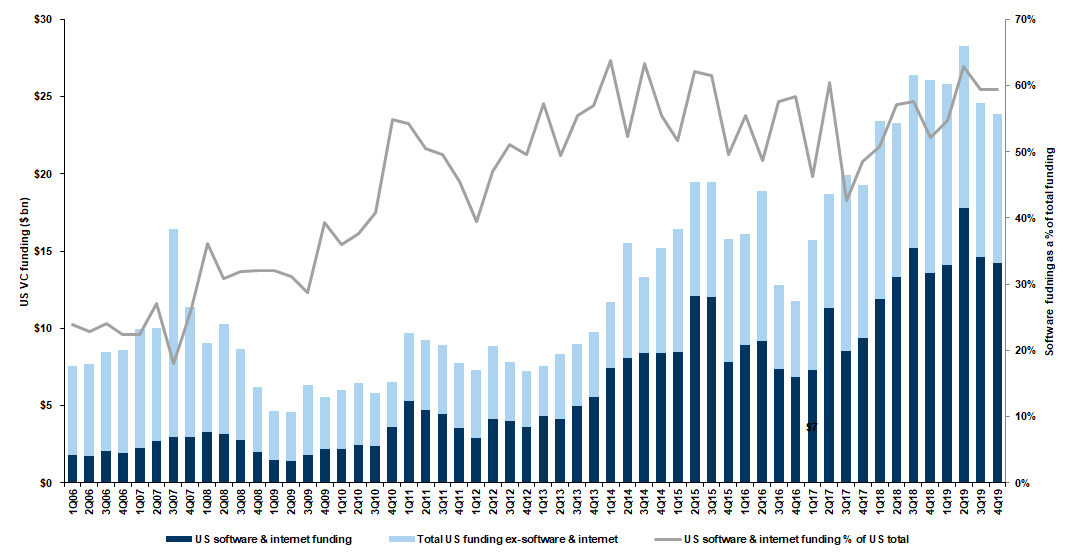

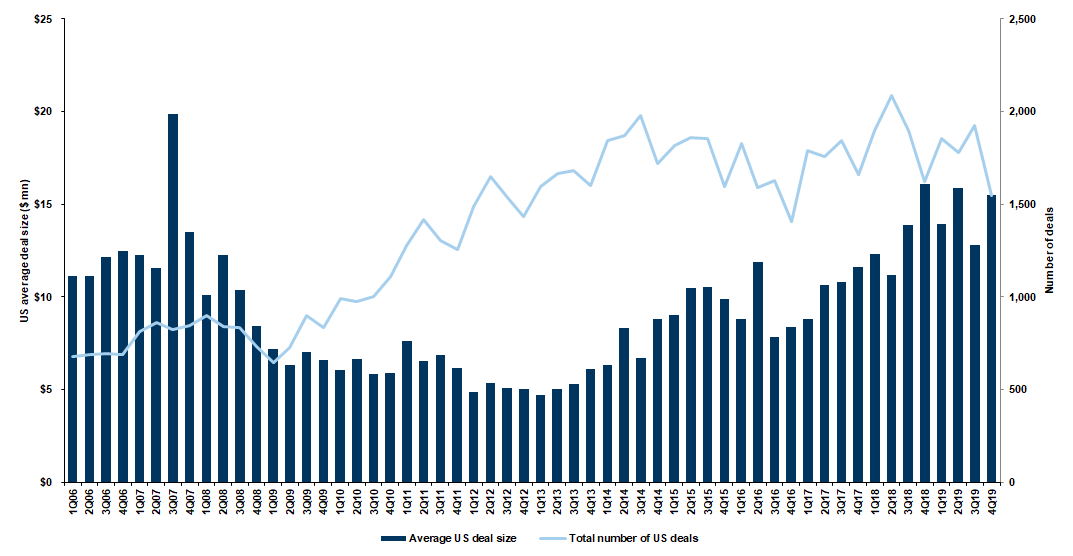

Venture capital funding

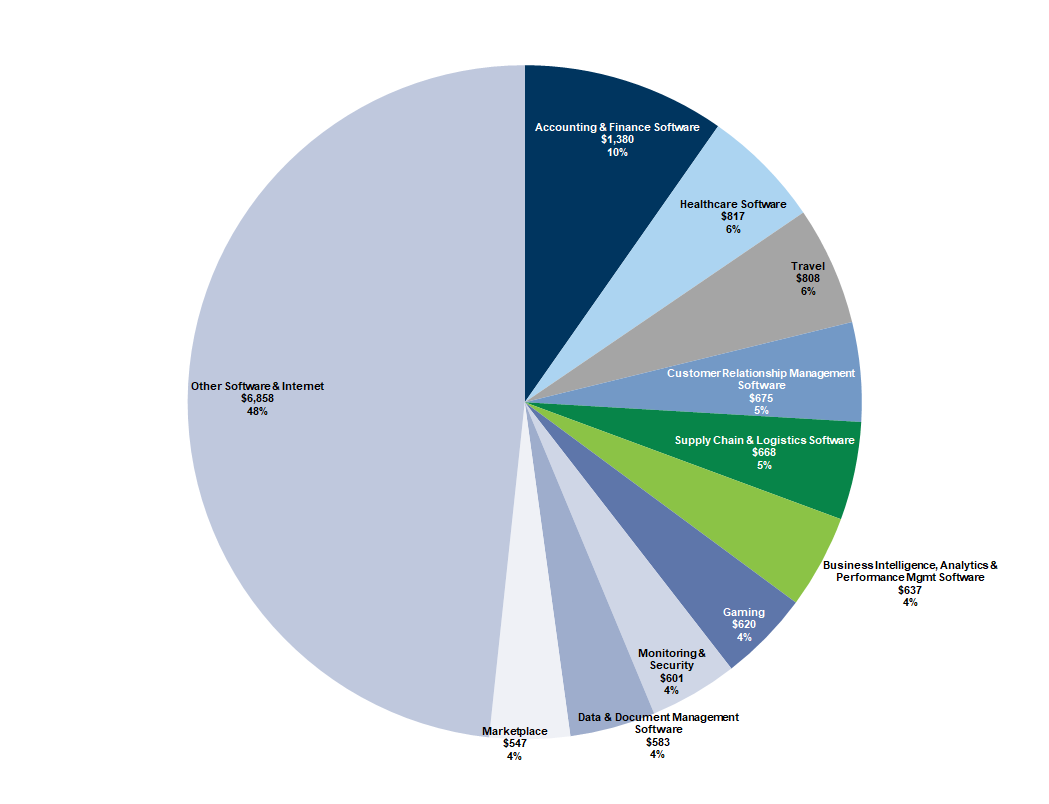

