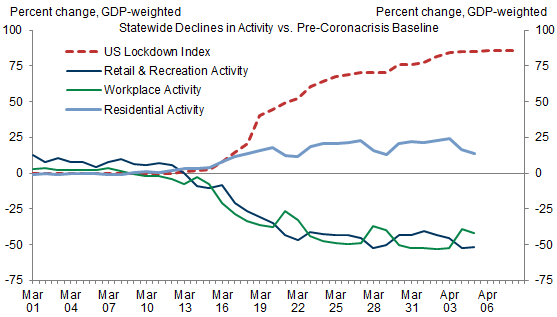

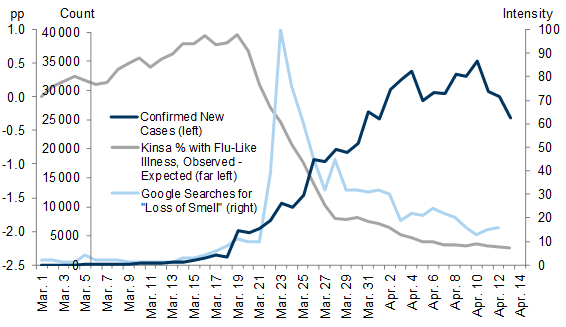

The US is now largely in lockdown mode and social distancing has increased nationwide. But with the daily number of new confirmed virus cases plateauing and big data measures indicating a sharp decline in the true number of new cases, discussion is turning to the plan for reopening. This week’s Analyst asks what reopening will look like and what it means for the pace of the recovery.

