- Intro

- ESG cementing its place on the corporate agenda

- Our methodology

- Links to performance: does increased ESG discussion translate into real outcomes?

- Topics in focus: which ESG topics are most discussed?

- The rise of S in ESG in the age of COVID-19

- Appendix - sector findings

- Utilities

- Industrials

- Financials

- Energy

- Materials

- Health Care

- Real Estate

- Consumer Staples

- Consumer Discretionary

- Communication Services

- Information Technology

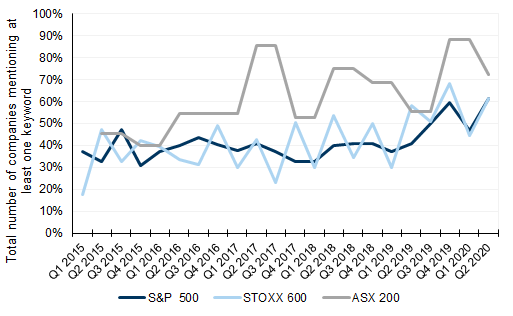

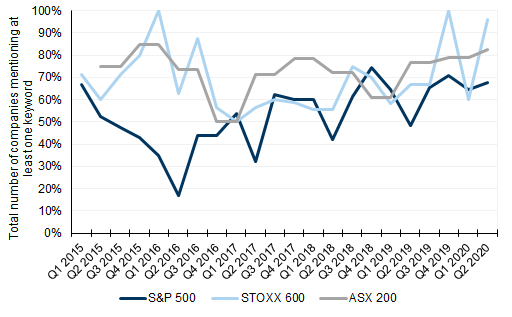

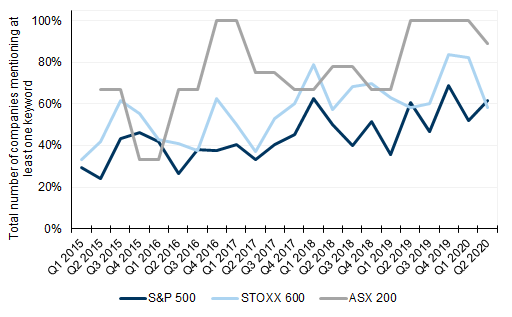

ESG cementing its place on the corporate agenda

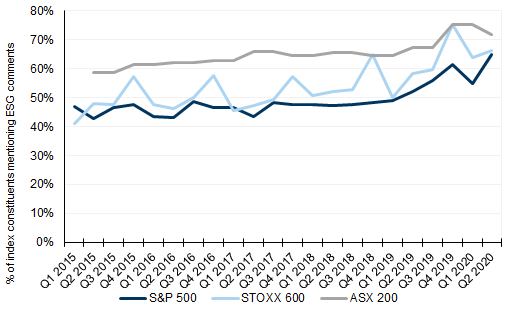

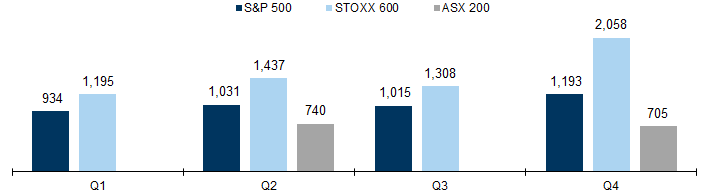

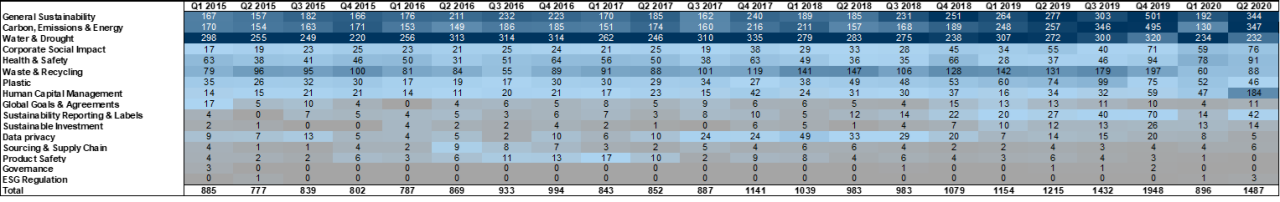

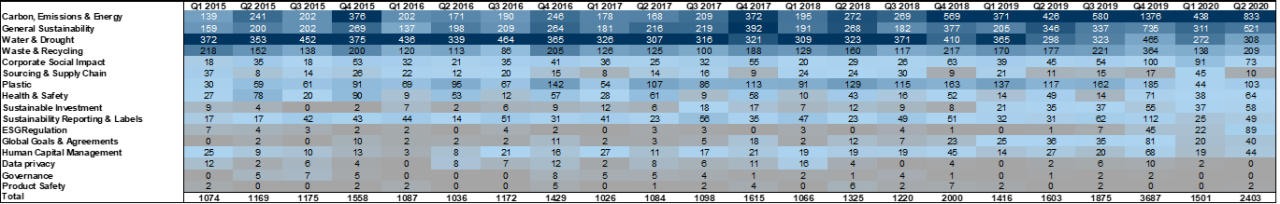

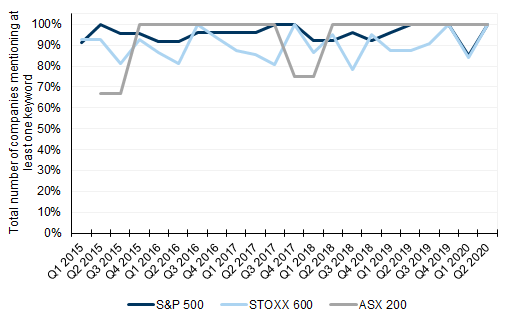

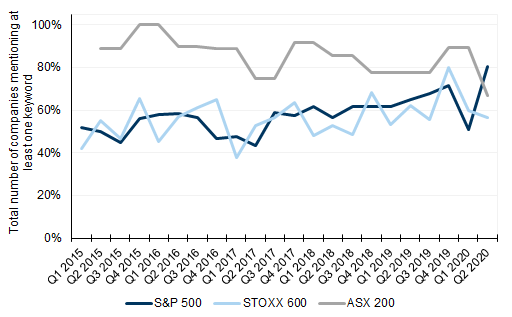

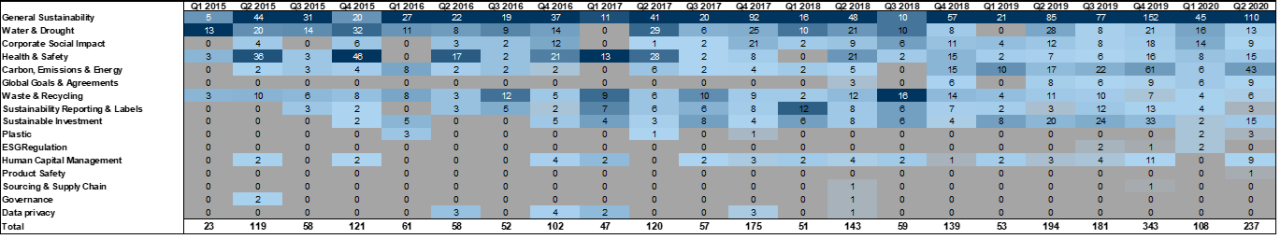

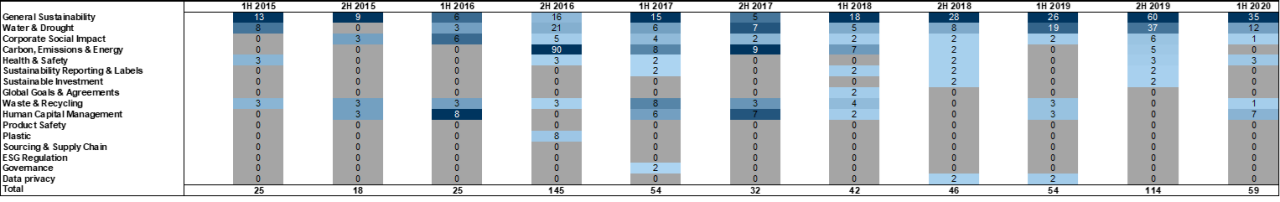

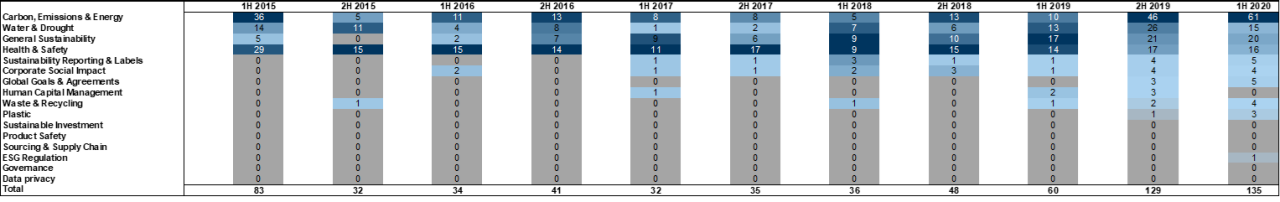

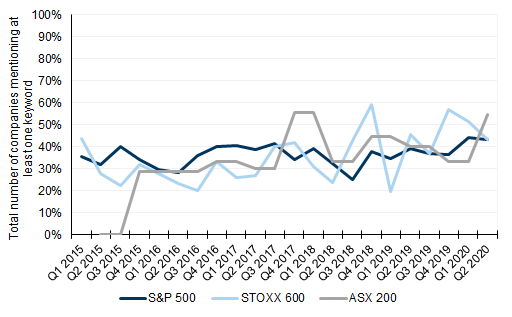

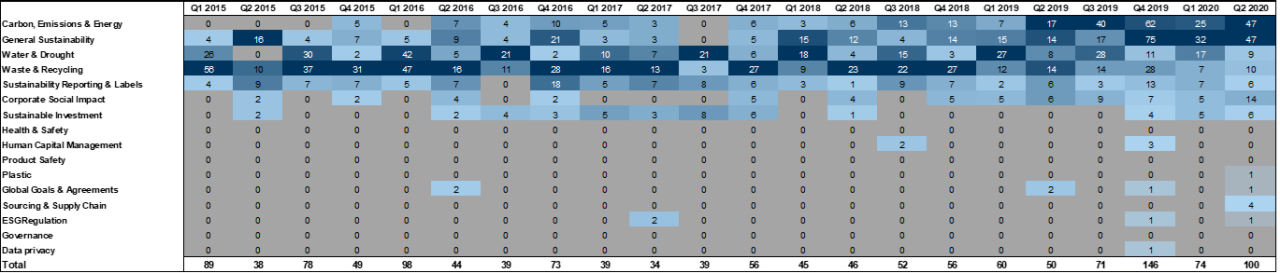

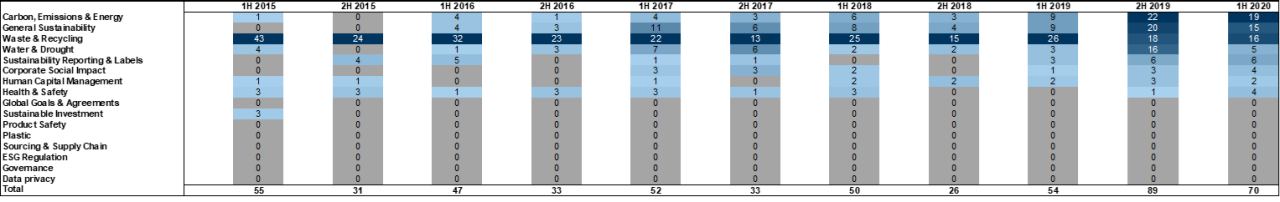

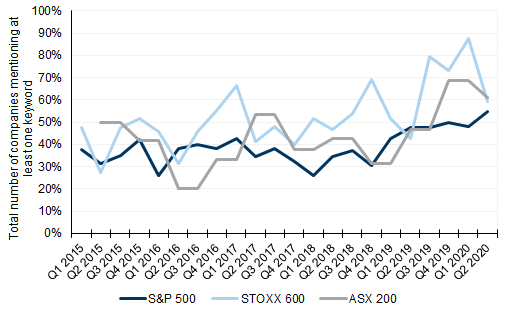

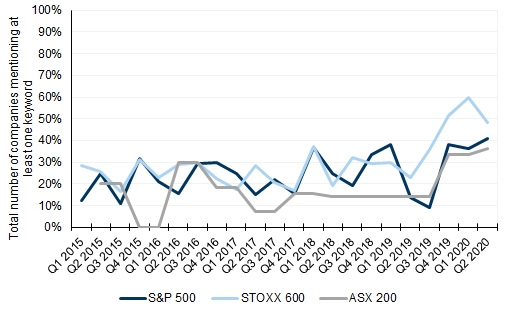

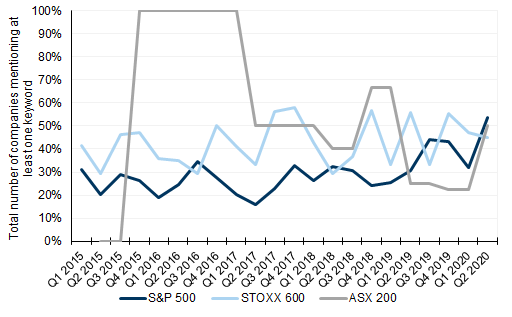

Exhibit 1: The number of companies talking about ESG is growing in all three regions