Breaking down the quarter in software and internet funding

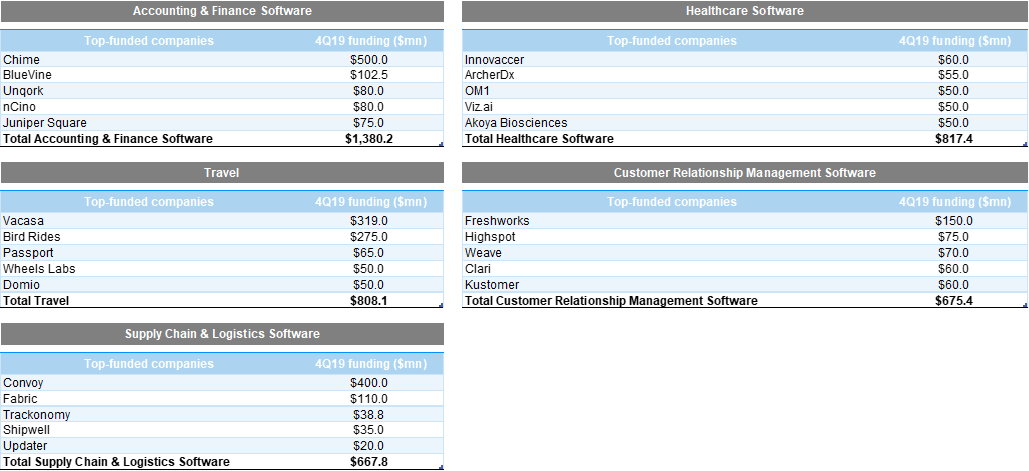

Accounting & Finance Software: $1.38bn (10%)

