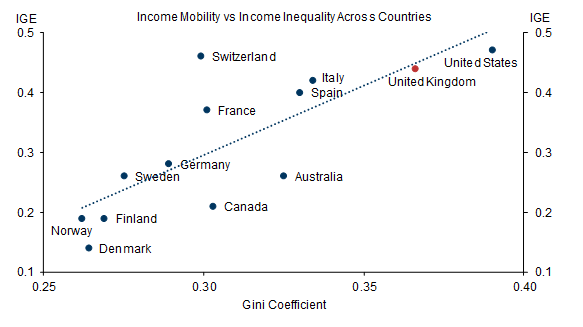

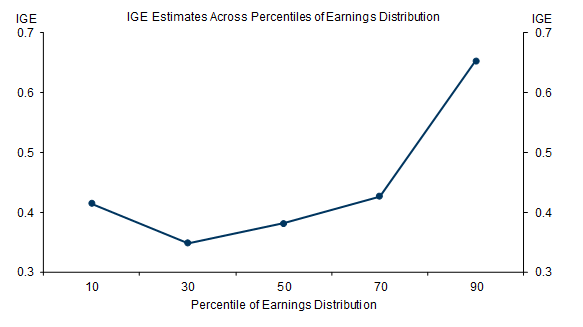

The UK performs poorly on international comparisons for both social mobility and inequality. The poorest and the richest are the most socially immobile. This exacerbates inequality as disadvantaged individuals are less likely to climb the income ladder, and the economically advantaged tend to stay at the top.

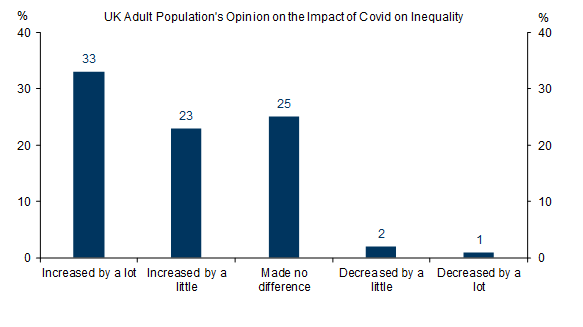

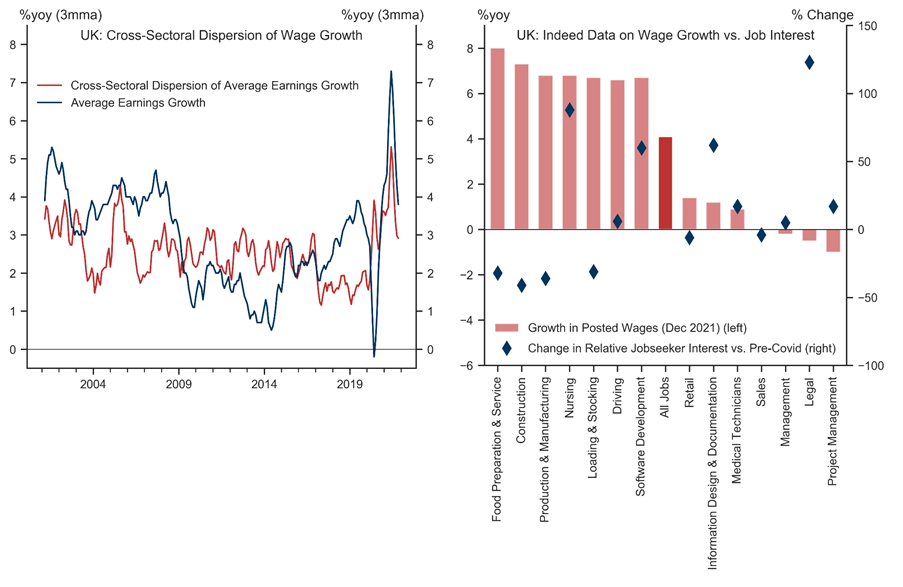

According to surveys, covid is increasing inequality further, and people in the North of England are more likely to report adverse impacts on education and employment than people in the South.

