- Intro

- Executive summary

- 1. Introduction: Making cities resilient to climate change

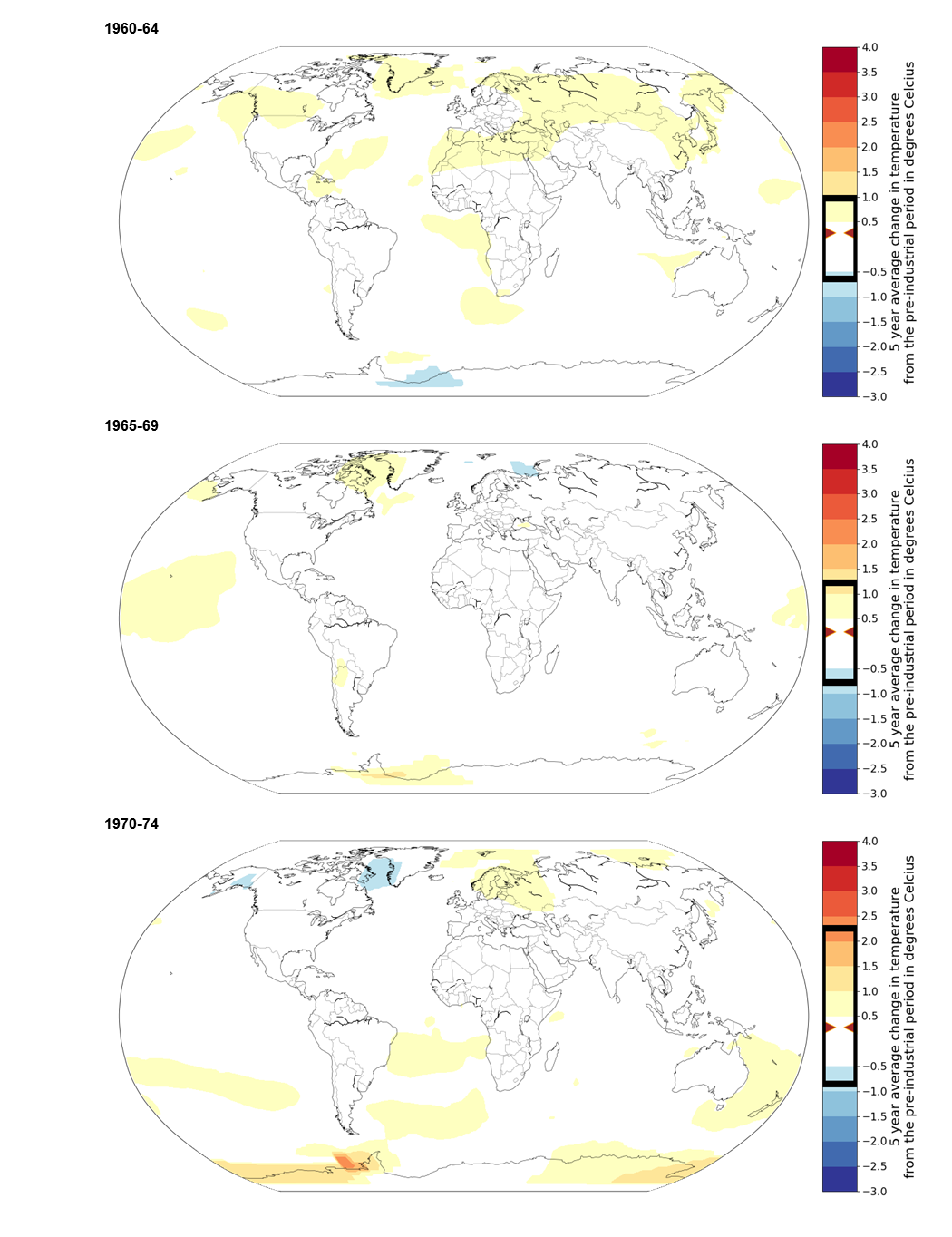

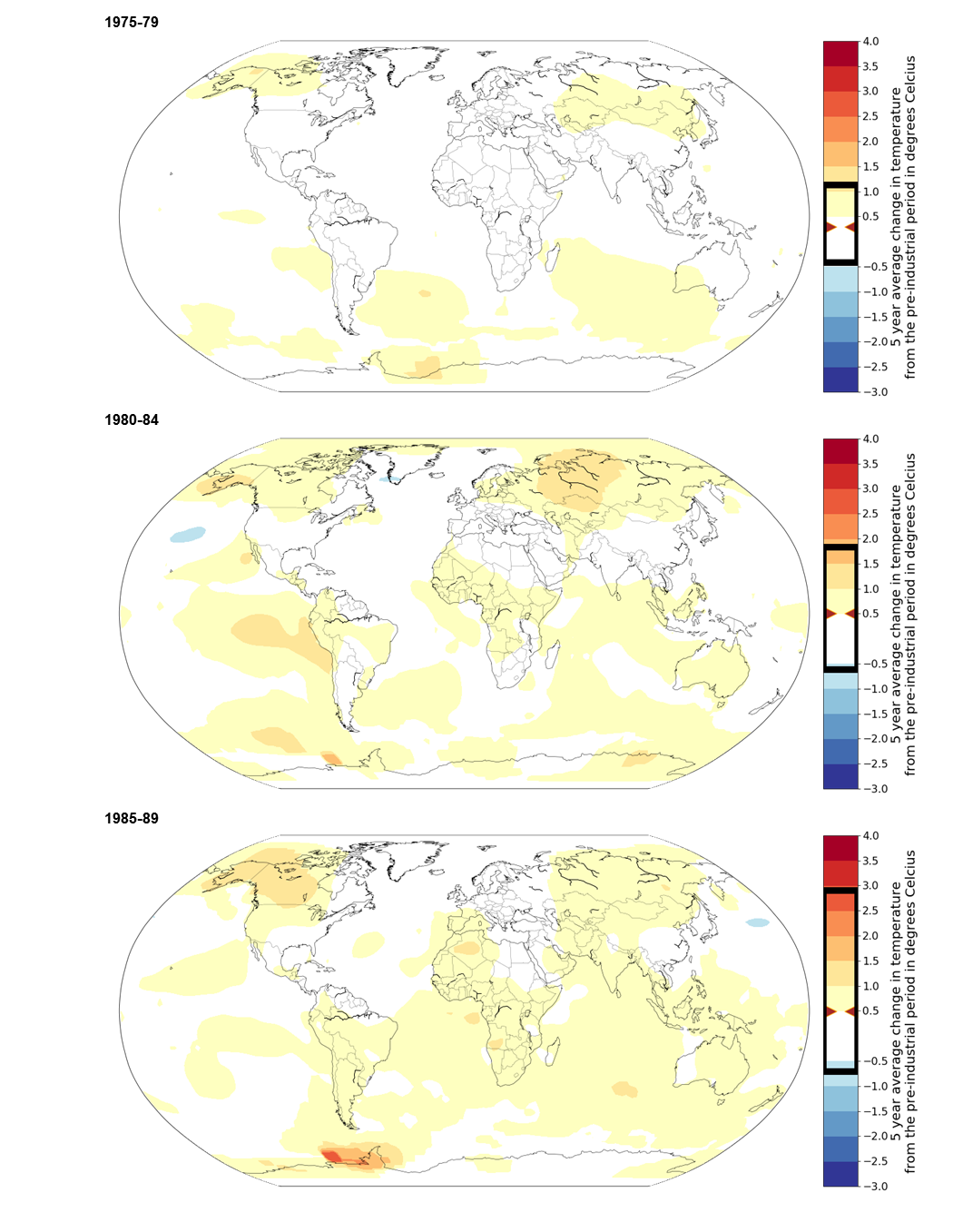

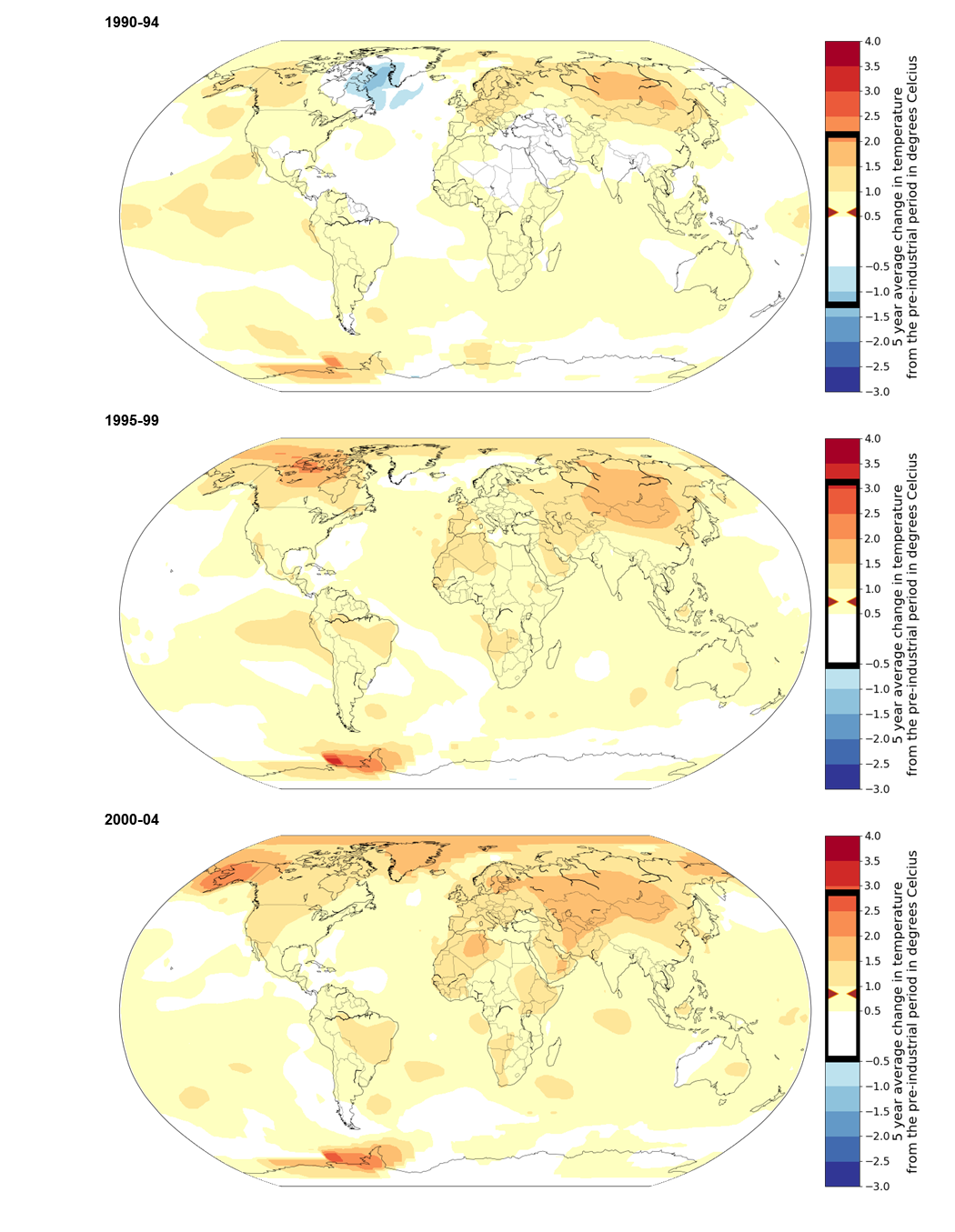