Healthcare Software: $817mn (6%)

Travel: $808mn (6%)

Customer Relationship Management Software: $675mn (5%)

Supply Chain & Logistics Software: $668mn (5%)

Business Intelligence, Analytics, & Performance Management Software: $637mn (4%)

Gaming: $620mn (4%)

Monitoring & Security: $601mn (4%)

Data & Document Management Software: $583mn (4%)

Marketplace: $547mn (4%)

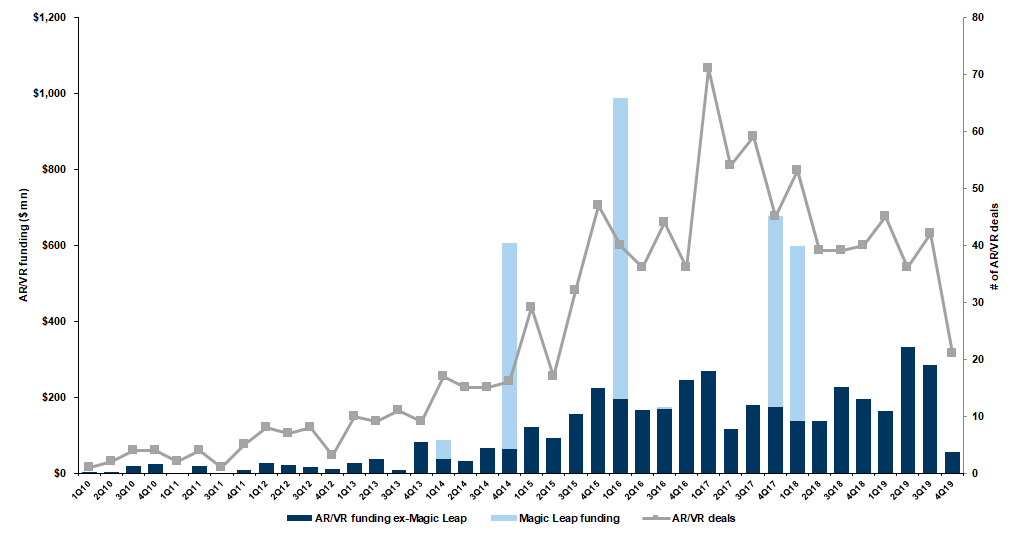

An update on AR/VR funding

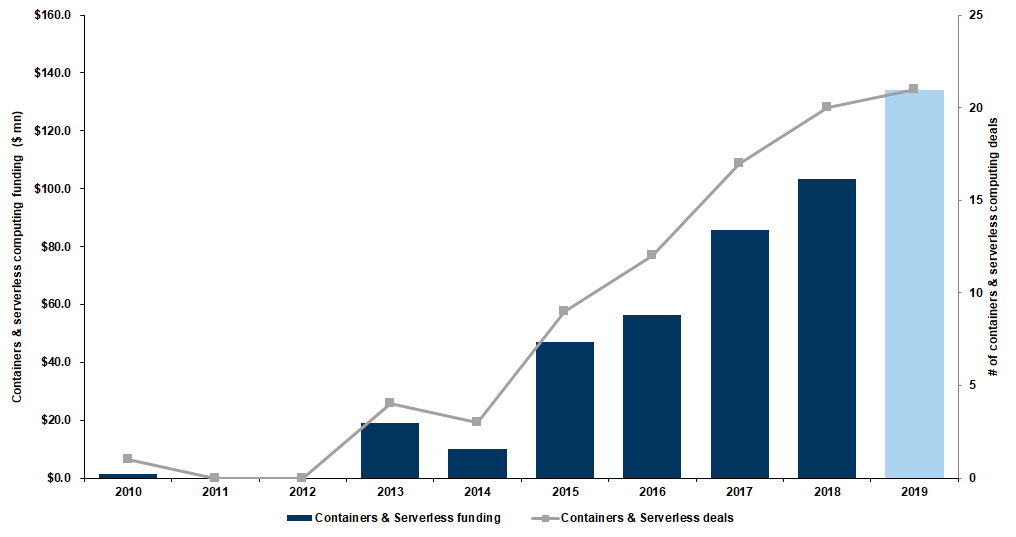

