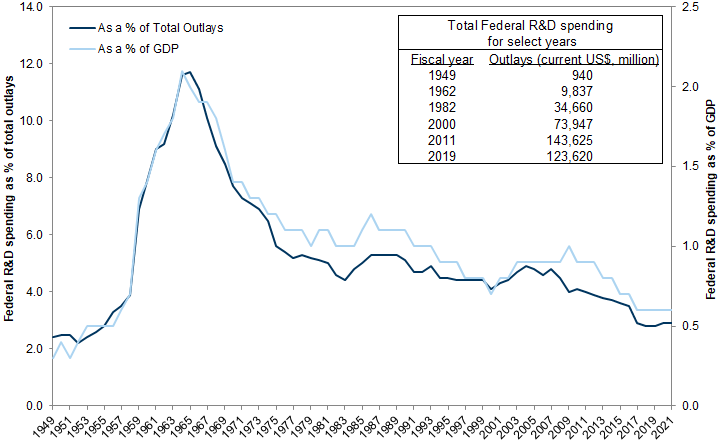

Ending the SARS-CoV-2 pandemic will ultimately require scientific approaches in the form of specialized therapeutics and effective vaccines. However, the current crisis comes at a time when the US federal government has underinvested in science for many years. In FY 2019, federal R&D spending equaled 0.6% of US GDP and 2.8% of total federal outlays, the lowest in over 60 years.