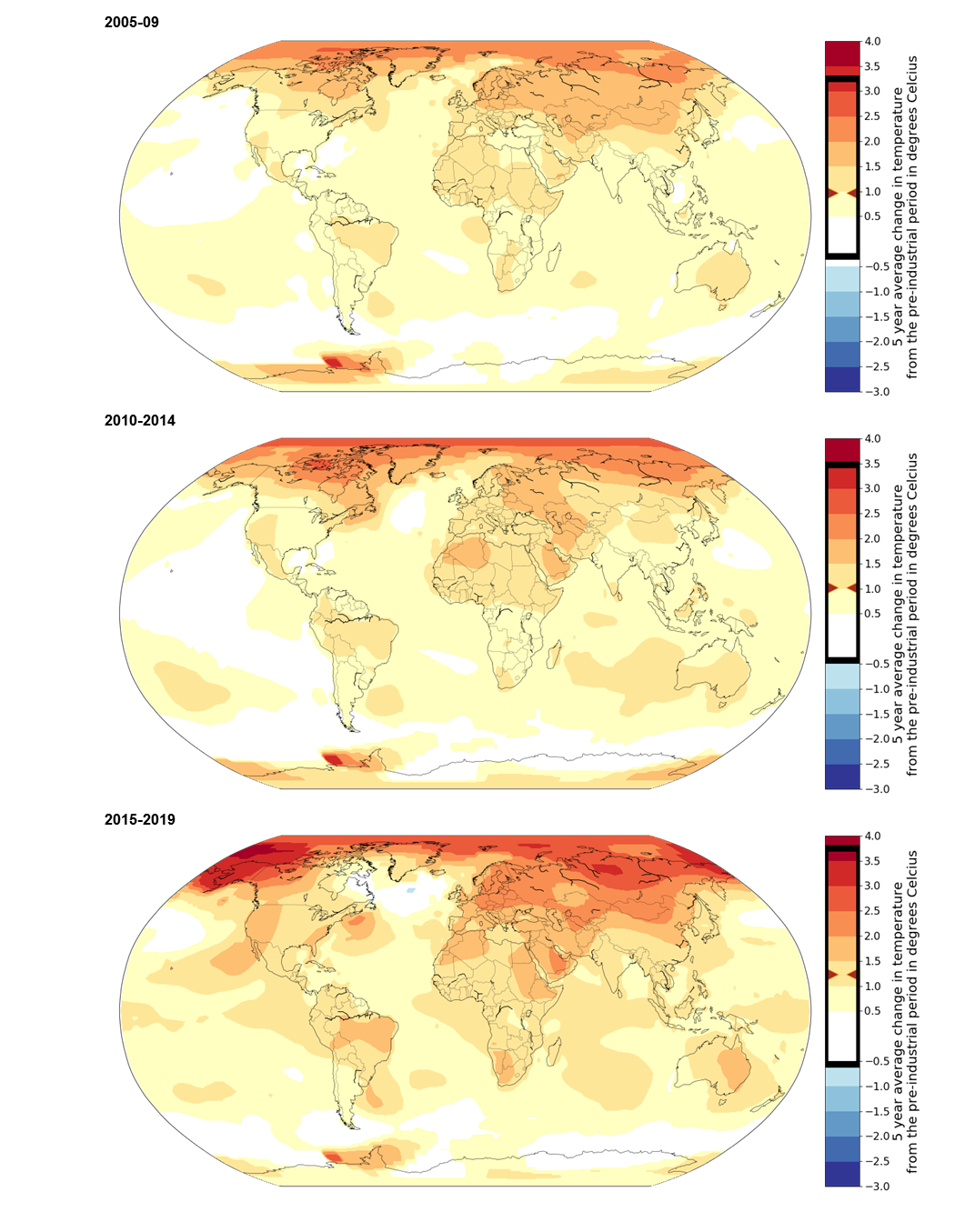

- 2. Living in a changing climate

- 3. Why focus on adaptation in cities?

