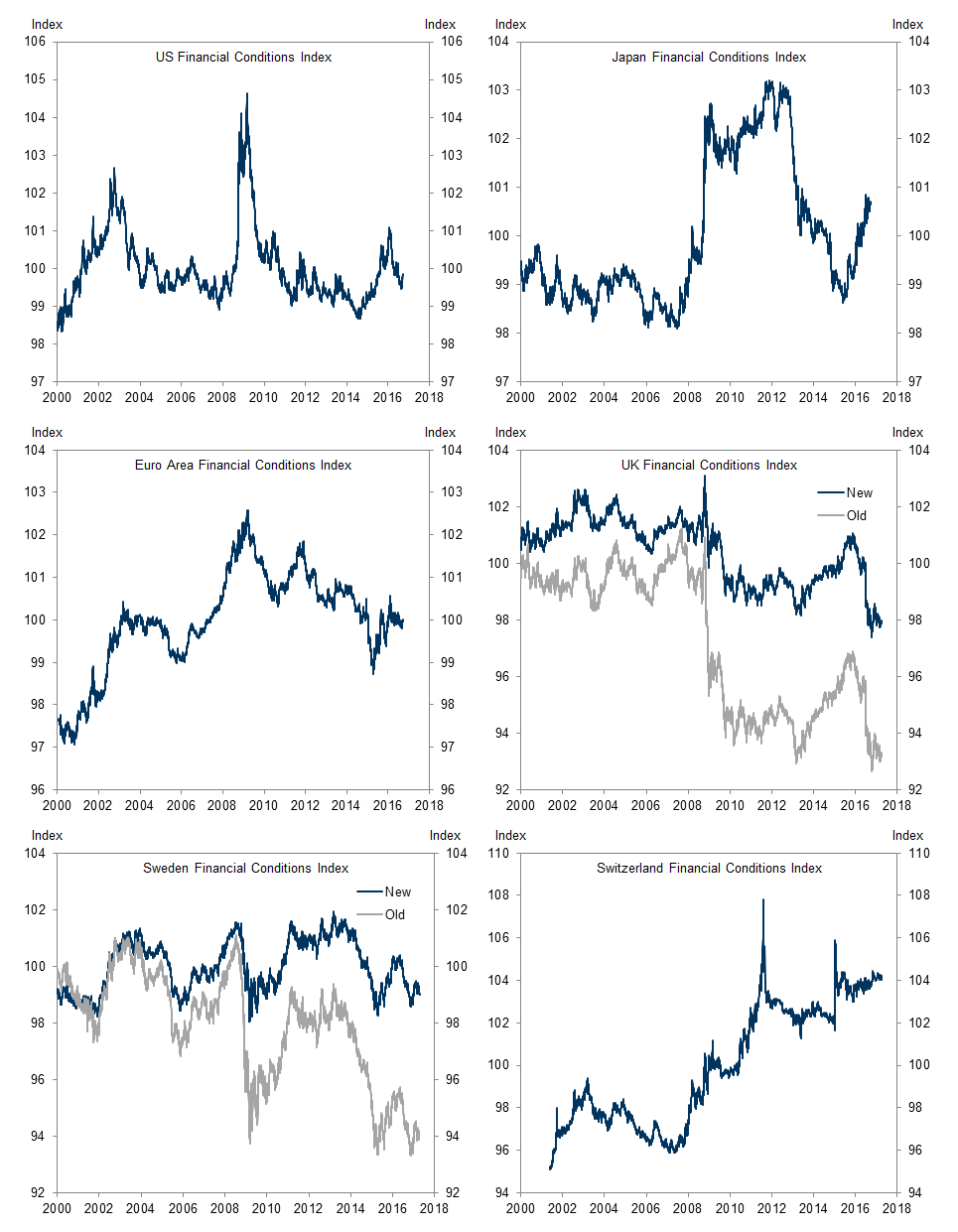

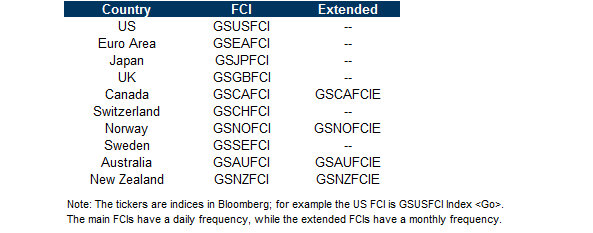

We have unified our financial conditions indices (FCIs) for the G10 economies using models that are methodologically consistent with one another while still allowing for structural differences between the economies. All ten FCIs are updated daily, and are published on Bloomberg.

