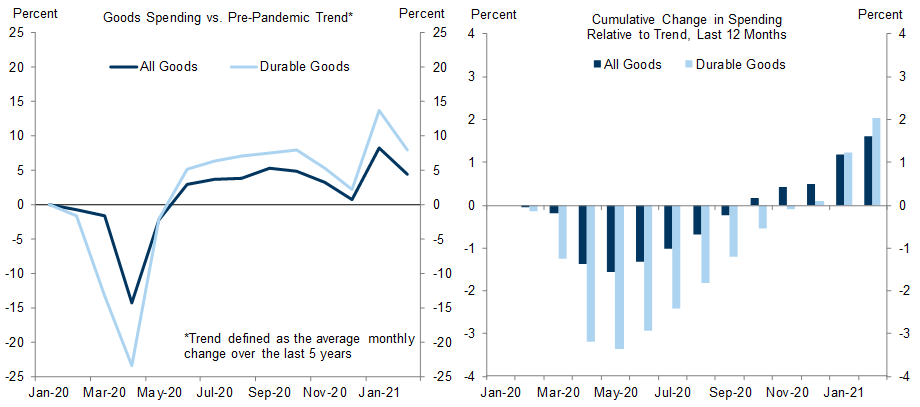

Goods demand has surged during the pandemic due to generous income support policies and a shift in consumption patterns away from unavailable services and towards goods. The extraordinary size and speed of this surge—for example, durable goods spending increased by 17% over the last year—raises questions about whether the current pace of goods purchases will be sustained, fall back toward trend, or even undershoot if goods spending has been “pulled forward.”

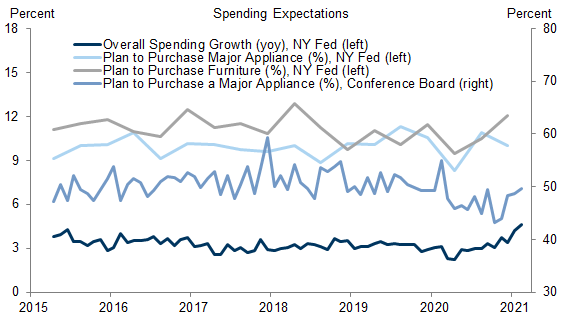

We see several reasons why goods spending will remain strong even as the service sector fully reopens. First, the current overshoot mostly reflects delayed purchases from last spring, suggesting that at most a small amount of future goods spending has been pulled forward so far. Second, consumer expectations for goods purchases have actually increased recently, and many companies also anticipate that demand will remain elevated after the pandemic ends. Third, household income and balance sheets will likely remain supportive of purchases.