- 4. Common challenges in building urban climate resilience

- 5. Financing urban adaptation is likely to require an “all-of-the-above” approach

- Appendix A: The risks of a warmer world

- Appendix B: Explaining our methodology

- Selected sources

Executive summary

Although the timing, scope and magnitude of the consequences of global warming remain uncertain, the potential risks are significant. Attention has focused on the need to reduce greenhouse gas emissions, and far more work will be needed here. Even as this work progresses, however, there will also be a need for adaptation efforts that can help the world withstand the potential effects of climate change.

Climate change could reshape the earth. Negative outcomes that could make adaptation critical in coming years include higher temperatures, more intense storms, melting glaciers, rising sea levels, shifting agricultural patterns, pressure on food and water and new threats to human health.

Cities will be on the frontlines of climate adaptation. Although the need for adaptation is likely to be widespread, we focus here on cities. Because they are home to more than half the world’s population and generate roughly eighty percent of global GDP, cities will find themselves at the epicenter of this challenge. Rapid urbanization in some developing countries will also likely sharpen the focus on cities.

Urban adaptation could drive one of the largest infrastructure build-outs in history. Greater resilience will likely require extensive urban planning, with investments in coastal protections, climate-resilient construction, more robust infrastructure, upgraded water and waste-management systems, energy resilience and stronger communications and transportation systems. Despite the uncertainty around the timing and scale of the impact, it may be prudent for some cities to start investing in adaptation now and to do so in ways that allow for maximum flexibility in the future – without committing to any one specific climate projection.

Given the scale of the task, urban adaptation will likely need to draw on innovative sources of financing. Even the most economically prosperous cities will likely need to look beyond tax revenues to other sources of funding, including central-government funds, public-private partnerships, institutional investors, insurance and, in developing economies, international financial institutions. “Soft” infrastructure, such as laws, regulations and markets that support financing, will matter too.

Adaptation may raise questions of fairness. Urban adaptation may raise questions of fairness – such as which cities can support adaptation and which cannot, or where limited resources should be directed within cities. This is likely to be true even in the most prosperous cities; the fact that many of the problems could prove to be local and specific could exacerbate this dynamic.

1. Introduction: Making cities resilient to climate change

2. Living in a changing climate

Two key drivers of continued warming

Climate projections are uncertain but do not bode well

More frequent, more intense and longer-lasting heatwaves that harm human health, reduce productivity, disrupt economic activity and hurt agriculture.

More frequent and more destructive weather events, including storms, winds, flooding and fires.

Changing disease patterns, which could adversely affect human health.

Shifting agricultural patterns, affecting the availability of food.

And pressure on the availability and quality of water for drinking and agriculture.

3. Why focus on adaptation in cities?

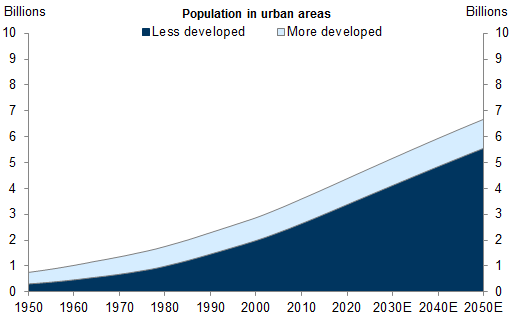

Exhibit 5: Most of the world's urban population is in less-developed regions

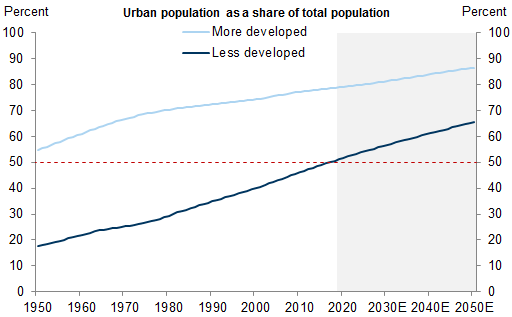

Exhibit 6: While the share of people in cities is higher in more-developed regions, less-developed countries are narrowing the gap

In 2011 Copenhagen issued a report outlining the short- and medium-term challenges of climate change for the city.

While recognizing the uncertainty around the long-term outlook, the city decided that “it nevertheless makes good sense to start on climate adaptation now” – in part to “avoid making the wrong decisions.”

The plan recommended focusing on integrating and “climate-proofing” municipal planning. It also called for the city to consider adaptation in the context not just of climate change but also of supporting economic growth and improving residents’ quality of life. For example, developing green spaces could reduce heating costs and emissions, manage storm-water and at the same time increase recreational opportunities.