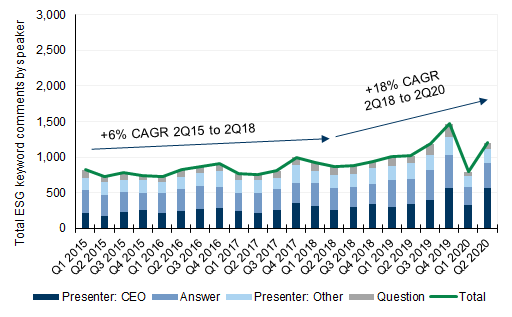

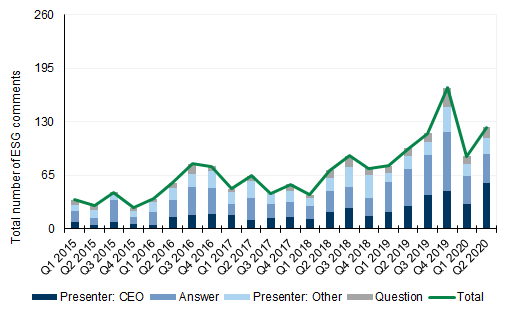

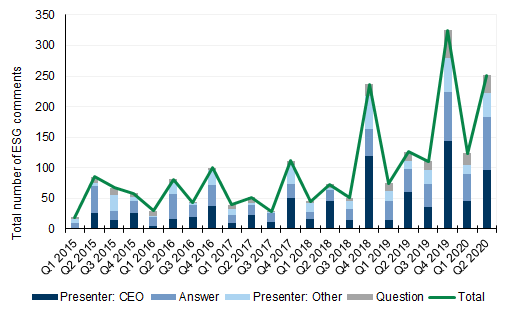

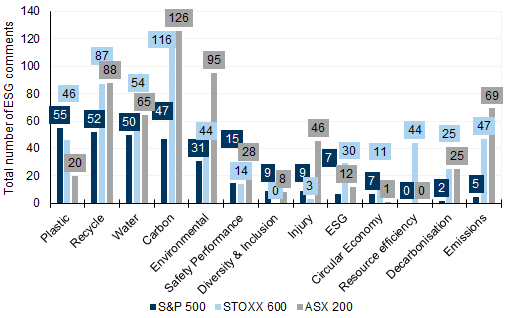

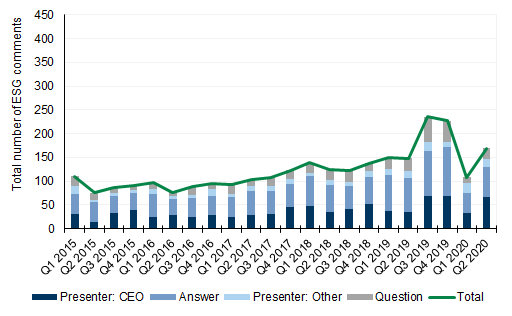

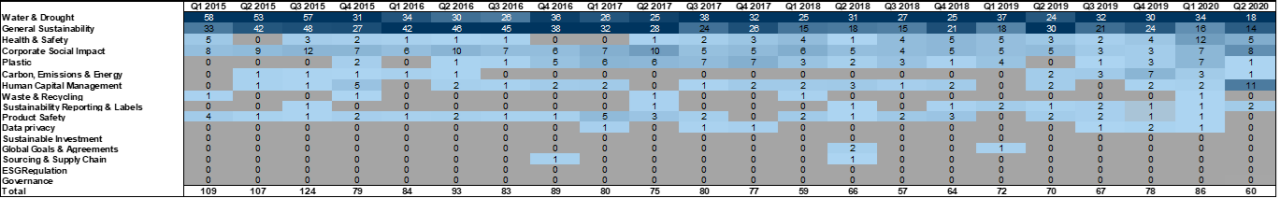

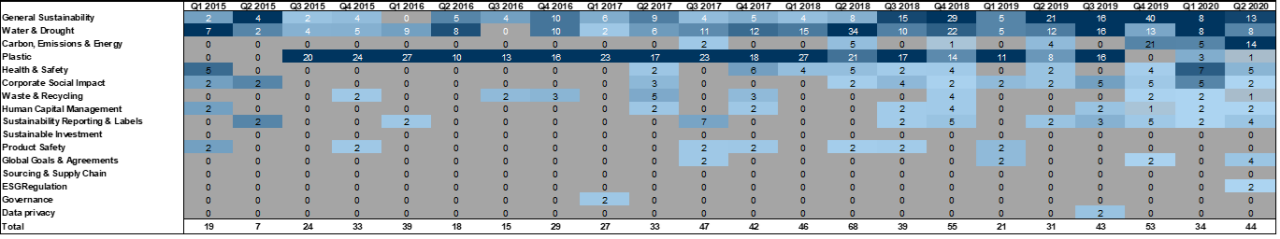

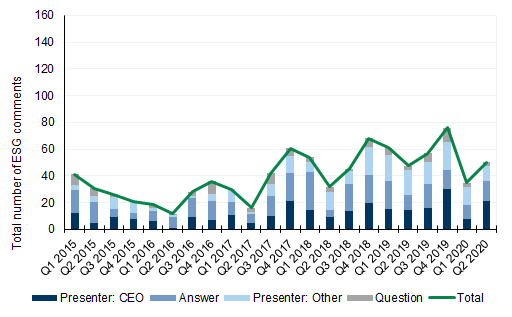

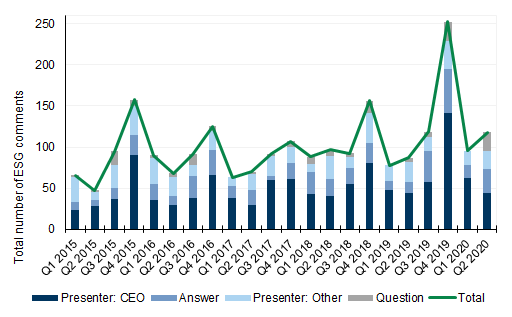

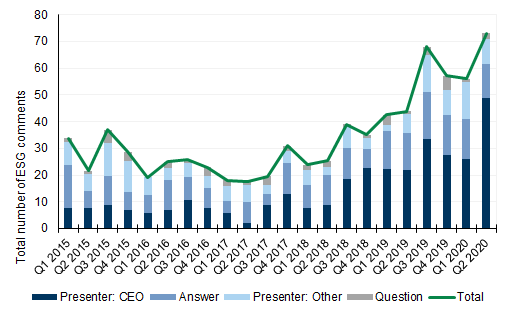

Exhibit 2: Growth in S&P ESG discussions accelerated significantly from 2019 onwards

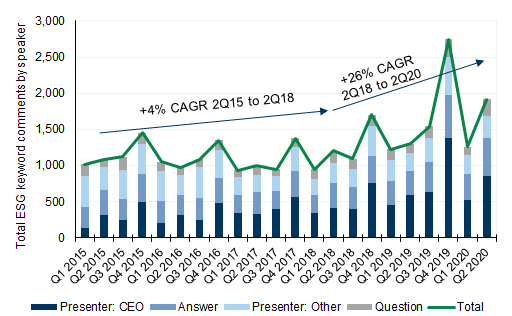

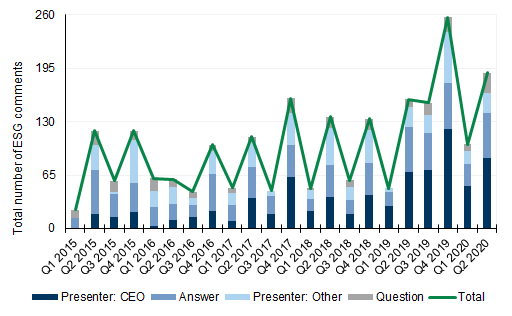

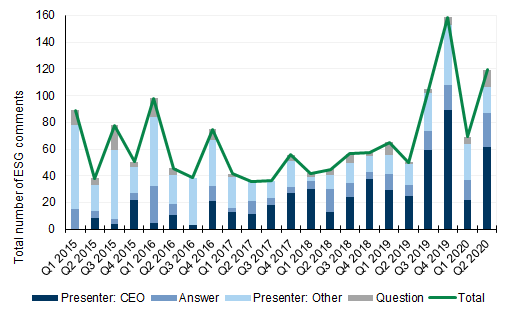

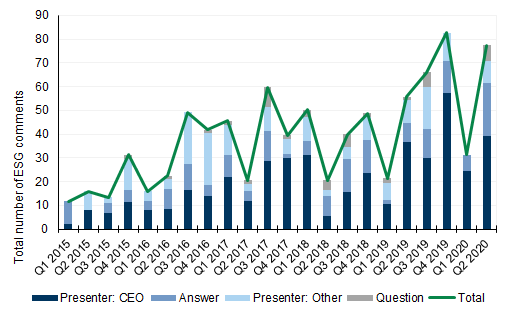

Exhibit 3: Similarly for Europe, growth has accelerated in recent years, despite more volatility between quarters