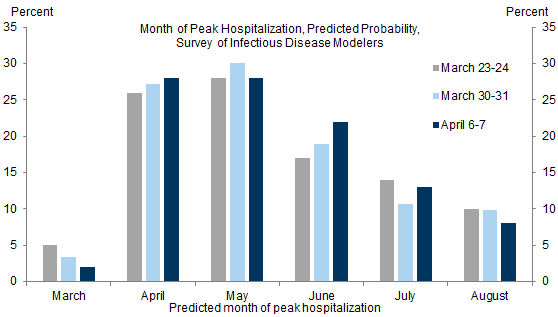

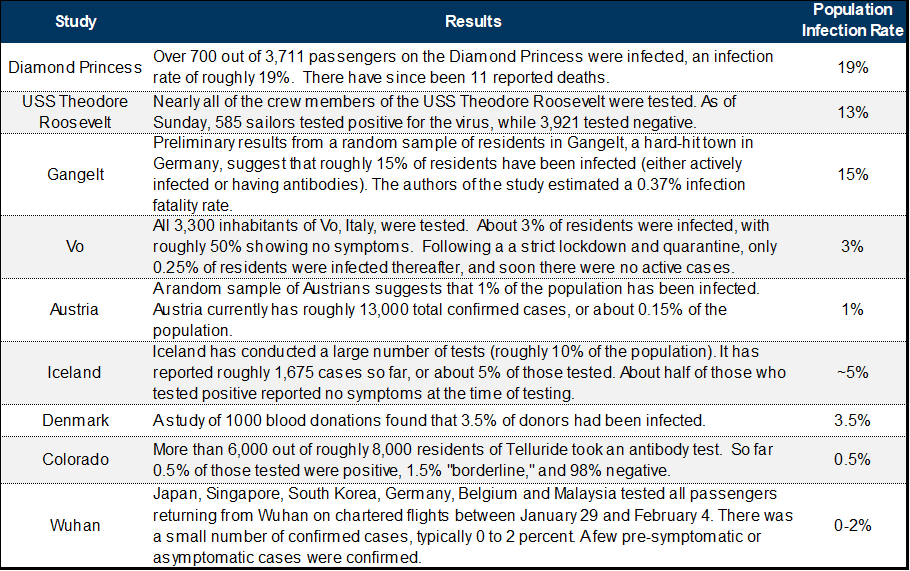

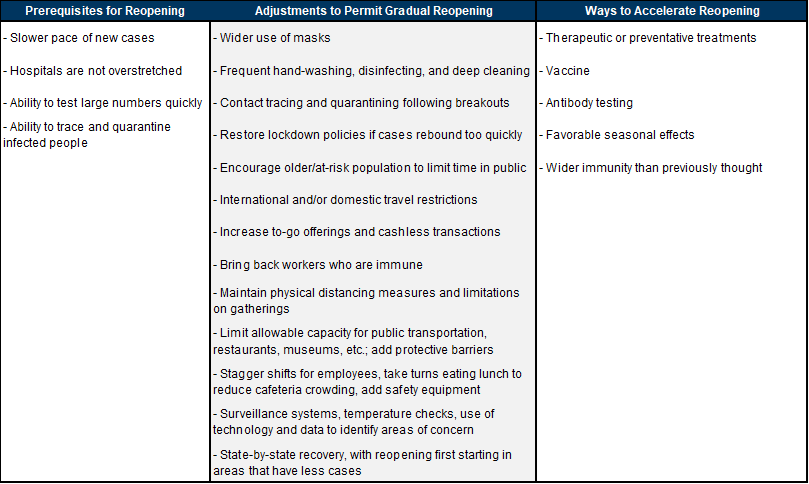

Absent a vaccine or treatment breakthrough, reopening will be gradual. New evidence suggests that the share of the population that has been infected is higher than test counts imply, but still too low to achieve herd immunity soon. As a result, the public will have to be persuaded that reopening is safe. We see a few prerequisites: further declines in confirmed new infections, sufficient hospital and testing capacity, and the ability to trace and quarantine those who might be infected. These look achievable in coming months, but there is much uncertainty about the feasibility of controlling virus spread during reopening.