The city’s focus is on prevention and rapid clean-up. In the specific case of flooding, for example, adaptive actions would include:

First, reducing the likelihood by building dikes, building on higher ground and bolstering sewer capacity and storm-water management.

Second, if that is insufficient, reducing the scale of the harm by establishing early-warning systems, creating storage capacity in public spaces and water-proofing basements.

Third, if the second level of protections is insufficient, reducing vulnerability by focusing on rapid clean-up.

In 2017 China announced the development of a major project, the Xiong’an New Area, designed to relocate people and some non-governmental functions away from Beijing. The project builds on the ground-up development of Shenzhen in the 1980s and Shanghai Pudong in the 1990s and is designed in part to create a model for the growth of other inland cities.

Key features include planning for a city that is 70% “green and blue,” with a park system that brings “forest around the city, wetland into the city” and an expansion of forest coverage to 40% from 11%. The expansion of green space will help to lower the urban heat-island effect, enhance biodiversity and create more opportunities for recreation.

As part of a nationwide “sponge city” initiative launched in 2013, Xiong’an will also address flooding and water-quality concerns by introducing an expansive reservoir and sewer system to collect, purify and reuse rainfall and waste water. The city also has targets for recycling and environmentally friendly waste treatment.

The multi-decade master plan also calls for capping population density; creating a low-carbon transportation network; and generating 50% of the city's energy consumption through wind, solar and other renewable technologies.

4. Common challenges in building urban climate resilience

Coastal protection

Following two periods of serious flooding in the 1990s, which ran the risk of overwhelming existing dikes and required the evacuation of a quarter of a million people, the Netherlands sought new ways to manage its flood risk.

The government began implementing the “Room for the River” project in 2007 to do just that.

Rather than reinforcing or replacing existing dikes to manage discharge volumes of nearby rivers, the program prioritized giving the rivers more space, for example by transforming agricultural land into floodplains. Expanding the floodplains also generated new parks and recreational areas.

The program was implemented through roughly 30 projects over approximately 12 years, with a budget of EUR2.3 billion (roughly US$2.6 billion) funded by the public sector.

Resilient construction

Water and waste management

Typhoons and other tropical storms make torrential rains and flooding common in Manila. Heavy rainfall is exacerbated by inadequate and blocked drainage and pumping systems. Storms often cause the evacuations of thousands of people, as well as deaths, property damage and disruption of economic activity.

In 2012 the Philippines government, with help from the World Bank, launched a Flood Management Master Plan for Metro Manila.

In 2017 the government, the World Bank and the Asian Infrastructure Investment Bank approved funding for the Master Plan’s first major project, the US$500 million Metro Manila Flood Management Program. The goal is to reduce flooding in 56 areas, benefiting at least 1.7 million people.

The project has four parts:

Modernizing drainage, by constructing new pumping stations and modernizing existing ones.

Minimizing solid waste in waterways, by improving collection and thus reducing waste in waterways.

Participatory housing and resettlement, by relocating and providing rental support to people whose homes will be affected by the work.

And project management and coordination, by providing further support to people who relocate.

Energy resilience

The electricity grid in the US consists of high-voltage transmission lines, local distribution systems and power-management and control systems that have been built over roughly 100 years.

Most of the grid is privately owned by for-profit utility companies. Since public utilities have a natural monopoly in the market, both federal and local government agencies regulate electricity rates and operating practices.

The US Department of Energy (DOE) indicates that severe weather is the single leading cause of power outages in the US; it estimates that between 2003 and 2012, nearly 680 power outages, each affecting at least 50,000 customers, occurred due to weather events.

As a result, the American Recovery and Reinvestment Act of 2009 allocated $4.5 billion in government funding to the DOE for investments in modern grid technology, with the aim of increasing the resilience and reliability of the grid in the face of severe weather.

Some of this funding has gone toward “smart grid” technology that utilizes remote control and automation to better monitor and operate the grid. This type of technology includes advanced grid sensors and distribution circuits with digital technology.

Transportation systems

Communications

Soft infrastructure

5. Financing urban adaptation is likely to require an “all-of-the-above” approach

Public-sector financing, whether from local tax revenues, municipal bonds or central-government funds, including direct government financing of projects and land-value capture strategies.

Private-sector financing, including green bonds, commercial bank loans and direct investments from institutional investors, particularly those seeking long-duration assets to offset their long-duration liabilities.

Public-private partnerships (PPP) and private finance initiatives (PFI).

In emerging economies, international financial institutions such as the World Bank and regional development banks.

Insurance, which can be designed to reduce moral hazard and to encourage innovative adaptation projects.

Direct government financing

Hurricane Sandy in 2012 caused roughly $70 billion of damage across the eastern seaboard of the United States, with flooding and storm surges affecting much of New York City. As a result, the city now has several projects in design or in progress to protect the city against future storms and floods.

These include a US Army Corps of Engineers project to defend Staten Island by building more than five miles of levees, floodwalls and a buried seawall/armored levee, supplemented by interior drainage improvements. The goal is to make Staten Island able to withstand a once-in-a-300-year flood.

