The coronavirus has transformed the global economy, with businesses and households quickly adapting to a new environment out of necessity. We assess possible long-term changes to the economy and their implications for the labor market recovery in this week’s Analyst.

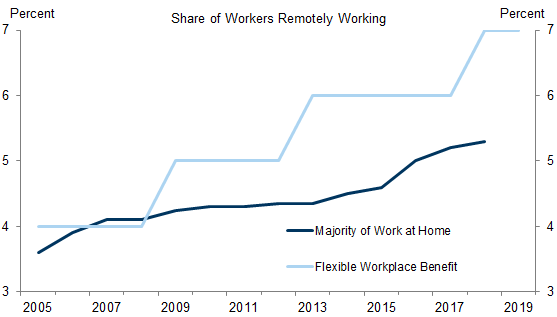

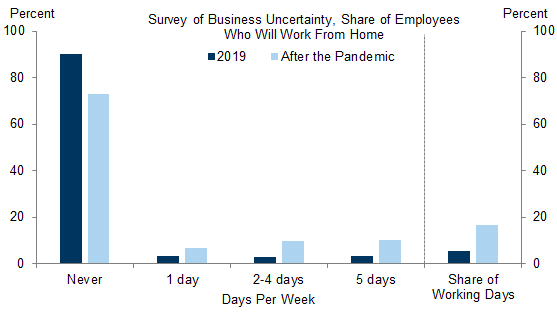

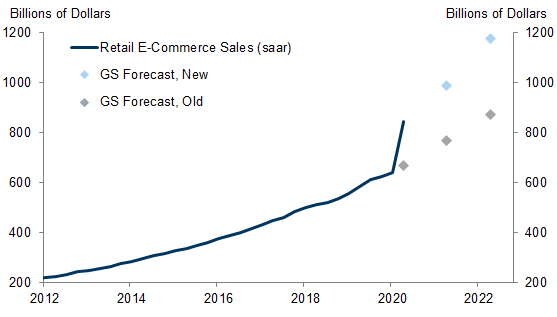

The virus shock has accelerated several existing trends, such as the rise in remote working and the digitization of services. Surveys indicate that a significant amount of remote working will likely persist, and our industry analysts expect digitization across industries to continue growing at an accelerated pace.

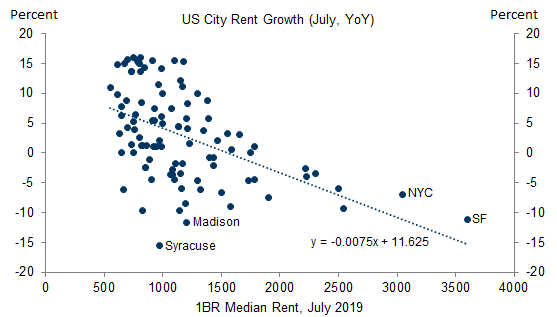

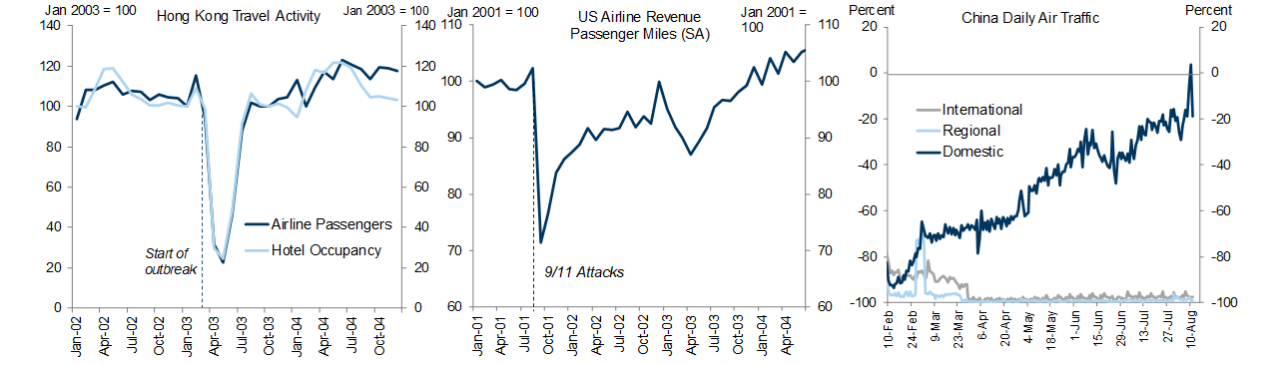

The virus shock has had disparate effects across regions and industries. Rents have plunged in dense cities as residents moved out, and activity in virus-sensitive sectors remains far from normal levels. While shocks such as SARS and September 11 had only temporary effects on migration and economic activity, the initial shock has been much larger in this recession.