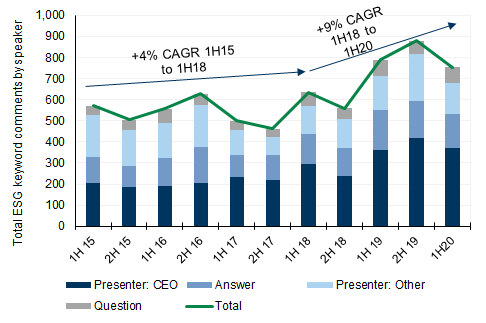

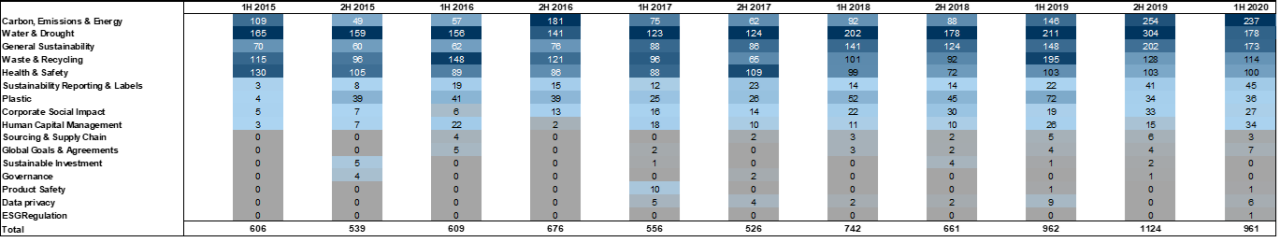

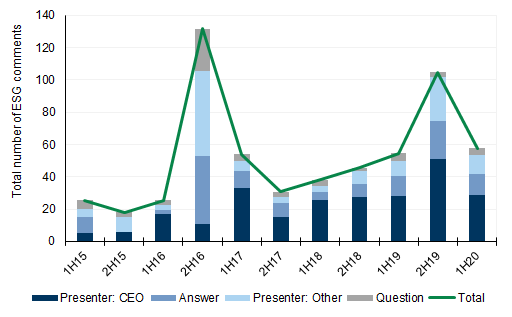

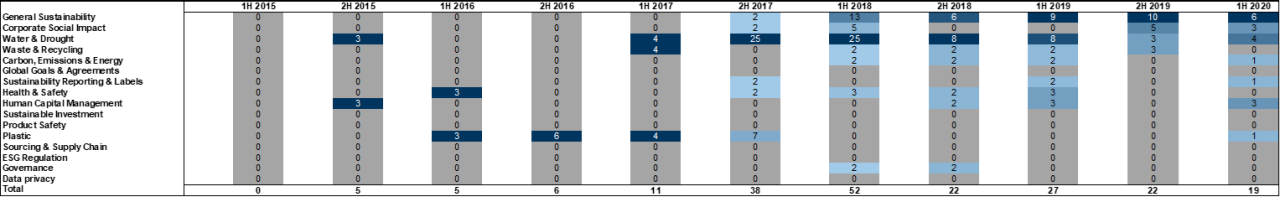

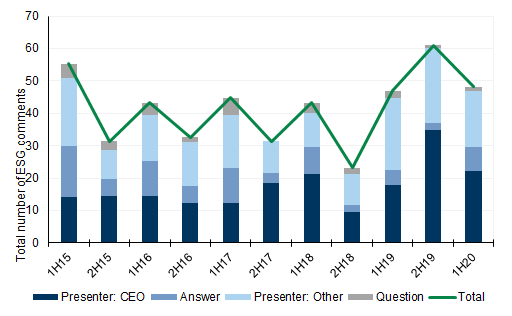

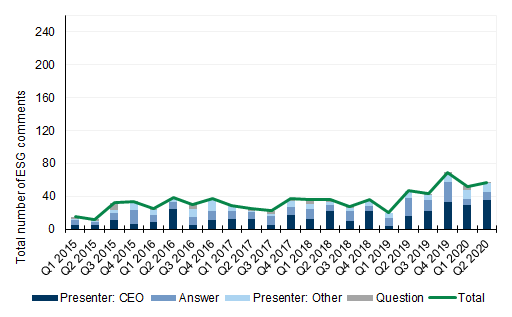

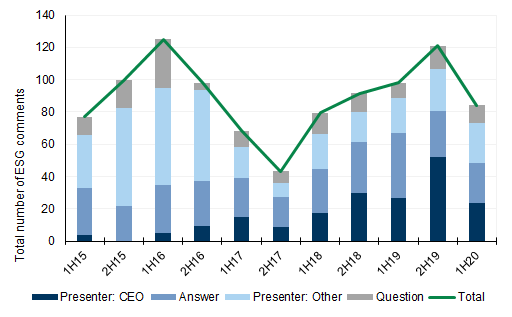

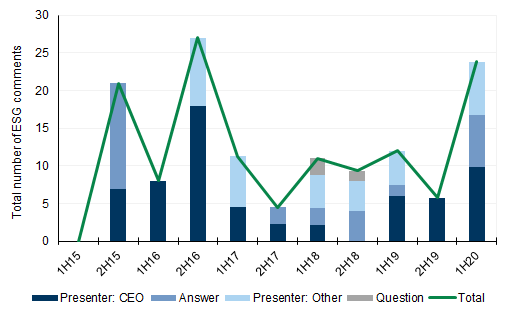

Exhibit 4: In Australia, discussions have also increased since 2019

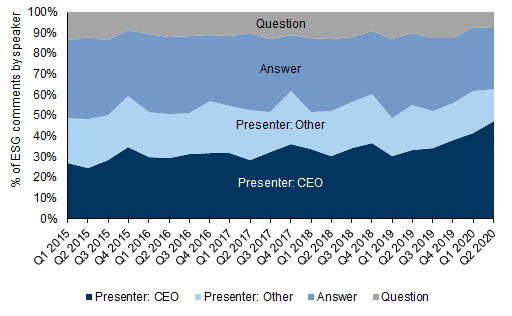

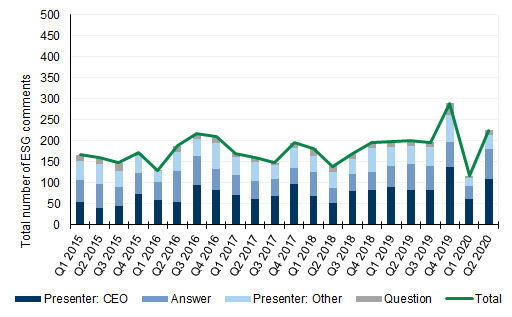

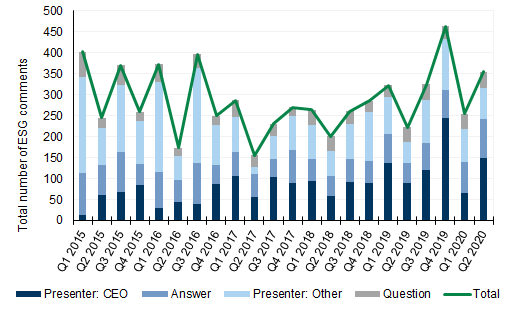

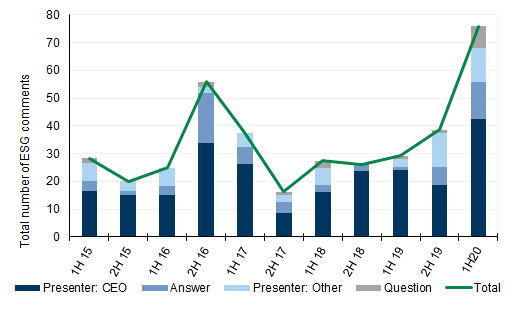

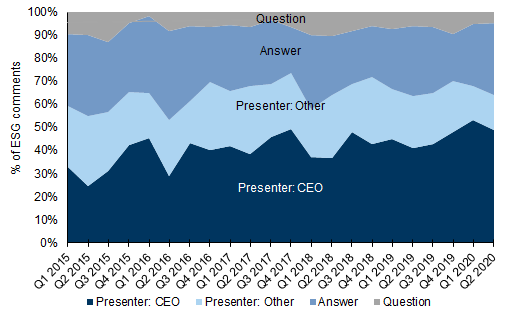

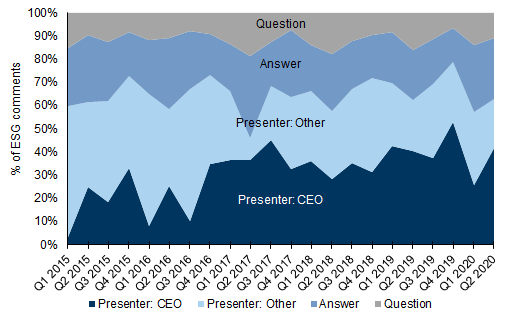

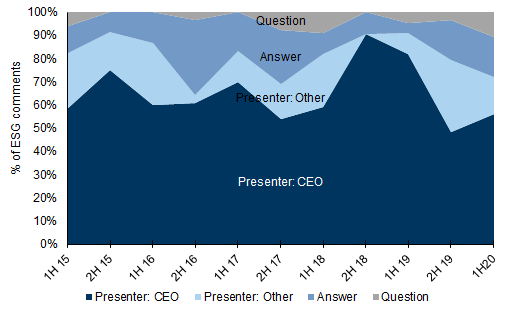

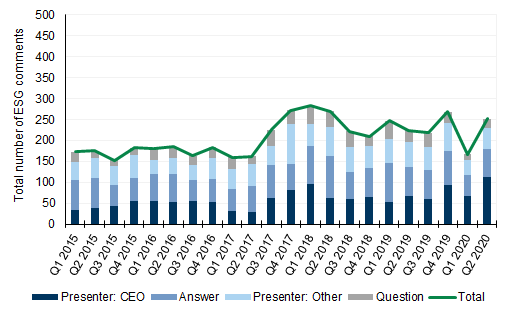

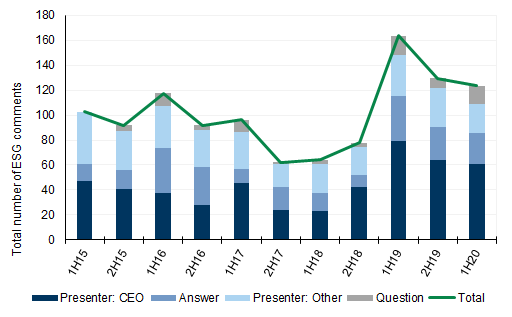

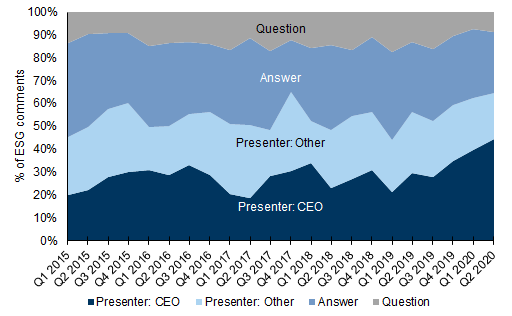

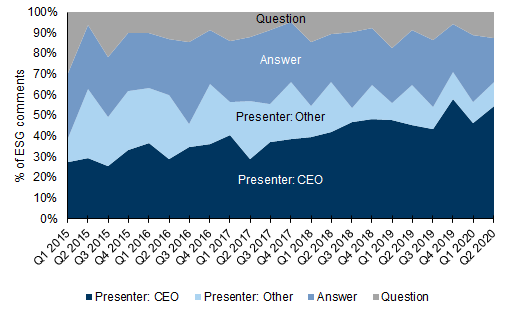

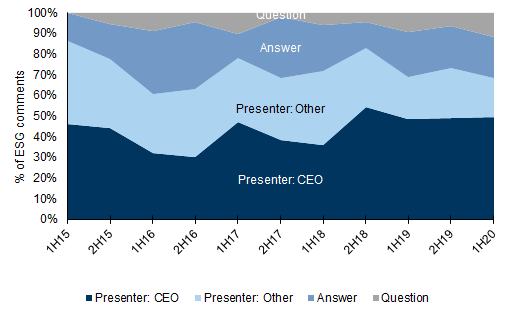

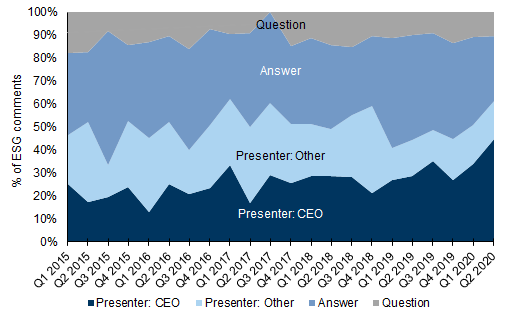

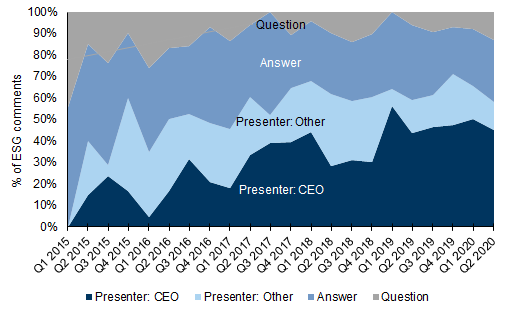

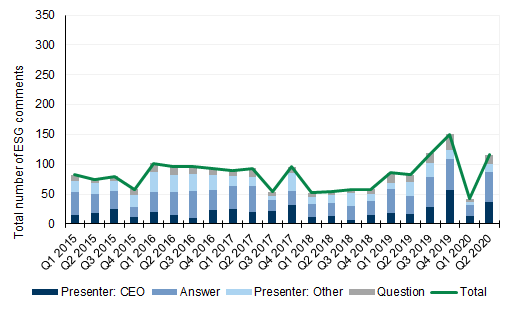

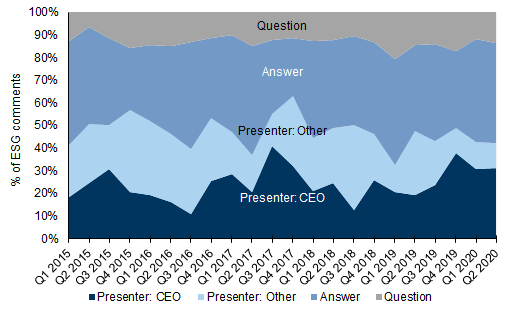

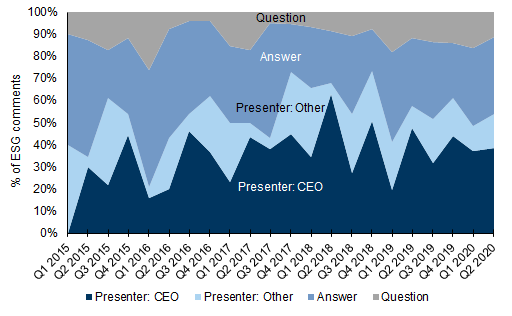

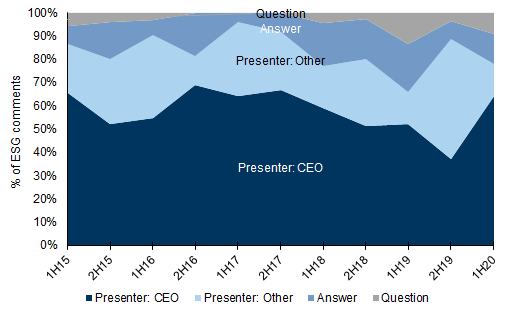

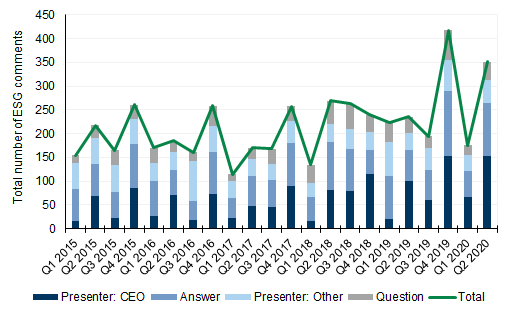

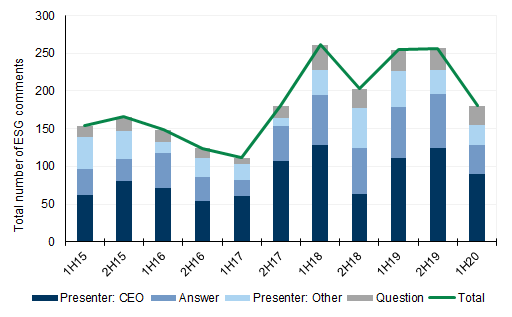

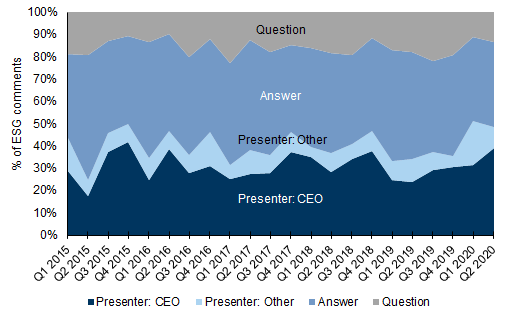

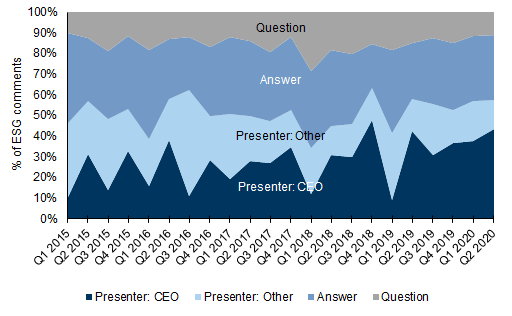

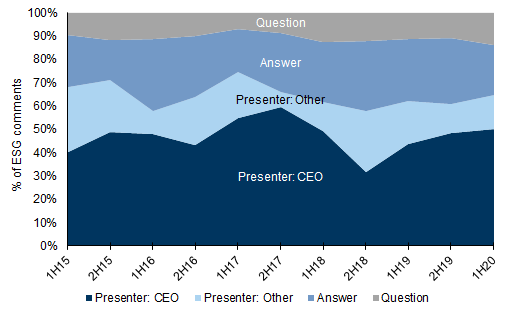

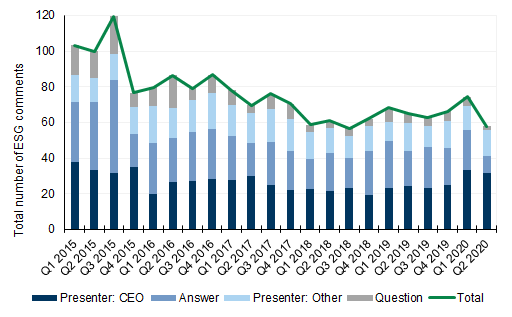

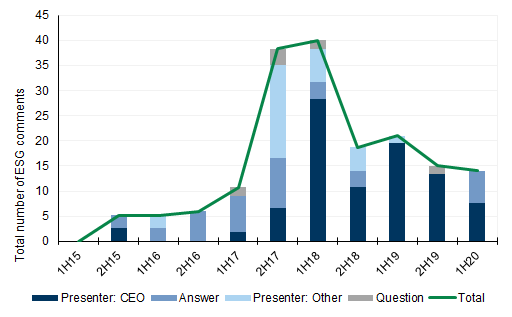

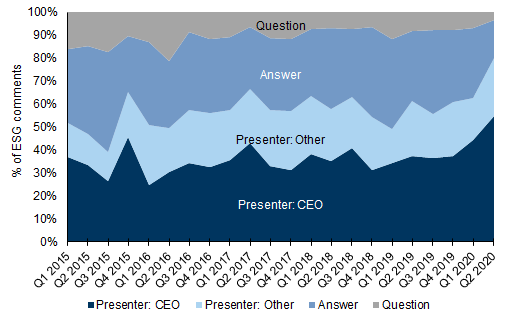

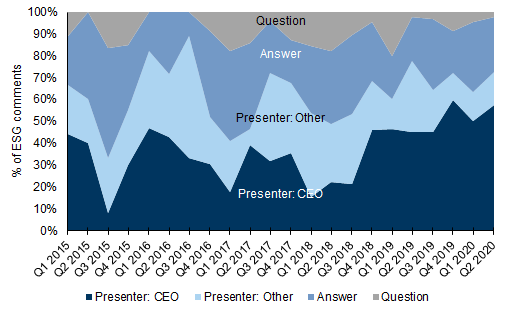

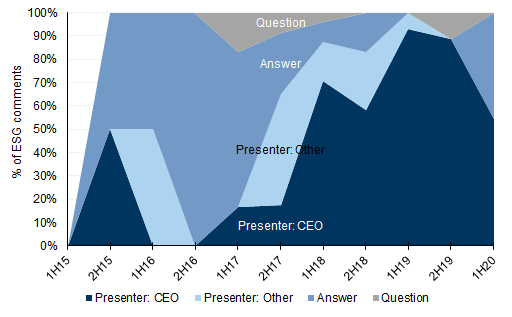

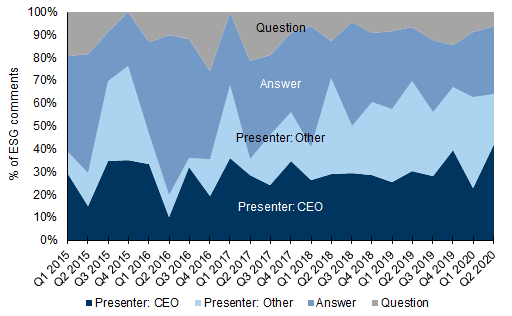

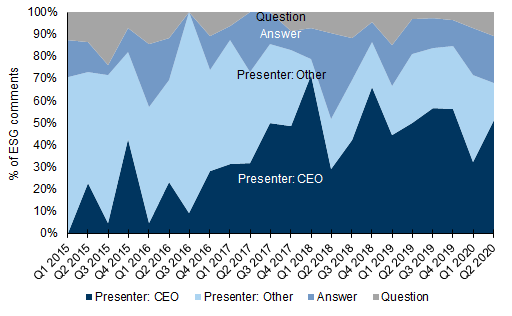