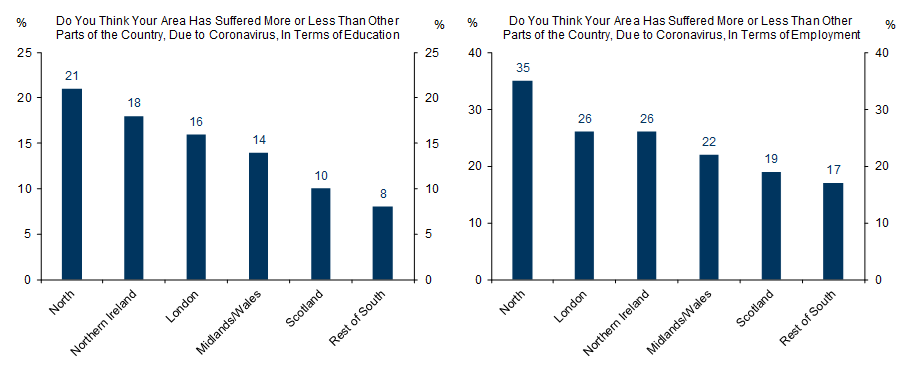

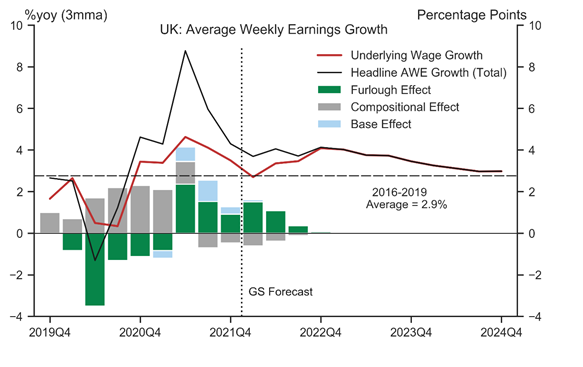

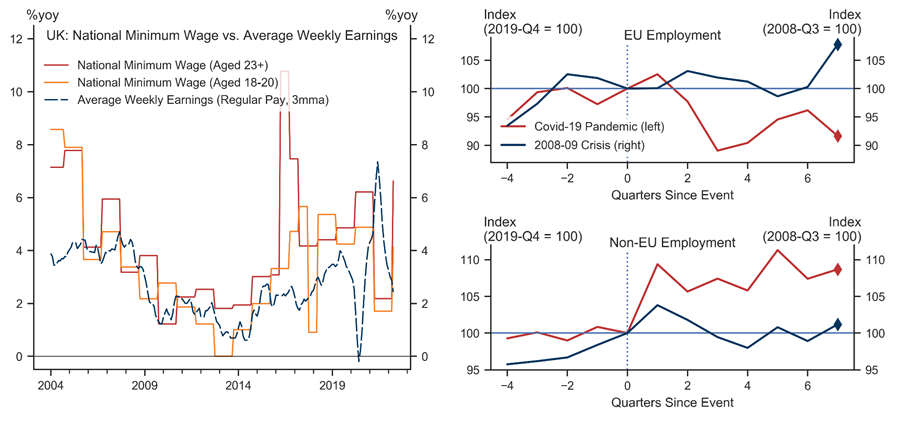

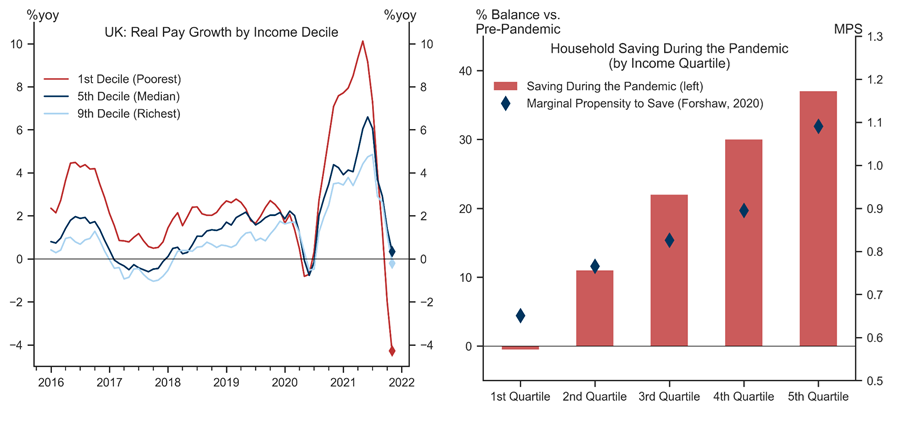

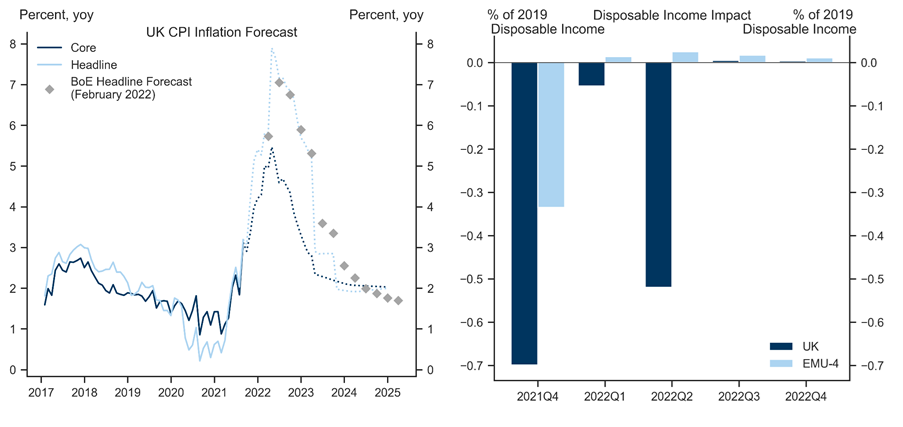

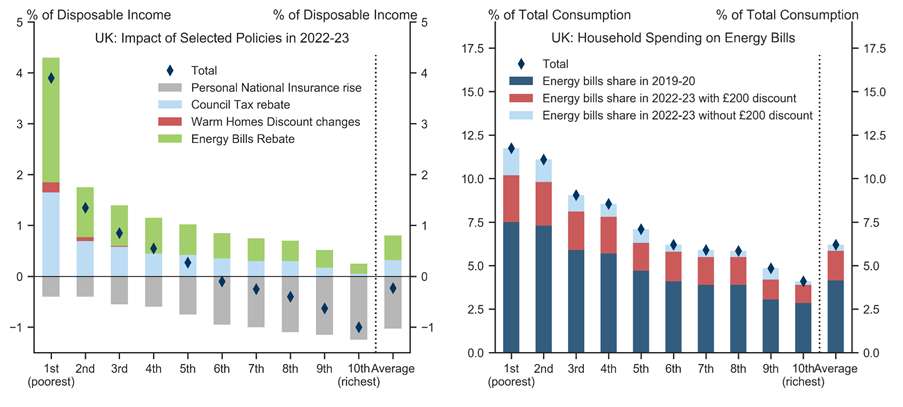

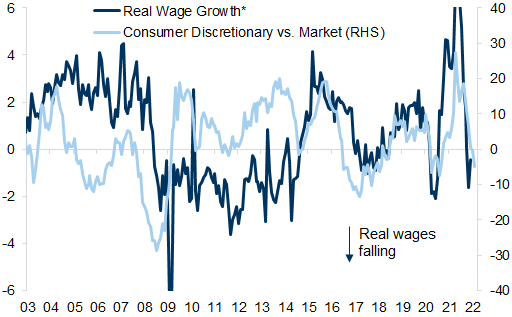

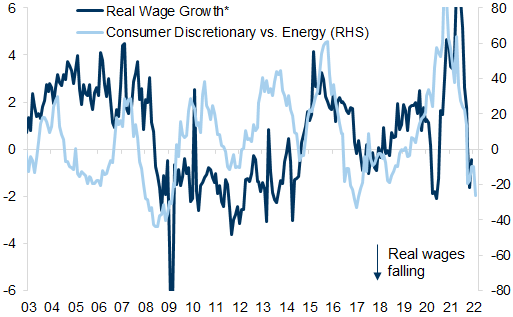

Recent rises in inflation, especially energy costs, are intensifying the problem: real pay has fallen by c.4% over the last year for households in the lowest 10% of the income distribution.

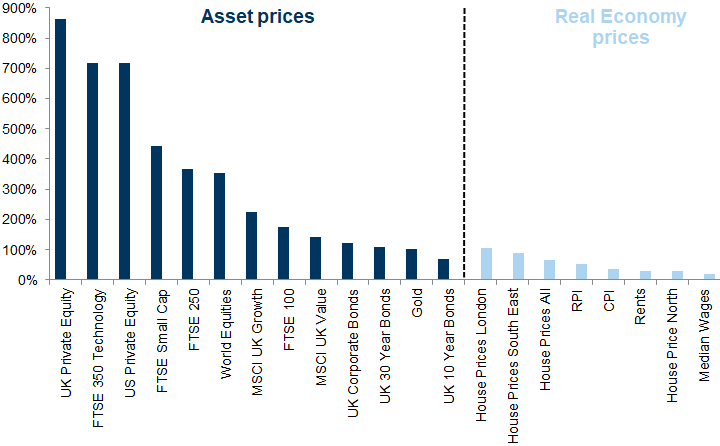

