Higher home prices and challenging affordability: How long can it last?

History shows the current market has more stable fundamentals

US Housing market crash turns not-so-sweet 16

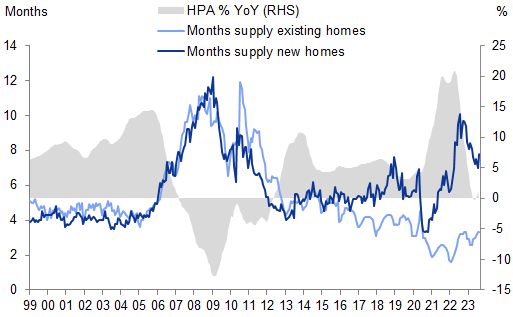

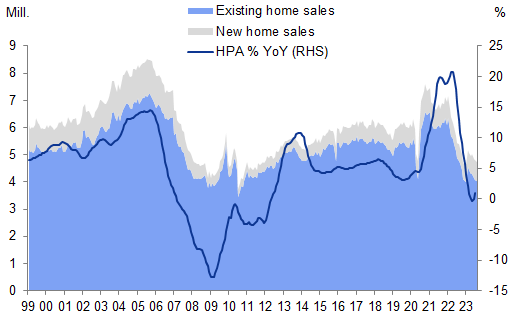

Supply and demand are unsurprising core drivers of home prices

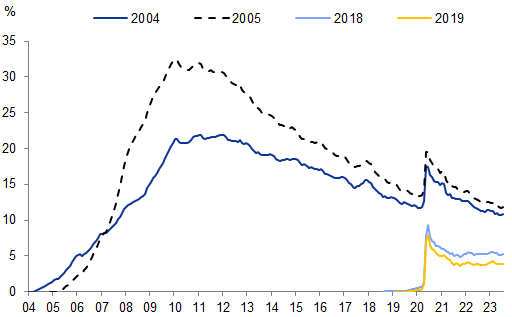

Exhibit 1: Sharp rise in supply of homes for sale put downward pressure on home prices