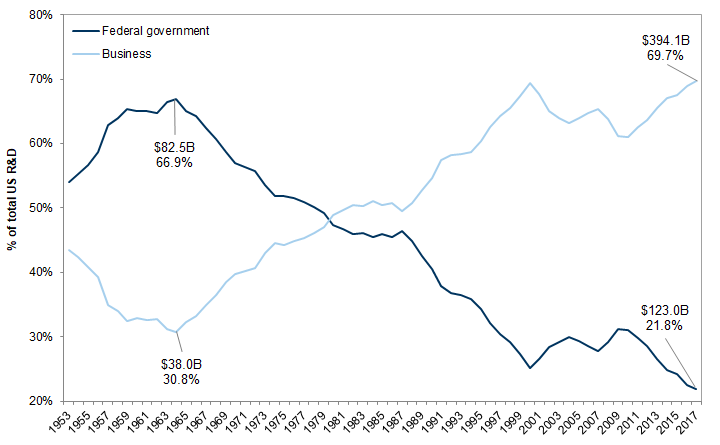

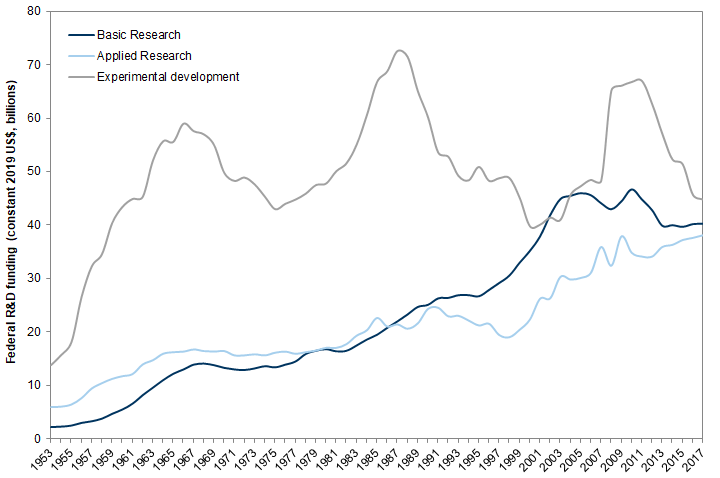

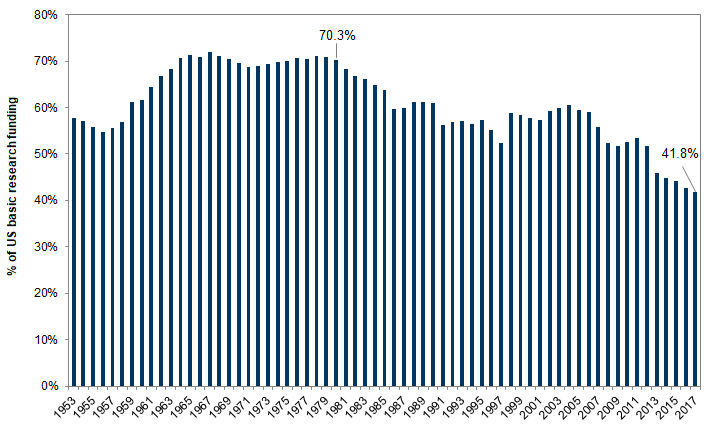

The historically low level of R&D may have severe consequences for the long-term advancement of science and technology in the United States. The bulk of federal funding for R&D is for basic and applied research, which often require consistent and substantial funding over long periods, and is not easily replaced by funding from the private sector. Many impactful innovations, including the internet and GPS, originated from publicly funded entities, including the Defense Advanced Research Projects Agency (DARPA).