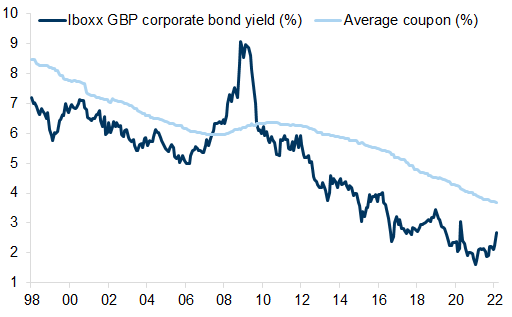

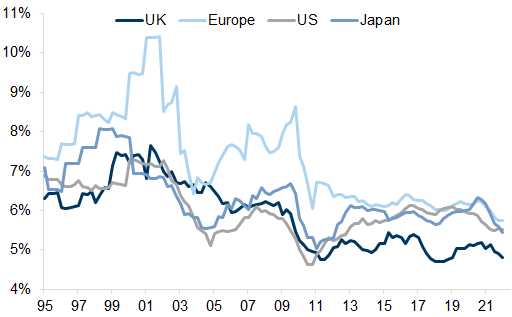

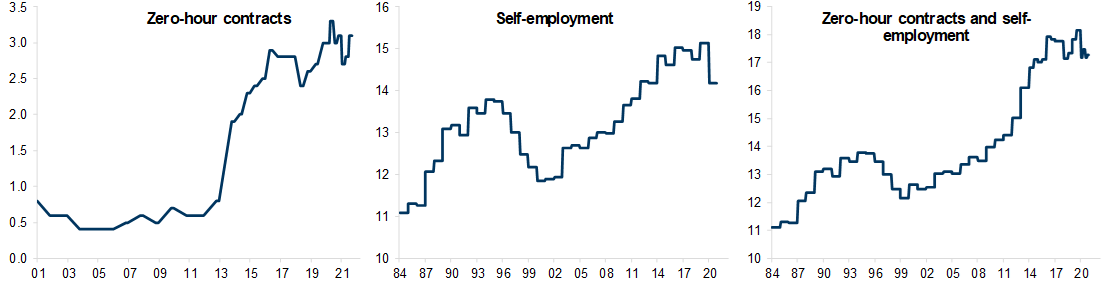

Inequality in recent years has been exacerbated by the moves in asset prices (persistent and strong) versus real wage growth (low). Central Bank QE was originally conceived to enhance productivity and wages by bringing down borrowing costs and encouraging investment. Instead, it has pushed up asset prices (which favours wealthier asset-owners) but without the investment; capex/sales is at a low in the UK and has fallen behind other regions.