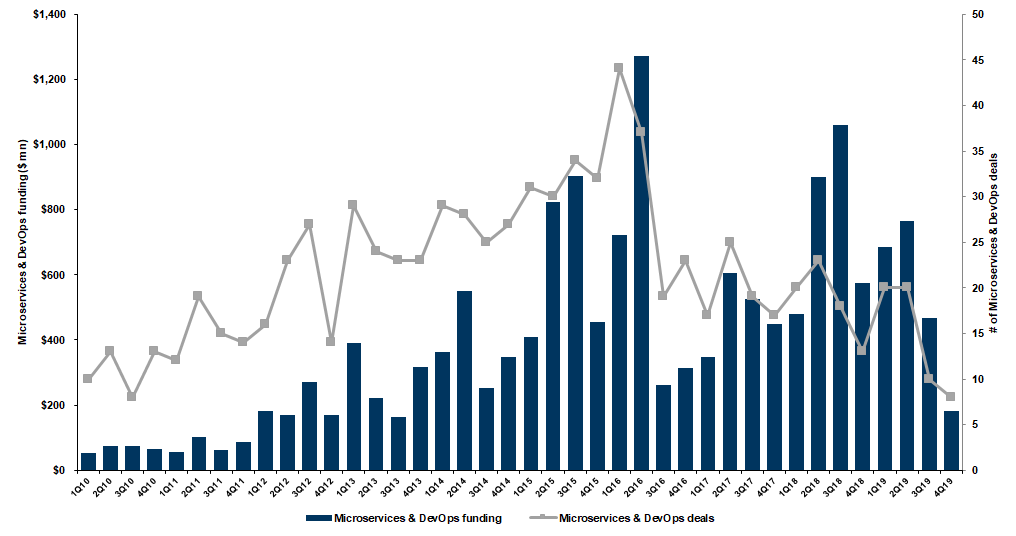

Containers, serverless computing, microservices, & DevOps funding

A $35mn Series C round for Diamanti, a purpose-built, fully integrated enterprise Kubernetes platform that spans on-premise and public cloud environments

A $14mn Series A round for Styra, which offers security products that help define, enforce, and validate security across Kubernetes environments.

A $8mn Series A round for Rafay Systems, which offers lifecycle management for containerized applications

