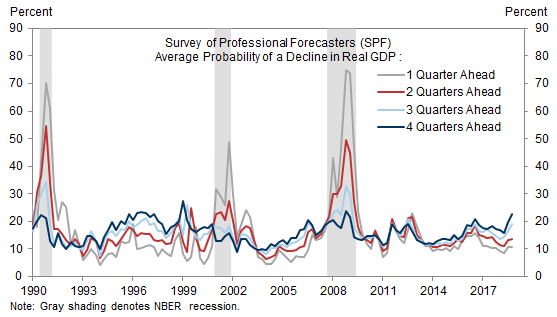

Markets and forecasters are increasingly worried that a recession could be coming in 2019 or 2020. The consensus estimate of the probability that real GDP will be falling four quarters ahead has now reached its highest level since 2008 in the Survey of Professional Forecasters. To assess the implications, we analyze the historical performance of these consensus numbers in predicting recessions.

While consensus rarely looks for contractions in output in its baseline projection, we show that consensus probabilities of a contraction do have significant value in predicting actual recessions. This historical predictive content, however, appears to diminish rapidly with the horizon.

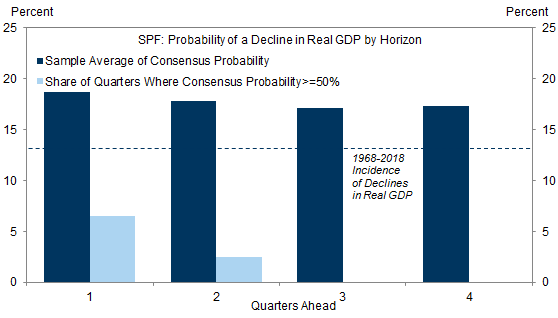

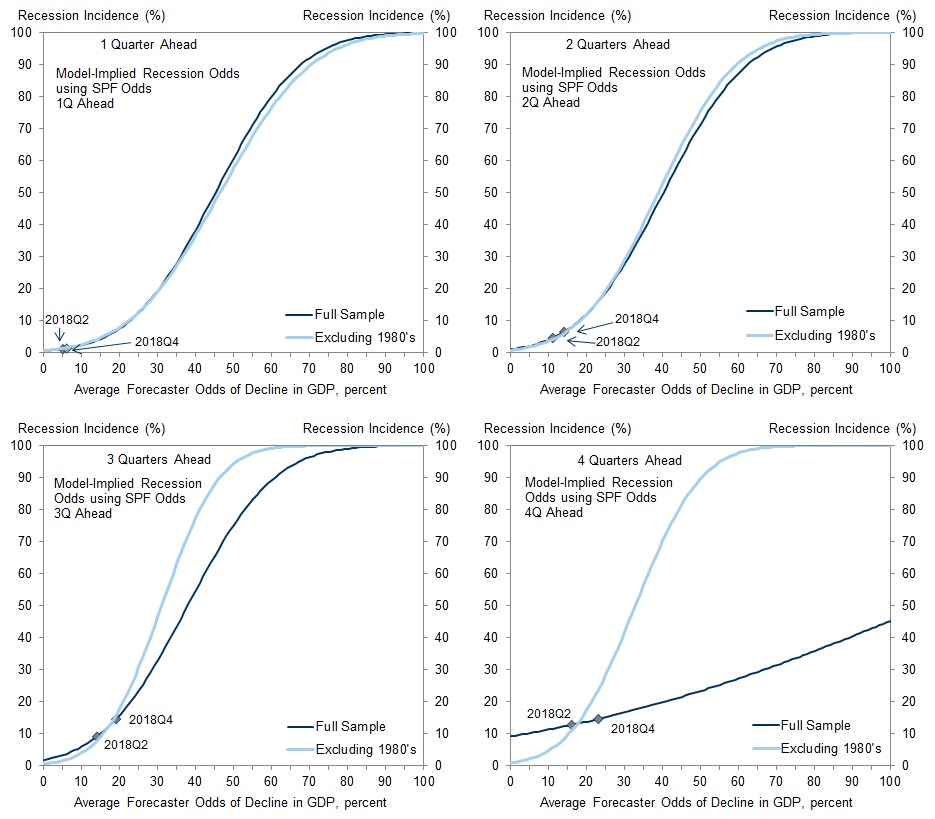

The latest consensus odds of a fall in GDP remain at levels well below those historically associated with a subsequent recession. At the 2-quarter horizon, the current contraction odds of 14% are substantially below the 40% threshold historically associated with a recession baseline. At the 4-quarter horizon, the current consensus odds of 23% imply <20% recession odds, and would have to exceed their 33% all-time high to signal a recession baseline.

We see two takeaways. First, the fact that the higher consensus odds of a fall in GDP in 2019 are concentrated at the 3- and especially 4-quarter horizon, but remain low at shorter horizons, supports our view that a 2019 recession is unlikely. Second, the finding that the predictive content declines with the horizon diminishes the signal from the popular view that recession is coming in 2020. The “wisdom of crowds” can be useful for predicting recessions, but primarily at relatively short horizons.

Consensus Estimates of Recession Risk: The Wisdom of Crowds?

Daan Struyven

Ronnie Walker

- 1 ^ The only period outside of an NBER recession where SPF consensus had greater than 50% odds of a fall in GDP two quarters ahead started in 1979Q3 and extended through the recession that started in 1980Q2.

- 2 ^ The pseudo R-squared values—a standard measure of goodness of fit for probit models—in the restricted sample equal 40%, 25%, 15% and 7% for the 1-,2-,3-, and 4- quarter horizons, respectively.

- 3 ^ The results are qualitatively similar when using a simple linear regression model.

- 4 ^ The 40% threshold historically associated with a recession baseline at the 2-quarter horizon conditions on currently being in an expansion. This threshold and the thresholds at the other horizons are similar when including recession starting points.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.