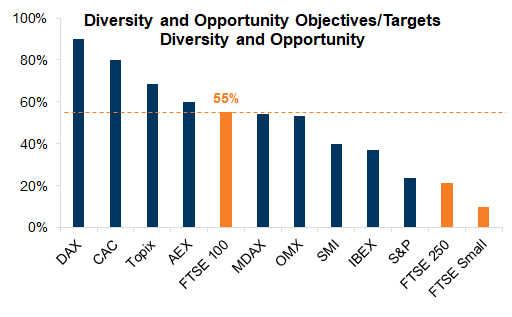

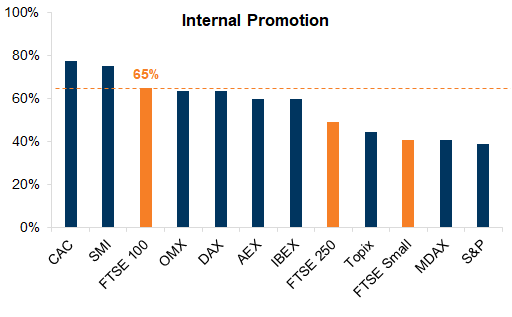

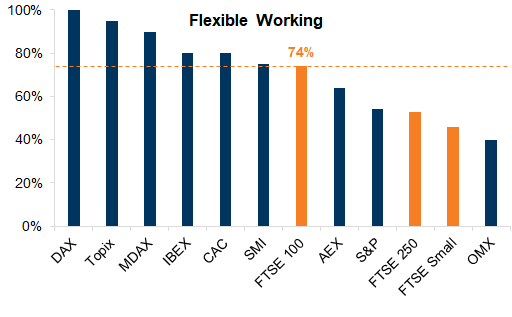

But, corporate managements are starting to focus on social issues (encouraged by the flows into ESG funds). Companies increasingly mention stakeholders rather than shareholders, more than 55% of FTSE 100 companies have diversity targets and 65-70% have internal promotion and flexible work schemes. We have also started to see investment intentions pick up in survey data and the potential to bring back supply locally or make supply chains more resilient may also increase employment opportunities in the UK.

We highlight examples of companies whose businesses are enablers of greater social mobility.

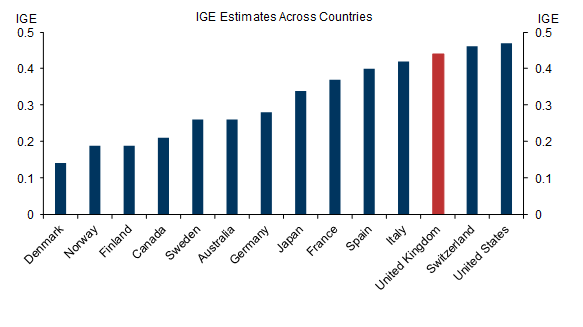

How Socially Mobile is the UK?

What is social mobility? How is the UK performing?

Social mobility and income inequality likely hit by covid

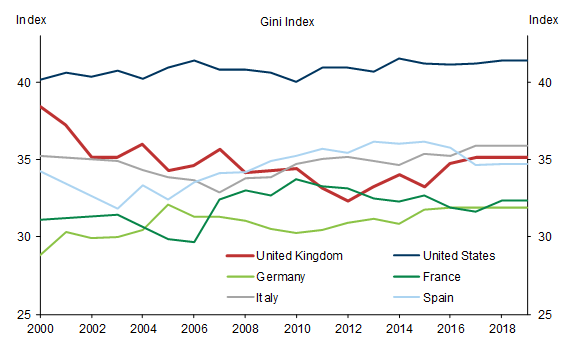

Exhibit 4: Inequality has Increased in the UK in Recent Years

Will higher wages and a tight labour market help?