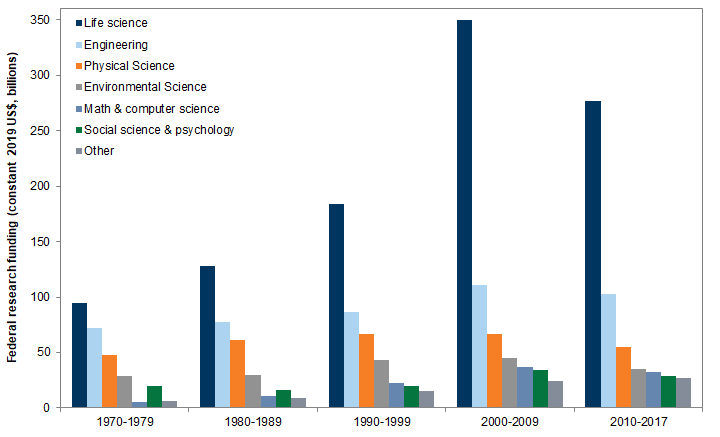

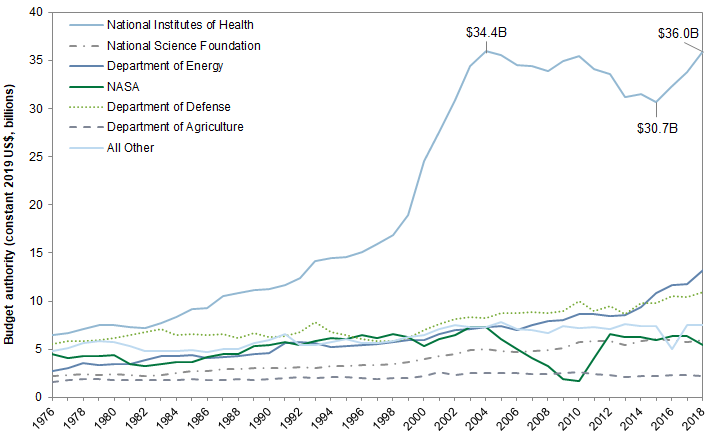

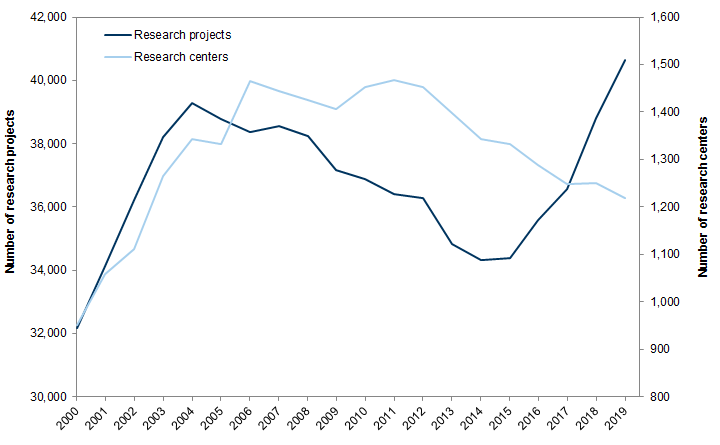

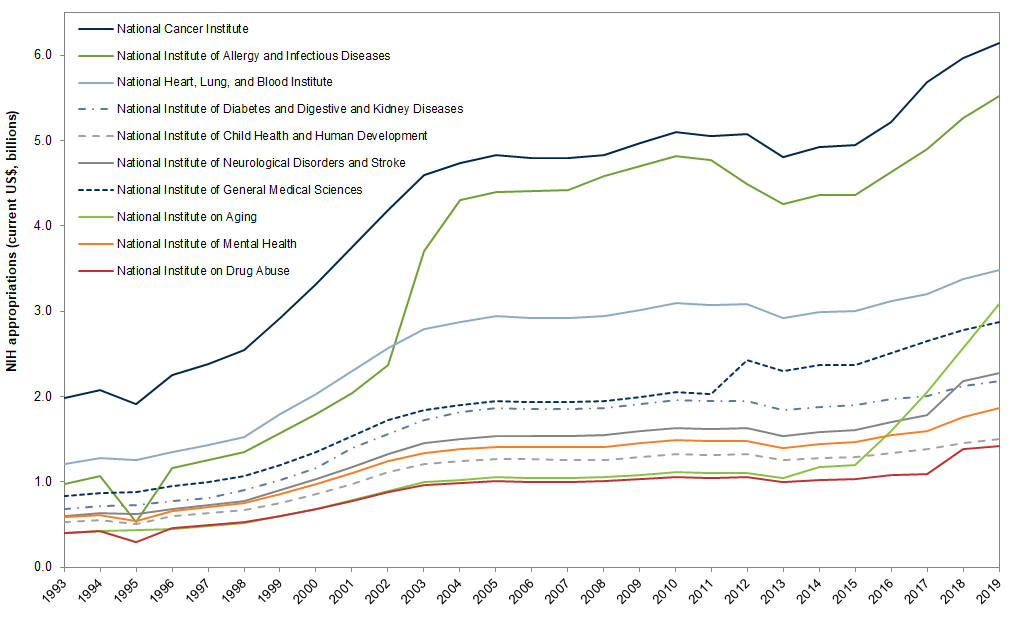

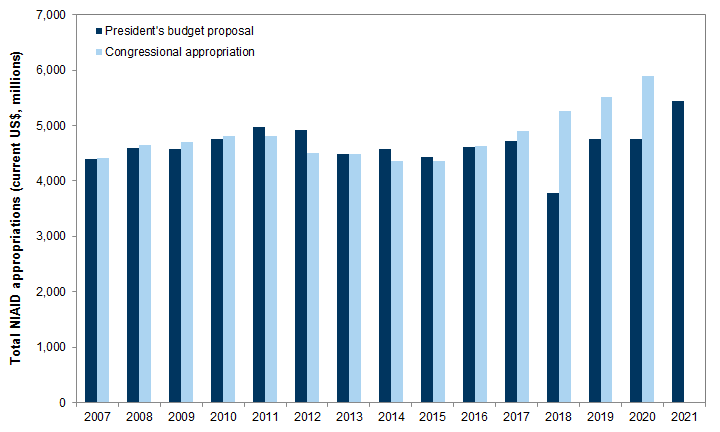

Over the past two decades, roughly half of all federal research funding was for life science, 80% of which was appropriated to the National Institutes of Health (NIH). Even so, funding for NIH has been essentially flat since 2004. The National Cancer Institute (NCI) is the largest institute within the NIH. The National Institute for Allergy and Infectious Diseases (NIAID) is the second largest. It is the primary federal agency responsible for conducting coronavirus-related research.