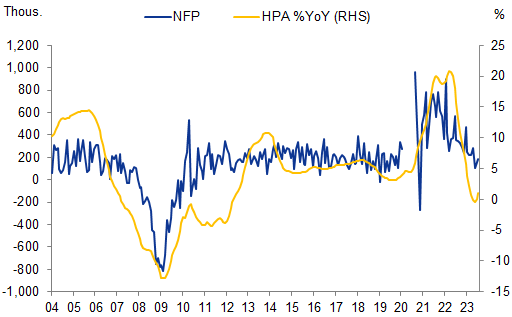

Exhibit 2: Demand helped drive home prices higher

The sequence of events that led to the last crash

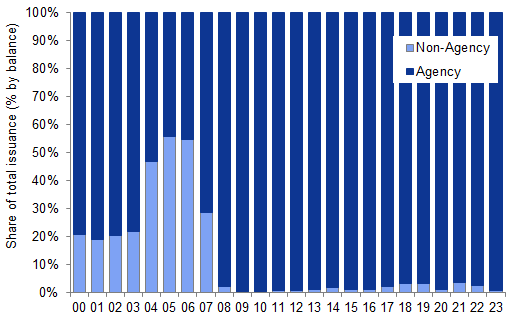

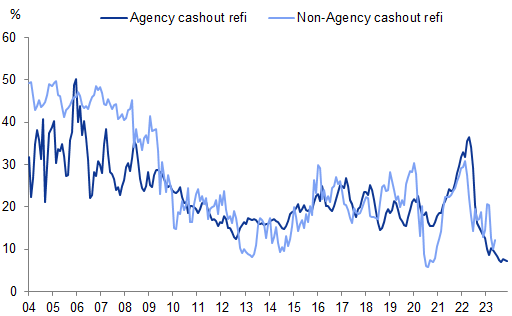

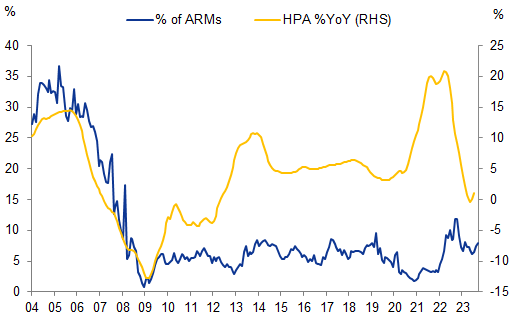

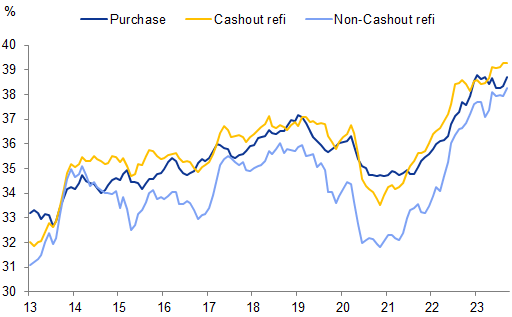

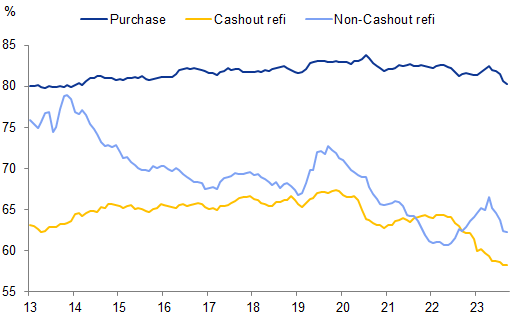

Affordability products and taking cash out of home equity helped home prices rise. To further highlight the looseness of credit conditions leading up to the GFC, Exhibit 5 shows that nearly 50% of the loans issued into non-agency MBS were for borrowers refinancing to take out equity, thereby allowing home prices to continue their rise. Additionally, initial borrower payments were lower than for 30-year fixed rate loans at the time. Most originations were adjustable rate mortgages (ARMs) which reached a peak of 80% of all non-agency MBS and 30% of all mortgages (Exhibit 6). Home prices were spurred on with these ‘affordability’ products. Looking to recent experience in both cases, the recent sharp rates selloff served the purpose of limiting cashout refinances and the inverted yield curve (along with post-GFC lending standards) has limited the origination share of ARMs.

Exhibit 5: Taking cash out of one’s home was common as home prices rose

Exhibit 6: Affordability mortgage products were common in the private market

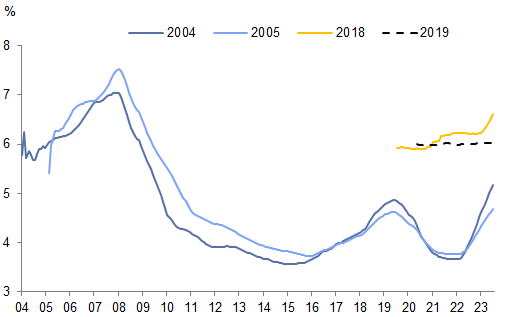

Mortgage rates started to adjust. Before the local home price peak in 2006, ARM rates started to adjust higher as loans reached the end of their initial, fixed-rate period of 2-3 years. Using the 2004 origination year as an example, the weighted average coupon (WAC) of loans rose to nearly 9% on these ARMs (Exhibit 7). Higher loan payments started to translate into weaker home prices. Again, in the relatively small non-agency MBS market of ARMs today, mortgage rates tend to be fixed for 5 years or more.

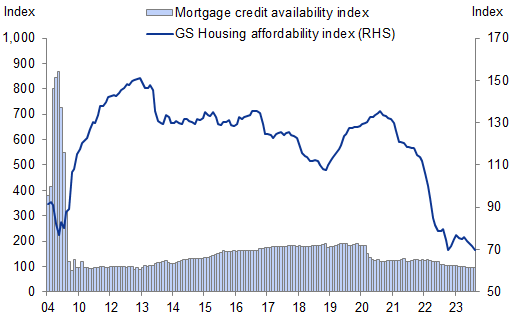

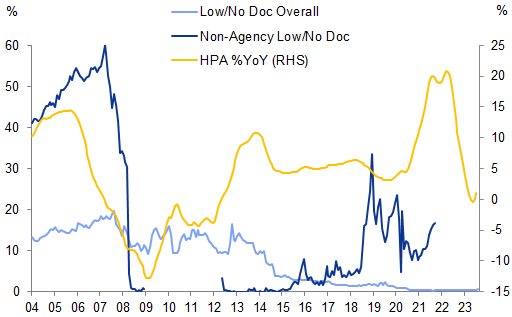

Credit availability pulled back sharply. After rate resets, home prices experienced another negative impulse in the form of a sharp pullback in credit availability. Using the non-agency share of loans with either limited or no borrower underwriting documentation as a proxy for underwriting standards rapidly pulled back over the second half of 2007 into 2008 (Exhibit 8). Borrowers were facing far fewer options for financing as the market effectively shut down and home prices fell further. Today, most loans originated in the mortgage market have fully-documented borrowers.