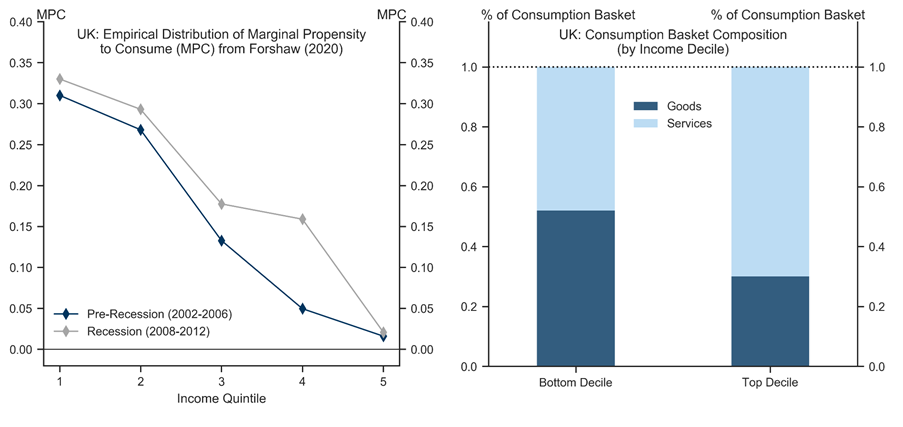

Exhibit 12: Poorer Households Are Likely To Cut Spending Disproportionately

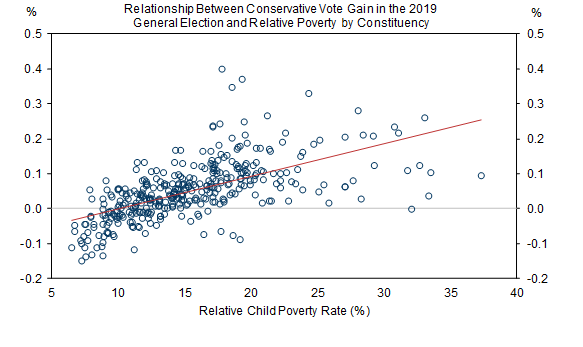

Politics and Policy

Improving geographical inequality by increasing public investment in less prosperous regions of the UK.

Ensuring benefits are well targeted and reducing child poverty.

Education is focused on equalising opportunities and improved access for children from lower-income households.

Apprenticeships and re-training programmes are focused on people from disadvantaged backgrounds.

High-quality digital access to less-wealthy households and those living in more remote locations.

Social Mobility: Asset markets & Corporates

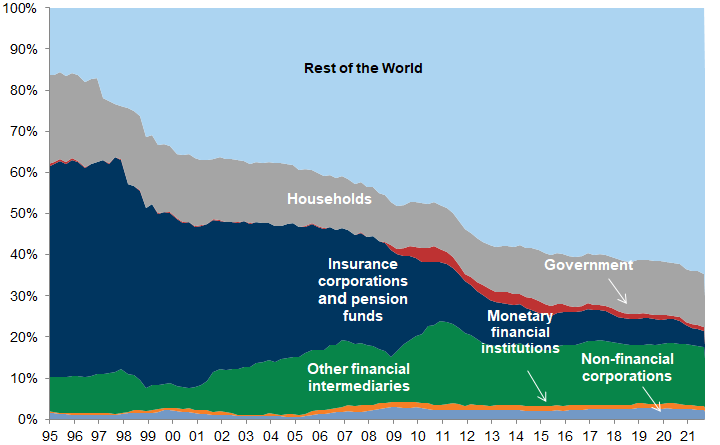

Asset market returns have exacerbated inequality

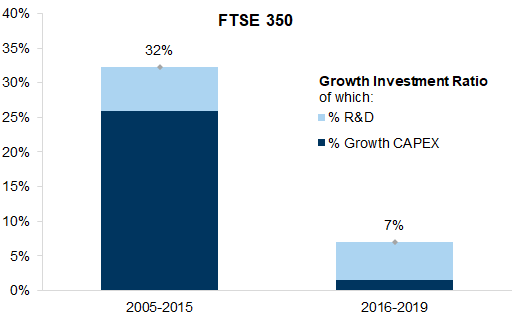

Lack of investment hasn't helped

Exhibit 16: Cost of Borrowing for UK Companies has Fallen

Exhibit 17: Race to the Bottom: The Investment to Sales Ratio is at a Low

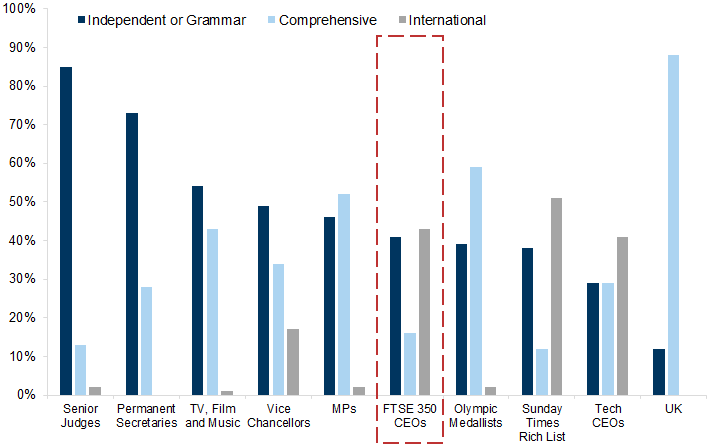

The corporate sector as a barrier to social mobility...

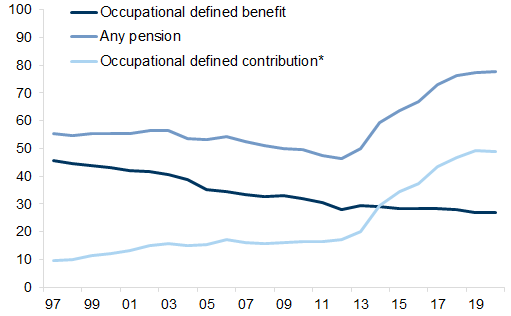

Exhibit 18: Fewer Defined Benefit Pensions, Although More People Now have Some Pension Provision

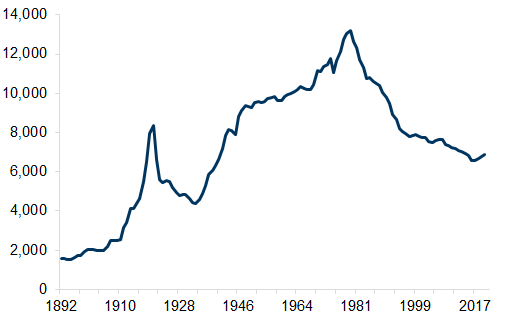

Exhibit 19: Trade Union Membership has Fallen But Levels have Slightly Increased in Recent Years

