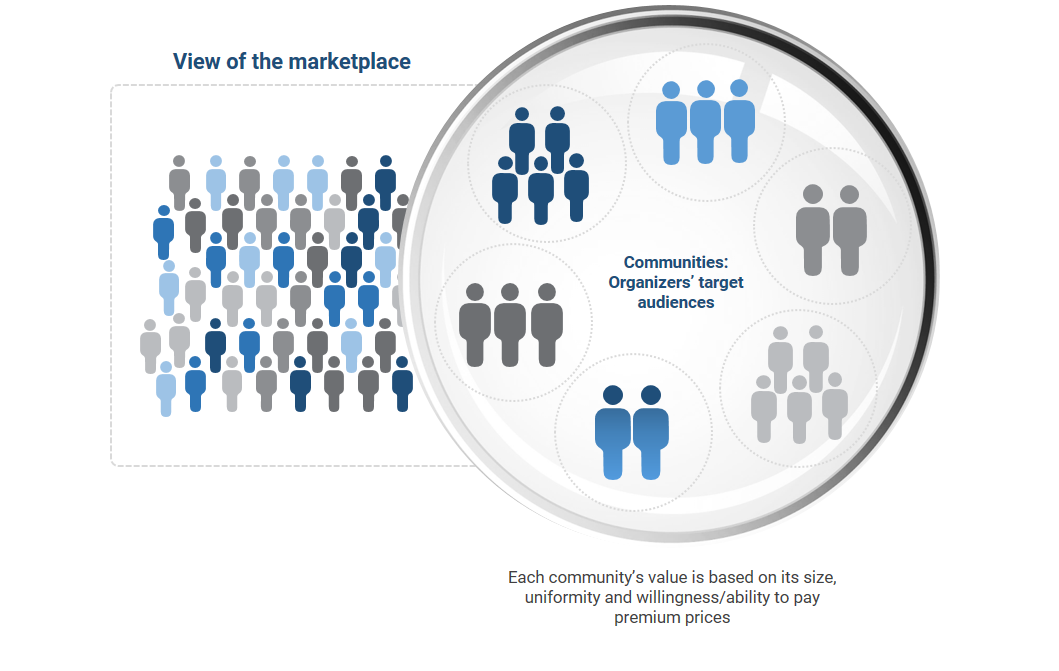

Organizers and the role of communities

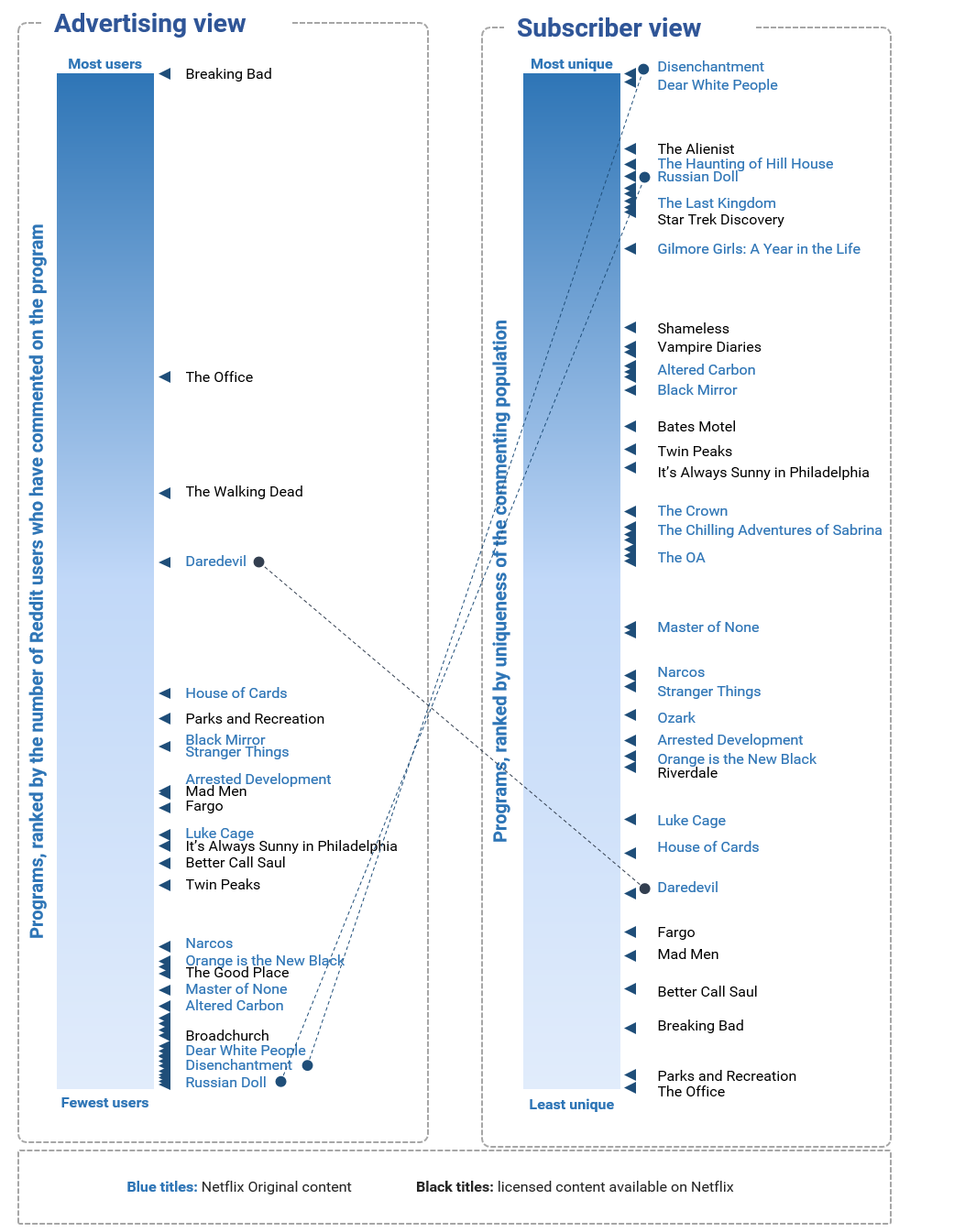

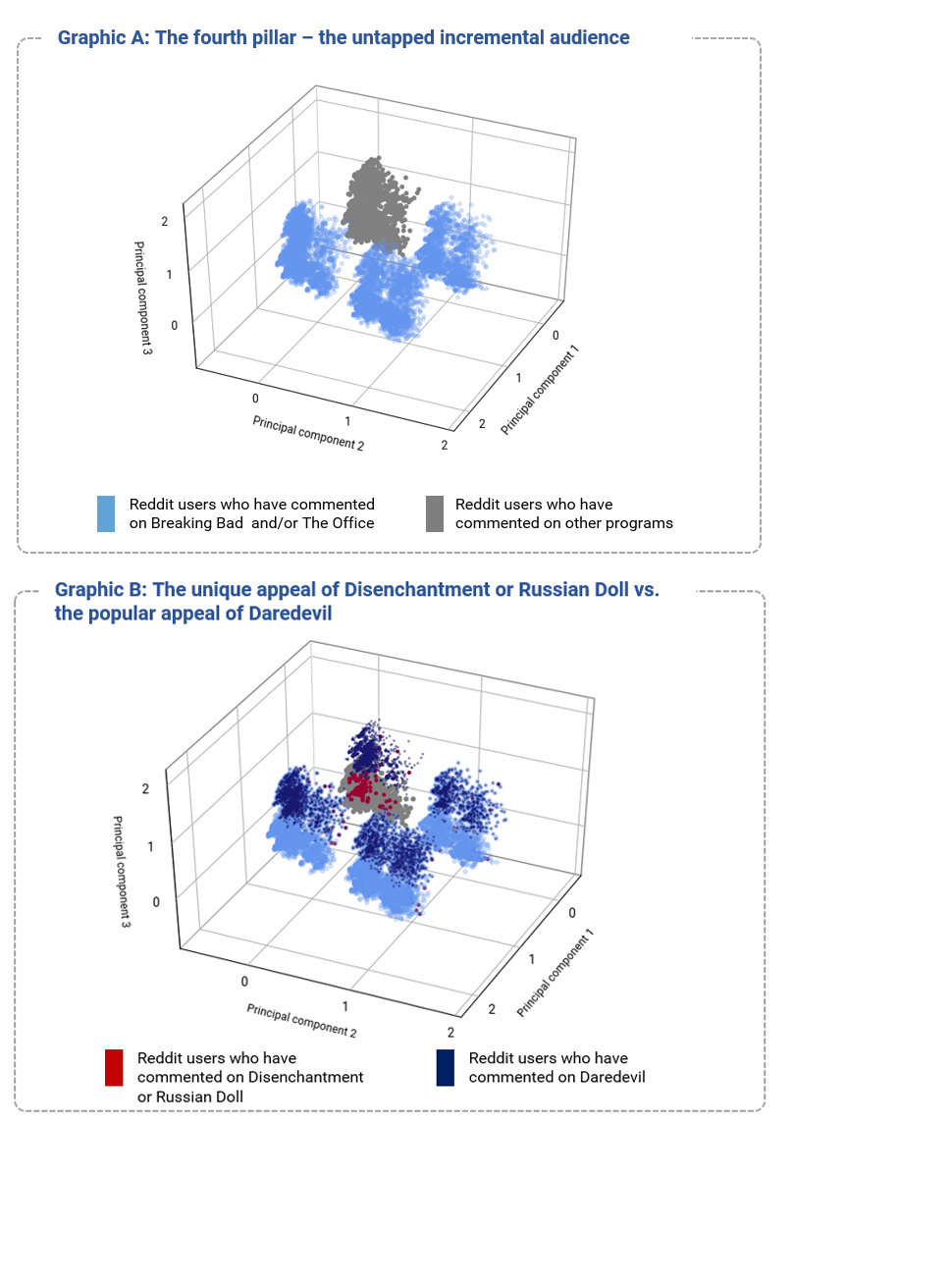

Case study 12: Netflix

Finding the next niche – or why TV is getting weirder

Community-linked Organizers

Case study 13: lululemon athletica

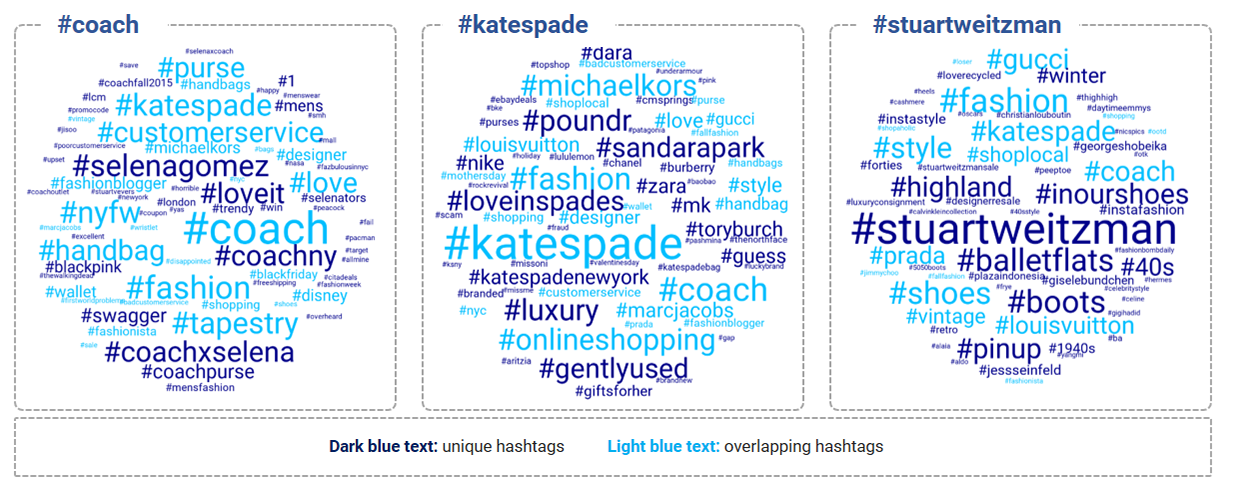

Case study 14: Coach

Chapter 5: The competitive value of data

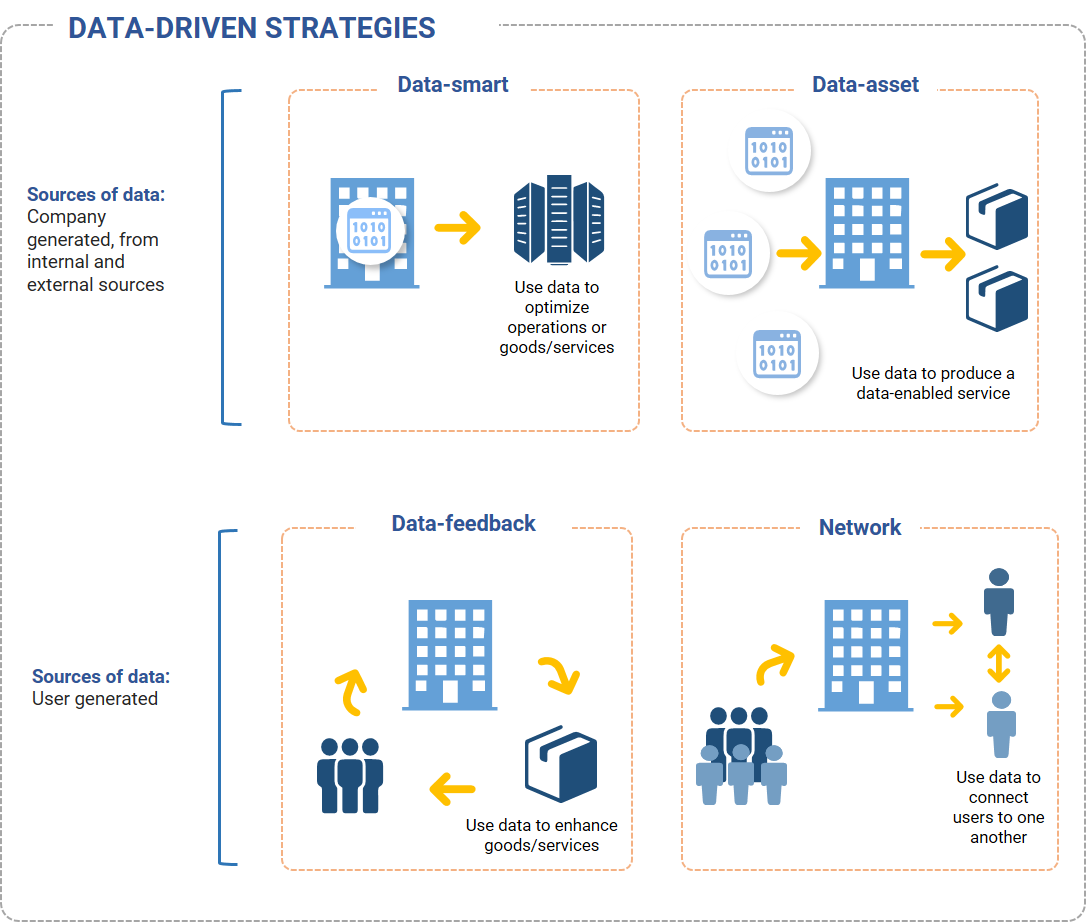

Data-smart strategies rely on a business’s internally generated data as the foundation for producing data-based insights – or what can be thought of as learning. These insights can be used to optimize both a firm’s operations as well as its output. An example of a business that uses a data-smart strategy is Amazon’s logistics service.

Data-asset strategies are dependent on a business’s ability to build a proprietary dataset using secondary sources, for example by collecting (free or purchased) data from sensors, genetic labs or satellites. These proprietary datasets can be used to produce data services that are sold to others. An example of a business that uses a data-asset strategy is IBM Watson Health.

Data-feedback strategies are applicable to businesses that collect user data. To employ this strategy, businesses collect the data that is generated by the users of their products or services, analyze it and leverage the resulting insights to enhance their products or services. Said another way, data-feedback strategies describe when a company leverages user data to create a feedback loop between its users and the goods or services it provides to those users. Examples of businesses that use data-feedback strategies include Spotify with its playlist suggestions, Amazon with its retail product recommendations or Google Maps.