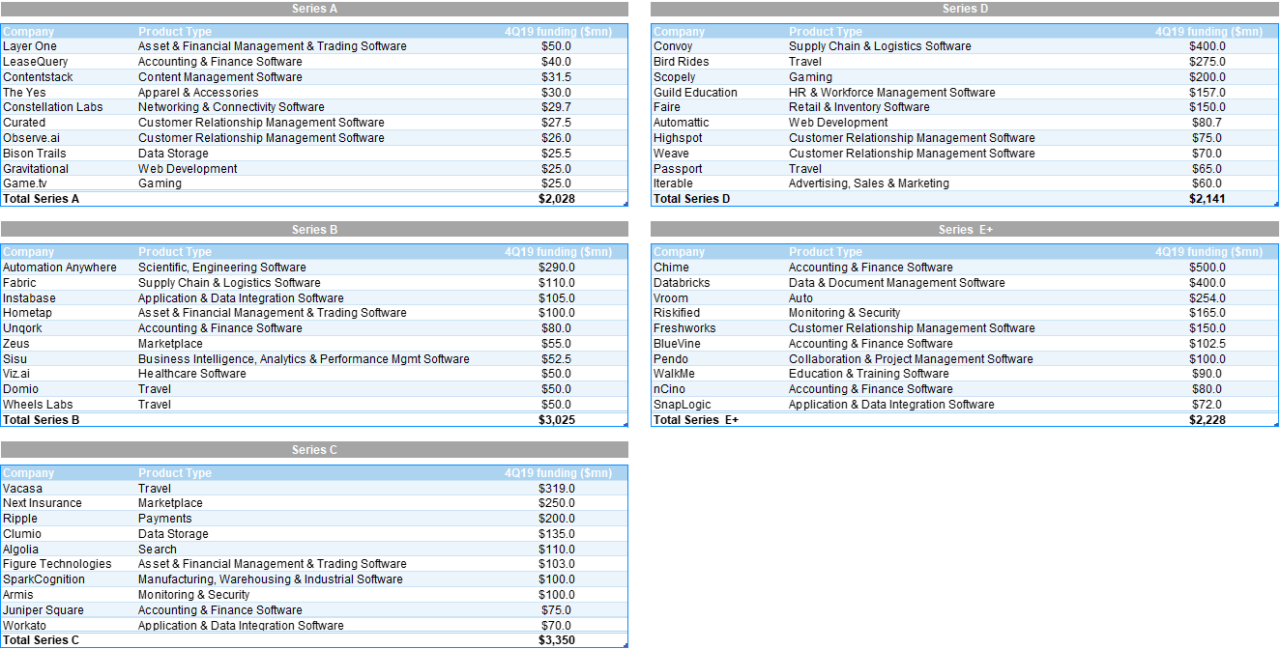

Learning the alphabet

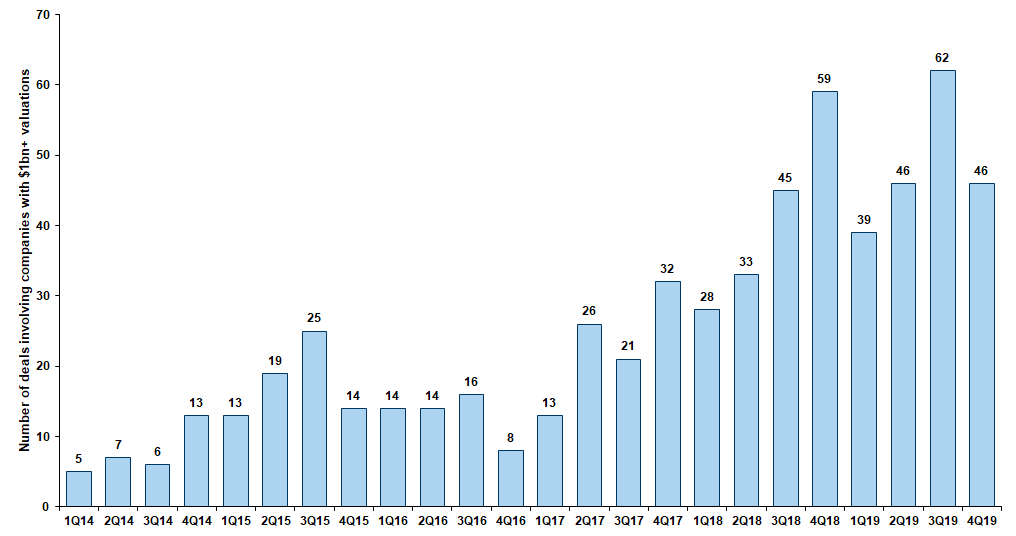

Deals involving billion-dollar valuations

A $290mn Series B round for Automation Anywhere, which offers robotic process automation (RPA) software designed to augment the human workforce by automating repetitive business processes. Automation Anywhere has a post-valuation of $6.8bn vs. $2.6bn in November 2018.

A $150mn Series H round for Freshworks, which offers customer engagement software for enterprises. Freshworks has a post-valuation of $3.5bn vs. $1.5bn in July 2018.

A $400mn Series F round for Databricks, a unified data analytics platform designed for big data analytics. Databricks has a post-valuation of $6.2bn vs. $2.75bn in Feb 2019.

A $85mn Series A round for Canva, an online graphic design platform. Canva has a post-valuation of $3.2bn vs. $2.5bn in May 2019.

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.