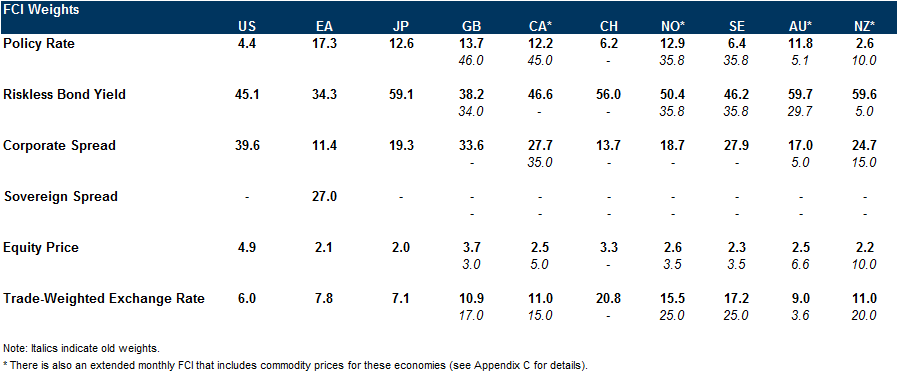

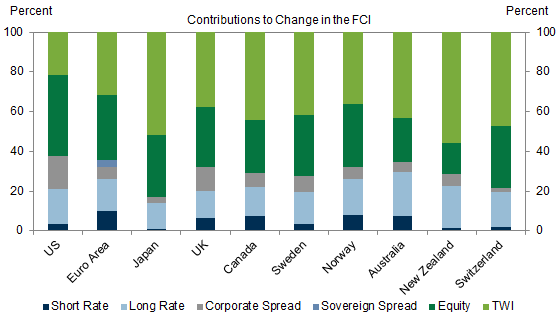

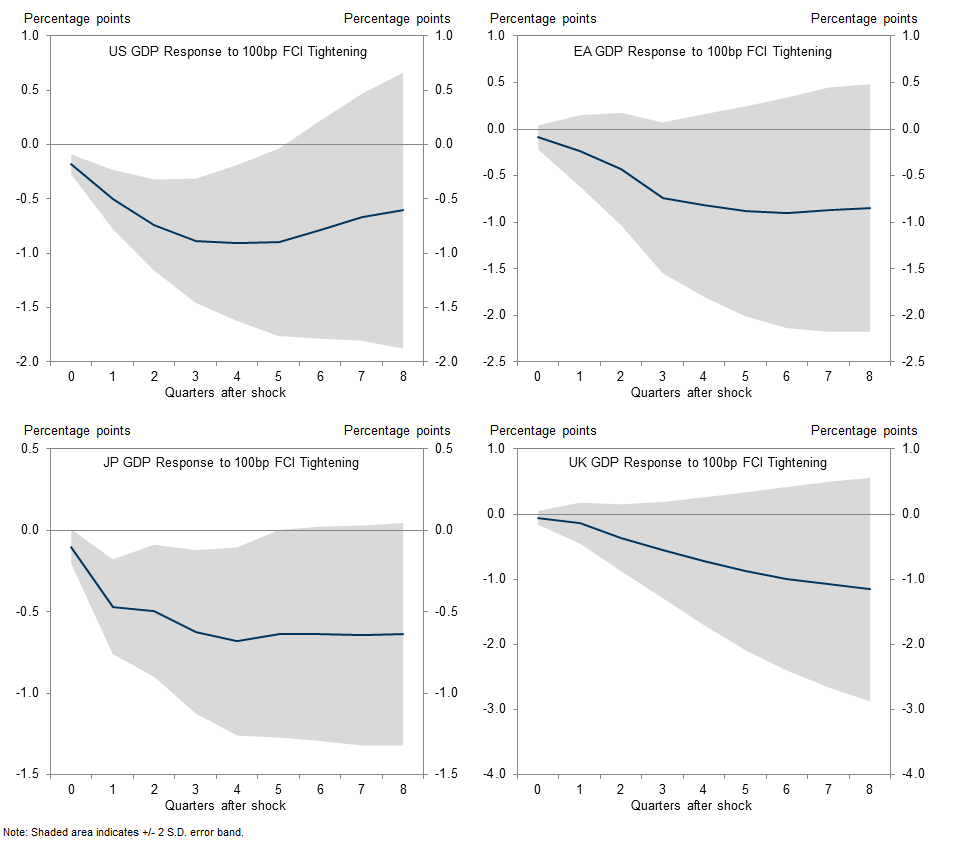

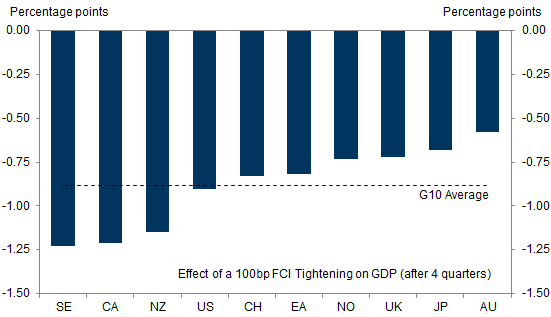

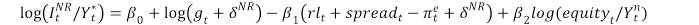

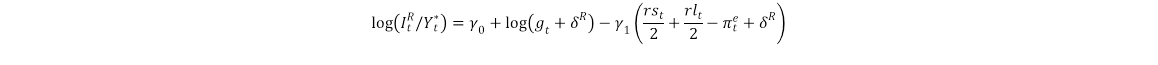

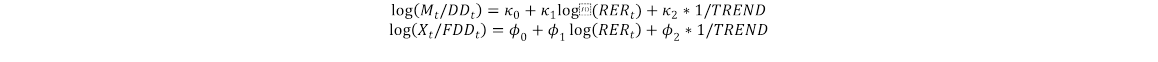