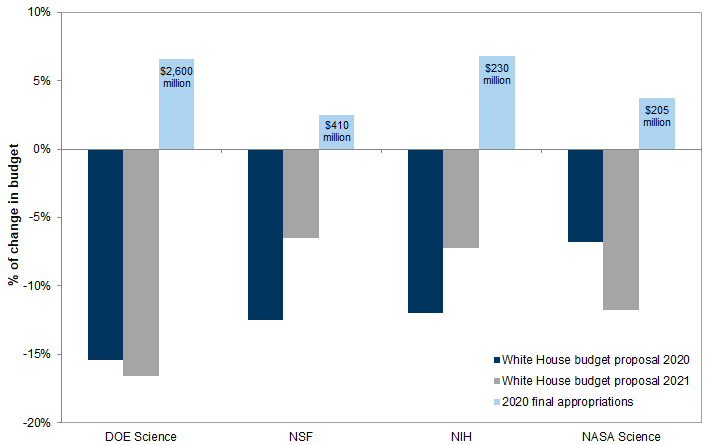

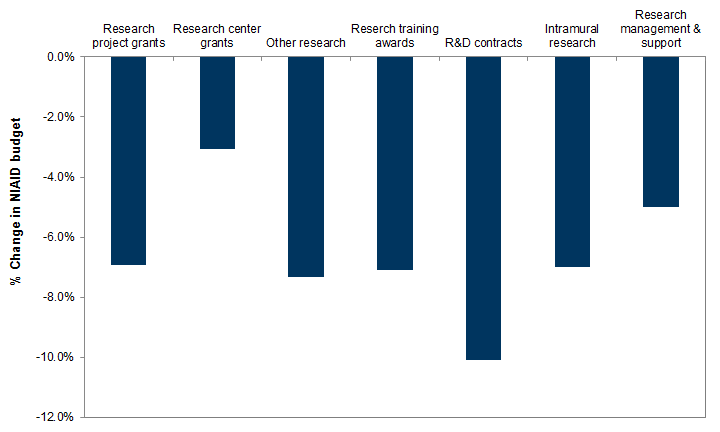

The Trump administration has repeatedly tried to cut funding from federal research and public health agencies. Its FY 2021 budget released on February 10 proposed funding cuts of 18.6% for the CDC, 7.5% for NIAID, and 7.2% for NIH. Since 2017, Congress has largely ignored these proposed reductions, and has actually increased funding for these agencies. On March 17, the OMB adjusted its proposal and restored funding for CDC and NIAID to FY 2020 levels. Some additional new funding has been provided by the CARES Act.

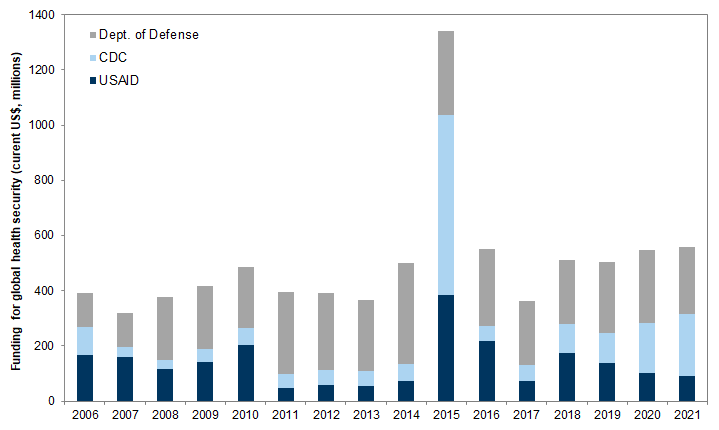

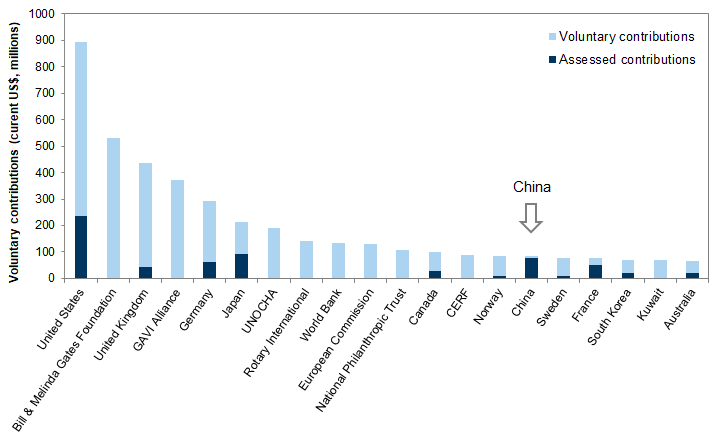

Federal funding for global health security programs, which are meant to protect the United States against emerging infectious diseases around the world, has stalled in recent years. The US government has historically been the largest contributor to the WHO. On April 14, the White House announced that, pending review, it will suspend financial contributions to the WHO, despite fears that the pandemic will seriously afflict Africa, South Asia, and other regions with poor health systems.

