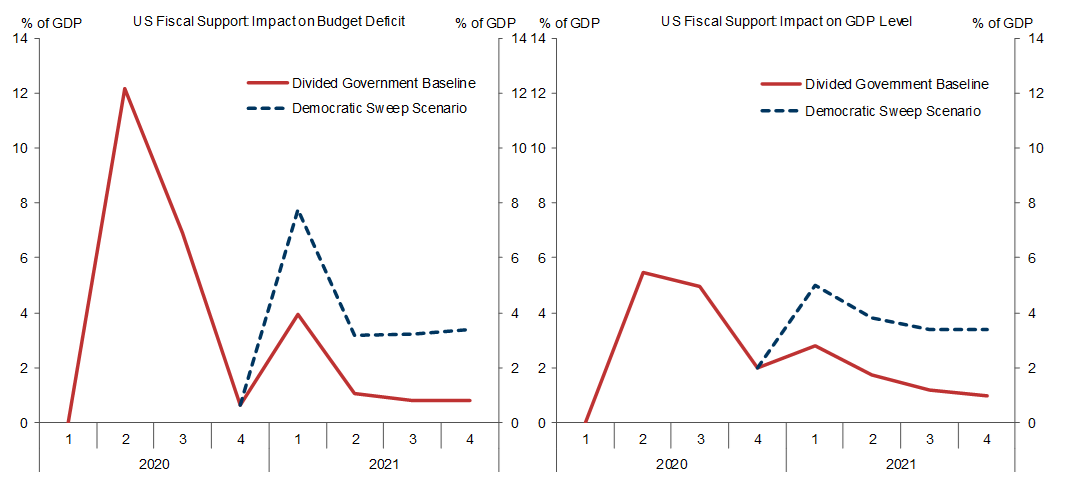

President-elect Joe Biden will likely have to work with a Republican Senate majority, limiting his ability to implement the Democratic fiscal agenda. Nevertheless, we expect a $1 trillion stimulus package, potentially enacted before his inauguration on January 20. This is less than half of what we might have seen under a Democratic sweep, but it should suffice for a small positive fiscal impulse to US growth in coming quarters.