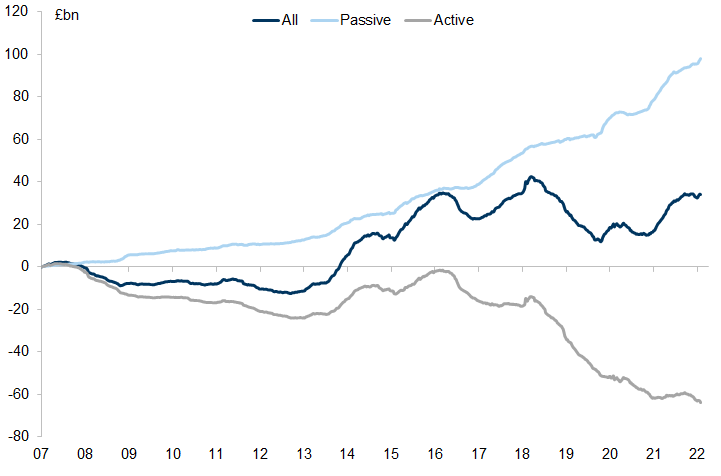

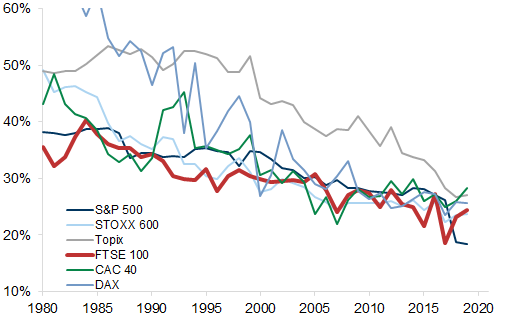

Exhibit 23: The Major Equity Indices have Seen a Decline in the Effective Tax Rate

Exhibit 24: The Growth Investment Ratio for FTSE 350 has declined considerably since 2016

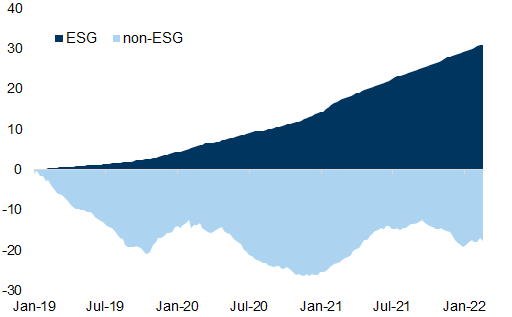

...Or a facilitator of equality and social mobility

Exhibit 26: ESG Funds Growing Steadily, While All Others are Seeing Outflows

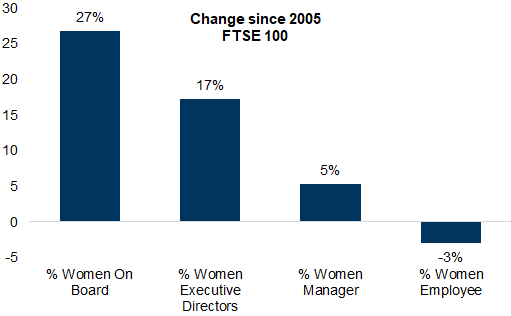

Exhibit 27: The Largest Change in % of Female Representation has been at the Board Level

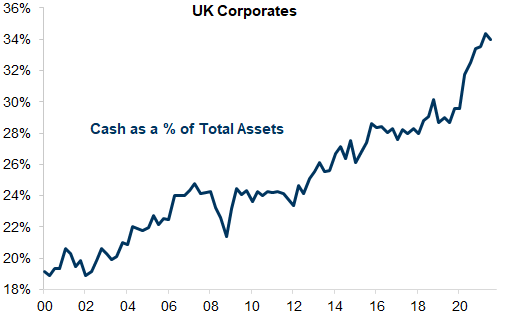

Exhibit 28: UK Corporates have High Cash Balances

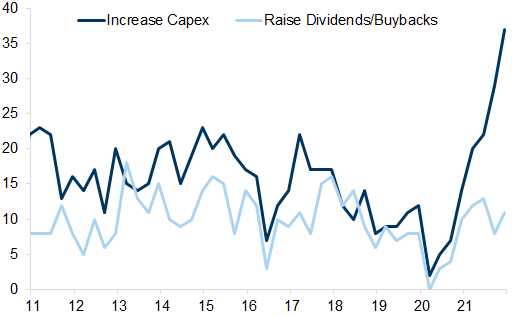

Exhibit 29: Increasing Capex is Becoming a Higher Priority

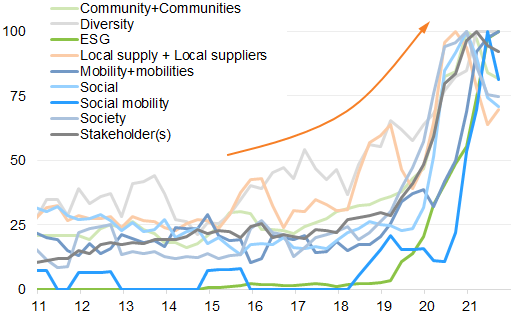

Exhibit 30: Mention of Key Social Mobility Words in Company Results

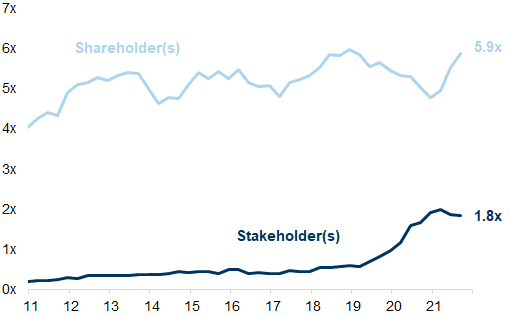

Exhibit 31: The Term 'Stakeholder' has become More Common in the Management Lexicon

Exhibit 32: 55% of FTSE 100 Companies have Targets for Diversity ...