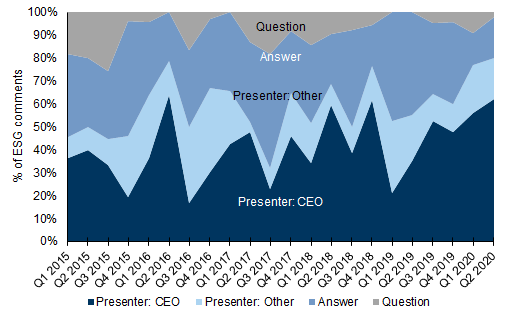

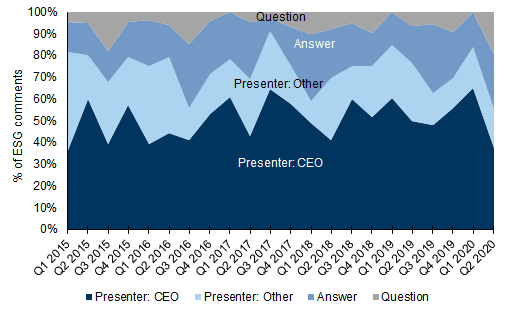

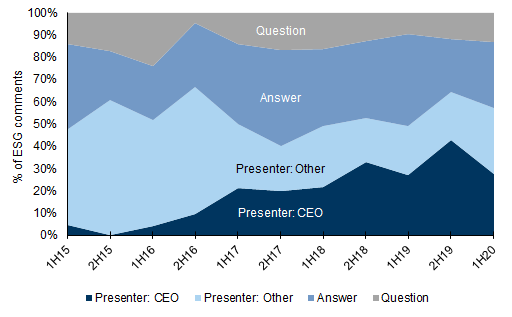

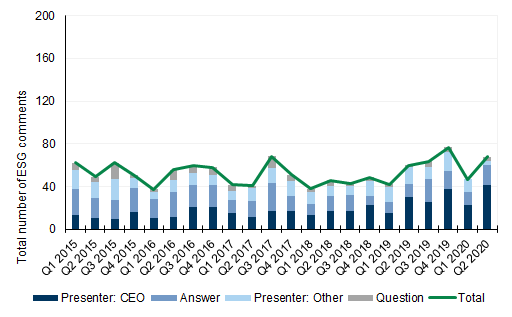

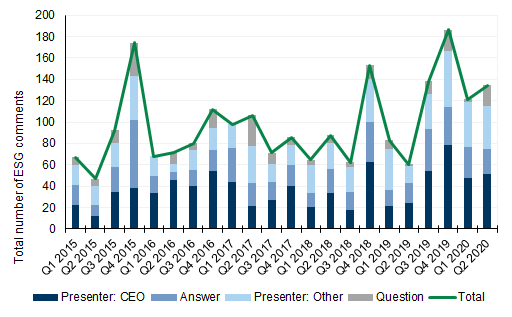

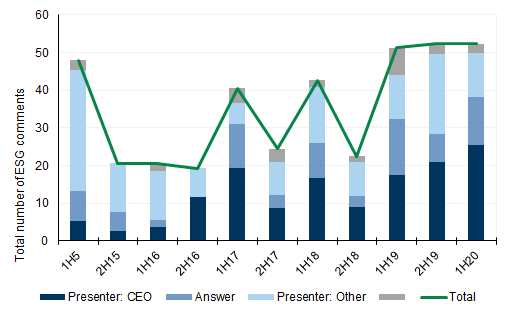

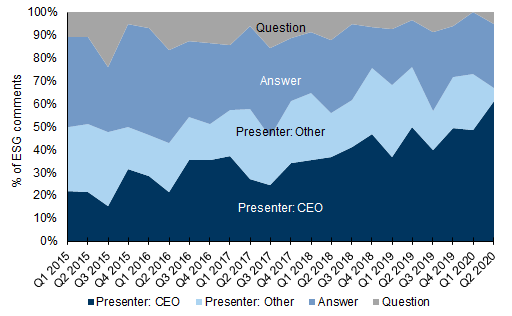

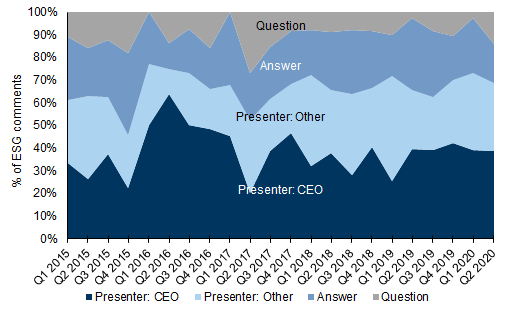

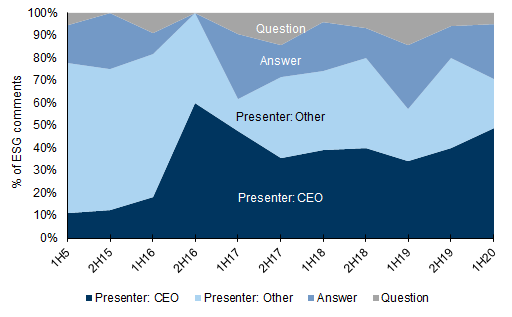

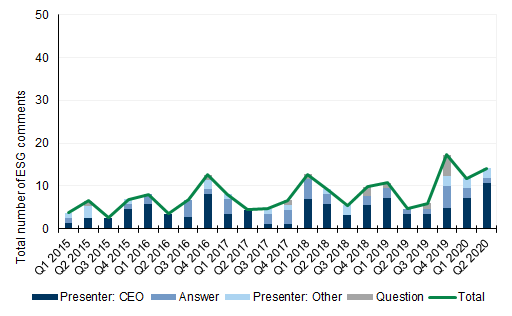

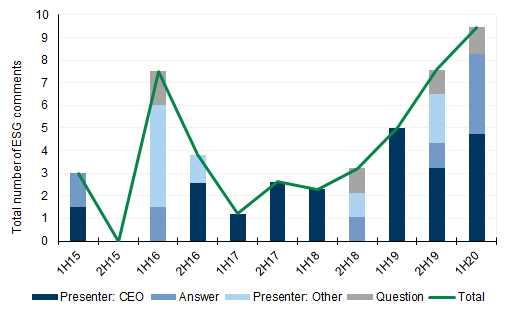

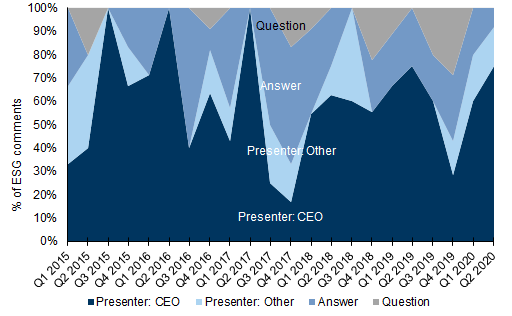

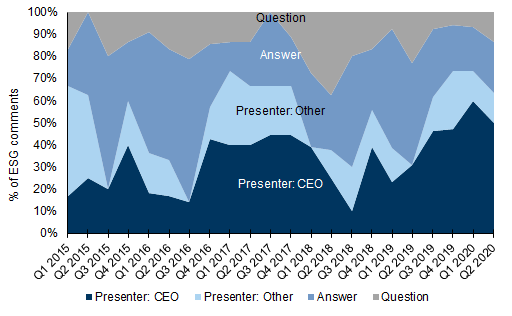

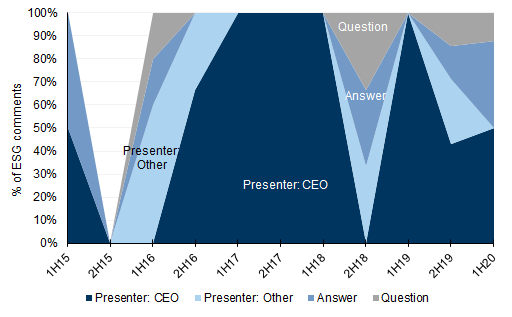

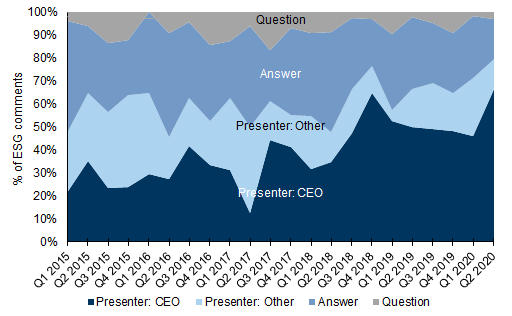

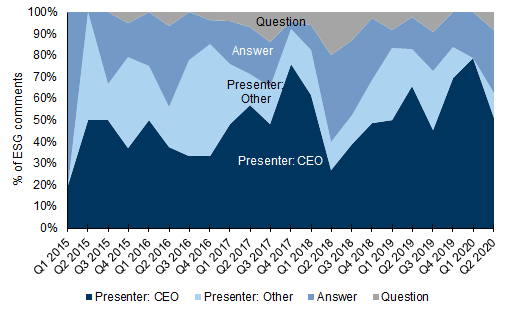

Exhibit 5: Across the S&P, the CEO is mostly steering the ESG conversation...

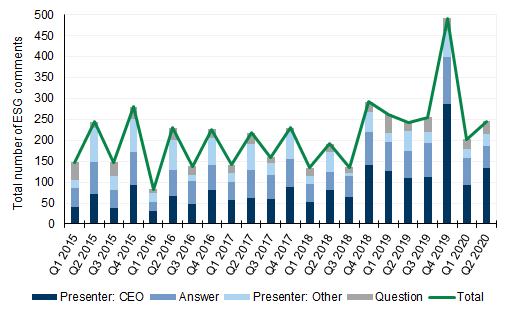

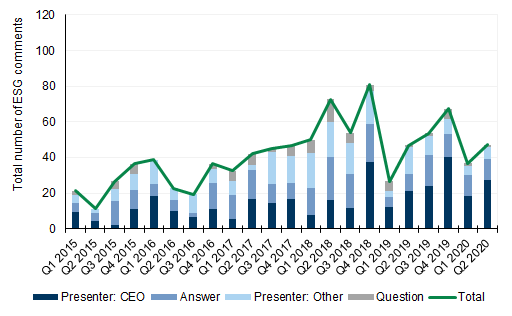

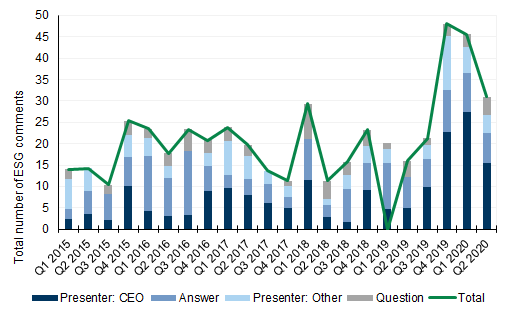

Exhibit 6: ...a similar trend across the STOXX, with companies also facing more Q&A

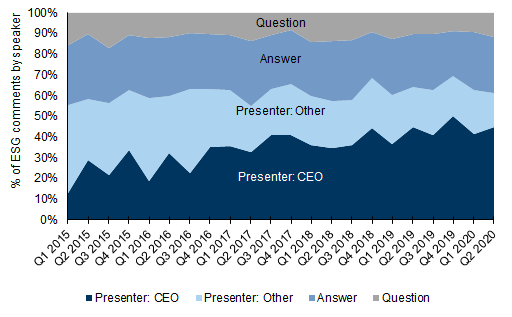

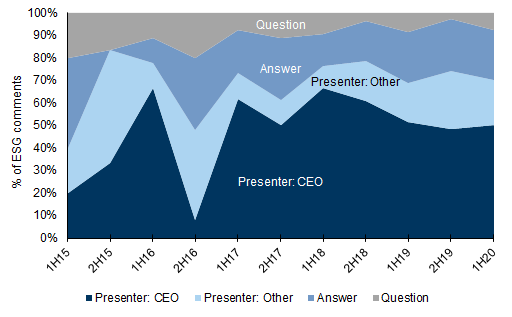

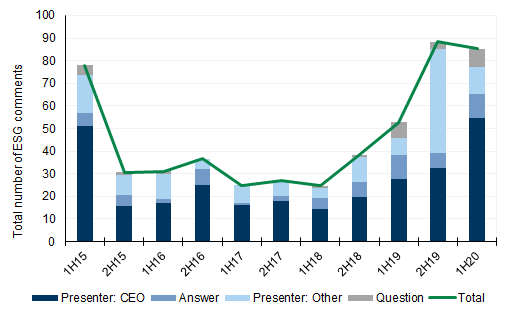

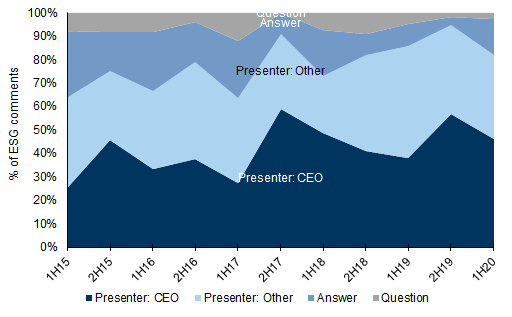

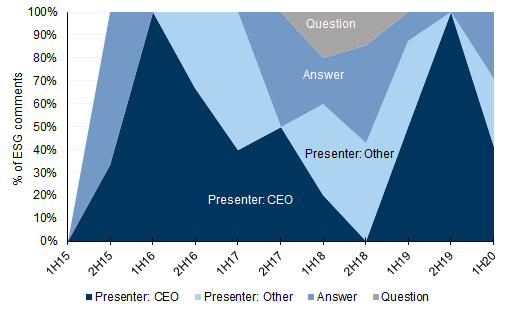

Exhibit 7: CEOs in the ASX are also the most engaged on ESG topics

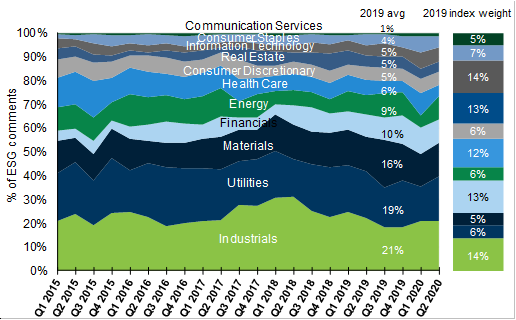

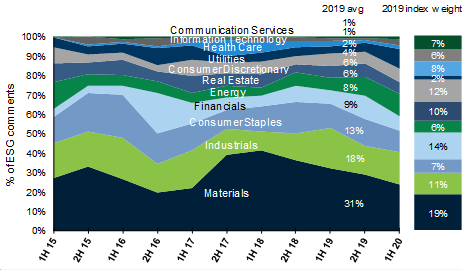

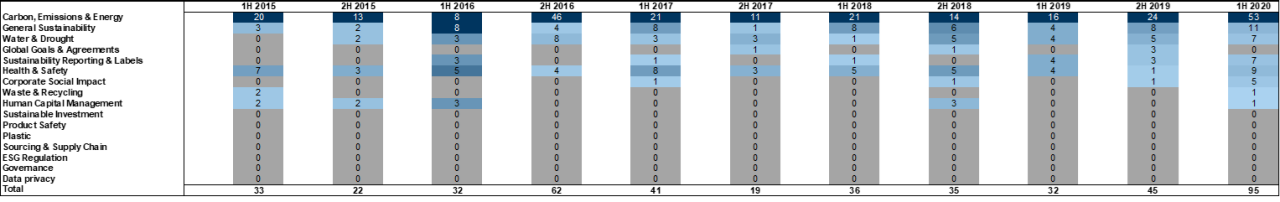

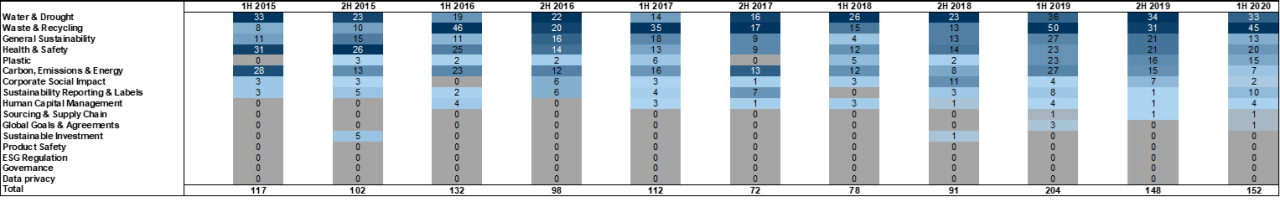

Exhibit 8: In the US, Utilities and Industrials have consistently been the most engaged...

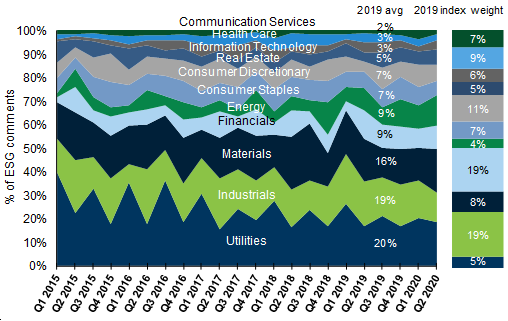

Exhibit 9: ...similarly in Europe, where heavier sectors are leading the discussion