The Staten Island project is estimated to cost $615 million and will be funded by the public sector, with New York City to contribute roughly 10.5% of the cost, New York State to contribute 24.5% and the remaining 65% to come from federal funds. The project received its first funding commitment in 2017 and the remainder in 2019. It is estimated to break ground in 2020 and to be completed roughly four years later. The project was delayed by the need for federal legislation authorizing the use of federal land for the seawall.

The separate East Side Coastal Resiliency Project is designed to protect the east side of Manhattan by raising its coastline. The project is estimated to cost $1.45 billion and to be completed by 2023. The project faces objections to its plans to close a riverside park during construction.

In addition, the mayor of New York has announced a $10 billion plan to protect lower Manhattan from rising sea levels and flooding by extending the shoreline into the Hudson River and the East River. Funding for and the timing of this project are currently unresolved.

These examples demonstrate some of the inherent complexities, financing needs and timelines associated with building resilience in urban areas – even in a city with ample economic resources and a dense population.

Municipal bond markets

Green bonds

Several US states and municipalities have issued municipal bonds – both general obligation bonds and revenue bonds – to finance major infrastructure adaptation projects. Among them:

Miami’s Miami Forever Bond program, approved in 2017, allocates nearly $200 million for climate-related infrastructure and capital improvements in storm-water and flood management.

A year after 2017’s Hurricane Harvey, Houston voters approved a $2.5 billion bond for more than 200 flood-control projects.

In 2018, San Francisco voters approved a $425 million general obligation bond, supported by an increase in property taxes, in part to finance the retrofitting and reinforcing of the city’s 100-year-old Embarcadero seawall.

Washington DC’s Water and Sewer Authority issued a $25 million “environmental impact bond” in 2016 to finance green infrastructure designed to prevent rain and storm-water runoff from overwhelming the city’s sewer system. The bond includes a contingent payment that reflects the effectiveness of the project in reducing runoff and includes a risk-sharing provision if it does not meet certain targets.

Land-value capture strategies

Public-private partnerships and private finance initiatives

The government structures the project and the bidding process, sometimes with the assistance of an international financial institution (IFI) such as the World Bank or a multilateral development bank. Key concerns are value for money and the need for the private-sector bidder to bear some of the construction risk by holding an equity stake in the project.

As part of the tender, the government guarantees certain payments to the operator of the asset. These can be generated from the asset’s cash flows, or in the case of assets that don’t have direct cash flows or have unclear visibility, through an “availability payment” that is independent of the use or pricing of the asset. Multilateral institutions can also provide credit guarantees or insurance for political risk.

The successful private-sector bidder (or in some cases multiple bidders) builds, operates and maintains the asset for a fixed concession period. In some cases, the bidder also owns the asset for this period and then transfers it to the government at the end of the term.

The debt that finances most of the construction comes from several types of investors, principally IFIs, export credit agencies, commercial banks or, increasingly, institutional investors. The long-dated assets draw investors with long-term liabilities, including insurance and pension funds. From an investment perspective, the stable cash flows, good visibility and limited fluctuation can make these investments attractive, particularly for long-duration investors. The private sector may bear some of the construction risk – but it is the equity holders rather than the debt holders who do so.

Given flooding risks stemming from rising sea levels and storm surges, the national government of an emerging economy decides to construct a new toll road at a higher elevation than existing transportation routes.

The toll road project connects two major cities and covers several hundred miles of land. In addition to its greater climate resilience, the project is likely to support economic growth in the major cities and to encourage growth in the less-developed areas through which the road passes.

The national government apportions some federal tax revenues as initial financing for the project, but domestic political dynamics limit its ability to provide additional funding.

The government thus turns to the private sector for the remainder of the financing, creating a public-private partnership (PPP). A regional development bank contributes its expertise in structuring the terms of the PPP and running the bidding process.

Under the terms of the PPP agreement, private-sector companies (often a consortium) contract with the government to build, operate and maintain the roads. The private sector bears the risks associated with the construction and, as per the tender, has an equity stake as “skin in the game” that will incentivize it to meet specified construction, operational and maintenance targets.

The consortium issues a bond to finance the project, collateralized by the toll fees from the roads and backstopped by a government guarantee for a minimum payment to the road operator. This guarantee reflects the uncertainty around the future revenue stream of this new project and helps to reduce the cost of capital.

Private-sector investors may include commercial banks, as well as pension funds, insurance companies and sovereign wealth funds looking for long-term assets.

International financial institutions may also provide subsidized loans or guarantees, both of which reduce the risk profile of the project.

International financial institutions

A municipality plans to replace its outdated, state-owned and state-operated port with a new facility that will meet several needs: becoming more resilient to rising sea levels, improving the environmental footprint of its operations, handling more capacity and improving productivity.

Under the commonly used “landlord” model, the government will own the land and basic infrastructure, while the private sector will manage the port’s operations and terminals and maintain the infrastructure.

