Pre-election fiscal stimulus looks like a much closer call than it did a couple of months ago amid mounting signs of trouble. Recent deadlines did not force an agreement and Congress will be in session only briefly before the election. The strong August jobs report also looks likely to reduce political pressure to compromise.

However, we still think that Congress is slightly more likely than not to enact a stimulus package by the end of the September. Enhanced unemployment benefits will soon run dry, which could force action, and September is likely to be the last opportunity to pass fiscal measures until well after the election and potentially early 2021. Incumbents of both parties might be wary of inaction for such a long period.

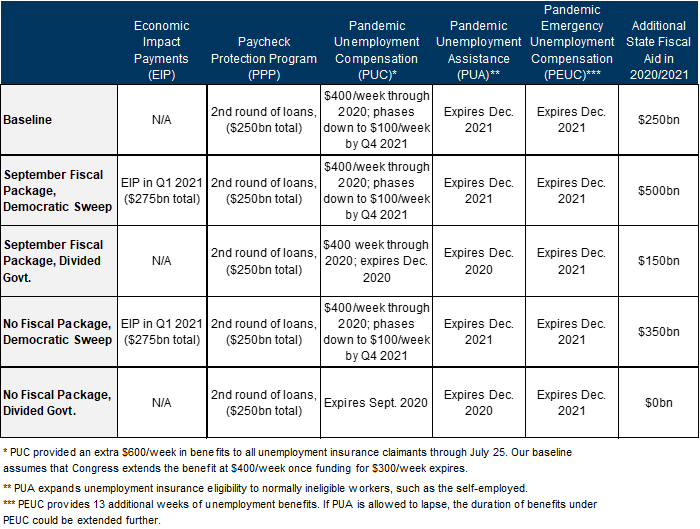

If Congress enacts a stimulus package in September, we believe the package is likely to be somewhat smaller than the $1.5 to $2.0 trillion package we believed was likely a month ago. There appears to be lukewarm support for another round of payments to individuals and concerns regarding the overall size of the package could crowd out an additional round of checks. We are revising our assumptions to assume a $1 trillion package that includes a $400/week payment extra unemployment benefit through year-end, additional small business support, and modest state fiscal aid, but no further payments to individuals.