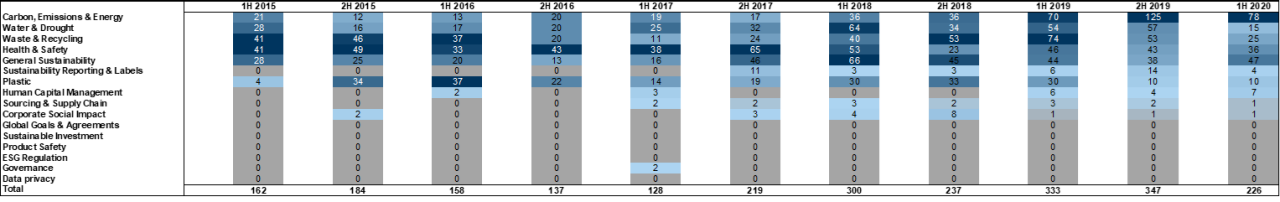

Exhibit 10: Materials are leading the discussion in Australia

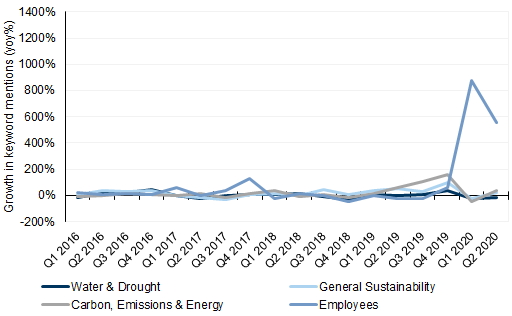

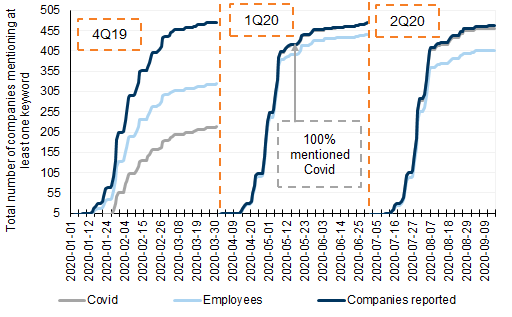

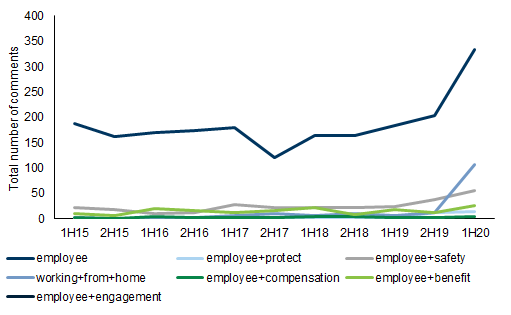

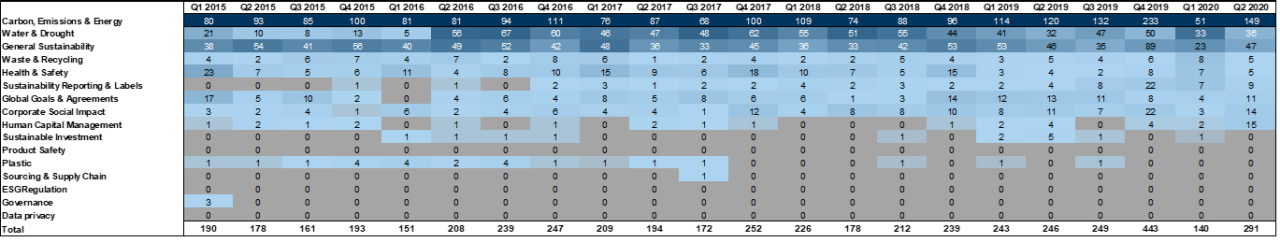

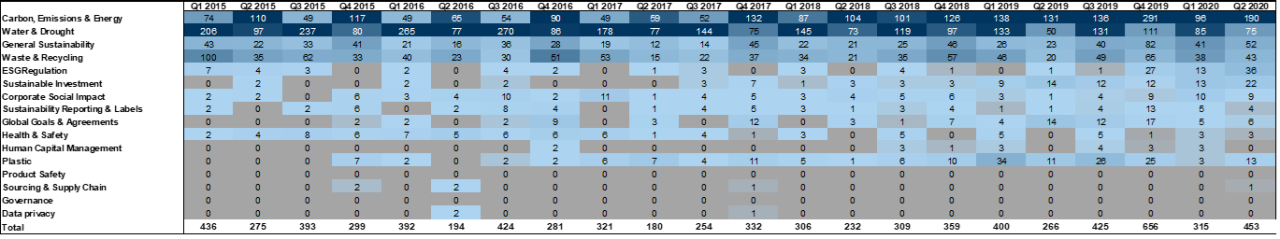

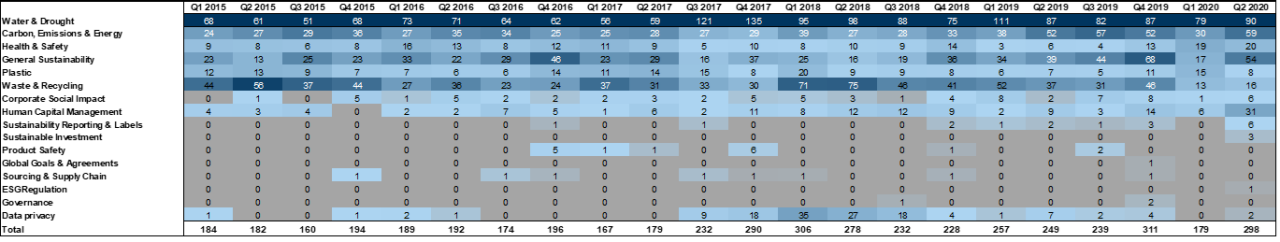

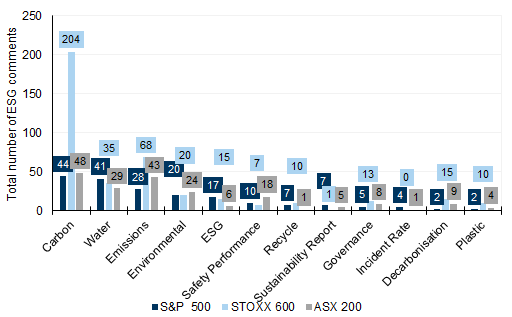

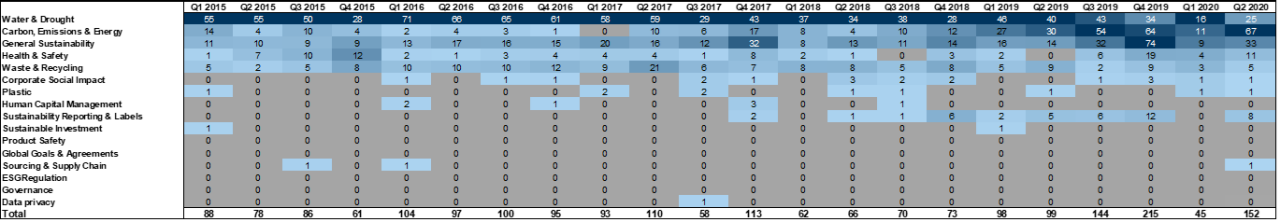

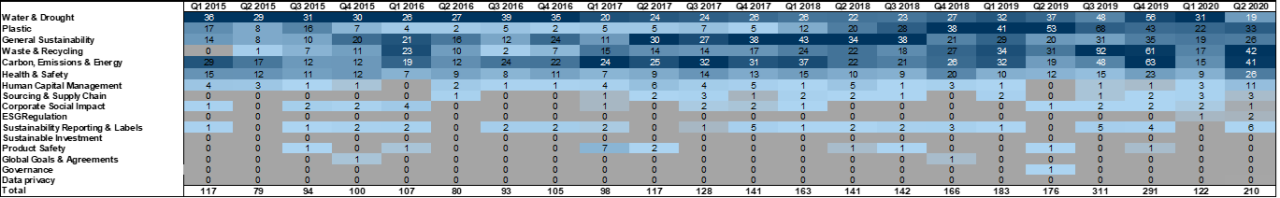

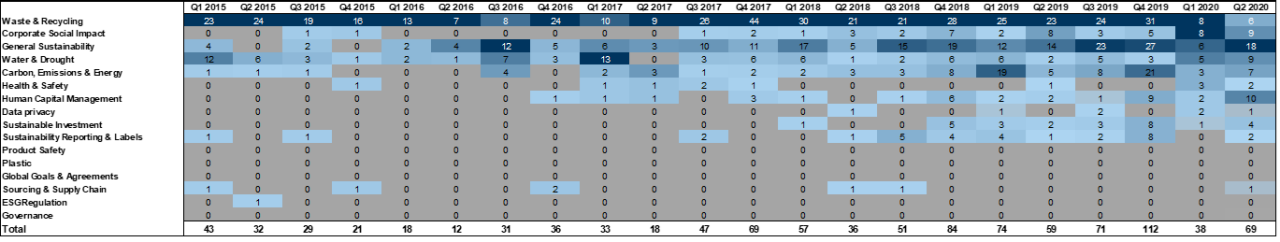

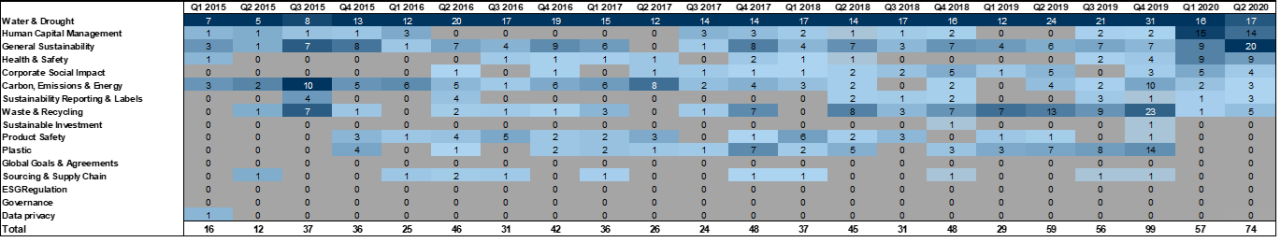

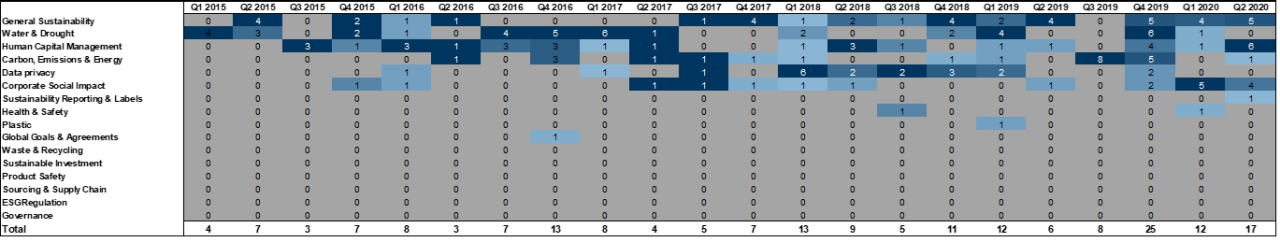

Exhibit 11: Employee-related discussions spiked in the US in the first half of 2020, amid the pandemic..

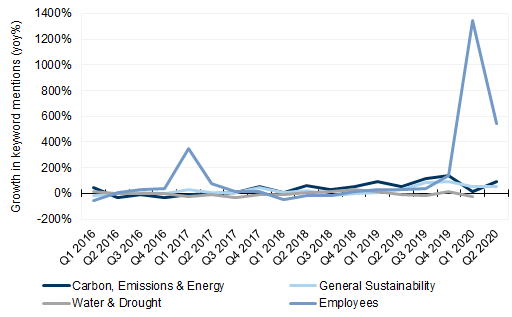

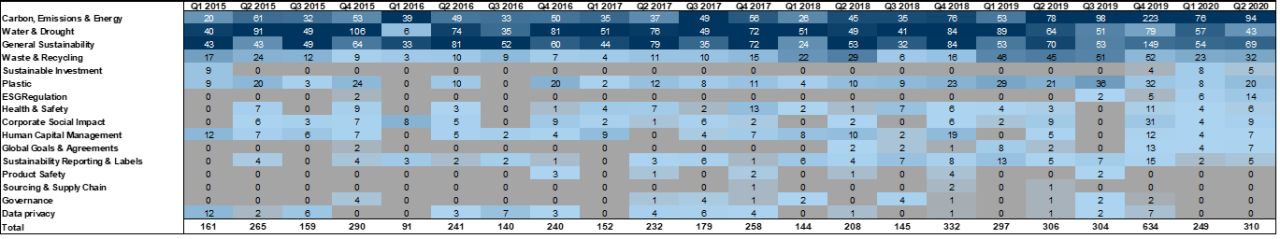

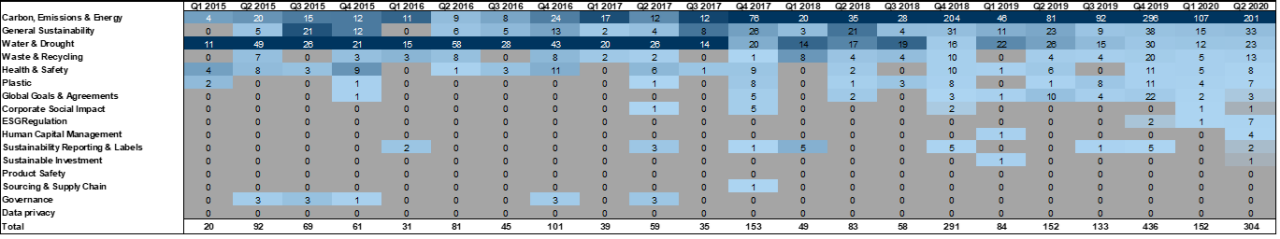

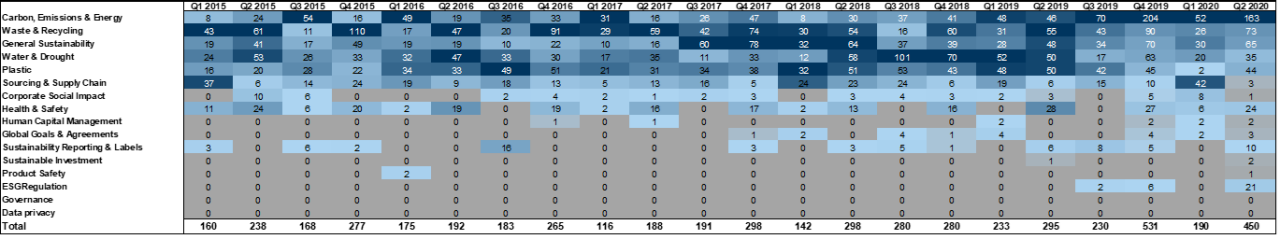

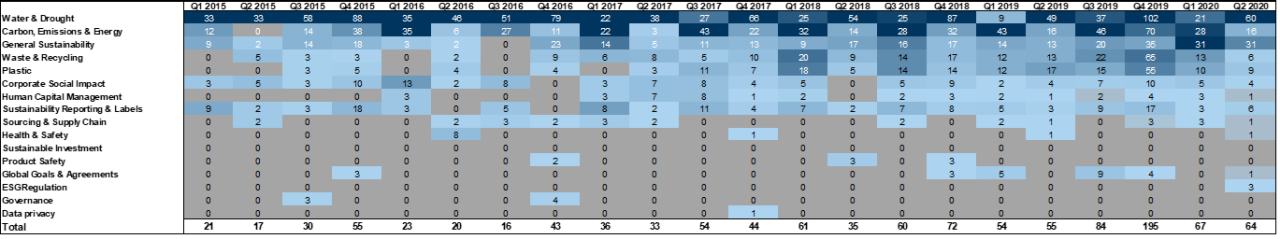

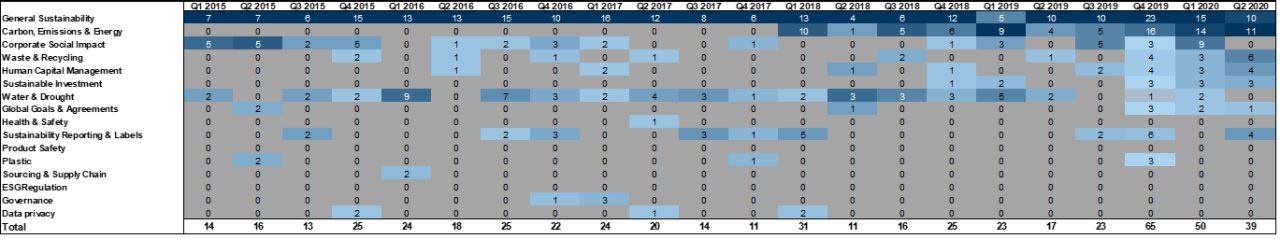

Exhibit 12: ...with similar trends seen across Europe...

Our methodology

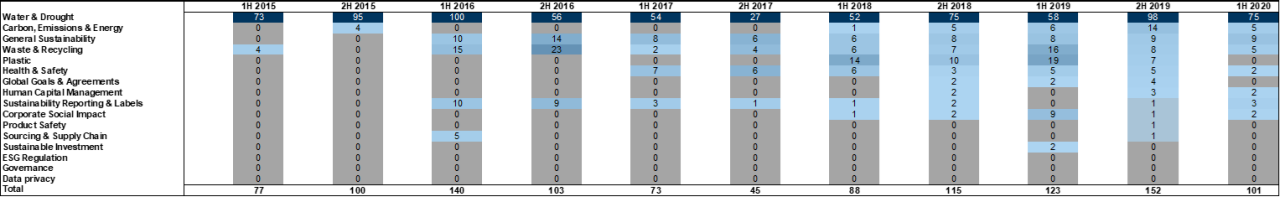

The SPX, STOXX and ASX were selected to ensure global representation from companies which spoke English during their earnings call - necessary for the transcript tool. This report uses calendar quarters, e.g. earnings calls that relate to the Jan - March period are 1Q for the S&P and STOXX. Earnings calls relating to Jan - June period are 1H for the ASX.

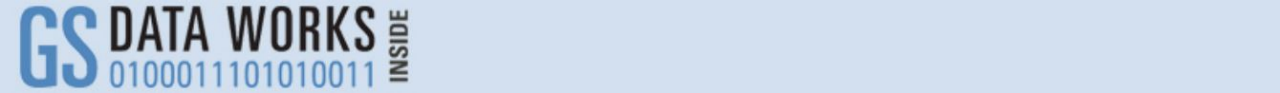

Links to performance: does increased ESG discussion translate into real outcomes?

Our momentum framework tracks the change in the latest available data point over the average of the prior two years. See Momentum & Materiality -- Building blocks for ESG integration

Carbon-related keywords

The majority (80-90%) of each regions' Top 10 have carbon emission reduction targets, signaling the discussion is tied to the business strategy for these companies and not mere greenwash.

Employee-related keywords

The majority (80-90%) of all Top 10 employee-related commenters have diversity & inclusion targets in place.