The city chooses an “availability-payment public-private partnership.” Under this structure, the city contracts with a private-sector consortium that builds and operates the port and is responsible for maintenance. This consortium is capitalized with investors’ equity and with debt raised from banks or capital markets; it may take a bridge loan to cover the construction costs.

The government contributes some funding toward construction and commits to paying the consortium a fixed “availability fee” for several decades. It may also offer credit support to the project.

The contract includes some provisions for political risk – potentially via credit support from the government – and for foreign-exchange risk.

The public sector avoids the up-front costs of construction and achieves greater budget stability through the fixed payments. It also benefits from the private sector’s expertise, which improves the port’s productivity – which is important given that, according to this contract's terms, the city still owns the rights to all of the port’s revenues.

The role of insurance

"Soft" infrastructure

Appendix A: The risks of a warmer world

More frequent, more intense and longer-lasting heatwaves that harm human health, especially among vulnerable populations, reduce productivity, disrupt economic activity and hurt agriculture. According to the IPCC, it is “virtually certain” that there will be more frequent hot and fewer cold extreme temperature days, and it is “very likely” that heat waves will occur with higher frequency and longer duration, particularly in the tropics. Higher surface temperatures could exacerbate the warming process by causing permafrost to melt, releasing further methane and CO2 into the atmosphere.