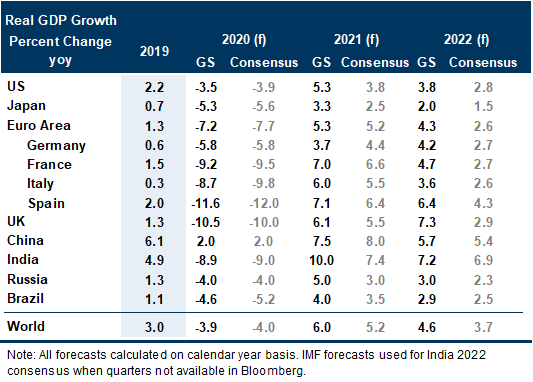

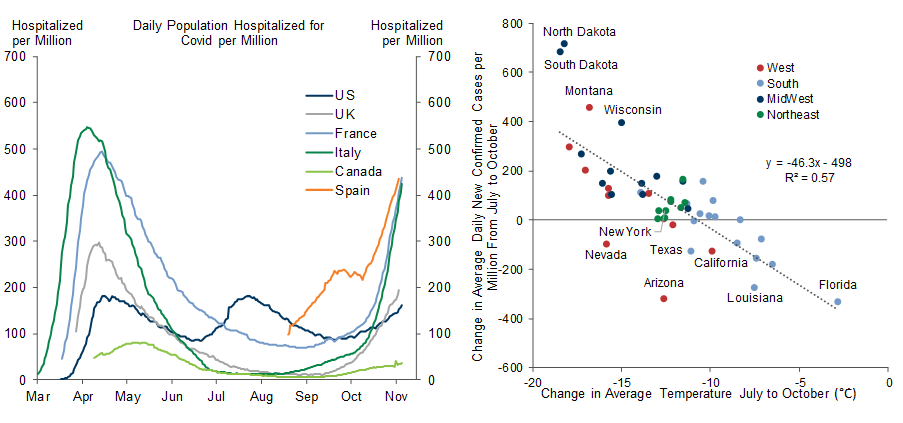

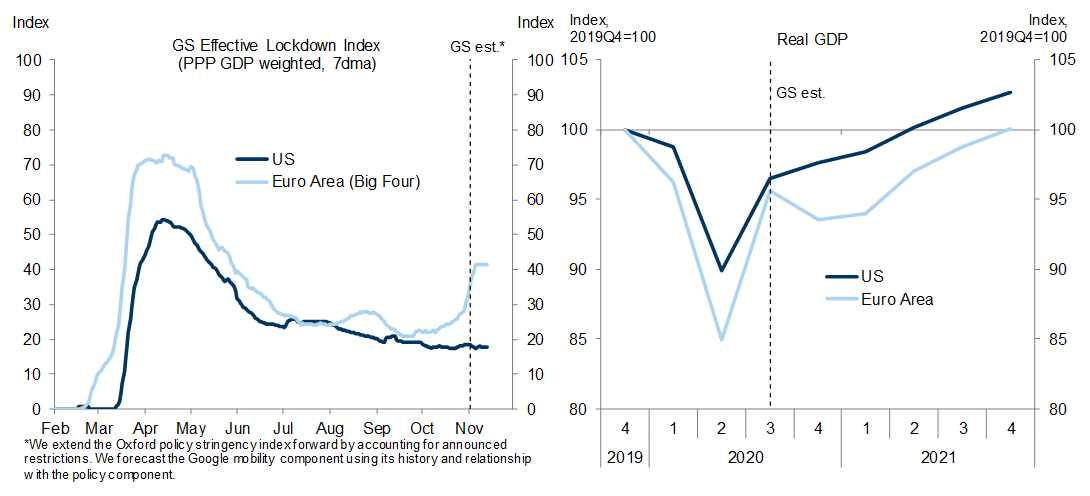

More important for the growth outlook is the second wave of coronavirus infections that is now sweeping the United States and especially Europe, where governments have already reacted with renewed partial lockdowns. This has led us to downgrade our Q4/Q1 GDP estimates on both sides of the Atlantic; in fact, we now expect the European economy to contract significantly in Q4. These revisions have brought down our 2021 global GDP forecast to 6.0% (vs. consensus of 5.2%) and the near-term risks remain on the downside.