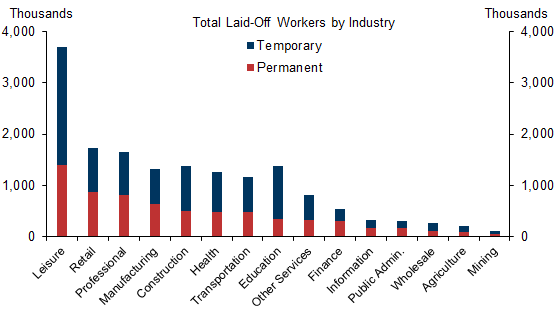

Adjusting to the new economy will likely require a large amount of labor reallocation. Permanent layoffs in virus-sensitive industries have rapidly increased, and retail employment will come under further pressure in an increasingly digital world. A greater shift to remote working may also mean fewer jobs in occupations such as building cleaning and maintenance.

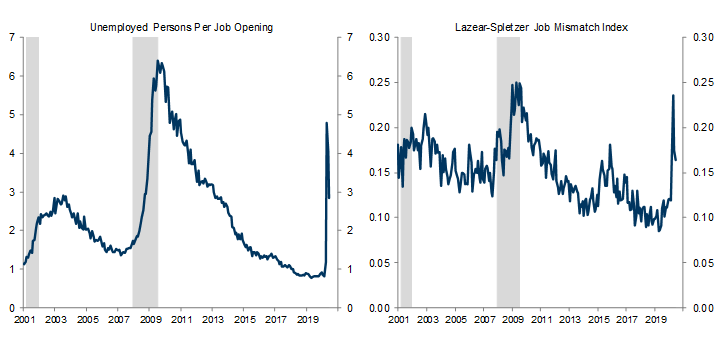

Nevertheless, we see several reasons why the labor market recovery may prove faster than in other recessions. First, we expect many temporarily laid off workers to be re-hired; second, there was no obvious imbalance prior to the downturn; and third, there is scope for a large amount of job creation, suggesting that reallocation could occur at a faster pace than usual.

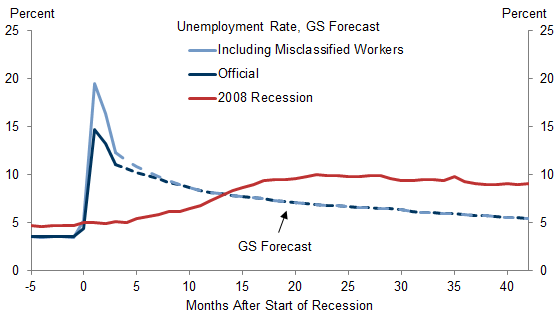

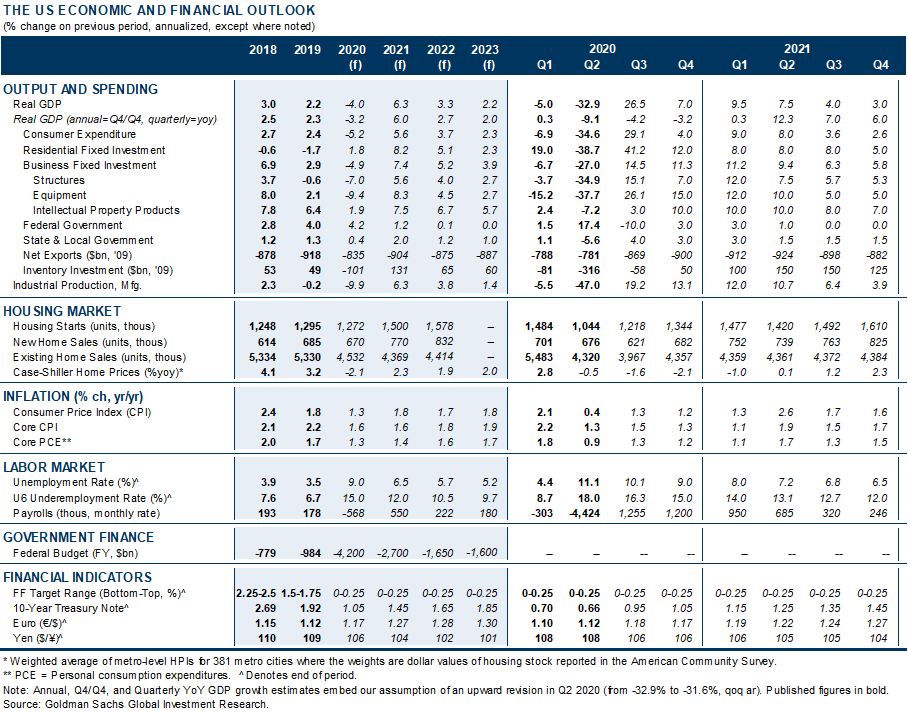

We thus expect a much faster recovery in the labor market than in the last recession. We expect the unemployment rate to decline to 9% by the end of this year, a further large decline to 6.5% in 2021 following a vaccine, and a more gradual recovery after that.

The Post-Pandemic Economy

Long-Run Changes to the Economy

Implications for the Labor Market Recovery

David Choi

The US Economic and Financial Outlook

Forecast Changes

- 1 ^ Surveys of employees also suggest that many workers would like to continue to work remotely after offices reopen. This may require firms to offer more flexible workplace arrangements in order to attract and retain employees.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.