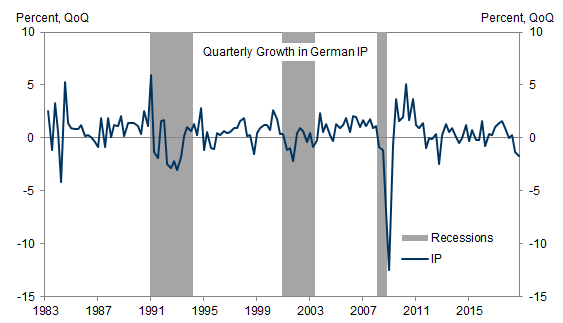

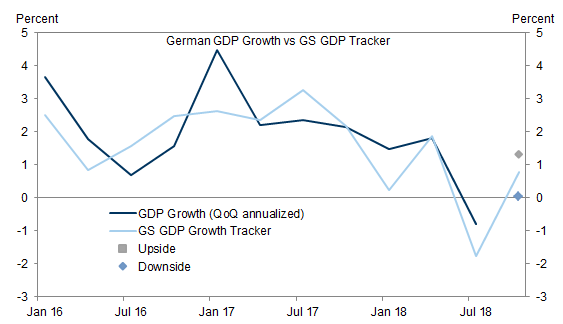

Industrial production has declined sharply in Germany and, following negative real GDP growth in Q3, has raised fears about a technical recession. We have marked down Q4 growth notably (and now look for only 0.8% annualized) but see three reasons not to worry too much about a German recession.

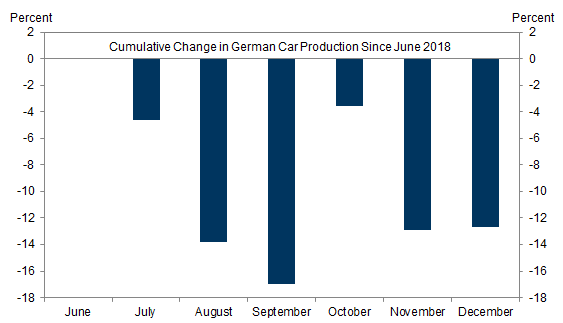

First, industrial production is a noisy indicator and a number of distortions have likely weighed on industrial activity in recent months. These include continued problems in the autos industry (related to a change in environmental standards) and potential seasonal adjustment issues (stemming from a bridge holiday in November).

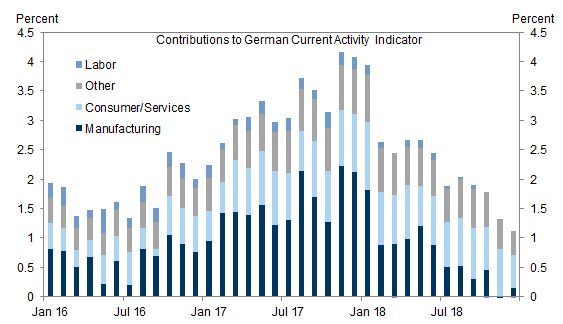

Second, the broader dataflow remains consistent with moderate growth in Germany. Our current activity indicator (which includes consumer and labour market data in addition to industrial indicators) has slowed markedly over the last year but is still consistent with moderate growth.

Third, a number of domestic macro drivers should support growth in 2019. Fiscal policy is set to boost growth significantly this year, strong wage gains should continue to support household income and bank lending conditions remain favourable. We therefore still expect a return to above-trend growth i n 2019.

Is Germany in Recession?

- 1 ^ See Alain Durré, Nicholas Fawcett and Michael Cahill, “A German Rebound Roadmap”, European Views, December 6, 2018.

- 2 ^ In the baseline case we assume that IP grows by 2% month-on-month (mom) in December, manufacturing output by 0.5% and retail sales by 0.5%. In the stronger scenario we assume growth rates of 3.5%, 1%, and 1% respectively.

- 3 ^ For further background see Alain Durré, Nicholas Fawcett and Michael Cahill, “A German Rebound Roadmap”, European Views, December 6, 2018.

- 4 ^ In regressions of month on month IP growth on changes in working days (not shown), an indicator of whether All Saints’ day was on a Thursday, and month dummies, we find that IP growth is one percentage point weaker in affected years. But this effect is not statistically significant.

- 5 ^ See Alain Durré, “Germany’s Outlook 2019-2022: Rotating but resilient growth”, European Views, December 28, 2018.

- 6 ^ See Lasse Holboell Nielsen and Roxane van Cleef, “A Larger Fiscal Boost”, European Daily, January 9, 2019.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.