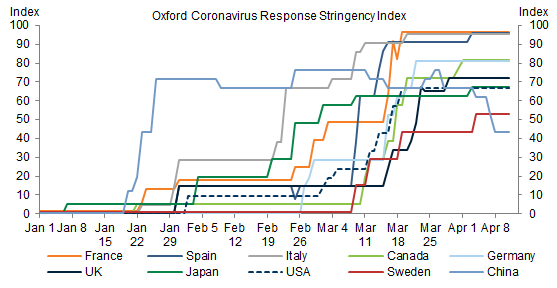

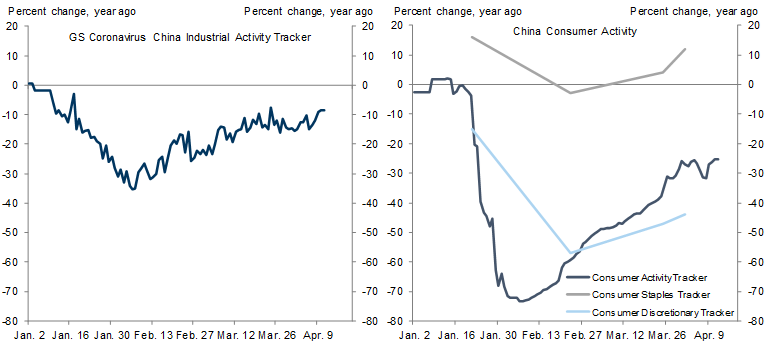

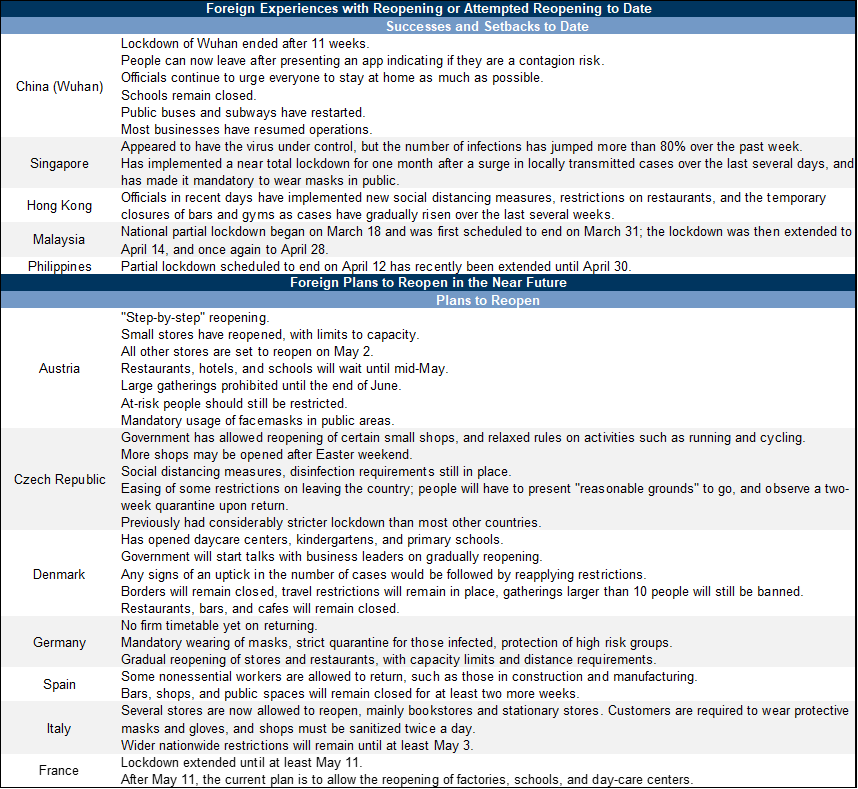

Several other countries have taken steps toward reopening. We see three lessons from their experiences. First, initial reopening timelines often prove too optimistic. Second, even countries at the forefront of reopening have gradual and conservative plans. Third, recovery is easier and quicker in manufacturing and construction than in consumer services.

We expect the economy to begin improving in coming months, with the peak virus hit fading thanks to partial relaxation of shutdown orders, adaptation to social distancing, and wider antibody testing to identify those who are now immune. While longer-lasting economic damage that delays the recovery is possible, so far the news has been mostly reassuring: most layoffs appear to be temporary and there has been no major uptick in bankruptcies at this early stage.