Exhibit 16: Companies most engaged in carbon- and employee-related discussions tend to show positive links to performance

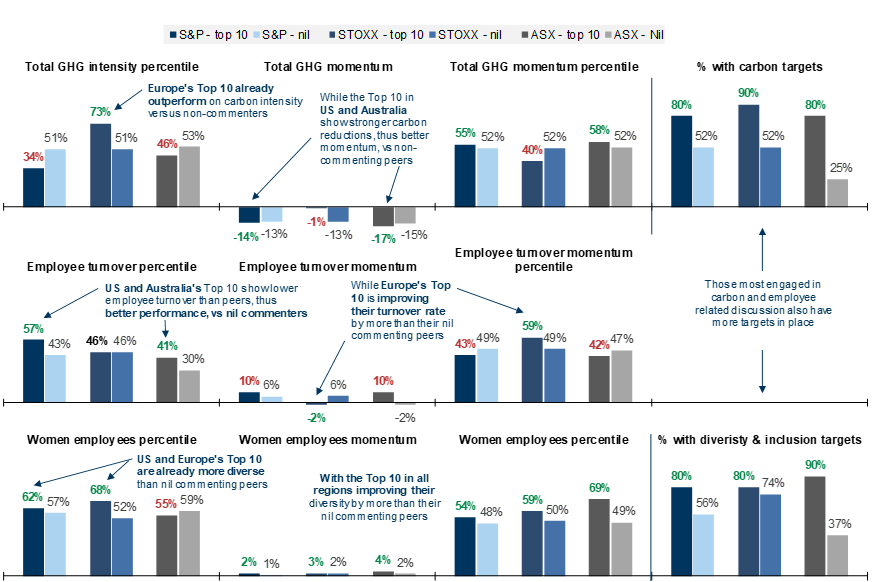

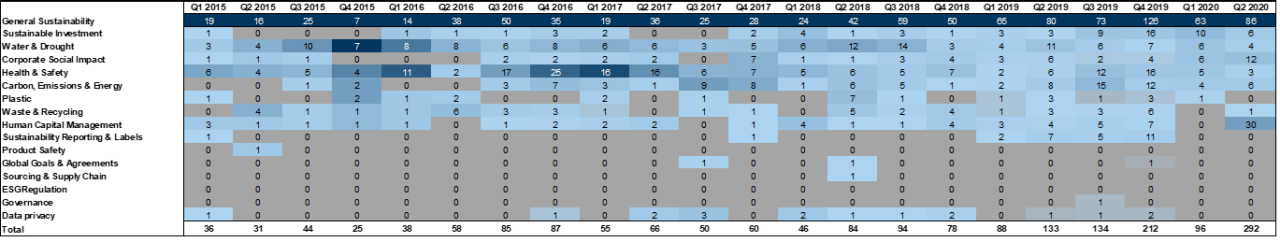

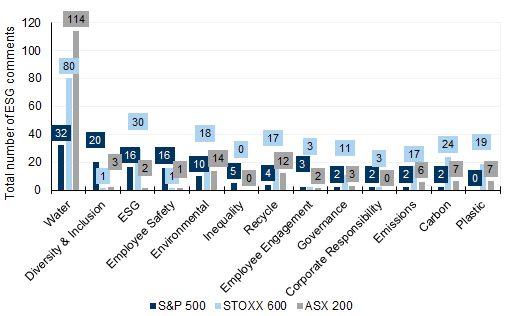

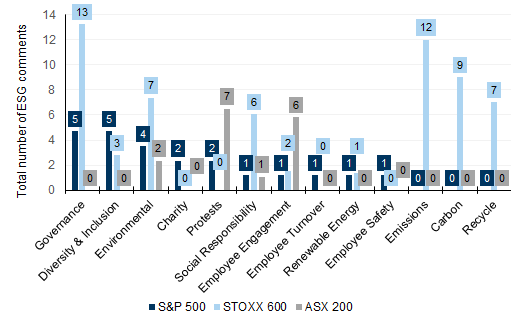

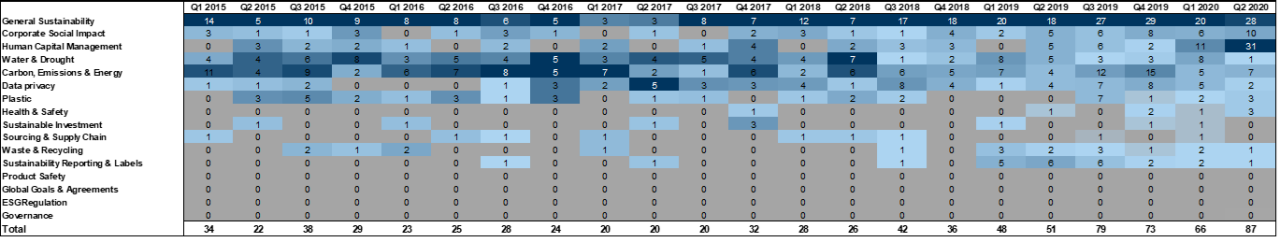

Topics in focus: which ESG topics are most discussed?

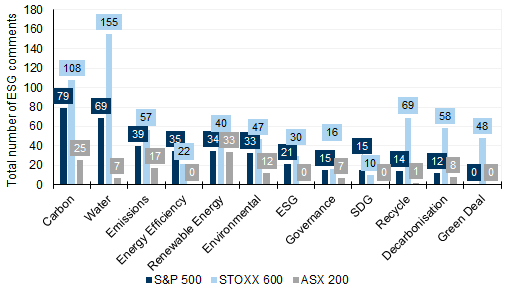

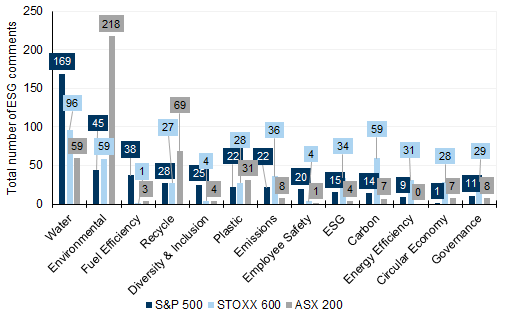

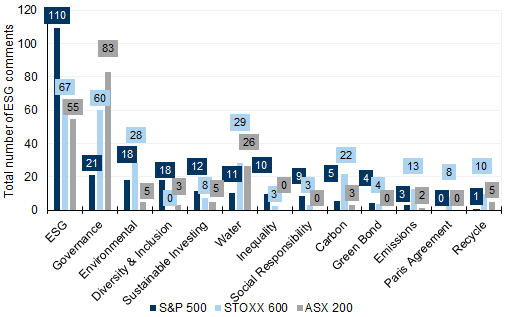

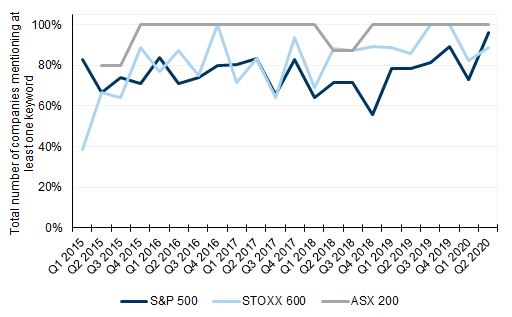

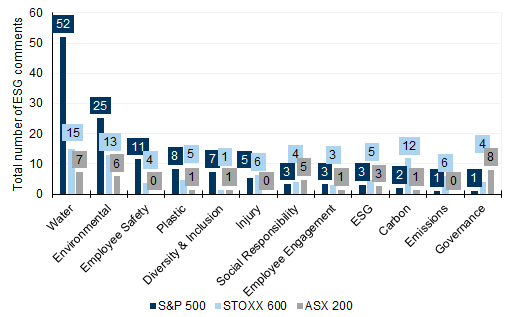

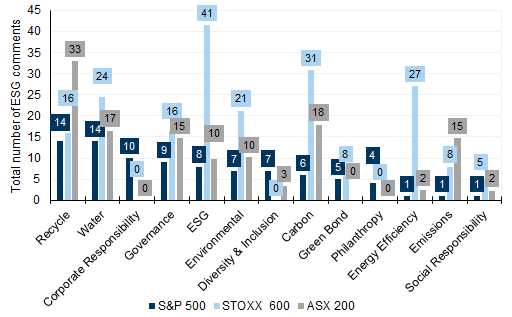

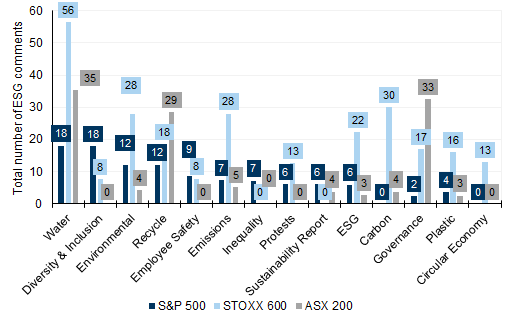

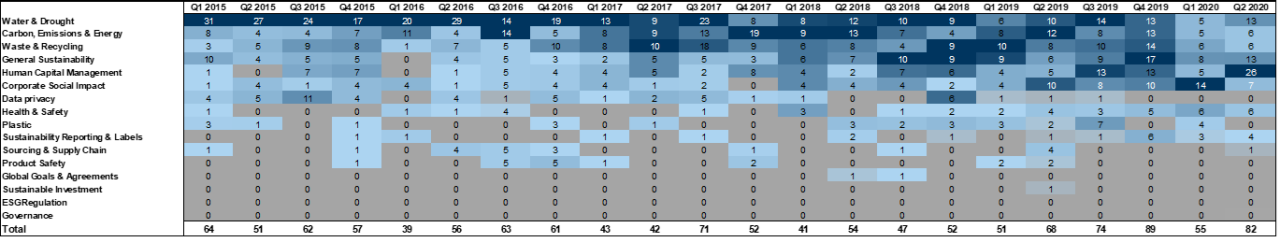

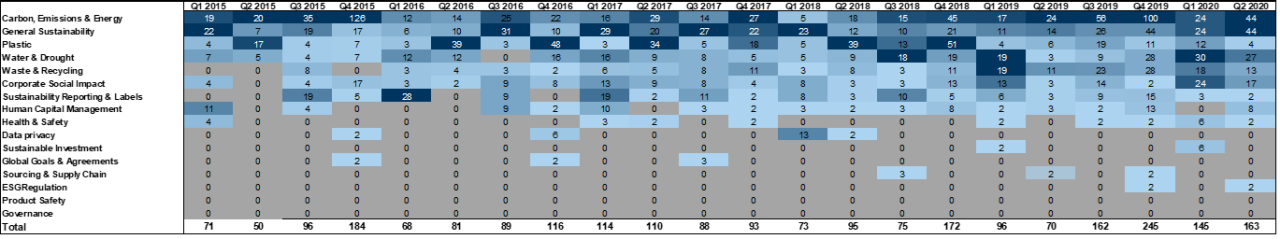

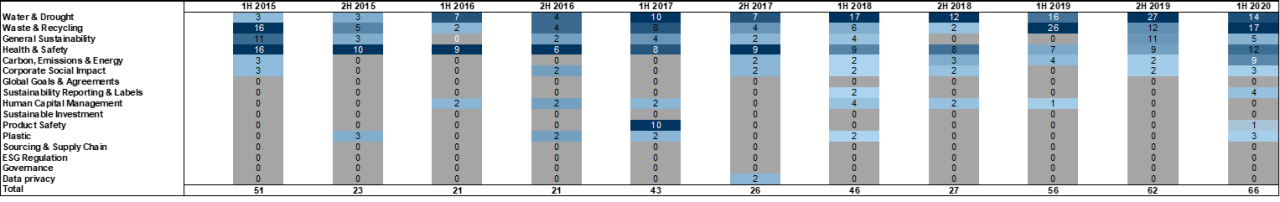

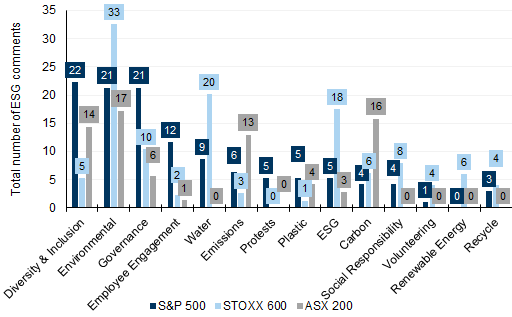

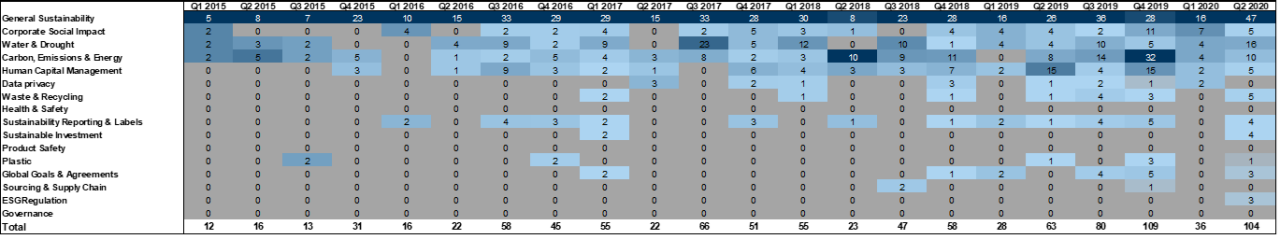

Exhibit 17: The most discussed themes vary by region, with the US and Australia most focused on Water and Europe most focused on Carbon

The rise of S in ESG in the age of COVID-19

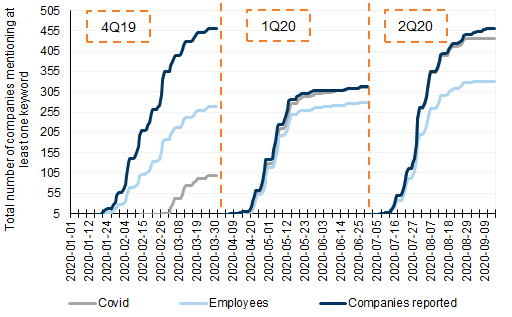

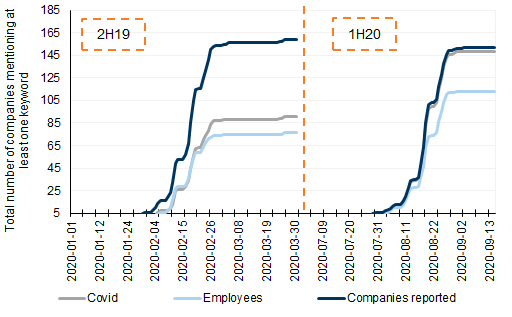

Exhibit 21: An increase in Covid-19 discussions correlated with an increase in Employee-related comments for the S&P

Exhibit 22: ...with similar trends seen for the STOXX

Exhibit 23: ...as well as the ASX

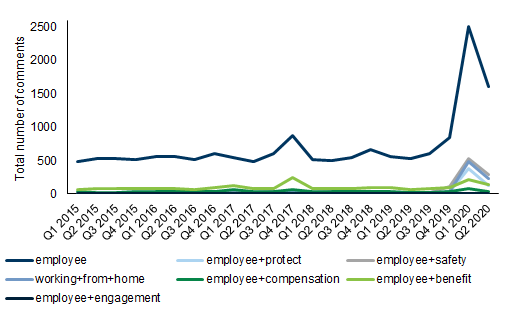

Exhibit 24: In the S&P, all Employee-related discussions more than doubled from 2Q19 to 2Q20

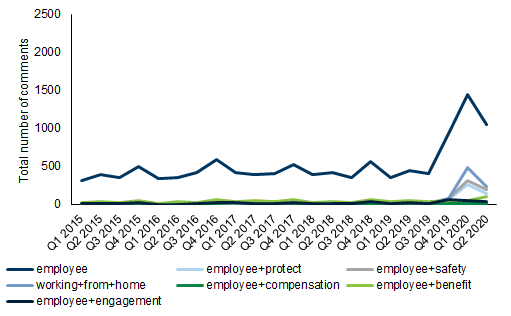

Exhibit 25: While in STOXX most topics also spiked from relatively low levels while some remained low

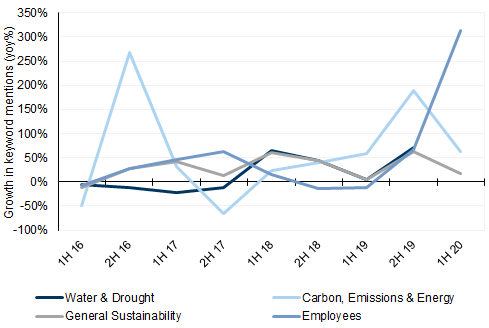

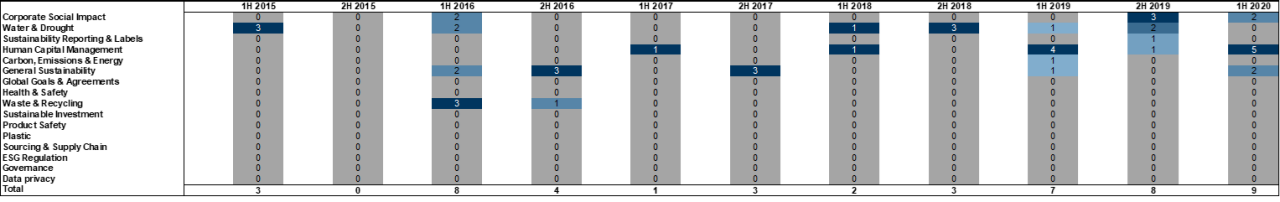

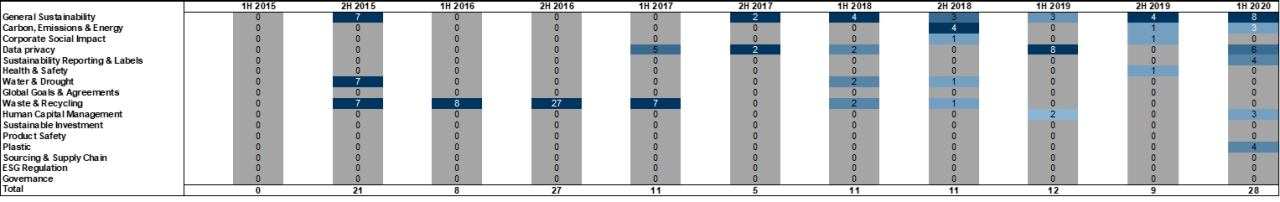

Exhibit 26: In ASX, Employee discussions were already growing before Covid-19, but gained momentum in 1H20

Appendix - sector findings

Utilities

Exhibit 27: 100% of Utilities in all regions discussed ESG in 2Q20

Exhibit 28: 'Carbon' most discussed in the US, 'Water' in Europe and 'Renewable Energy' in Australia

Exhibit 29: ESG discussions on the rise in the US since 2019, despite a dip in 1Q20 as Covid unfolded...