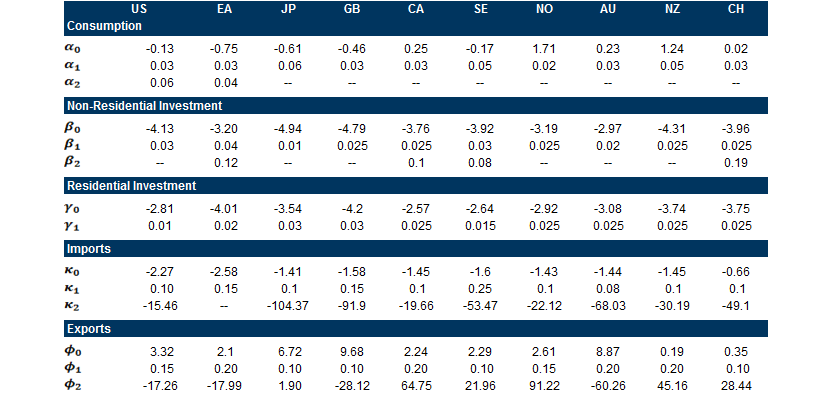

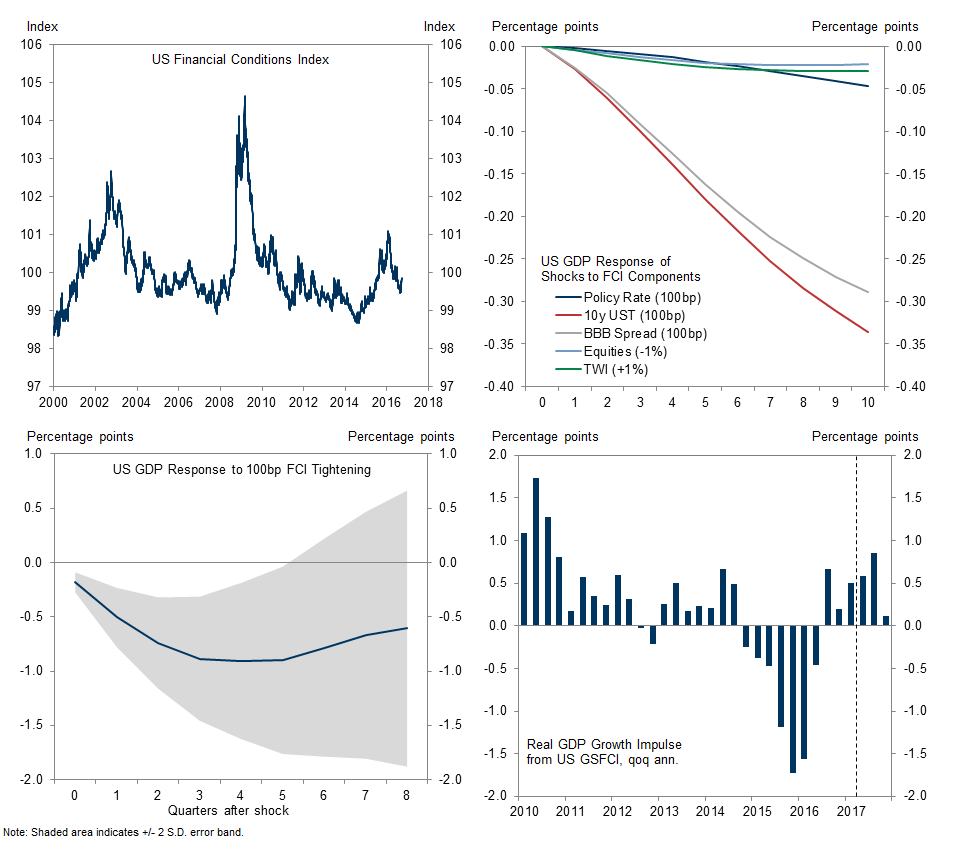

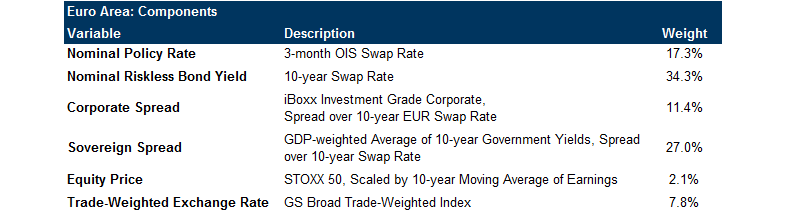

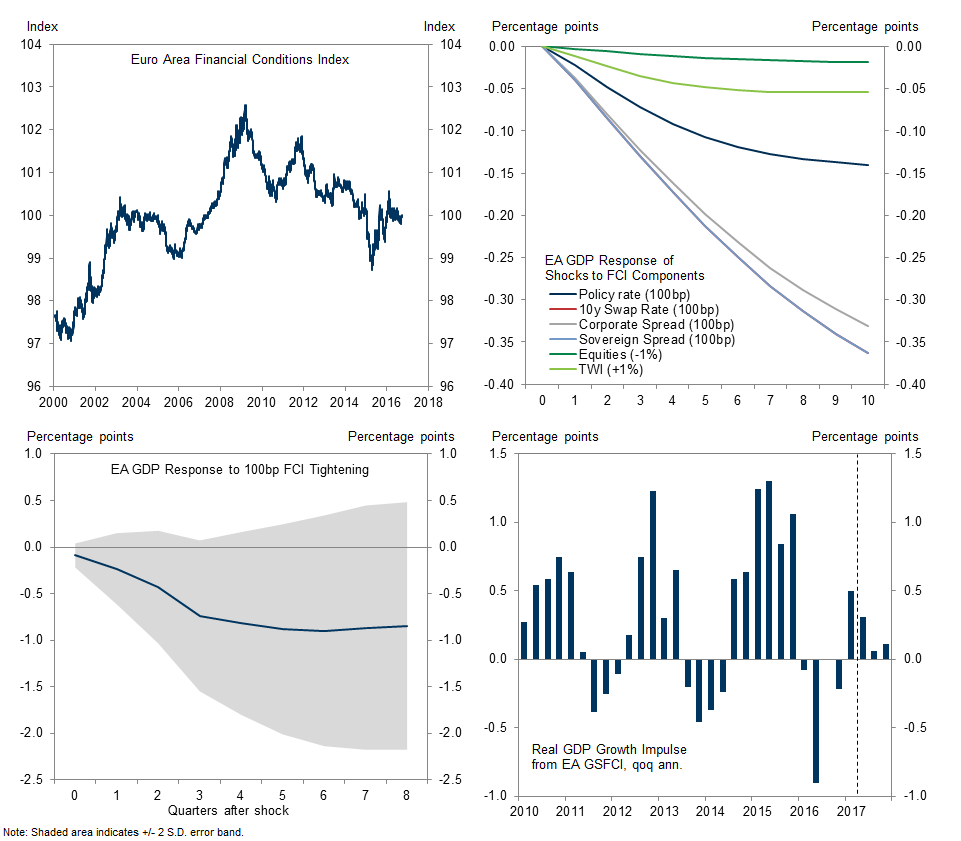

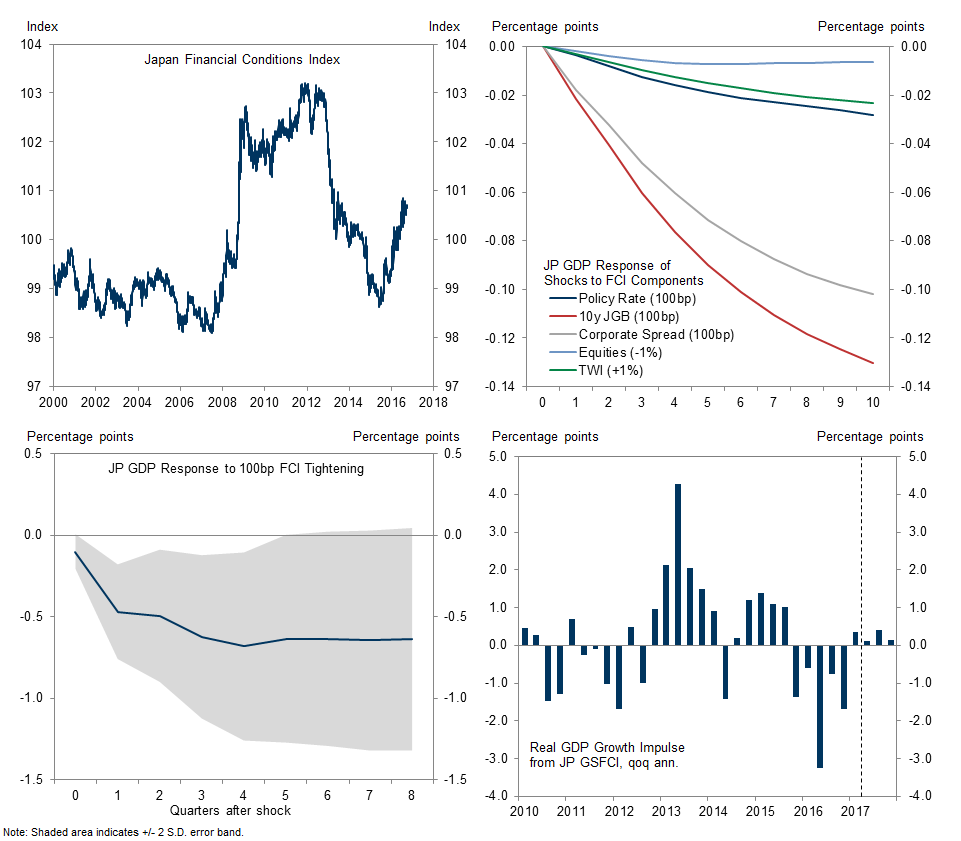

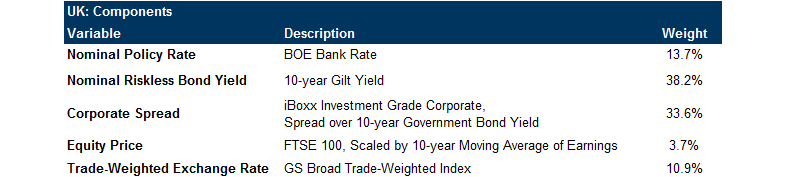

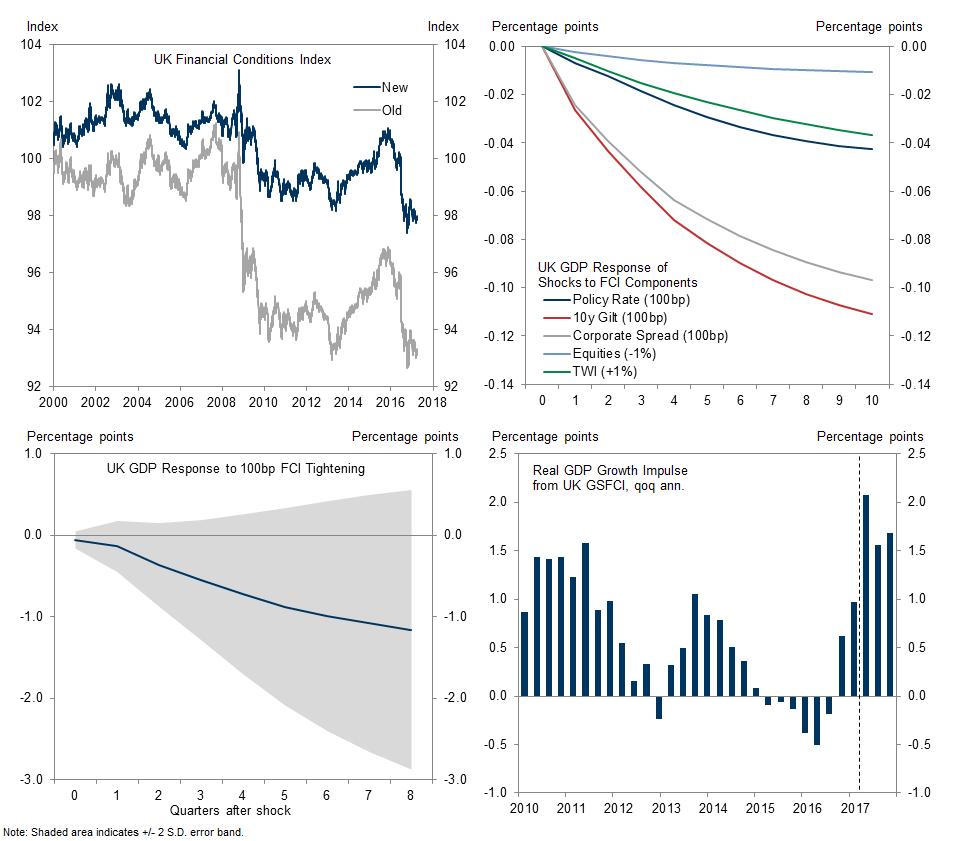