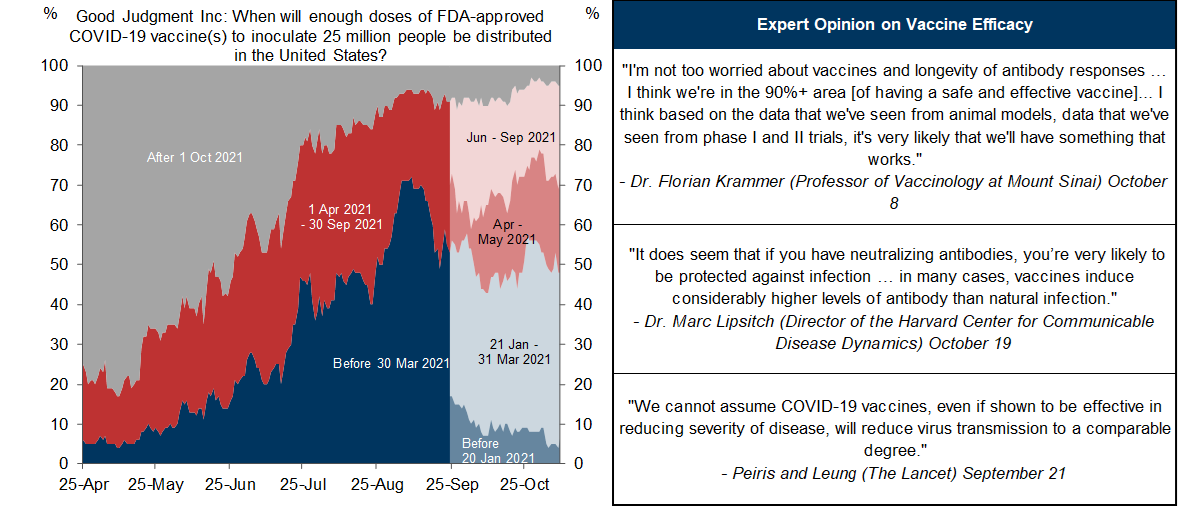

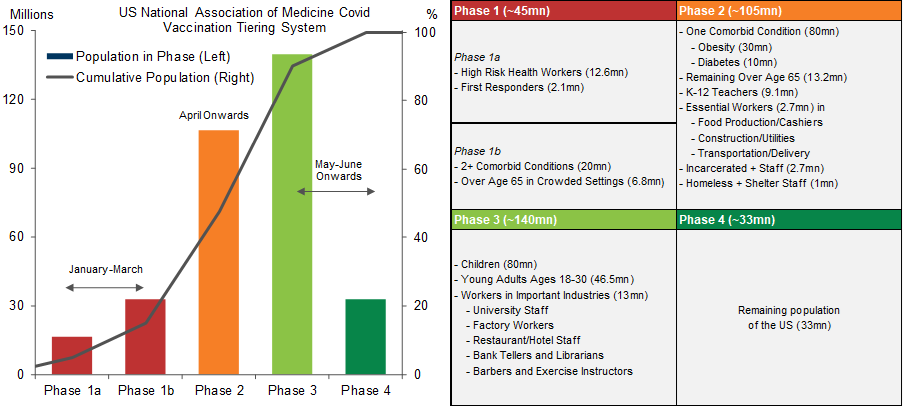

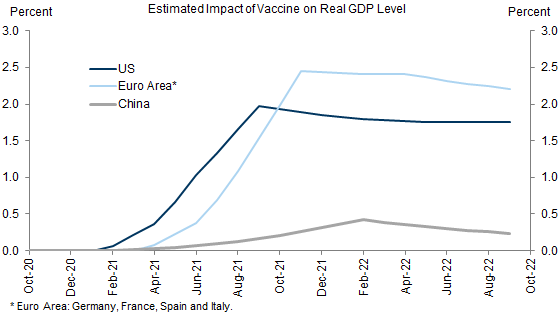

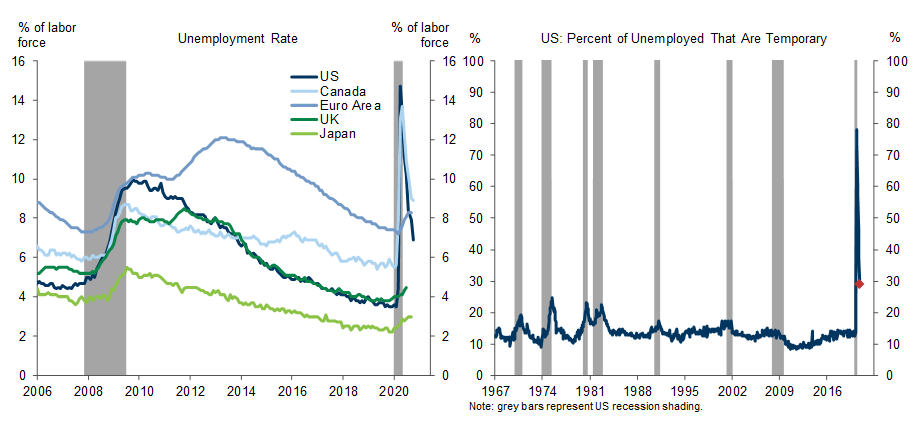

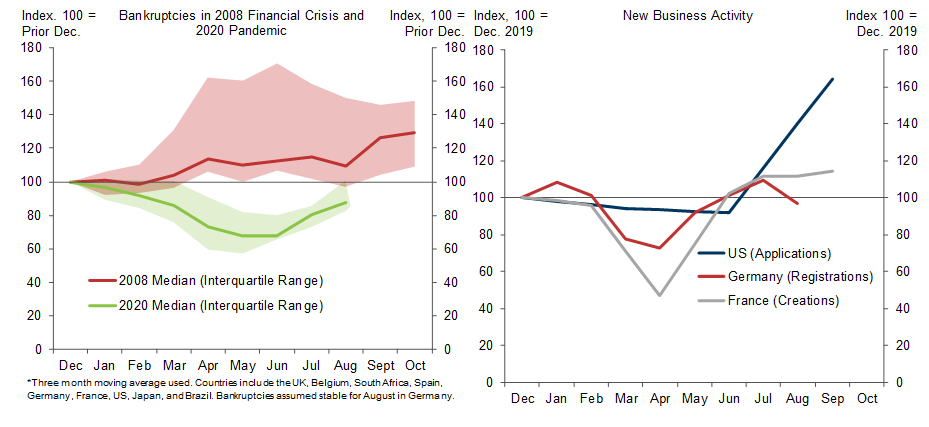

But just as the global economy rebounded quickly (albeit partially) from the lockdowns in the spring, we expect the current weakness to give way to much stronger growth when the European lockdowns end and a vaccine becomes available. Assuming the FDA approves at least one vaccine by January and mass immunization of the general population starts shortly thereafter, as we expect, growth should pick up sharply in Q2. The apparent lack of scarring effects from the earlier GDP plunge is consistent with this view.