Exhibit 30: ...a similar trend across Europe, despite more volatility...

Exhibit 31: ...while volumes peaked in Australia in 1H20

Exhibit 32: The CEO has led most of the discussion across S&P Utilities...

Exhibit 33: ..as well as in the STOXX, albeit with some volatility between quarters...

Exhibit 34: ...and similarly for Australia

Exhibit 36: ...while in Europe, 'Carbon, Emissions & Energy' overtook 'Water & Drought' to become the most discussed since 2018

Notable Utilities ESG discussions from recent earnings

On WEC Energy's earnings call 2020-08-04, the executive chairman stated that the company had achieved its 2030 carbon emission reduction target a decade early. The firm also announced 2 new targets to reduce carbon emissions by 70% below 2005 levels by 2030 and reach carbon neutrality for the generation fleet by 2050.

On ORSTED's earnings call 2020-01-30, the CEO highlighted the group's initiatives towards reaching carbon neutrality by 2025, including a 20GW on- and offshore renewable capacity build-out, a phase out of coal by 2023 and a commitment to 100% EVs by 2025. The company also stated it will engage with suppliers to decarbonise its procurement of components and vessel services related to offshore wind.

On The Southern Company's earnings call 2020-02-20, the CEO noted a 22% decrease in coal-powered production in 2019, reducing the contribution of coal profits to only 14% of total revenues. Since 2007, the company has reduced emissions by 44%, showing progress towards its 50% reduction target by 2030. The firm will continue to expand its renewable footprint across its portfolio, and expects to have over 15,000 MW of renewables by 2022 across state-regulated utilities.

On National Grid's earnings call 2019-11-14, the CEO reiterated the firm's commitment to support the UK's 2050 net zero target and announced £2bn investment in new interconnector capacity, which facilitates excess renewable energy sharing across countries. By 2024, the company will have 7.8GW of interconnector capacity equivalent to powering 8 million homes across the UK.

On AWK's earnings call 2020-05-07, the CEO noted the basis for the group's earnings growth continues to be the capex made to provide clean, safe and reliable services. The firm has committed $20-22bn over the next 10 years to ensure service quality and reliability, and expand water and wastewater solutions across the country.

On SUEZ's earnings call 2020-02-26, the CEO highlighted the importance of wastewater maintenance and water reuse solutions, as water scarcity is threatening 2 billion people by 2030.

Industrials

Exhibit 38: ASX Industrials historically more engaged, with S&P and STOXX recently catching up

Exhibit 39: 'Water' most discussed in the US and Europe, and 'Environmental' in Australia

Exhibit 40: Flat growth from US Industrials since peaking in 2018, but strong recovery from 1Q20...

Exhibit 41: ...while volumes peaked more recently for European Industrials in 4Q19...

Exhibit 42: ...and for Australia, peaking in 1H19 and remaining the most resilient region with respect to the Covid declines

Exhibit 43: The CEO is taking a larger share of the conversation in the US...

Exhibit 44: ...with strong growth also for European CEOs...

Exhibit 45: ...and a strong contribution from ASX CEOs

Notable Industrials ESG discussions from recent earnings

On Carrier's earnings call 2020-07-30, the CEO highlighted the recent publication of the company's first ESG report, stressing that ESG is core to the business and that the firm takes pride in being a leader.

On Delta Air Lines' earnings call 2020-01-14, the CEO reaffirmed the company's commitment and focus on ESG goals and requirements. The company acknowledged that its historically older fleet has opened an opportunity to make faster progress relative to peers with upgrades. Specifically, the company is adding 80 new planes to its fleet which are 25% more fuel-efficient than those retired. Also highlighted was the commitment to voluntarily cap the group's carbon footprint at 2012 levels.

On Rockwell's earnings call 2020-01-29, the CEO stressed the focus on product efficiency, highlighting the group's power control offering, variable speed drives, which dramatically reduces the amount of energy required to run industrial processes. The newly introduced eco industrial segment specifically targets energy efficiency/reduction in the renewables, water and waste water treatment, and mass transit industries. Additionally, the company provides technology and services aimed at automating safety, which will continue to be a focus for the company.

On Georg Fischer's earnings call 2020-02-26, the CEO noted 12% yearly growth in the group's cooling segment, supported by the new COOL-FIT 4.0 system which saves customers up to 30% of the energy used for the cooling application. For example, the system can help reduce the energy consumed by data centers (responsible for 3% of global electricity consumption), of which 40% of the total energy is used for cooling. Also highlighted was the 4% growth in its business supplying skids for water rehabilitation, with more than 200 million sales. Tackling water scarcity by providing further solutions will remain a focus.

On Eaton's earnings call 2020-07-29, the CEO highlighted the company's sustainability focus on capitalizing electrification secular growth trends across its businesses and in the energy transition. The company has reduced emissions by 16% since 2015 and is on track to deliver its 2025 targets. Additionally, the company has committed to science-based targets of reducing GHG emissions by 50% from 2018 levels and reaching carbon-neutrality by 2030. The speaker noted that this will be achieved via carbon offsets, a complete switch to renewable electricity and energy storage solutions delivery.

On Southwest Airlines' earnings call 2020-01-23, the CEO highlighted the firm's focus on sustainability, particularly on conservation and fuel economy. The MAX planes consume 15% less gas than other models, with the CEO stressing the importance of getting the airplane back in service. Additionally, the company notes that air traffic control systems can be modernised and there needs to be a commercially viable alternative fuel of adequate supply and reasonable pricing within the next 10 years, as there is only so much that can be offset before there just needs to be less carbon emitted.

On PACCAR's earnings call 2019-07-23, the CEO noted the company's focus on investing in future growth, with up to $725mn capex and up to $340mn in R&D this year on enhancing aerodynamic truck models, integrated powertrains, zero emissions electric and hydrogen fuel cell technologies, advancing driver assistance systems and truck connectivity. The company is enhancing manufacturing and distribution facilities, with a new robotic CAB build cell added recently to a truck factory and the new construction of a paint facility to lower operating costs and increase capacity and quality.

On Meggitt's earnings call 2020-02-25, the CEO noted an 8% increase in employee engagement over the last 2 years, reaching the global high-performance norm level, which is based on data of employees who work at very high-performing global companies.

On Republic Services's earnings call 2020-02-13, the CEO highlighted a 100bps improvement in the company's overall employee engagement score to 86%, which the firm claims is well above national norms and high for the industry. Driver turnover was also reduced 100bps versus the prior year. The company views its people as the most critical component to successfully executing its strategy, noting that the business units with higher employee engagement have fewer safety incidents, better customer service and better financial performance.

Financials

Exhibit 49: Increasing proportion of Financials discussing ESG in all regions

Exhibit 50: 'ESG' most discussed in the US and Europe, and 'Governance' in Australia

Exhibit 51: ESG discussions on the rise in the US since 2015, despite a dip in 1Q20 as Covid unfolded...

Exhibit 52: ...a similar trend across Europe, despite more volatility...

Exhibit 53: ...while volumes peaked in Australia in 2H16 and 2H19

Exhibit 54: Discussions during the company's presentations are the major source of discussion today across S&P Financials...

Exhibit 55: ...as well as in the STOXX...

Exhibit 56: ...and similarly in the ASX

Notable Financials ESG discussions from recent earnings

On Moody's earnings call 2019-10-30, the president of Moody's Investors Service discussed growth in the labelling of sustainability-linked bonds and loans, driven by investor demand for ESG-compliant securities, market focus on climate risk and issuers wanting to demonstrate their own sustainability credentials. With the acquisition of Vigeo Eiris, Moody's believes it is well-placed to be a leader in the space.

On S&P Global's earnings call 2019-10-29, the CEO observed that the growing focus on the energy transition and climate change is creating increased demand for a combination of ESG products, such as the 0.5% IMO sulphur product which is moving to the CME and ICE exchanges as futures. The company is focused on trying to identify what the next biggest trends are going to be impacting financial and market decisions and how S&P can create product and services addressing these trends.

On BlackRock's earnings call 2020-01-15, the CEO highlighted that sustainability has reached an inflection point, with more clients focused on the ESG factors of their portfolios due to alignment with values, but increasingly because of the financial risk and returns implications due to sustainability and climate change. The letter sent to all CEOs reiterated the view that we are entering a new era of finance, where the investment risk associated with climate change would drive significant reallocation of capital, and that corporates, investors and regulators need to be better prepared.

On Intermediate Capital's earnings call 2020-06-04, the CEO noted that ESG was a key focus for the group's Capital Markets Day, a theme of importance reminded by the crisis. ESG is a fundamental trend and an integral part of its strategy and investment approach. The firm is committed to continue building on its solid ESG reputation within its industry. Recent business strategies have had an ESG component, including an exclusive current renewables energy transaction and recently commissioned climate change study aiming to help portfolio companies and the firm assess and take into account climate change risk, applying it throughout their investment decision-making and portfolio management processes.

On MSCI's earnings call 2020-07-28, the chairman and CEO highlighted strong performance from the ESG franchise, reaching a runrate of $174mn and the highest ever ESG research quarterly subscription sales. AUM in equity ESG and climate change ETFs linked to MSCI indices grew to $55bn, an almost two-fold increase in the last year. The group has observed increased investor adoption of its ESG and climate change tools to build resilient portfolios, believing that its long-held belief in sustainable investing being critical to the long-term investment process has helped it capitalise on being an early mover to now being a leader in the space.

Energy

Exhibit 60: Around 90% of Energy in all regions discussed ESG in 2Q20

Exhibit 61: 'Carbon' most discussed across all regions, most notably in Europe

Exhibit 62: ESG discussions in the US accelerated in 2019...

Exhibit 63: ...while in Europe ESG discussions show a positive trend with spikes around yearly FY/E calls...

Exhibit 64: ...while volumes in Australia accelerated in 2H19

Exhibit 65: Q&A has led most of the discussion across S&P Energy...

Exhibit 66: ...in the STOXX, the share of discussion in the CEO presentation rises over time

Exhibit 67: Across ASX Energy, the CEO has led most of the discussion

Notable Energy ESG discussions from recent earnings

On National Oilwell Varco's earnings call 2020-02-07, the CFO noted a focus on leveraging the company's core competencies to help develop solutions that minimise its customers' environmental footprint while improving operational efficiencies. For example, the company's new PowerBlade system reduces the carbon footprint and cost of fuel for drilling contractors by recycling energy the system captures back into the rig. They estimate this could reduce diesel consumption by 771,000 gallons per year, saving $1.75mn, reduce NOx emissions by 110 tons per year and reduce CO2 emissions by 6,200 tons per year.

On Worley's earnings call 2020-02-23, the CEO highlighted the shift in power investment towards renewables and all other low-carbon technologies as the world continues to electrify. With the decline in coal-fired plants and slowdown in new gas-fired plants, the firm observe high demand growth in offshore wind technology, which requires significant investment in enhancing power networks to cope with changing loads and supply patterns. Notably, the speaker says a 50% increase by 2040, or $3.2tn annually, in global investment into the energy mix is required if the Paris-aligned targets are to be achieved.

On Valero Energy's earnings call 2020-01-30, the CEO noted the continued focus on the group's renewable fuels business, with a new renewable diesel plant as part of its Diamond Green Diesel joint venture (pending approval) expected to increase renewable fuels production capacity to over 1.1 billion gallons annually or over 70,000 barrels per day when operations commence in 2024. The firm expects 2020 capex to be c.$2.5bn, consistent with average spend over the last 6 years, with c.$1bn allocated for high-return growth projects that are focused on market expansion and margin improvement, and for maintaining safe, reliable and environmentally responsible operations. The company has a favourable outlook on refining margins with the IMO 2020 low sulfur fuel oil regulation, with Valero seeing itself as well positioned to take advantage of discounted high sulfur crude and fuel oils as feedstocks. The diesel segment also continues to generate strong results due to higher renewable fuels demand.

On Neste's earnings call 2020-04-24, the CEO highlighted the ongoing commitment from its customers to reduce their carbon footprint. Key initiatives were discussed, including a new sales agreement on sustainable aviation fuel with Finnair and JetBlue, the Mahoney Environmental acquisition that supports building a global waste and residue feedstock platform to meet the world's growing demand for renewable products, the strategic cooperation with Borealis for production of renewable polypropylene, and joint investments with Mirova in recycling technologies to accelerate the developments of chemical recycling and foster the transition to a circular economy for plastics. The company has also taken a minority stake in Sunfire, which has patented technology to allow production of renewable hydrogen and direct conversion of water and CO2 into raw materials for petrochemical products.

On Oil Search's earnings call 2020-02-25, an MD and director acknowledged the strategic review will reevaluate the company's long-term vision, including how to proactively manage risk to deliver PNG assets in a sustainable, environmentally responsible and profitable way through project execution. The firm will consider how the company is positioned among the global energy business and how the company can evolve with technological changes and ESG considerations.

Materials

Exhibit 71: Over 95% of Materials in the US and Europe discussed ESG in 2Q20

Exhibit 72: 'Plastic' most discussed in the US, and 'Carbon' in Europe and Australia

Exhibit 73: ESG discussions in the US grew consistently and spiked in 2019...

Exhibit 74: ...a similar trend across Europe...

Exhibit 75: ...while Australian volumes grew substantially in 2018 but declined in 1H20

Exhibit 76: Q&A and management presentations took up a similar share of ESG discussions across S&P Materials...

Exhibit 77: ...as well as in the STOXX

Exhibit 78: In Australia, the CEO presentation leads discussion

Notable Materials ESG discussions from recent earnings

On Eastman Chemical Company's earnings call 2020-08-04, the CEO highlighted the group's carbon renewal technology which repurposes its gas fire to reforming waste plastic, using the gas fire instead of coal to completely clean up the waste plastic to its molecular elements and rebuild acetyls and cellulosic products. Using this technology, the new Naia product already has 50% bio content from sustainably grown forest, with the other half soon to be based on recycled plastic - making them as biodegradable as microfibers in the ocean. The company has had significant interest already from a number of customers, including H&M which has included the technology in their conscious collection.

On Sealed Air's earnings call 2020-08-06, the CEO, president and director emphasized sustainability as core to the group's corporate strategy. The firm's commitment to meeting the 2025 sustainability pledge and drive a circular economy for plastics was reinforced, with initiatives including collaborating with industry pioneers, R&D of advanced technologies and implementation of new solutions. Most recently, the firm made a $2.5mn equity investment in Plastic Energy Global and entered an agreement on joint R&D to further the recyclability of plastic waste.

On Air Products and Chemicals' earnings call 2020-07-23, the Chairman, President and CEO stated they were very enthusiastic about carbon capture and had numerous projects in development. The speaker commented that carbon capture and hydrocarbons will be a huge business, and that the company has projects in the works that may result in real commercial proposals in the next 2-3 years.

On Glencore's earnings call 2020-02-18, the CEO discussed the group's commitment to a low-carbon economy, including the 2019 capex spent on energy transition materials such as copper, cobalt and nickel. For example, the Katenga asset will this year produce 30-32,000 tonnes of cobalt, and the company will increase nickel production in Canada which is used in battery production.