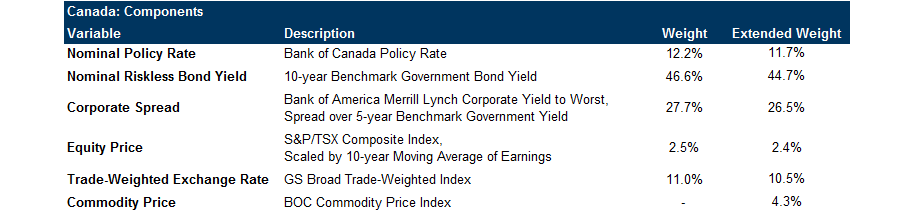

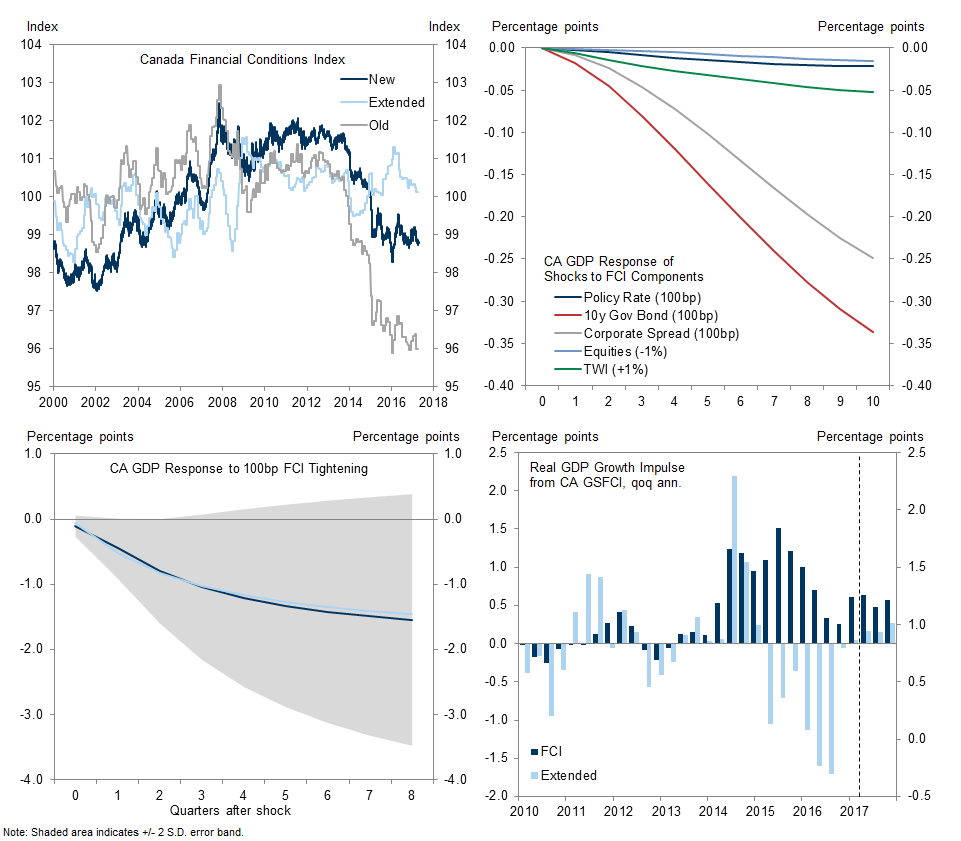

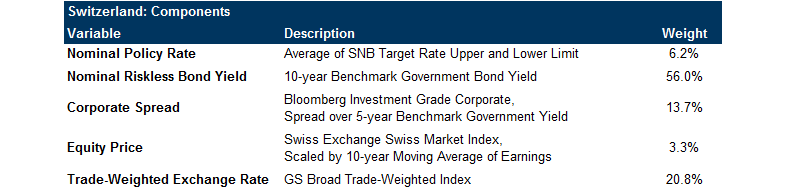

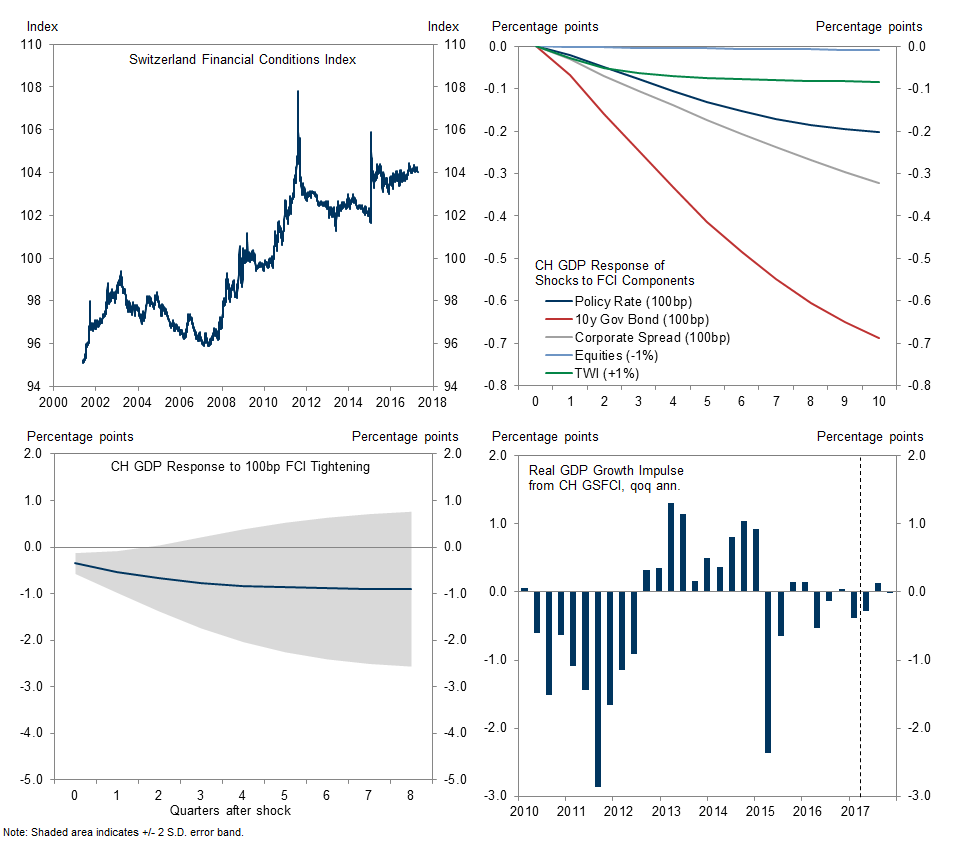

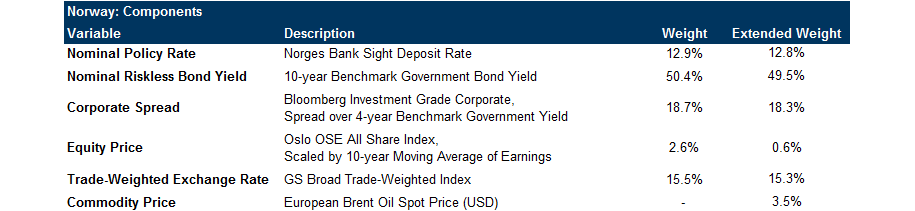

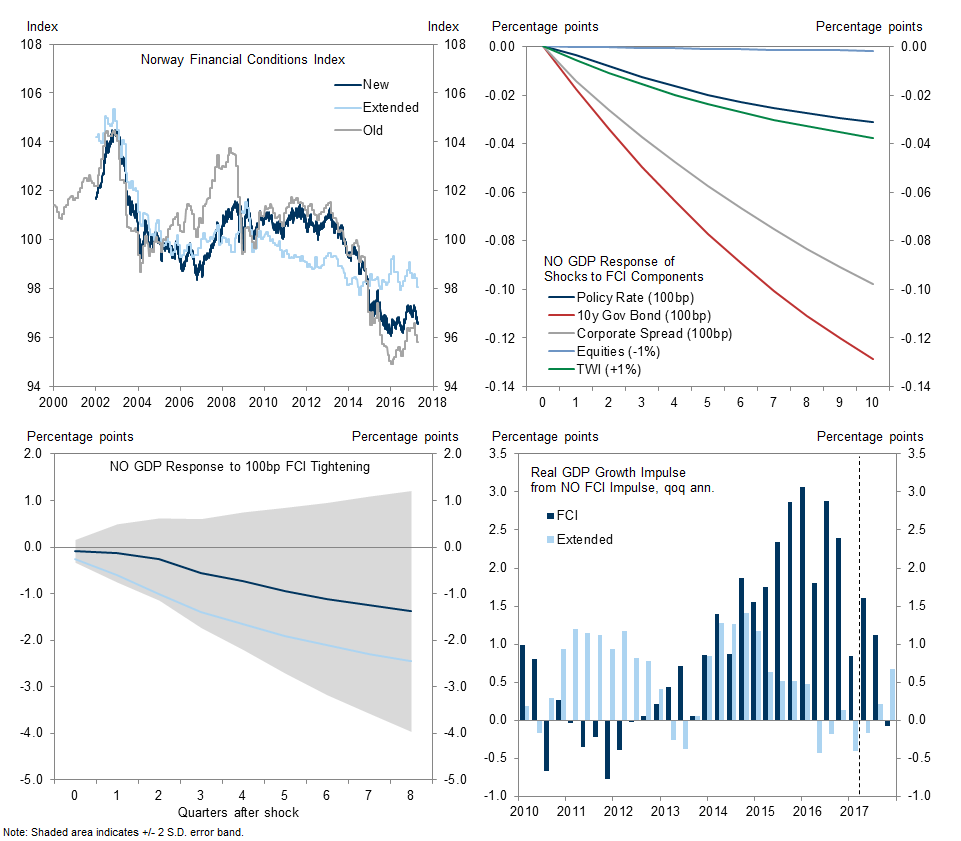

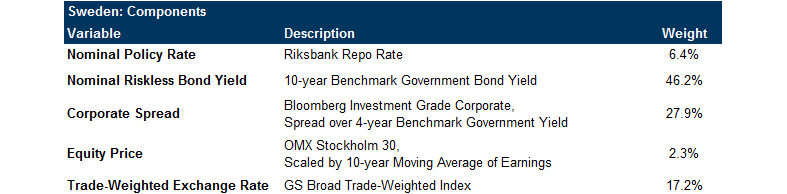