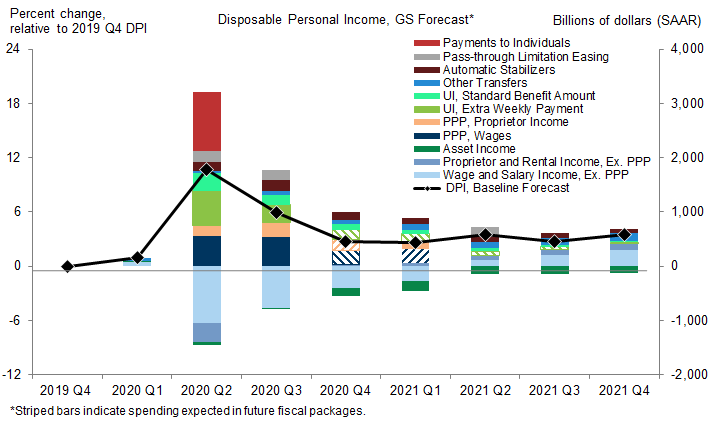

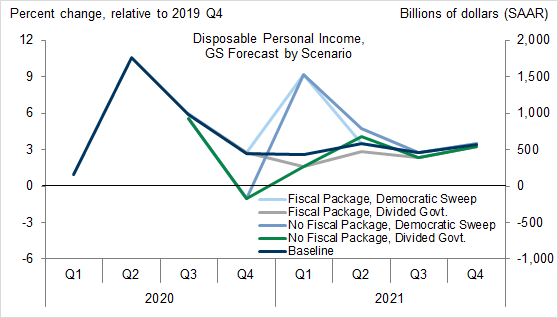

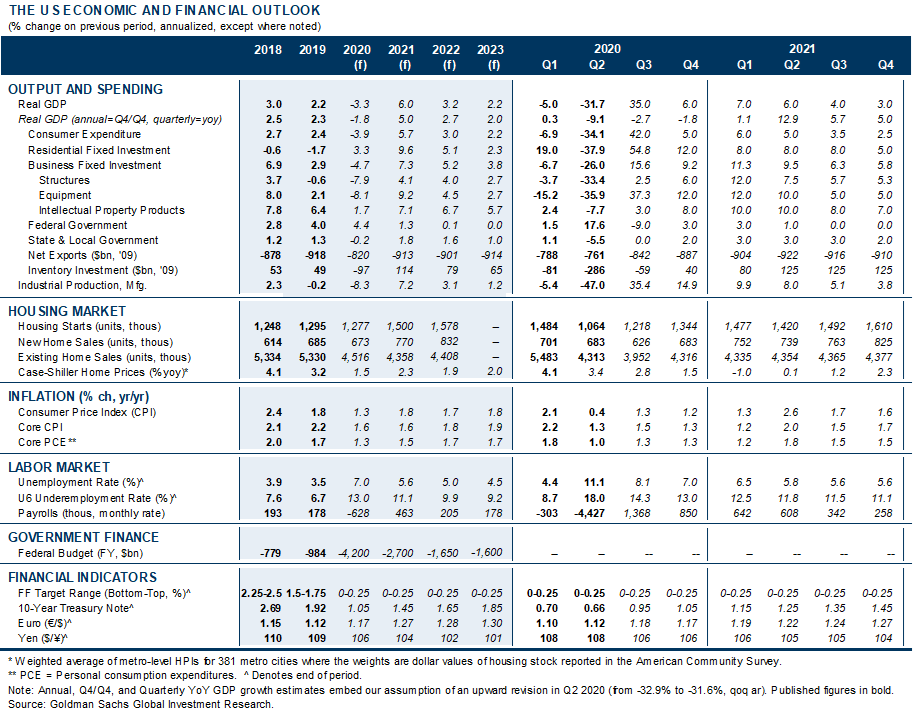

Despite the bad news on the fiscal policy front, we have upgraded our disposable personal income (DPI) forecasts following recent spending and employment data that have come in much better than we expected. We now expect nominal DPI growth of 6.3% in 2020 on a full-year basis (vs. 4.0% previously) and -1.9% in 2021 (vs. -2.3% previously) as fiscal support declines.

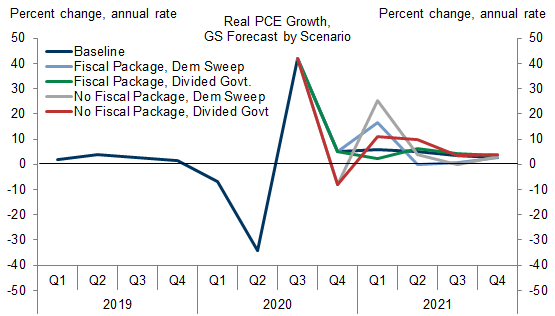

On the back of continued strong signals from alternative consumption data, we have also upgraded our Q3 consumption tracking estimate further (+42% annualized vs. +35% previously, and well above consensus of +24%) and our Q4 estimate (+5% vs. +4% previously). Some of this near-term upgrade reflects a pulling forward of the consumer recovery, which combined with the net downgrade to our fiscal projections implies modestly weaker spending growth in 2021.

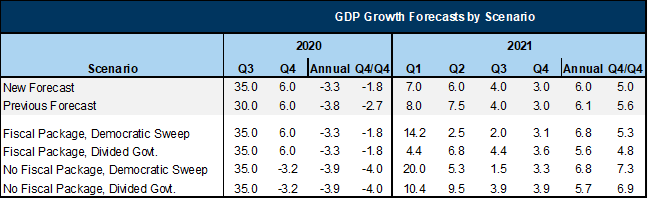

We are also revising our GDP forecast on the back of these changes. The largest change is in Q3, where we now expect quarterly annualized GDP growth of +35% (vs. +30% previously and consensus of +21%). We have marked down our 2021 forecasts modestly, again reflecting both the pulling-forward of the recovery and the modest fiscal downgrade.

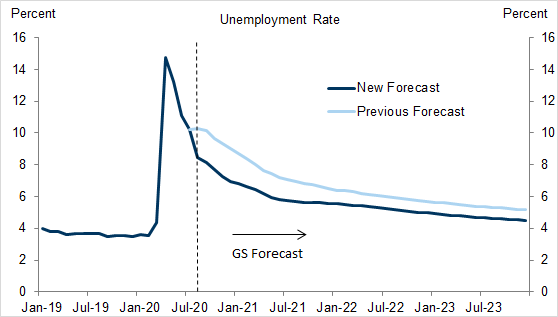

We now expect the official unemployment rate to reach 7.0% at end-2020 (vs. 9.0% previously), 5.6% at end-2021, 5% at end-2022, and 4.5% at end-2023. Our +6% forecast for 2021 GDP growth on its own would call for a larger decline in the unemployment rate next year, but we think participation will rebound strongly as a vaccine eliminates most of the hurdles to rejoining the labor force.

Good News on the Economy, Bad News on Fiscal Stimulus

The passage of recent deadlines did not come close to forcing an agreement. We expected that the expiration of stepped-up unemployment insurance payments at the end of July would put pressure on lawmakers to reach a deal. However, neither the passing of that deadline nor the start of the congressional recess that followed a week later was enough to bring about a compromise.

The August jobs report reduces political pressure for further stimulus. Some lawmakers opposed extension of the extra unemployment benefit due to its potential to disincentivize a return to work and might see the sharp drop in the unemployment rate as support for their view. While the details of the report do not bear this out—the employment gains came primarily from fewer layoffs rather than more hiring—it does suggest that the economic situation continued to improve in August with relatively little fiscal support.

The two sides appear to be moving farther apart. While Republicans and Democrats had narrowed the gap between their positions to less than $1 trillion by early August, it appears to have widened a bit since then. Senate Republicans are readying a package reportedly worth around $500bn, while Democrats are seeking $2.2 trillion.