On Fletcher Building's earnings call, the CEO noted the increasing consumer appetite to opt for lower carbon options, given that cement manufacturing contributes around 8% of the world's carbon emissions. The speaker discussed some of the company's low-carbon initiatives and advantages, including its competitively priced cement with a 20% lower embedded carbon than imports, the Tyre Derived Fuel project which achieves more efficiencies in its cost base and consumes up to 50% of New Zealand's waste tyres, and working on introducing pozzolans as a cement substitute.

Health Care

Exhibit 82: ESG discussion is less of a priority for Health Care companies

Exhibit 83: 'Water' most discussed in the US and Europe, and 'Governance' in Australia

Exhibit 84: ESG volumes have been declining in the US

Exhibit 85: European volumes saw moderate growth, albeit volatile

Exhibit 86: In Australia volumes peaked in 2018 but fell in recent quarters

Exhibit 87: Management presentations led the majority of ESG discussions in the latest quarter across S&P Health Care

Exhibit 88: ..while presentations saw growing share of ESG discussions in Europe

Exhibit 89: In Australia, the majority of ESG comments came from CEO presentations

Notable Health Care ESG discussions from recent earnings

On Eli Lilly and Company's earnings call 2020-01-30, the CEO discussed how Insulin Lispro helped nearly 79,000 US patients during December, complementing existing offerings from its Diabetes Solution Centre which helps 20,000 patients per month to better afford their insulin. The company commits over $5bn pa in long-term R&D and is committed to continuing pursuing sustainable business, social and environmental practices.

On Novartis' earnings call 2020-01-29, the CEO showcased the Novartis in Society Report, which details the group's key ESG metrics increasingly needed by investors and ratings agencies. Recent commitments were flagged, including reducing the launch time lag for innovative medicines to less than 3 months for low- and middle-income countries vs the US and Europe, committing to carbon neutrality by 2025 and tackling Scope 3 emissions, and delivering on the UN Equal Pay for Equal Work and Gender Equity goals.

On AstraZeneca's earnings call 2020-02-14, the CEO announced that the firm had reduced carbon emissions from operations by almost a third and water consumption by almost a fifth, but acknowledged that more progress is needed and that efforts would be increased.

On Estia Health's earnings call 2020-02-24, the CEO highlighted initiatives including the completion of the current phase of the group's solar and LED lighting program that would enable 63 homes to be retrofitted with energy-efficient systems, a new program to replace inefficient water heating and gas dryers, and a partnership with a third party for electricity usage monitoring. Further, the company completed an environmental and social risk baseline assessment, and has commenced a climate change resilience assessment for its assets.

Real Estate

Exhibit 93: 96% of Real Estate in Europe discussed ESG in 2Q20

Exhibit 94: 'Recycle' most discussed in the US and Australia, and 'ESG' in Europe

Exhibit 95: ESG discussion has seen an upward trend since in the US since 2016

Exhibit 96: In Europe, growth was slow until it accelerated in 2019

Exhibit 97: In Australia, volumes accelerated in 2019, but fell in recent quarters as Covid unfolded

Exhibit 98: Management presentations led most of the discussions across S&P Real Estate...

Exhibit 99: ...similarly for STOXX Real Estate...

Exhibit 100: ...and even more notably in the ASX

Notable Real Estate discussions from recent earnings

On Charter Hall Retail Real Estate Investment Trust's earnings call 2019-08-15, the CEO of Retail, Fund Manager and ED noted that the firm had implemented waste management programs to double landfill diversion rates across the portfolio, and additionally recycled 90 million containers through an ongoing recycling partnership with TOMRA. The company is also committed to engaging with the communities within which it operates.

On British Land Company's earnings call 2020-05-27, the CFO reiterated the group's key commitment to reach net zero carbon by 2030, which includes initiatives such as ensuring all future developments are net zero, that all developments have 50% less embodied carbon, and by reducing operational carbon by a further 75%. The company’s approach is based on the reuse, recycle, and resource sustainably, with offsets only being used as a last resort.

On Vornado Realty Trust's earnings call 2020-02-19, the President noted the company’s priority to reduce its carbon footprint and mitigate its contribution to climate change. Over the past 10 years, the company has reduced same-store energy consumption by 25%, aiming for further progress through continued energy retrofits, smart building technology and tenant engagement. Renewable energy is also in focus as the company transitions towards carbon neutrality. Recent achievements were used to evidence the company’s position against recently introduced climate laws, such as being Energy Star Partner of the Year for the seventh time and a NAREIT Leader in the Light Award recipient for the tenth year in a row. The speaker also states the firm is a top performer among global real estate sustainability benchmark respondents and has been cited as the industry model for its audited ESG reports by the SEC.

On LEG Immobilien's earnings call 2020-05-11, the CEO discussed the firm’s commitment to all aspects of ESG and target setting. Notably, the company is continuing to modernize 3% of its portfolio to improve energy efficiency, and is working to adopt new ESG reporting standards, such as TCFD and SASB.

On Dexus's earnings call 2020-02-05, the CEO discussed how the Australian bushfire events put in focus the impact that the environment can have on communities, and that the firm remains focused on enhancing property resilience to mitigate environment- and climate-related impacts. In the company’s journey towards net zero emissions, its off-site renewable energy supply agreement has commenced across NSW, and the presenter notes that the firm achieved excellent results across leading global ESG benchmarks.

On Charter Hall Group's earnings call 2020-02-19, the CIO highlighted that the company already has the largest Green Star rated portfolio in the country, but is continuing to look for further opportunities to improve. The company now has net zero targets for all assets within operational control by 2030 and is focused on working with tenants and contracts to further help reduce emissions. The company is putting climate change adoption plans in place across its portfolio and will continue rolling out solar with 6.9MW of solar PV, up 1.7MW in the latest period, generating enough power for 314 homes across its assets.

Consumer Staples

Exhibit 104: 89% of Consumer Staples in the ASX 200 discussed ESG in 2Q20

Exhibit 105: 'Water' most discussed in all regions

Exhibit 106: ESG discussions have been growing in the US from a lower base

Exhibit 107: Discussions spiked in 2019 in Europe

Exhibit 108: In Australia, volumes accelerated in 2018 but declined recently due to Covid

Exhibit 109: CEO presentations are the major source of ESG discussions across S&P Consumer Staples...

Exhibit 110: ...similarly in Europe...

Exhibit 111: ...while in Australia the share of CEO presentations grew from a lower base

Notable Consumer Staples ESG discussions from recent earnings

On Church & Dwight Co.'s earnings call 2020-01-31, the CEO outlined some of the company’s ESG goals, including a 25% reduction of water and wastewater by 2022, water recycling of 75% by the year of the year, and 100% carbon neutrality by 2025 through green electricity and reforestation. Today, the company is 60% carbon-neutral, achieved partially through offsets.

On Costa's (Australian) earnings call 2020-02-26, the CEO highlighted the group's increasing focus on enhanced water collection and recycling initiatives, which included recycling 200ML of drain water in its glasshouse tomato crops in 2019, as well as the use of renewable energy with solar power at the Monarto mushroom facility.

Waste & Recycling

On Coca Cola's earnings call 2020-01-30, the CEO discussed the company’s progress on sustainability initiatives, addressing water stewardship, sugar reduction, women's empowerment and climate. In particular, the World Without Waste initiative that aims to reduce packaging waste was highlighted, with notable achievements including the availability of bottles made with 100% recycled PET in 12 markets with more planned, and that Coca-Cola Sweden will be the first market globally to transition to 100% recycled PET for all plastic bottles made in the country - a fully circular economy.

On Essity's earnings call 2020-04-23, the CEO noted some of the firm’s sustainability innovations, including its feminine brands having all paper-based packaging based on recycled fibre and all plastic packing having at least 50% of plastic coming from either recycled fibre or plastic sourced from renewable sources. In Tempo, the products are also now made from 100% paper packaging after the plastic usually at the opening of the facial boxes was replaced with paper.

On Coca Cola Amatil's earnings call 2020-02-20, the Group MD and Executive Director announced that 7 out of 10 of the group's bottles in Australia were made from 100% recycled materials, which has more than doubled the company's use of recycled plastic and bottles, and secured Coca-Cola's position as a market leader in recycled packaging. Further, the company said it was the first in the broader Coca-Cola system to make 100% recycled bottles for carbonated beverages of or under 600ml on an ongoing basis which is very much being driven by demand from consumers.

Consumer Discretionary

Exhibit 115: ESG discussions in Consumer Discretionary on the rise, especially in Europe

Exhibit 116: 'Water' most discussed across all 3 indexes

Exhibit 117: ESG growth has been sluggish in the US...

Exhibit 118: ...while in Europe discussions accelerated in 3Q19, albeit volatile...

Exhibit 119: ...with Australia volumes staying at a high level since 2019

Exhibit 120: CEO presentations are increasingly leading ESG discussions in the US

Exhibit 121: In the STOXX, the share from CEO presentations has been fairly stable in recent quarters

Exhibit 122: In Australia the majority of discussions come from management presentations

Notable Consumer Discretionary ESG discussions from recent earnings

On Ulta Beauty's earnings call 2020-08-27, the CEO and director announced the firm's pledge to ensure 50% of all packaging sold either be made from recycled or bio-sourced materials, or be recyclable or refillable, by 2025. The company will pilot a circular shopping experience with Loop in early 2021, a reusable packaging pioneer.

On Hennes & Mauritz's earnings call 2020-01-30, the CEO noted that sustainability initiatives are good for the company and are increasing in importance for both customers and employees. The company aims to be a sustainability leader in the fashion industry with circular solutions, reduced energy use and more renewable energy. H&M has set a target of 100% recycled or sustainably sourced materials by 2030, and continues to ensure good working conditions in the supply chain.

Carbon, Emissions & Energy

On Carnival's earnings call 2019-12-20, the CEO highlighted sustainability achievements, including a 4% reduction in per unit fuel consumption in 2019 with another 4% reduction expected in 2020 to bring the cumulative reduction in fuel consumption per ALBD to 35%. The company also joined the Getting to Zero Coalition which is an alliance of organisations across the maritime, energy, infrastructure and finance sectors that are focused on accelerating the decarbonisation of international shipping.

On Daimler's earnings call 2020-04-29, the Chairman of the Management Board and CEO & Head of Mercedes-Benz Cars Division reinforced the firm's commitment to investing in electrification, including hybrids, digitization and software architectures – all non-negotiable elements for the company’s future. Near-term low-carbon product launches were discussed, including both the latest generations of combustion engines with 48-volt systems and multiple plug-in hybrid.

On Wesfarmers' earnings call 2019-08-27, the MD of Officeworks reiterated the firm's commitment to responsible and sustainable business which supports communities. A few accomplishments for the year were highlighted, including a 7% reduction in carbon emissions and an improvement in operational waste recycling from 76% to 82%.

Communication Services

Exhibit 126: ESG discussions are rising from a low level across regions

Exhibit 127: 'Governance' most discussed in the US and Europe, 'Protests' in Australia

Exhibit 128: ESG discussions on the rise from low levels in the US...

Exhibit 129: ...while in Europe volumes spiked in 2019, despite a dip in 2Q20 due to Covid

Exhibit 130: In Australia, ESG discussions grew consistently since 2017

Exhibit 131: CEO presentations are the predominant source of ESG discussions in the US...

Exhibit 132: ...while in the STOXX, share of CEO presentations grew from a lower base

Exhibit 133: In ASX, CEO presentations led most of the discussions

Notable Communication Services ESG discussions from recent earnings

On Alphabet's earnings call 2019-10-28, the CFO noted that sustainability cuts across every element of the business, including in the technical infrastructure, in product development, with the group's facilities, and what the firm is doing with AI. For example, the company is applying machine learning to energy efficiency in its data centers, which has helped to reduce energy consumption - a positive for both sustainability and efficiency. The company has committed to offset 100% of electricity use with renewable, and is making meaningful investments which is catalysing further investments in renewables.

On Telefonica's earnings call 2020-02-20, the CEO highlighted that Telefonica was top of the list of the main ESG benchmarks; the firm was first among peers on Sustainalytics, rated A by MSCI, and part of the Bloomberg Gender Diversity Index for the third year in a row.

Human Capital Management

On Telecom Italia's earnings call 2020-02-20, the CEO noted improvements made to the management remuneration scheme which is now fully aligned to shareholders' interest. Key KPIs now included in management’s variable compensation include stock price performance, equity FCF and debt reduction, as well as customer satisfaction index, employee satisfaction and other ESG pillars.

On Chorus's earnings call 2020-02-23, the CEO discussed how even during this period of change, the engagement of the group's workforce, which is measured quarterly, has seen continued growth. Notably, the company’s latest Employee Engagement review reached a score of 8.1, and its Employee Net Promoter Score had significantly increased to 48.

Information Technology

Exhibit 137: 45%-55% of Information Technology across three indices discussed ESG

Exhibit 138: 'Diversity & Inclusion' most discussed in the US, and 'Environmental' in Europe and Australia

Exhibit 139: ESG discussions have increased rapidly in the US, recovering to above pre-Covid level in 2Q20...

Exhibit 140: ...a similar trend across Europe, albeit greater volatility...

Exhibit 141: ...while in Australia, volumes spiked in 1H20

Exhibit 142: CEO presentation increasingly led the ESG discussion across S&P Information Technology...

Exhibit 143: ...a similar trend in the STOXX...

Exhibit 144: ...while in Australia sources of discussions vary over time

Notable Information Technology ESG discussions from recent earnings

On SAP's earnings call, the Co-CEO highlighted the performance on the group's employee engagement index, at 83% for 2019 which the speaker claimed was above industry benchmarks, as well as its high employee retention rate at 93%. Also noted was positive feedback given on Glassdoor and the company’s achievements making the best employer list in 7 countries (#1 in Argentina and Brazil) and making the top of Forbes America's Best Employers for Diversity list, with roughly 34% women in the workforce and 27% women in leadership position.

On Capita's earnings call 2020-03-05, the CEO noted that the company must invest in its people if it is to keep customers pleased. Initiatives have included guaranteeing the real living wage for UK staff effective April 1, 2020, which would improve the salaries of c.6,000 colleagues, as well as improved parental pay and life insurance packages. The cost for these initiatives in 2020 is estimated to be c.£10mn, more than initially planned; however, the firm believes the long-term benefit will be seen in further improvements in employee engagement, lower levels of voluntary departures and therefore lower recruitment costs, and reduces the cost of poor quality as more experienced staff are retained.

General Sustainability

On Xero's earnings call 2020-05-14, the CEO highlighted the commitment to the group's people, diversity and inclusion, their community and the environment. In response to COVID-19 increasing the community need for well-being and social support tools, the firm launched the Xero Assistance Programme in New Zealand in late 2019 and formed a partnership with Beyond Blue in Australia. Meanwhile, the CEO also announced the firm's pledge to fully offset its carbon emissions each year starting from fiscal year 2019, as well as the funding of three internationally recognized environmental and conservation carbon offset projects.

Carbon, Emissions & Energy

On Xerox's earnings call 2020-04-28, the CEO discussed the group's newest cleantech innovation area, where the company is looking at identifying technologies that reduce humankind negative environmental impacts on the world. For example, one team is working on an early-stage technology aimed at improving building energy and HVAC efficiency, which the presenter noted would also help progress work the company is doing with the US Dept of Energy to develop a solution to reduce air conditioner energy consumption by up to 80%, improving emissions and indoor air quality.

On Spectris' earnings call 2020-02-50, the CEO highlighted emissions control as an area of particularly strong growth within Industrial Solutions. The speaker discussed how, on top of power plants and hydrocarbon processing, Midrex Technologies had helped to set up equipment for one of the world's most modern and efficient iron making facilities used in steelmaking. Additionally, Servomex helped to improve customer energy efficiency through sampling systems and monitoring controls, which lowers plant cost and reduces the carbon footprint.

On Analog Devices' earnings call 2020-05-20, the CEO noted the sustainability benefits the company has observed over a short period, including sizable reductions of carbon dioxide, nitrous oxide and carbon monoxide at ADI. Also highlighted was the recently published comprehensive CSR report.

On Spectris' earnings call 2020-02-20, the CEO commented on the increasing scrutiny around environmental monitoring in Energy & Utilities, and that as a key beneficiary, the firm saw strong sales into hydrocarbon processing, the petrochemical sector, and BKV's wind industry.

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.