Exhibit 8: Credit availability rapidly tightened, further pressuring home prices

Excess supply was building off market and job losses drove prices to the depths. Around the same time that credit availability tightened in 2007, delinquency rates, which were already rising from previously mentioned trends like ARM resets, took another leg higher as borrowers were faced with fewer financing options (Exhibit 9). Not only was the months' supply of homes high as in Exhibit 1, there was also a buildup in ‘shadow’ inventory of homes of borrowers facing foreclosure even before job losses started (Exhibit 9). And then, as non-farm payrolls shifted into materially negative territory, home prices were pushed to the depths as lending markets seized and borrower demand fell (Exhibit 10).

Exhibit 9: Seriously delinquent borrowers were another form of excess supply of home inventory

Exhibit 10: Material job loss removed home demand and drove prices to the depths

Affordability is offset by low inventory and the ‘lock-in’ effect today

Borrowers are stretching on payment. One notable trend is that borrowers are stretching on mortgage payment relative to their income. Exhibit 11 shows borrower debt-to-income (DTI) ratios at origination over time for agency mortgages. Home purchaser mortgage payments are now averaging ~39% of income according to agency loan level data. Approximately one third of borrowers have a DTI over 43%, the initial threshold set up under the first iterations of the qualified mortgage rules in the post-GFC period. This DTI should be alleviated, however, as our economists project ~3% real income growth next year.

Borrowers are not taking as much leverage when taking cash out of the home. And while borrowers are stretching on their mortgage payment and cashout refinances do occur, borrower leverage is relatively low. LTV at origination for agency mortgage cashouts are now below 60%. Credit standards appear to be holding firm in this metric (Exhibit 12).

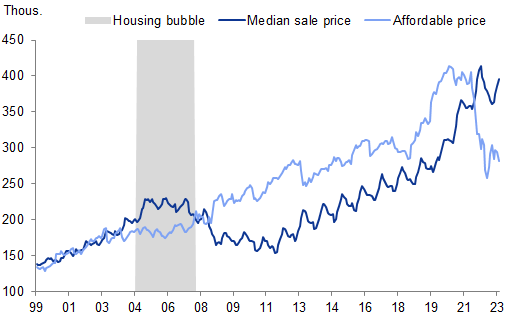

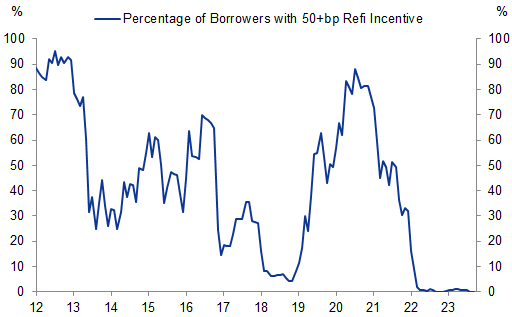

Affordability is challenged by high rates: Regardless of current credit standards, affordability remains challenging for the incremental home buyer. To put this in context in the simplest form we know of, Exhibit 13 stacks up the median sale price of an existing home vs. a theoretically ‘affordable’ home price. This affordable home is calculated by assuming a borrower spends 25% of gross household income on a mortgage payment, uses a 15% down payment, and borrows the remainder with a 30-year fixed rate mortgage. Looking over the time series, homes traded rich during 2004-07 because of the previously mentioned issues and subsequently fell as excess supply hit the market. Because interest rates fell and household income was relatively flat in the post-GFC period, there was a general pull upward on home prices that could partly be accounted for by tight credit conditions. But now that interest rates have reversed course and are now far higher, affordability for the incremental home buyer is more challenged than during the 2004-07 period. But, the limited supply of homes for sale remains very low and most of the mortgage market has mortgage rates far below current levels (Exhibit 14). Additionally, borrower delinquency rates remain very low, further highlighting the fact there is little distress in the system. As a result, we continue to expect home prices to rise at a slow pace over the medium term.

Exhibit 13: Home prices are materially disconnected to affordability due to high rates

Exhibit 14: Percentage of outstanding 30-year conventional mortgages with at least a 50bp incentive to refinance

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.