Neither party appears to face political pressure to agree. A CNBC poll in early August found that an equal share of likely swing-state voters blamed Republicans as blamed Democrats for a failure to pass a fiscal relief package prior to the expiration of the increased unemployment benefit payment in late July.

There isn’t much time left to reach a deal. The House does not return until September 14 and is scheduled to be in session only ten full work days before adjourning October 2 ahead of the election. While the calendar can be extended if necessary, the probability of a deal will dwindle as the election approaches.

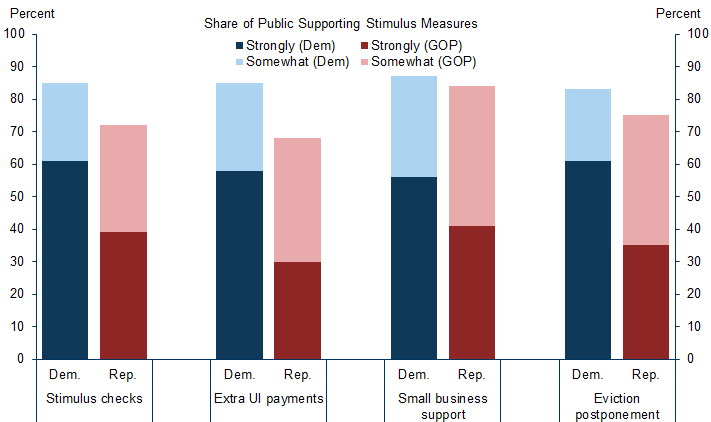

At least publicly, none of the main parties to the negotiation opposes substantial stimulus. Voters of both parties appear to support additional fiscal measures, though Democrats support them more strongly than Republicans. Likewise, most Democratic lawmakers have publicly supported an even larger package than most Republicans, despite the greater political incentive that Republicans have as the incumbent party to support the economy ahead of the November presidential election. The White House has announced support for a $1.3 trillion package, as well as the extension of extra unemployment benefits, another round of payments to individuals, and additional support for businesses. Most Republican lawmakers are also likely to support a smaller package (somewhere between $500bn and $1 trillion) that includes those components expected to come up for a vote in the Senate in the next several days. Congressional Democrats have reduced their proposed top line from $3.5 trillion to $2.2 trillion, though it is unclear what parts of their prior proposal this smaller package would omit.

There are still some potential forcing events on the calendar. The extra unemployment benefit that the White House partially and temporarily restored through executive order will likely lapse again by late September as funding runs dry after states make lump-sum payments of $300/week retroactive to early August. Once Congress recesses at the end of September or early October, they are unlikely to return until mid-November, so declining to extend those benefits before they leave for the election would essentially eliminate any chance of further extension. Since both parties appear to believe some extension is in their interest, this seems likely to push lawmakers to reach at least a limited deal. That said, uneven implementation by states is likely to mean that there is a not a single deadline in the media that focuses public and media attention.

Congress also needs to pass legislation before the end of the federal fiscal year on Sept. 30 to extend spending authority and several expiring programs. However, the pact among congressional leaders and the White House to pass a clean “continuing resolution” to avoid a shutdown means that this could still be a useful legislative device to ease passage of a deal that has been worked out, but the deadline is unlikely to force an agreement that wouldn’t be reached otherwise.

While voters do not appear to blame one party more than the other, this might change. With a Republican president running for reelection, Congressional Democrats have little political incentive to support additional stimulus. As noted above, so far voters appear to blame both sides equally for the failure to enact additional relief, but this might change. Democrats might come under more political pressure if, for example, they block a proposal that has near-unanimous Republican support. The dynamic could shift in coming days if Republicans are able to get at least 50 votes in the Senate for their own stimulus measure. Since at least 7 Democratic votes would be needed to overcome a filibuster, Democrats have sufficient votes to block it but doing so would leave Democrats in the situation of opposing less fiscal stimulus in favor of no fiscal stimulus.

Four months is a long time to wait. Most observers believe that failure to enact stimulus in September would likely push the debate into early 2021, when the next presidential term begins and the new Congress is seated. The year-end expiration of many CARES Act policies, including broadened unemployment insurance eligibility, could prompt Congress to enact before then, but it nevertheless seems unlikely that lawmakers will be comfortable with inaction over such a long period.

Aid to state and local governments. The House-passed HEROES Act provided roughly $1 trillion in fiscal support to state and local governments. We expect that a Democratic-controlled Congress would approve an amount closer to half of this.

Extension of expanded unemployment insurance. We expect that a Democratic Congress would extend expanded eligibility and extended duration of benefits through 2021, and would phase down extra payments from the $400/week we expect through year-end to $100/week by the end of 2021.

Small business support. The Biden campaign has endorsed a “comeback package for Main Street businesses”, which we expect would involve, at a minimum, allowing businesses to take additional loans under the Paycheck Protection Program (PPP) and some additional funding for that program.

Joseph Briggs

David Mericle

Alec Phillips

The US Economic and Financial Outlook

- 1 ^ As of September 6, trading on PredictIt implied an 82%, 55%, and 57% probability that Democrats will win the House, Senate and White House, respectively.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.