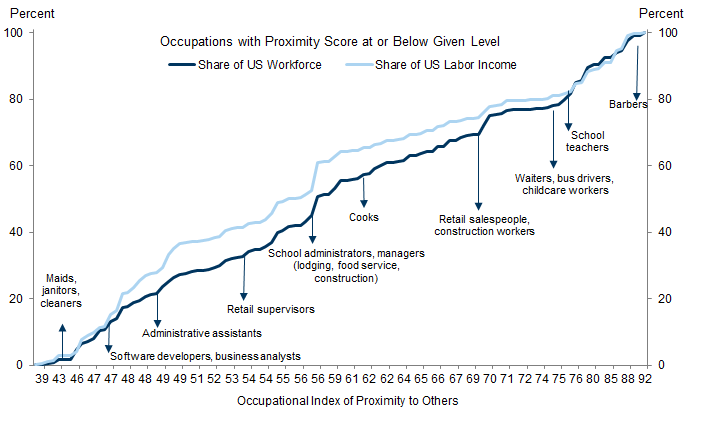

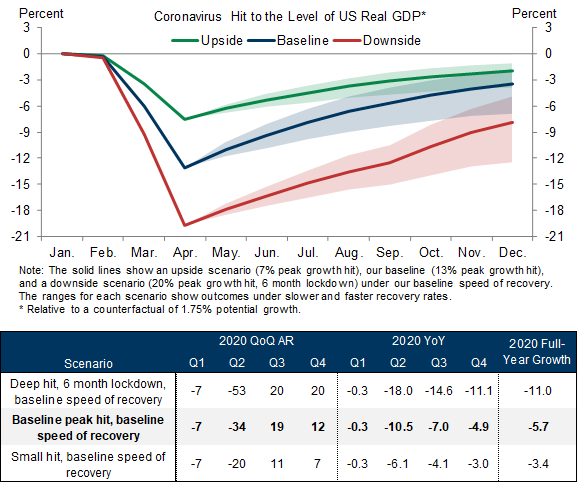

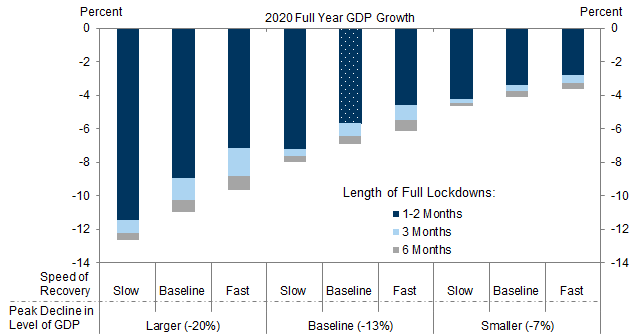

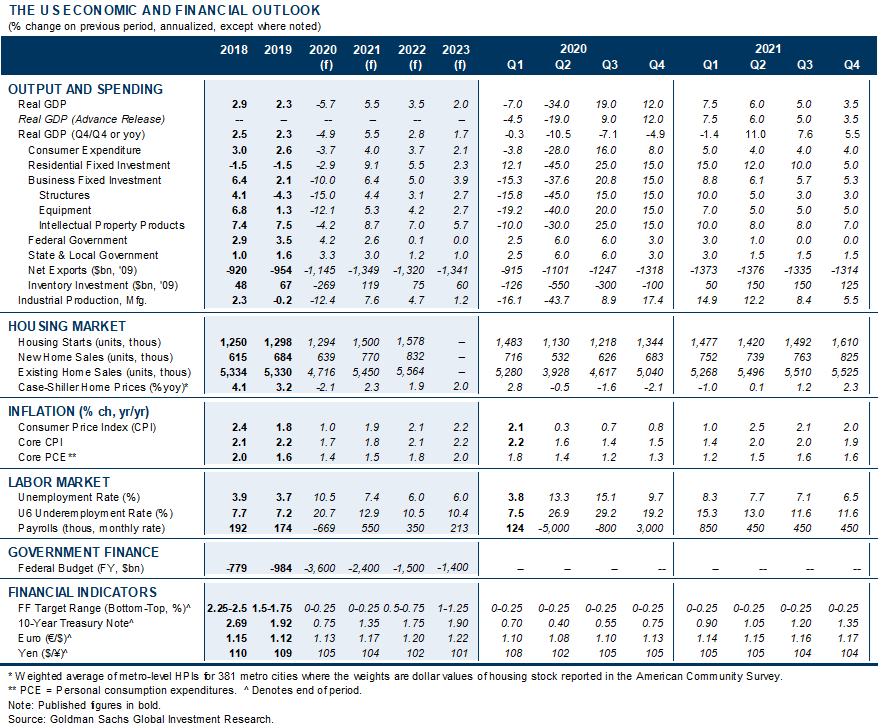

The growth path depends on the depth of the hit, the length of lockdown, and the pace of recovery. We estimate a 25% peak hit to manufacturing, a 30% hit to construction, a 60% hit to broker fees and home improvements, and a 14% hit to consumer services, with manufacturing and construction recovering more quickly. Our GDP growth forecast remains a quarterly annualized rate of -7% in Q1, -34% in Q2, +19% in Q3, and +12% in Q4, implying an annual average rate of -5.7% in 2020. We see both upside and downside risks to our forecast.

Reopening the Economy

What Will Reopening Look Like?

Lessons from Foreign Experience with Reopening

The Economic Recovery: A Scenario Analysis

David Choi

David Mericle

The US Economic and Financial Outlook

Forecast Changes

- 1 ^ See https://www.bsg.ox.ac.uk/research/research-projects/coronavirus-government-response-tracker. We think that this measure understates the severity of the China lockdown for several reasons, most importantly that China did not have any international travel controls in place for most of this time (1/7 of the Oxford index) because there was no fear of international transmission.

- 2 ^ Seth Stephens-Davidowitz, “Google Searches Can Help Us Find Emerging Covid-19 Outbreaks,” The New York Times, April 5, 2020.

- 3 ^ For more on progress on vaccine and treatment development, see recent research by our Japan healthcare analysts, Akinori Ueda and George Zhou, “COVID-19 FAQ: Strong interest in progress on treatment/vaccine development, product positioning,” April 11, 2020.

- 4 ^ Marc Lipsitch, “Who Is Immune to the Coronavirus?” New York Times, April 13, 2020.

- 5 ^ A challenge in the US is balancing tracing contact between people with privacy concerns. A cell phone app developed by mathematicians, NOVID, anonymously traces virus exposure by using Bluetooth radio waves and ultrasonic frequencies captured by the microphone to measure the distance between people and later alert people who have been near someone who self-reports as infected. Such technologies could enable the same tracing of potential new infections as more invasive approaches in other countries. See Novid.org.

- 6 ^ Eric Budish, “R<1 as an Economic Constraint: Can We ‘Expand the Frontier’ in the Fight Against Covid-19?” April 1, 2020.

- 7 ^ For examples see Jonathan Dingel and Brent Neiman, “How Many Jobs Can Be Done at Home?” March 26, 2020.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.