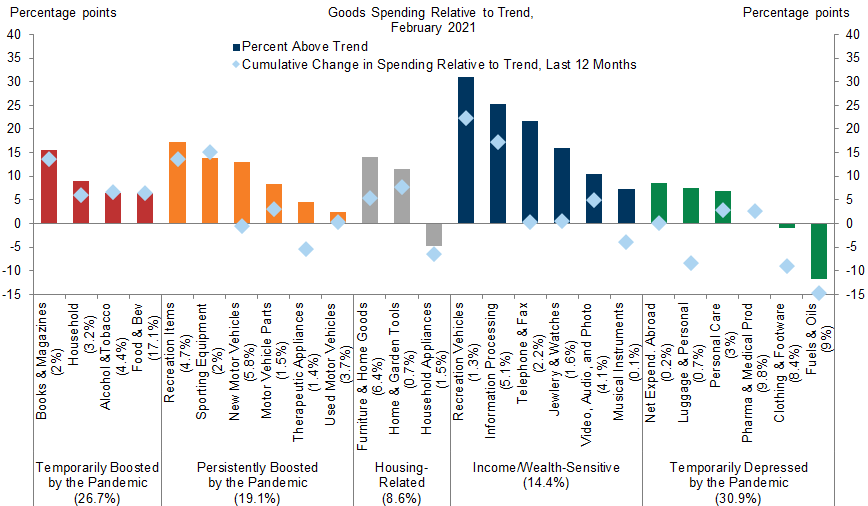

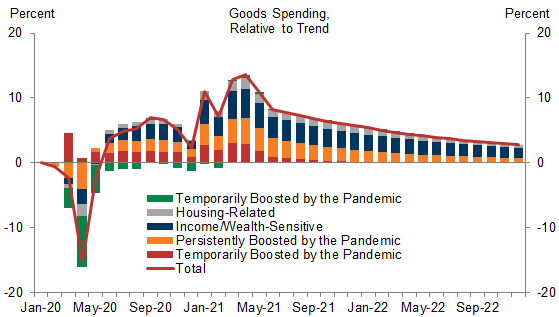

Of course, spending on some categories of goods should normalize as the economy reopens. For instance, spending on food and beverages at home could fall sharply once restaurants fully reopen, and spending on home goods might drop as consumers spend less time at home. After taking demand normalization into account using a category-level forecast, we estimate that real goods spending will fall in 2021H2 as consumers shift consumption back towards services but will still remain well above trend through 2022.

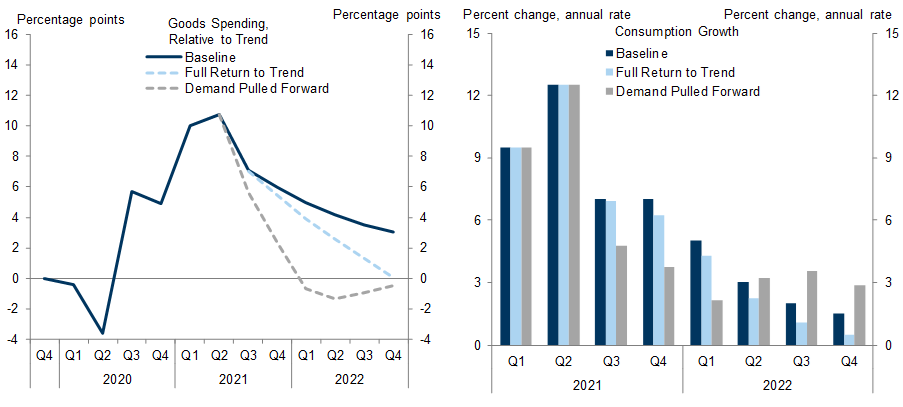

Uncertainty around the goods spending outlook is high, so to assess risks we consider two alternative scenarios where 1) goods demand fully reverts to trend and 2) the current overshoot displaces future spending. We find that the first scenario would moderately lower consumption growth in 2022 (-0.7pp to +4.4%, annual basis) while the second would meaningfully reduce consumption growth in both 2021 (-0.5pp to +7.7%) and 2022 (-1.3pp to +3.8%). However, we also see upside risks to our forecast if households spend pent-up savings faster than expected.

Demand for Goods Will Remain Strong After the Pandemic

Goods where demand was temporarily boosted by the pandemic and should normalize quickly once the economy reopens, like food and beverages.

Goods where demand was likely persistently boosted by the pandemic due to shifts in consumer taste and should only partially normalize once the economy reopens, like sporting goods.

Goods where demand was boosted by a surge in housing-related expenditures and should remain above trend given our favorable housing outlook, like home and garden tools.

Goods where demand was boosted by increases in income and wealth during the pandemic and should remain above trend due to household income and balance sheet strength, like jewelry and watches.

Goods where spending was temporarily depressed by the pandemic and should normalize quickly once the economy reopens, like clothing and footwear.

Joseph Briggs

- 1 ^ For goods that were either temporarily boosted or depressed during the pandemic (1 and 5) we assume that spending normalizes as the economy reopens and fully reverts to trend once the economy fully reopens. For goods that will likely be persistently boosted due to shifts in consumer tastes (2), we assume that spending decays at a rate such that 25% of the June overshoot is still present at the end of 2022. We similarly calibrate income- and wealth-sensitive goods spending (4), but allow 50% of the June overshoot to persist due to the large amount of pent-up savings that will continue to boost spending in this category. For housing-related spending (3), we assume that the overshoot persists through the end of 2021 before fading halfway back towards trend by the end of 2022.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.