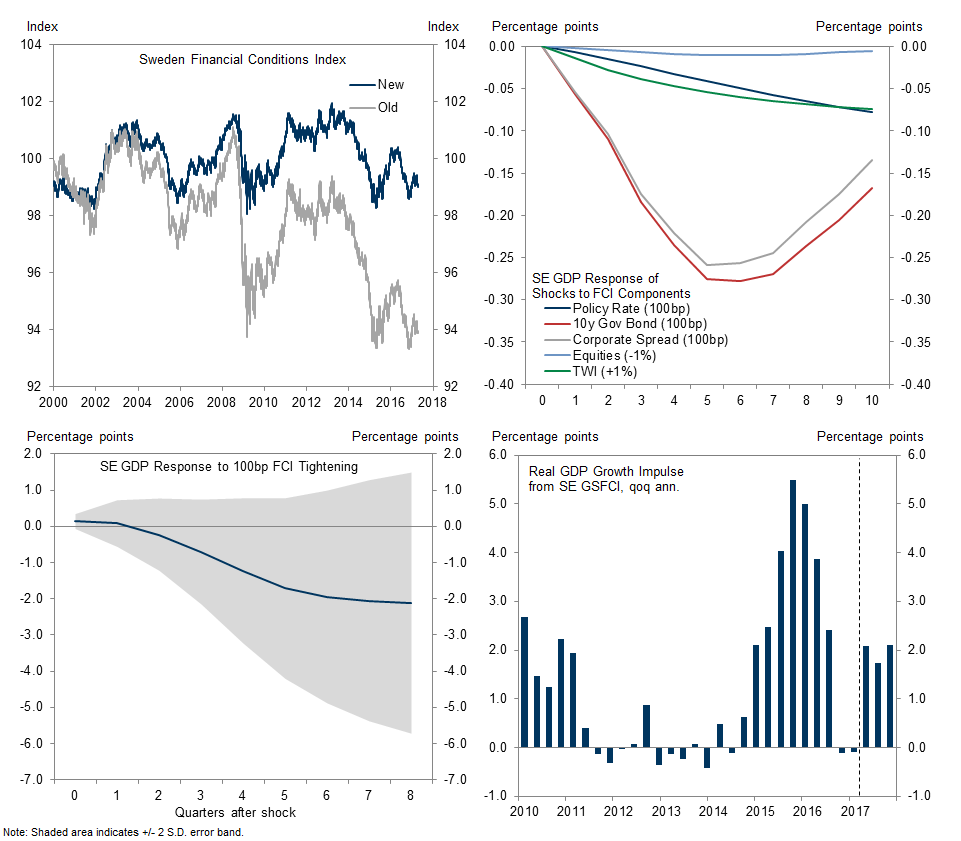

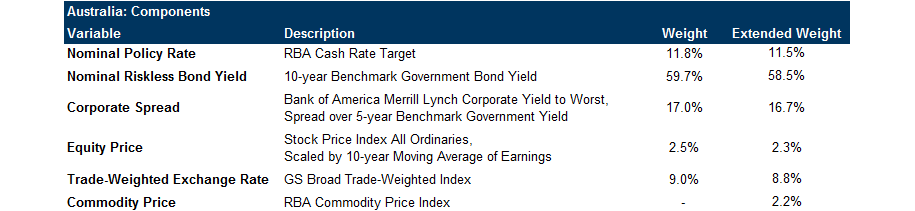

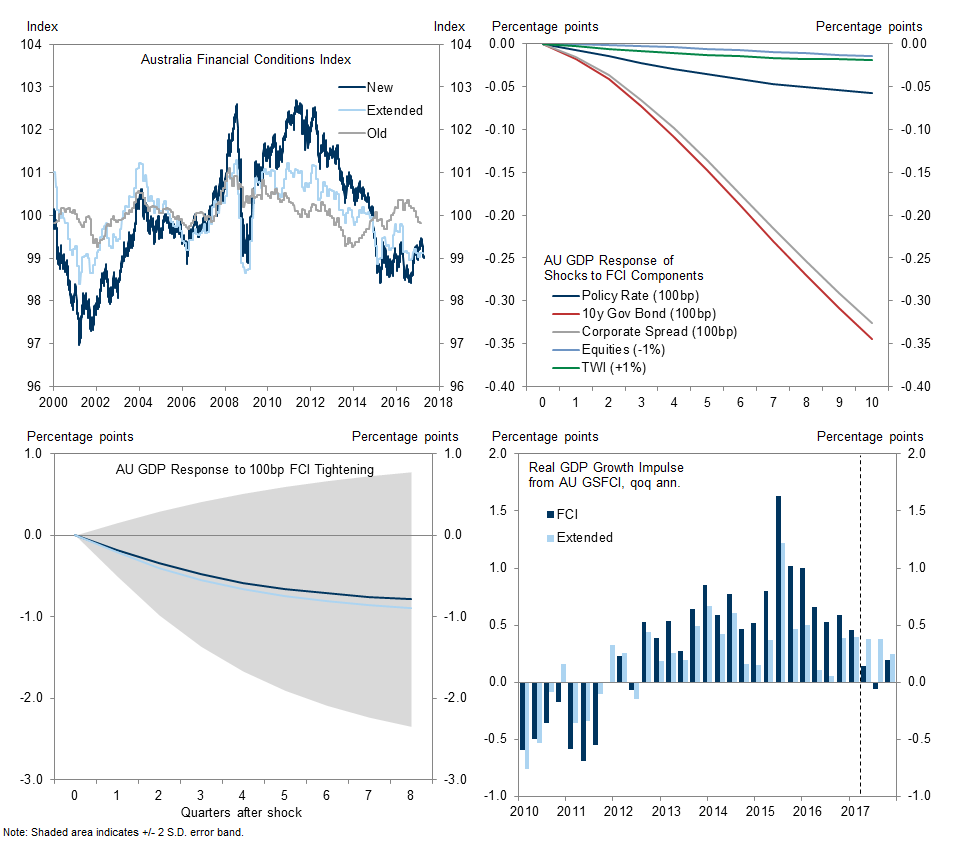

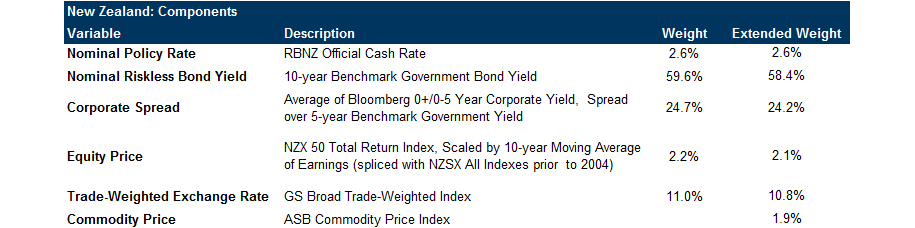

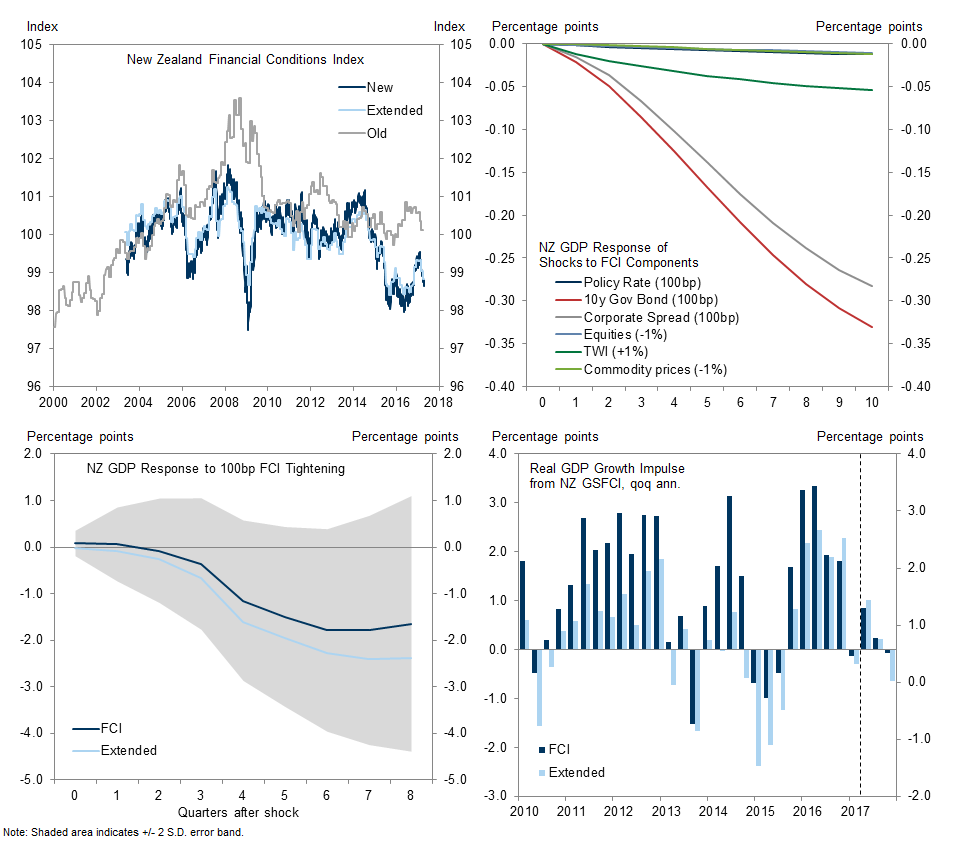

Each FCI is calculated as a weighted average of a policy rate, a long-term risk-free bond yield, a corporate credit spread, an equity price variable, and a trade-weighted exchange rate; in the Euro area we also include a sovereign credit spread. The weights mirror the effects of the financial variables on real GDP growth in our models over a one-year horizon.