Exhibit 33: Majority of Companies Encouraging More Home-Grown Talent via Internal Promotion schemes

Exhibit 34: Over 70% of Large Cap Companies Offer Flexible Working - a Smaller % of Mid/Small Caps Do

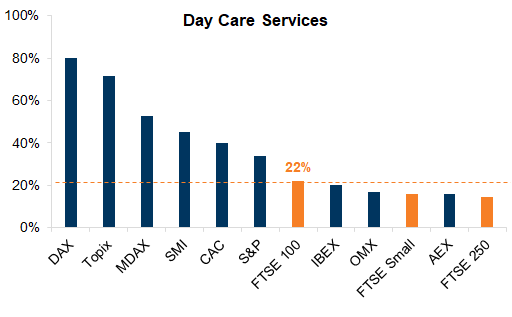

Exhibit 35: Day Care Services are Still an Exception, Offered by Just 20% of FTSE 100 companies and c.15% of FTSE 250/FT Small Cap Companies

More investment spend, which has been lacking in recent years, should boost longer-term returns, and is a good use of cash when borrowing costs are low. While some investment may be a substitute for labour, ultimately it tends to lift productivity and therefore wages.

Continued focus on diversity targets – this has improved but there is a long way to go.

More schemes to encourage internal mobility and flexible working; also, relatively few companies offer day care services.

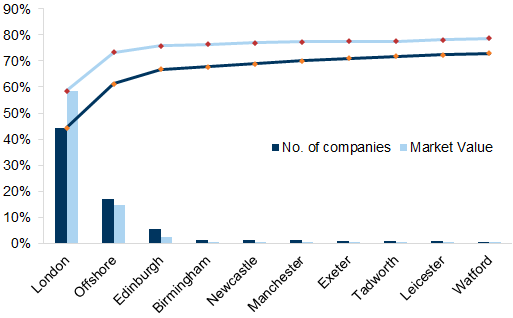

Location, location, location — the bias in the UK is very much towards London

Exhibit 36: UK Company Headquarters are Concentrated in London

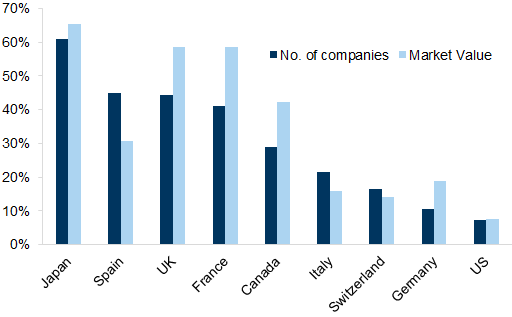

Exhibit 37: UK Not Alone in One-City Dominance among Listed Stocks But It's More Extreme than for Many

Energy inflation and the impact of the cost of living crisis for stocks

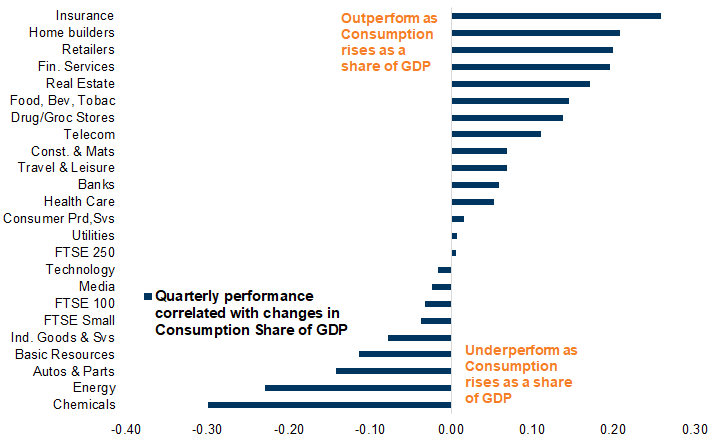

Exhibit 39: Consumer Discretionary Stocks Tend to Underperform the Market When Real Wages are Falling

Exhibit 40: Consumer Discretionary Stocks Tend to Underperform Energy stocks when Real Wages are Falling

Enablers of Social Mobility

Companies enabling social mobility

1/ Investment in real estate, housing or social impact funds

Real Estate provided £83 million of facilities to a joint venture to fund the development of student accommodation properties.

Investec partners with the Bromley by Bow Centre, which focuses on economic regeneration in London by helping entrepreneurs to launch their businesses. Many of the entrepreneurs are female and/or from an ethnic minority. It also provides financial and other support for digital learning in rural and disadvantaged communities.