Network strategies are also applicable to businesses that collect user data. However, the purpose of a network strategy is to leverage user data to connect users with one another. Examples of businesses that use network strategies include Uber, Lyft, Airbnb and Facebook.

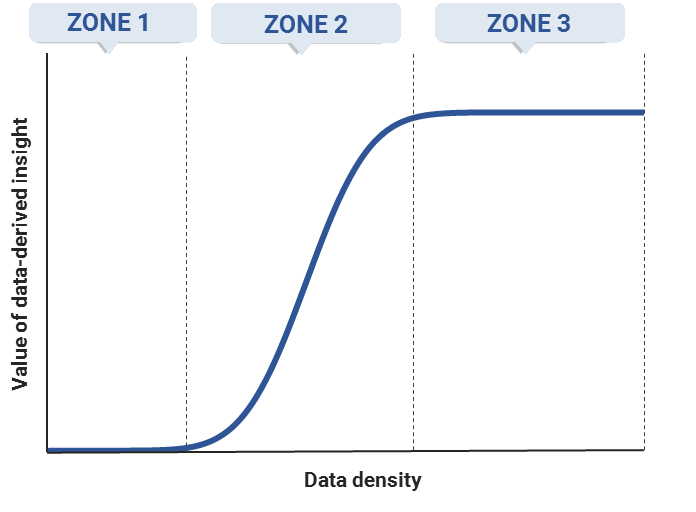

The learning curve

In zone 1, depicted on the left-hand side of Exhibit 18, the learning curve is flat and the incremental value associated with data analysis is low. This means the gains associated with incremental data analysis and data density are limited. The fact that learning is slow in zone 1 is due to the fact that a certain amount of data must be collected before it can be effectively modeled.

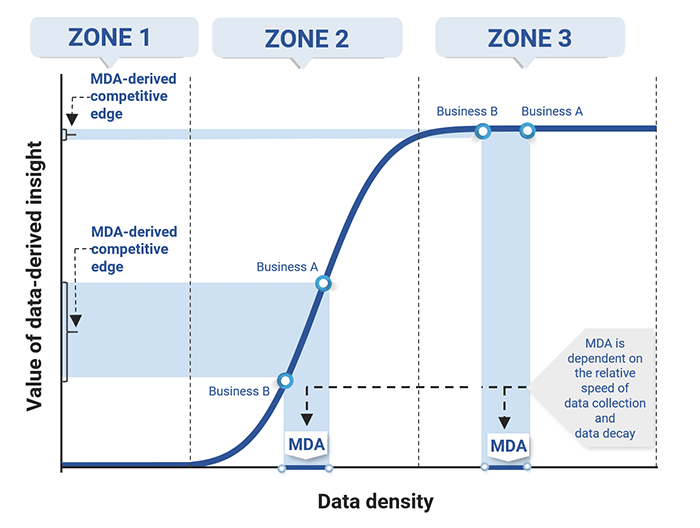

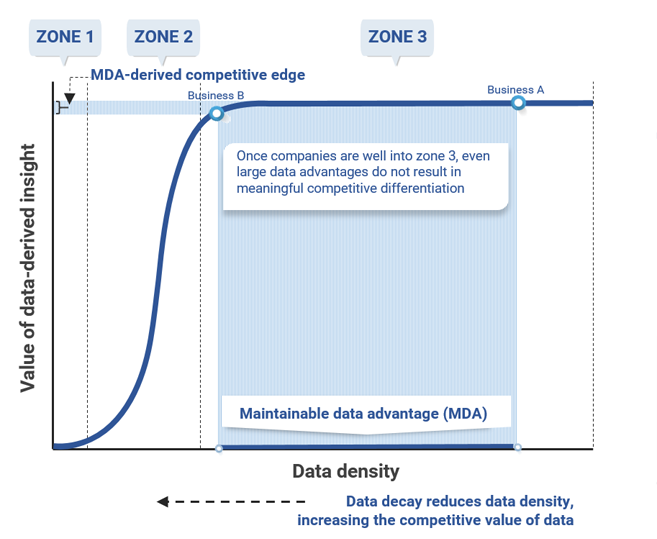

In zone 2, the learning curve begins to slope upward and becomes steeper, typically very steep. At this point, the nature of the data model has become clearer and is better defined, so the incremental value of data-derived information is high. As a result, in this zone, accumulating more data – particularly relative to competitors – can result in a maintainable data advantage (MDA) and can generate significant incremental value (as the middle portion of Exhibit 18 shows). The MDA refers to the pure advantage in the amount of data one business can collect relative to another; the learning curve can then be used to map that MDA to determine a business's relative competitive position given the value of its data-derived insights.