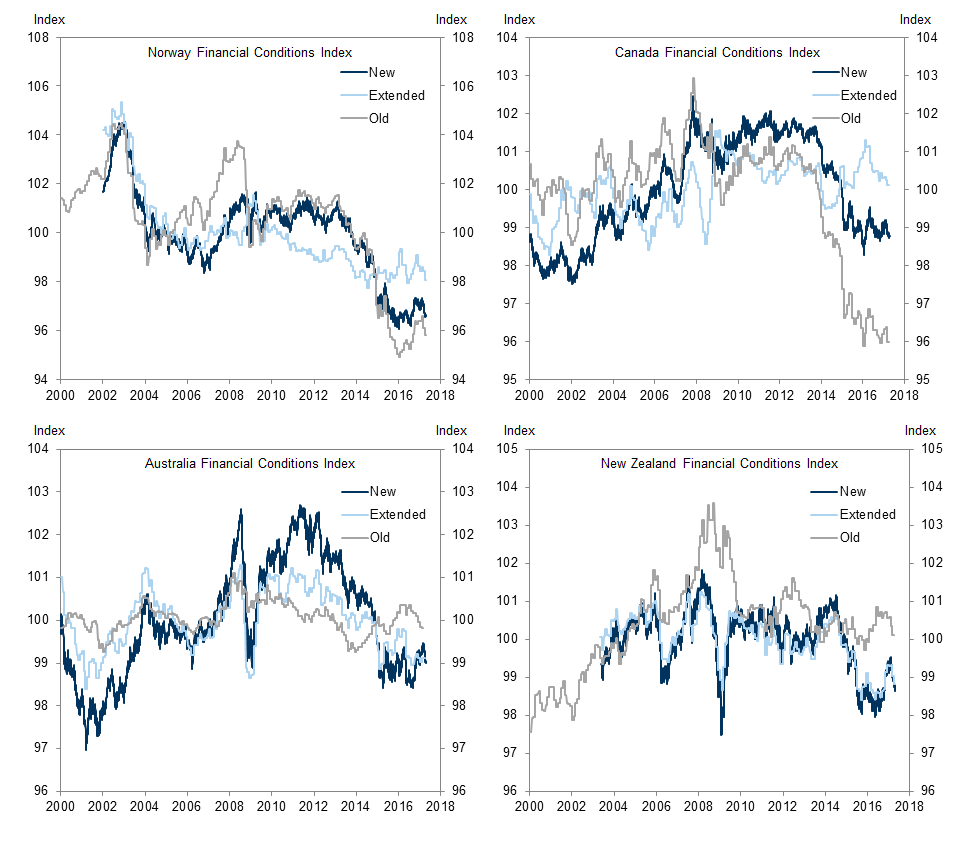

The FCIs for the US, Euro area and Japan are unchanged from their recent revamp but we made a number of significant changes to the other G10 FCIs. The updated FCIs now generally have a smaller weight on the policy rate, a bigger weight on long-term interest rates and corporate spreads, and a smaller weight on the exchange rate. The FCIs for Australia and New Zealand no longer contain commodity and house prices. But we now also provide extended monthly measures that contain commodity prices for Australia, New Zealand, Canada and Norway. We produce an FCI for Switzerland for the first time.

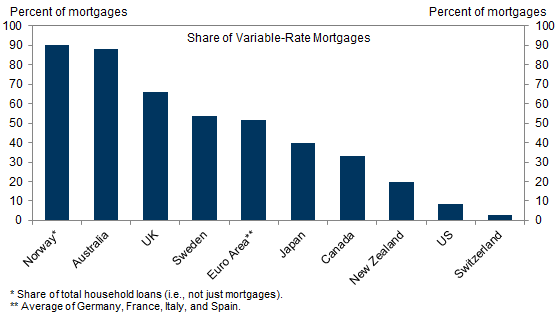

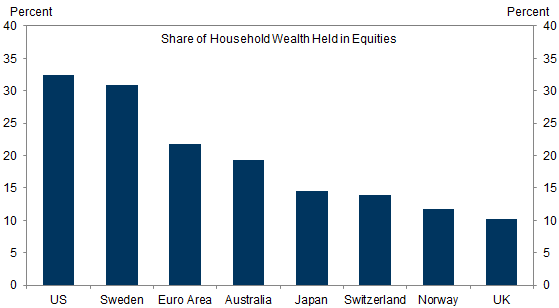

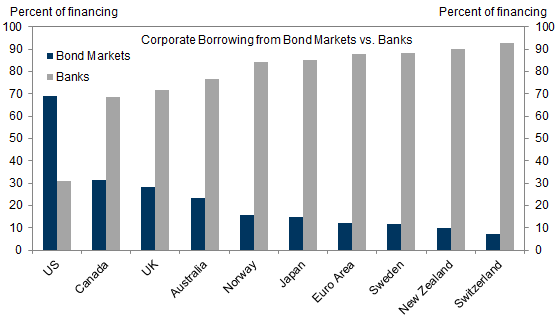

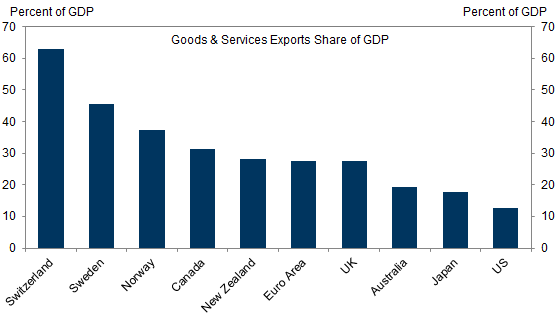

Differences in weights across economies reflect differences in financial systems and economic structures. Economies with larger shares of variable-rate borrowing also have larger weights on short-term rates. Similarly, equity prices and corporate credit spreads generally have the biggest weights in countries where these markets are more common sources of firms’ funding. The exchange rate is much more important in the small open economies than in the US.

