A big macro week in markets. Macro market volatility jumped last week, with the 10-year Treasury yield jumping 17 bps to close the week at 3.23% (its highest level since 2011), and Brent oil prices rising $3.57 at midweek before closing the week $1.44 higher at $84.26 (its highest level since 2014). Equities fell only modestly, but it was a terrible week for total returns in credit, with HYG dropping 1.3% (the most since February) and LQD falling 1.75% (the largest weekly drop since the fall of 2016).

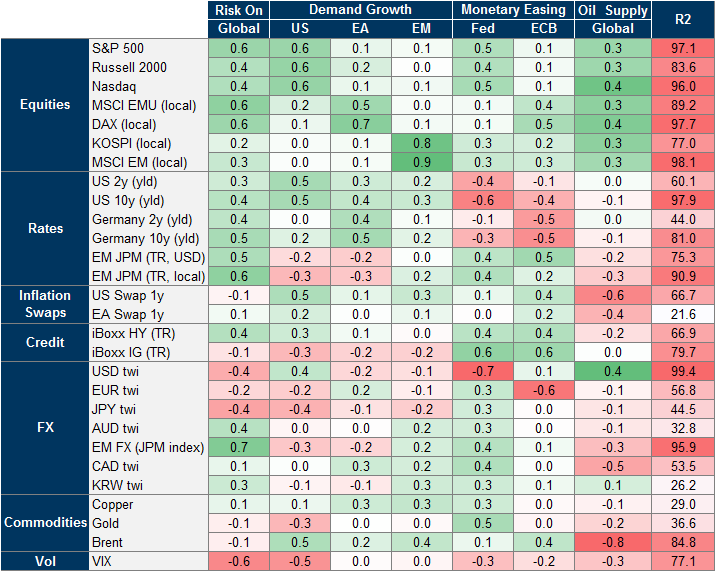

Macro factor models. Such large moves across markets naturally raise the question: What’s moving markets? We discuss estimates of a macro factor model designed to answer such questions. This model identifies the macro themes that are most visible across a wide range of assets in equities, rates, credit, FX and commodities. When our macro factors are used in regressions to explain the cross section of asset returns, the signs and magnitudes of the factor sensitivities (“betas”) are highly intuitive and consistent with economic priors.

Macro themes leave fingerprints on markets. The trick to extracting economic factors from market data is to recognize that common macro narratives (like “US monetary fears” or “oil supply concerns”) leave well-defined fingerprints in the cross-section of macro asset prices. For example, a hawkish-sounding Fed will generally send equities lower, bond yields higher, credit spreads wider, inflation swaps lower, and the USD TWI higher. In practice, of course, markets are usually digesting several themes in parallel. Distilling these simultaneous narratives from market prices is the complex task for which our model is designed.