In zone 3, the learning curve flattens because incremental data accumulation and analysis no longer result in significant value, which can be seen on the right-hand side of Exhibit 18. In this zone, the learning process is nearly complete since most of what can be learned from data to address a specific question or problem has already been learned; businesses in the same market segment that reach zone 3 are in essentially the same competitive position. Accordingly, as Exhibit 18 shows, the same MDA that resulted in a significant competitive advantage for Business A relative to Business B in zone 2 becomes a very small advantage if both businesses reach zone 3.

Data density: the rate of collection vs. the rate of decay

Data-driven learning strategies

The data-smart strategy

The data-asset strategy

Data-asset strategies: a comparison to deep-water drilling for oil or new drug development

The data-feedback strategy

The network strategy

The four-part test

Is there sufficient data to analyze?

Are the insights gained from the data novel and valuable enough to be of competitive benefit?

Is the data-derived strategy difficult to copy without the data?

Is the data sufficiently scarce or hard enough to collect that competitors cannot replicate the analysis in normal course?

Chapter 6: Concluding thoughts

Innovations are in general easier to execute, but are less likely to provide a sustainable advantage.

The use of external service providers allows firms to have a more narrow, focused approach to business but also creates a web of interdependencies that needs to be managed.

The path to success is actually more straightforward today: firms must have the best product, but the ability to stay on that path is far harder because someone else is coming!

An economic policy postscript

Lower barriers to entry across industries mean that firms will often find it more difficult to successfully engage in anti-competitive behavior, regardless of their own size or market position.

Given the role that most large firms now play as part of a more cooperative business environment, they now have strong incentives to support rather than exploit others.

The plug-and-play aspect of the EaaS economy lowers switching costs and makes it easier to displace “bad” actors, further limiting the scope for anti-competitive activity.

Appendix A: Considering communities

Principal component analysis of Reddit comments on 50 Netflix programs

The word clouds: a glimpse into community perceptions using Twitter hashtags

Bibliography

- 1 ^ Some of this material was included in Strongin, Steve et al (Dec 2018), The Everything-as-a-Service economy, Goldman Sachs Global Markets Institute.

- 2 ^ See Strongin, Steve et al (Apr 2019), What the market pays for, Goldman Sachs Global Markets Institute.

- 3 ^ Historically, economies of fit were referred to as monopolistic competition. See Chamberlin, E. (1933), The Theory of Monopolistic Competition, Cambridge Harvard University Press.

- 4 ^ We looked at a variety of similar ranking algorithms, including best fit types, all of which produced similar answers.

- 5 ^ The complete list of programs considered: 13 Reasons Why, The Alienist, Altered Carbon, Always Sunny in Philadelphia, American Horror Story, American Vandal, Arrested Development, Ash vs Evil Dead, Bates Motel, Better Call Saul, Black Mirror, Bojack Horseman, Breaking Bad, Broadchurch, Crazy Ex-girlfriend, Daredevil, Dear White People, Disenchantment, Fargo, Gilmore Girls, House of Cards, Luke Cage, Mad Men, Master of None, Mindhunter, Narcos, Orange is the New Black, Orphan Black, Ozark, Parks and Recreation, Parts Unknown, Peaky Blinders, Portlandia, Riverdale, Russian Doll, Sabrina, Shameless, Star Trek Discovery, Stranger Things, The Crown, The Good Place, The Haunting of Hill House, The IT Crowd, The Last Kingdom, The OA, The Office, Twin Peaks, Unbreakable Kimmy, Vampire Diaries, The Walking Dead.

The Global Markets Institute is the research think tank within Goldman Sachs Global Investment Research. For other important disclosures, see the Disclosure Appendix.