The coronavirus pandemic and US federal investment in science

Federal expenditures on R&D now at the lowest levels in 60 years

The difference between research and development

Federal funding for life sciences: NIH, CDC, and their component agencies -- NIAID and NIOSH

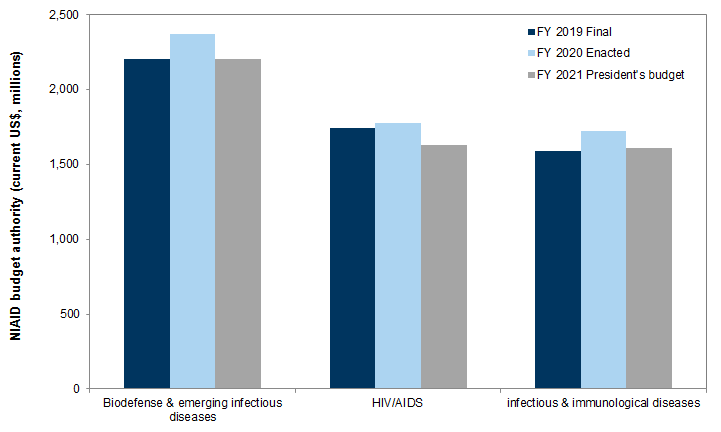

Exhibit 9: NIAID budget authority by research activity

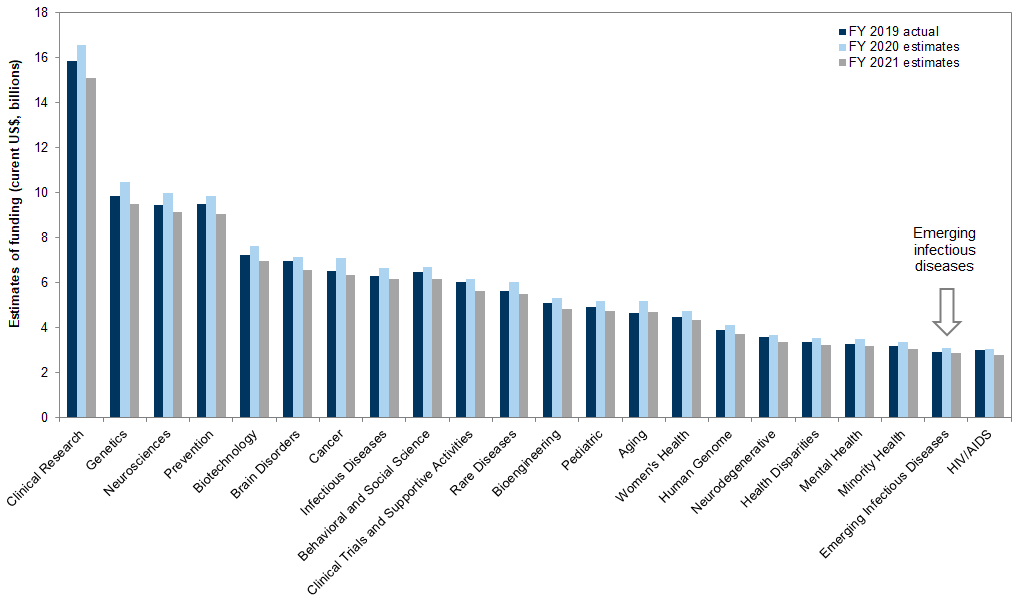

Exhibit 10: Estimates of NIH funding by research area, health condition, and disease

Science funding during the Trump administration

Exhibit 13: Changes in NIAID budget: FY 2021 proposal vs. FY 2020 enacted

US funding for global health security and the WHO

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.