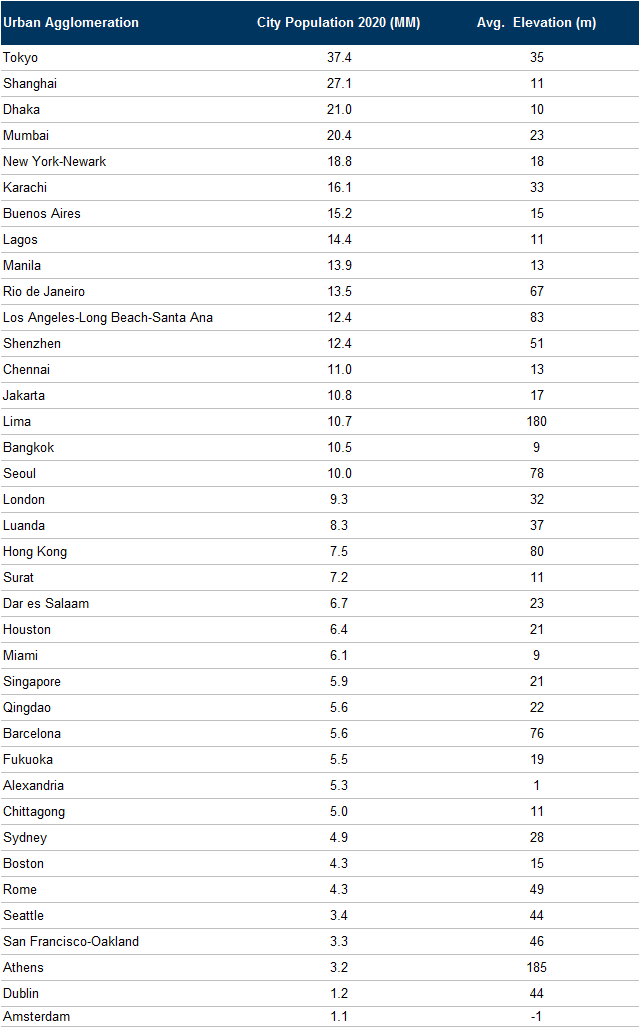

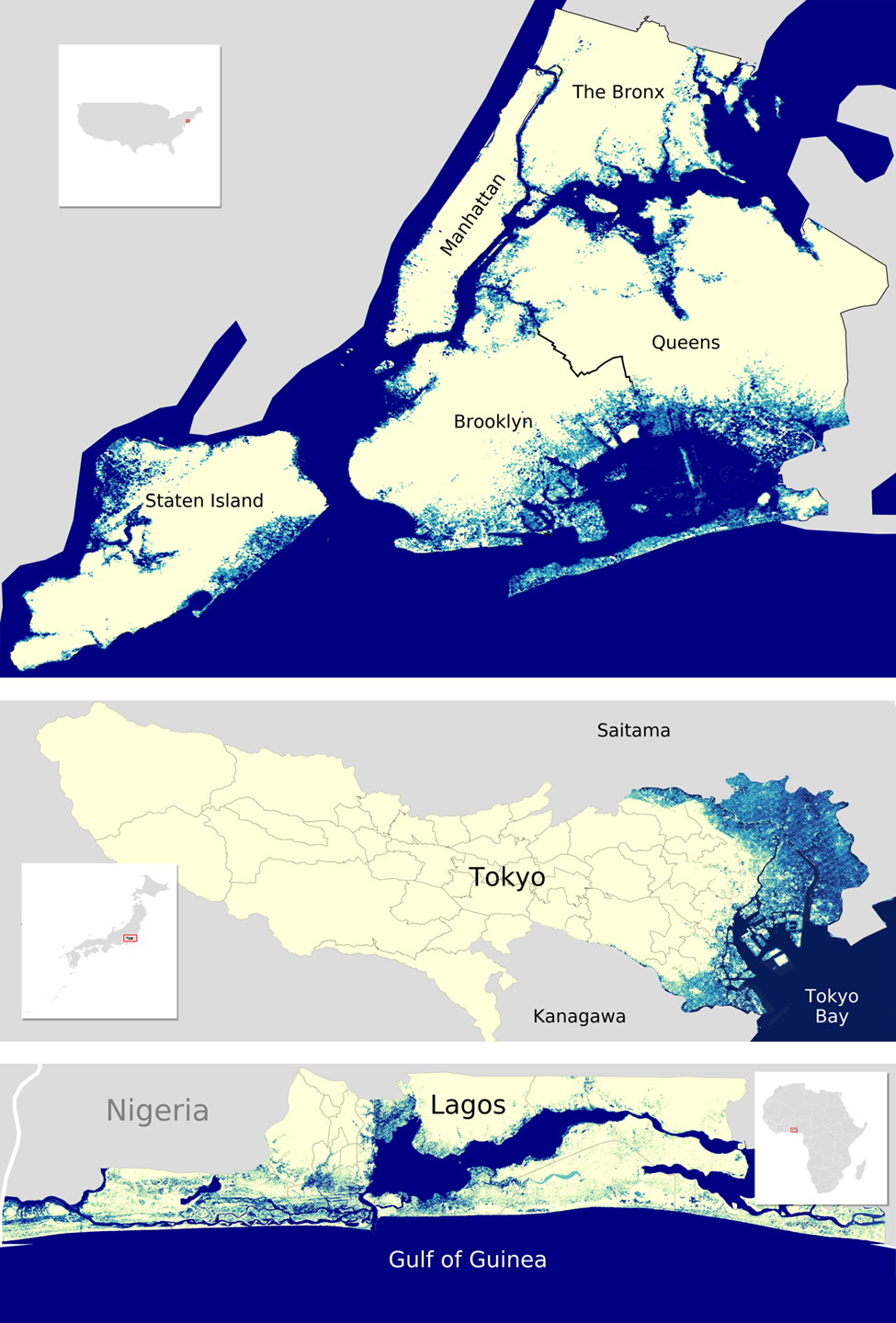

More frequent destructive weather events, including storms, winds, flooding and fires. Some regions could see more precipitation, and tropical cyclones bringing heavy rain and winds could become more frequent or more intense (or both). The maps below show (in shades of blue) our estimates of how flooding could affect some of the world’s major coastal cities, including New York, Tokyo and Lagos. Other major low-lying coastal or already flood-prone cities include Shanghai, Dhaka, Mumbai and Karachi – each of which has a population of 15 million people or more (see Exhibits 7 and 8 below and Appendix B for our methodology). Yet in other areas, droughts are projected to become more frequent and more intense.

Changing disease patterns, which could adversely affect human health. Warmer temperatures could cause disease vectors to migrate from the tropics to regions where people have less immunity; this is true not only for viruses like malaria and dengue fever but also for water-borne and food-borne diseases. Air pollution and increased ground-level ozone could also increase occurrences of asthma and respiratory diseases.

Shifting agricultural patterns, affecting the availability of food. Warmer temperatures and shifting precipitation patterns could reduce yields and nutritional quality as well change growing seasons and agricultural zones around the world. Livestock could be affected by higher temperatures and reduced water supplies. Ocean acidification is likely to put stress on aquatic populations and affect current fishing patterns. Some of these changes are already underway. Some climate scientists, for example, estimate that coral reefs will be all but extinct over the course of the century due to ocean acidification.

Pressure on the availability and quality of water, with widespread potential consequences. The World Health Organization (WHO) estimates that half of the world’s population will live in water-stressed areas as soon as 2025. Even in non-stressed areas, the quality of surface water could deteriorate as more rain and storms drive erosion and the release of toxins. These dynamics could affect everything from the availability of drinking water for people to a shortage of water for livestock and crops (with negative effects for the food supply) to decreases in hydroelectric power generation (which itself is expected to play a role in countering carbon accumulation over the long term).

Appendix B: Explaining our methodology

Selected sources

- 1 ^ The IPCC was formed in the late 1980s by the United Nations and the World Meteorological Organization. The organization does not conduct its own scientific research but instead coordinates work from scientists around the world to provide regular assessments of the drivers, risks and likely outcomes of climate change, along with the impacts of mitigation and adaptation. The IPCC presents its work using a range of confidence intervals. Other widely-cited reports or experts in the field include the National Climate Assessment in the US, which released its fourth version in late 2018, the Organization for Economic Cooperation and Development (OECD), the International Energy Agency (IEA), China’s National Center for Climate Change Strategy and International Cooperation (NCSC) and the US National Oceanic and Atmospheric Administration (NOAA). Other countries, as well as some cities and municipalities, have also issued their own reports, which tend to be more granular in their examination of critical local issues.

The Global Markets Institute is the research think tank within Goldman Sachs Global Investment Research. For other important disclosures, see the Disclosure Appendix.