One of Investec’s partners in the UK, Arrival Education, is a social enterprise that focuses on supporting young people from minority ethnic groups through programmes which encourage social mobility.

In the UK, Investec’s Asset Finance business supports over 50,000 SME clients, just over 50% of their client population.

Aberdeen has collaborated with Big Issue Invest to offer ways of investing that promote societal as well as financial benefits. An example of this is the UK Equity Impact Employment Opportunities Fund. The fund aims to promote stable employment, wages and opportunities for learning and progression – particularly in the UK's most deprived communities.

Aberdeen Standard Investments (ASI) invested £70 million into Network Homes which enabled Network Homes to boost liquidity and help achieve its social housing goals.

The UK Community Housing Strategy is a real estate strategy that seeks to generate financial and social returns by investing in the UK affordable housing sector.

The business is targeting the creation of a £400mn fund to build 3,500 homes of which it has already raised the first part and has deployed c.£31mn into a 227-home scheme.

£1bn residential joint venture between EQT Exeter and Sigma Capital to create a portfolio of high-quality 'build-to-rent' (BTR) residential homes at market rental rates in more affordable areas of Greater London.

Schroders and Big Society Capital (BSC) launched the Schroder BSC Social Impact Trust plc, a new investment trust strategically positioned to address significant social challenges in the UK.

2/ Infrastructure investment

Legal & General have been large investors in infrastructure in regions within the UK for some years – including in Manchester, Cardiff, Salford, Sheffield and Oxford. The company calls this inclusive capitalism, and they are committed to putting their capital and the capital backing their c£90bn annuity portfolio into building better and greener infrastructure.

These projects include urban development, science and technology parks and data centres, leaving the company well positioned to benefit from the UK government's focus on 'building back better' in the regions. The company has also made a commitment that all its residential homes will be operationally carbon emission free from 2030. This includes c.3,000 traditional homes pa and 3,000 affordable homes, coupled with 'build to rent' homes.

They are committed to providing capital for up to 5% of the UK clean energy market by 2021 and increasing the proportion of economically and socially valuable assets within their real asset portfolio by 20% by 2023.

BT is playing a major role in broadening out digital connectivity for the UK. With a fibre build-out to 25mn homes by 2026, BT plans to build faster than any European operator has done before.

In partnership with charities, Vodafone is tackling digital exclusion in the UK. With 1.5 million UK homes still without internet access, Vodafone aims to bridge the gap and broaden the opportunity set for users who would have otherwise struggled to access basic services, study from home, or keep in touch with relatives. Note, the UK is only 10% of Vodafone's business.

3/ Education access and training/apprenticeships

Pearson supports the existing UK academic system across GCSEs and A Levels as well as vocation-focused BTEC and T Level curricula, materials and qualifications. Beyond the traditional school-aged student, the company also operates Pearson VUE, which facilitates professional assessments and qualifications from a range of different industries.

The company created the 'UK learns' portal during the pandemic, providing certified online courses for furloughed workers and is now open to individuals across the UK wishing to access these courses.

The company has recently committed to growing its business offering in 'workforce skills' to support the upskilling and reskilling efforts of corporates, a market which it believes was worth £280bn globally in 2019.

LTG supports employers (including UK corporates and the public sector) in upskilling and reskilling their employees for the future needs of the workforce. It does this through providing digital content authoring tools, as well as specialists that partner with customers directly to create bespoke digital learning content.

LTG’s software and platforms offering includes businesses such as Affirmity and PDT Global, which enable corporates to assess the diversity of their workforce.

The company’s software and platforms offering also includes products that help corporates identify skills gaps across their workforce and then both recommend and facilitate appropriate training.

BAE has a track record of investing in education. The company hired c.800 apprentices in 2021, and they were maintained even during the pandemic. It invests in STEM & early careers training for around 3,000 young people in the UK.

'Leveling-up': It employs over 20,000 in North West England. In 2020, BAE directly employed 14,700 workers in the most deprived local authorities, 40% of its total employment in the UK.

4/ Support and access to finance for small businesses

Provides online-based SME lending with a process that is faster and smoother than the traditional banks.

In addition, the company was used successfully by the government to distribute pandemic-related interest free loans to UK SMEs.

Sage provides accounting, payroll and HR software to small and medium businesses.

The main issue for Sage, according to our Equity analysts, is that in order to remain competitive it needs to spend a high amount of its revenues on R&D (c.15%) and a third of its revenues on sales and marketing.

This is a global business but around a quarter of revenues are from the UK.

Wise is an enabler of cross-border money transfer solutions, but it increasingly leverages its platform to provide a broader range of financial services ranging from multi-currency accounts and debit cards for consumers and businesses. See our Equity analysts' report.

Enabler of access to financial products. Experian is focusing on expanding the amount of data added to credit reports to help with access to mortgages and other credit financing (or insurance) for the underprivileged or unbanked population.

It is predominantly a US business but is one of the major players in the credit market in the UK.

For example, they add mobile phone bills or utility bills to credit reports in order to increase an individual’s credit history, making banks more comfortable providing first-time loans, and focusing on UN SDGs related to access to financial resources and poverty elimination.

Experian has increased its capex spend on product development from c.18% in 2016 to c.33% in 2020.

HSBC is working with housing and homelessness charities such as Shelter to help people without a fixed home address to open a bank account.

Who is likely to benefit from 'leveling-up'?

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.