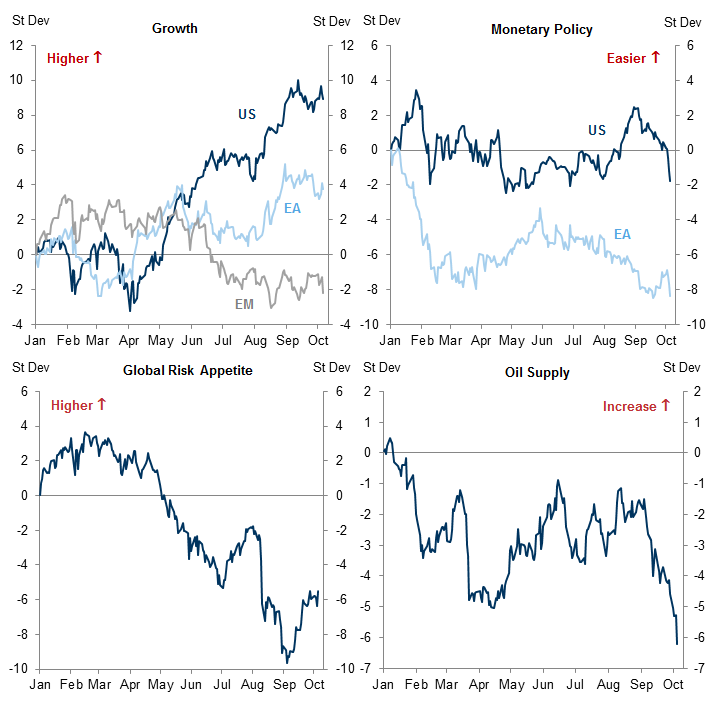

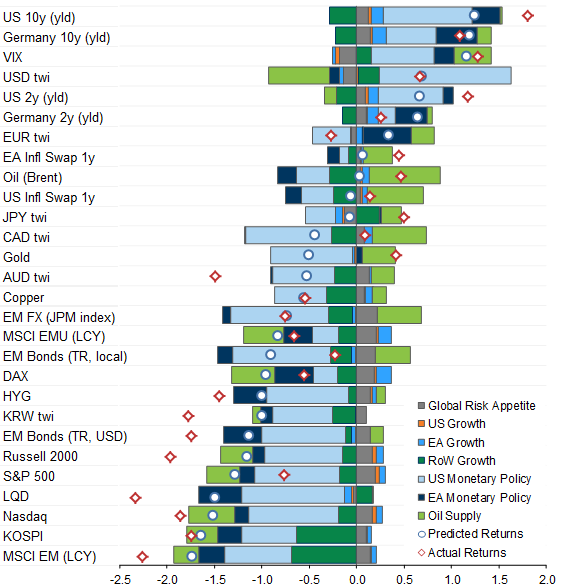

How our macro factors viewed last week. Monetary policy fears were clearly the biggest macro theme of the week. This theme was visible in the jump in US and German yields, but was further consistent with the weakness of risk assets, the rallies in USD and EUR TWIs, and the sharp declines in credit ETFs (LQD, HYG, EMB, and LEMB). The next most important macro themes of the week were “oil supply” and “EM growth”. Oil traded higher on the week due to what our model identified as supply concerns, but would have traded higher still had it not been for offsetting concerns about EM growth and DM monetary policy.

Distilling Macro Themes from Market Prices

Macro factors from market prices

How our macro factors interpreted last week

Charlie Himmelberg

Matthieu Droumaguet

James Weldon

- 1 ^ See also our previous report, “An Economic Factor View of EM Equities”, Global Markets Daily, Sept. 27, 2018.

- 2 ^ “Wavefronts 2.0: The impact of macroeconomic shocks on markets”, Global Economics Paper No. 228, Jan. 31, 2016.

- 3 ^ We use Bayesian econometrics to impose our economic priors on the factor loadings. Our Bayesian approach provides a natural way to impose such priors. It also allows us to assume time-varying volatility for both the factors and idiosyncratic error terms. Allowing for the latter allows for a more realistic description of market returns – the volatilities of both macro themes and asset-specific returns obviously vary over time – appears to improve the fit of the model.

- 4 ^ The ever-growing popularity of characteristic-based “risk factors” like “value” and “momentum”, for example, reflects that these factors are known to offer risk premia with desirable risk-reward properties (for example, see “Value and Momentum Everywhere”, by Clifford Asness, Tobias J. Moskowitz, and Lasse Heje Pedersen, Jan. 30, 2018, Journal of Finance, 68(3)). There has also been recent revival of an older academic literature on macro pricing factors which dates back to Nai-Fu Chen, Richard Roll, and Stephen A. Ross (1986), “Economic Forces and the Stock Market”, Journal of Business, 59, 383-403. But these factors are designed to identify risk premia, not macro themes.

- 5 ^ This is not to rule out the possibility that risk factors and macro factors may be related in some interesting ways. Indeed, our inclusion of a “Global Risk Factor” in our list of macro factors reflects our belief that shocks to risk appetite are drivers of asset returns which are distinct from macro shocks.

- 6 ^ See “Economic Tracking Portfolios”, by Owen Lamont, Journal of Econometrics, 105(1), pp. 161-184.

- 7 ^ In an earlier effort to extract “macro views from market data”, we pursued a strategy that was essentially identical in spirit to Lamont (2001), namely, we designed market factors that explicitly aimed to track economic outcomes like GDP growth and inflation (“Tracking Macro Views in Market Data”, Global Markets Analyst, April 3, 2018). Over the course of that research, however, we came to recognize that the construction of such portfolios is complicated by the structural instabilities described in the text. The design of the macro factors described here effectively sidesteps this issue.

- 8 ^ This is similar to the method of “sign restrictions”, which is increasingly popular among academic macroeconomists. See for example, “Sign Restrictions in Structural Vector Autoregressions: A Critical Review”, by Renée Fry and Adrian Pagan, Journal of Economic Literature, Dec. 2001, 49(4), pp. 938-60. For a related applications to financial market data, see also “The Economic Impact of the New Oil Order on Emerging Asia”, Asia Economics Analyst, Jan. 12, 2015; and “Oil Supply versus Demand: A Market Perspective”, US Daily, Feb. 10, 2015.

- 9 ^ For a more in-depth analysis of risk sensitivities across FX, see “Explaining risk correlations across DM and EM exchange rates”, EM Macro Themes, Aug. 11, 2018.

- 10 ^ This generates more reasonable results than the approach used in our previous Daily, which imposed zero restrictions on the cross-region impact of regional shocks.

- 11 ^ See “Financial intermediaries and the cross-section of asset returns”, by Tobias Adrian, Erkko Etula, and Tyler Muir, 2014, Journal of Finance LXIX, 2557-2596.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.