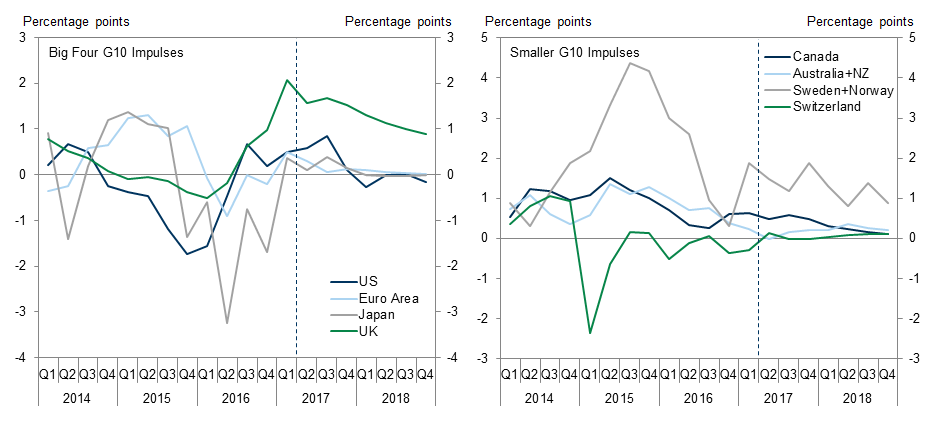

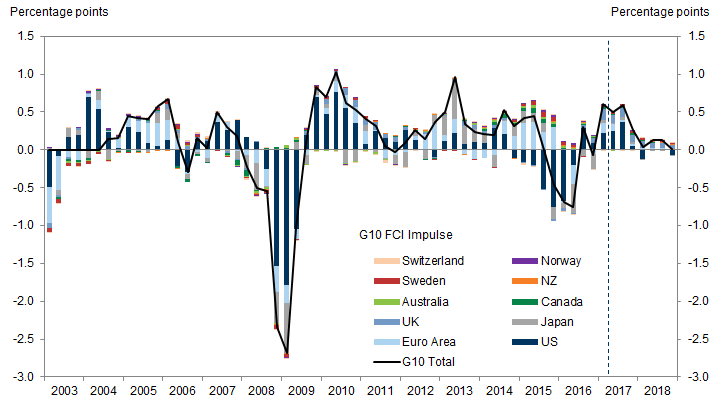

Our revised FCIs have meaningful predictive power for growth, especially in the large G10 economies. We find that financial conditions have played an important role in supporting the recent pickup of growth across the advanced economies. The FCI impulse is currently most positive in the US, UK, Sweden and Norway; it is more neutral in Australia, New Zealand, Japan and Switzerland. Our estimates point to a continued boost from financial conditions this year, consistent with our expectation of above-trend growth in most G10 economies.

Our New FCIs

Most importantly, we now apply the same modeling approach across all economies, to estimate the partial impact of changes in each financial variable while holding the other variables constant. This avoids giving too much weight to some variables—such as the short-term policy rate—whose effect on GDP actually comes via their impact on other series such as long-term yields and the exchange rate.

Corporate credit spreads are now included in all economies. Incorporating credit measures is particularly important for the US and UK, where credit risk has played an important role in the business cycle in recent years.

We now scale equity prices by a 10-year moving average of earnings. This eliminates the artificial trend toward a higher equity variable and easier financial conditions that results from using a nominal equity price index.

To make the daily FCIs comparable across countries, we exclude commodity and house prices from all series. This affects the old Australia and New Zealand FCIs, but sharpens the focus towards purely financial variables for day-to-day moves in financial conditions. But since commodity prices are particularly relevant to Canada, Norway, Australia, and New Zealand, we also produce an extended FCI at monthly frequency, which incorporates relevant commodity prices for each.[3]

Interest rates. We use the policy rate and the nominal 10-year risk-free rate.

Corporate spread. We use investment-grade domestic corporate spreads over equivalent-duration government bond yields.

Sovereign spread. For the Euro area we also include a measure of sovereign risk within the bloc, by including GDP-weighted 10-year government yields, and take the spread of this over the 10-year swap rate.

Equity prices. To get a stationary series for equity prices, we use the ratio of a broad-based equity index to a lagged 10-year average of earnings per share, which has become known as the “Shiller P/E” ratio.

Commodity prices. To reflect the importance of commodity prices in Canada, Norway, Australia, and New Zealand, we also include commodity prices in an extended monthly FCI. The daily FCI series for all G10 countries focus solely on financial series, and exclude commodity prices.

Trade-weighted exchange rate. We use the broad GS nominal trade-weighted exchange rate index. This is the trade-weighted average of 36 bilateral exchange rates, with weights that reflect each economy’s exports, imports and third-market competition of domestic firms vis-à-vis foreign firms.

Different Weights for Different Economies

Weights vs. Importance

The Link with Growth

Nicholas Fawcett

Sven Jari Stehn

Jan Hatzius

Appendix B: Building a Unified Framework for Financial Conditions

Simulating the effect of FCI component shocks

From model weights to FCI weights

Constructing FCI Impulse

Appendix C: Country details

- 1 ^ See William C. Dudley and Jan Hatzius, “The Goldman Sachs Financial Conditions Index: The Right Tool for a New Monetary Policy Regime,” Global Economics Paper No. 44, June 8, 2000.

- 2 ^ See Jan Hatzius, Sven Jari Stehn and Nicholas Fawcett, “Financial Conditions: A Unified Approach,” Global Economics Analyst, September 20, 2016.

- 3 ^ Details of the commodity series are included in Appendix C. Some of these series are composite measures weighted by commodity production, rather than consumption; but although the path of commodity prices obtained by the former rather than the latter may differ at times, the gap is unlikely to be systematically big.

- 4 ^ Admittedly, the direct effect of policy rate cuts may be smaller if rates are already negative and banks are unable to pass through additional cuts to their depositors. Even if that is the case, however, the distortions to the FCI would be small. For example, the weight of the policy rate in Japan is 12%, so that a 10bp rate cut eases our FCI directly by only 1.2bp. And if it is true that negative policy rates hurt the economy, as some believe, this would presumably show up in tighter conditions via the FX or equity markets, which we do pick up. A good example is the January 2016 BoJ cut, which was followed by a meaningful tightening in the Japan FCI.

- 5 ^ The VARs use quarterly data and include only the FCI and real GDP in the US, Euro area and Japan. In the smaller G10 economies we also include a measure of foreign demand in the VAR (except in Australia). In the commodity-producing economies (Australia, New Zealand, Canada and Norway) we also include measures of commodity prices. Since it is not clear theoretically how to order the variables when computing the impulse responses—as causation within a given quarter likely runs in both directions—Exhibit 8 shows an average of the impulse responses for two different orderings (one orders GDP before the FCI; the other orders the FCI before GDP growth). We order the FCIs last in Australia and Switzerland.

- 6 ^ This summary is specific to the setup of the model. Of course, growth will be affected by other factors--such as fiscal policy--which we do not capture explicitly in the model.

- 7 ^ The projected UK FCI impulse comes with the caveat that the model does not take into account the impact of greater uncertainty in the UK surrounding the EU referendum, or our UK economists' view that higher inflation will weigh on real disposable incomes, both of which could drag on growth.

- 8 ^ See, for example, “Japan’s Easing Options,” Global Economics Analyst, July 27, 2016; and “The Bank of England’s Trade-off,” Global Economics Analyst, August 2, 2016.

- 9 ^ We also include an aging variable in Japan to capture demographic changes.

- 10 ^ See “How much does the exchange rate matter for growth?”, Global Economics Analyst, 10 September 2016.

- 11 ^ We do not include foreign demand in the Australia VAR.

- 12 ^ We order the FCI last in Australia and Switzerland.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.