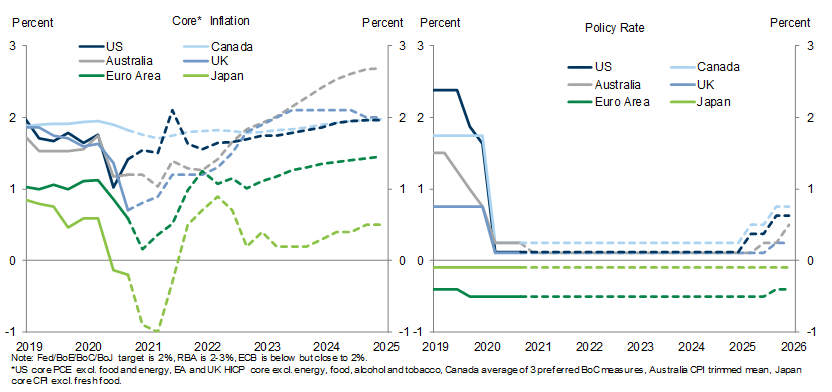

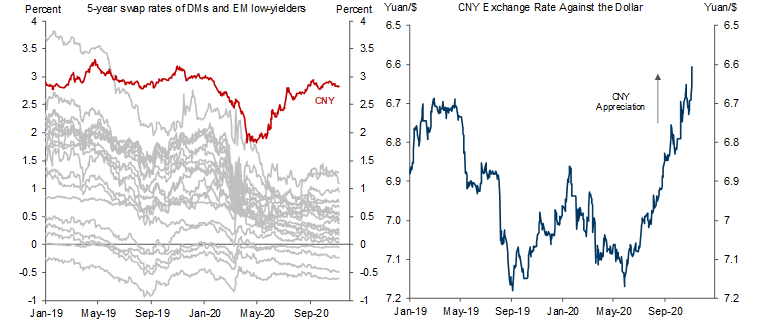

The DM central banks are likely to steer a dovish path for the next several years. Even under our forecast of a strong growth rebound, labor market conditions will normalize only gradually and inflation looks set to remain below central bank targets. We expect the Fed, the ECB, and the Bank of England to wait until 2025 before hiking rates; besides, the ECB looks set to deliver additional QE next month.

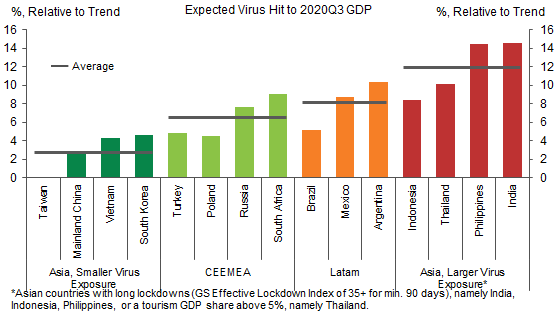

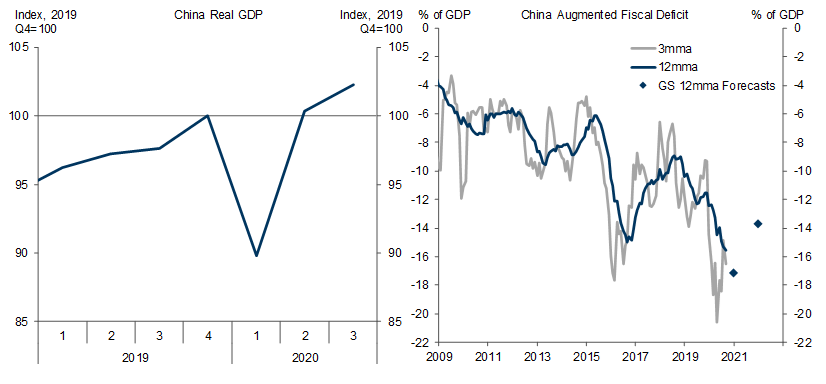

Our growth forecasts in the emerging world in 2021-22 are mostly above consensus. The main exception is China, where output is already back to pre-pandemic levels, credit is growing rapidly, and fiscal policy remains very expansionary. Policymakers look set to react by easing off the accelerator, which should result in a modest sequential growth slowdown.

V(accine)-Shaped Recovery

It's Still Mostly About the Virus

Exhibit 3: Sharp Rises in Hospitalizations and Infections Following Colder Weather

A Vaccine to the Rescue

Few Signs of Scarring So Far

Easy Monetary Policy Across DM

Marching to a Different Drummer

Exhibit 11: The Coronacrisis Hit the Emerging World in Very Different Ways

Rebound Coming

- 1 ^ Quarterly GDP changes are typically reported at an annualized rate in the United States and at a quarterly rate in Europe. We use annualized numbers throughout our Global Economics publications for consistency. An 8.7% annualized drop corresponds to a 2.3% not annualized decline.

- 2 ^ This assumes that it takes a couple of months between approval and availability of 25 million doses in the US.

- 3 ^ Regulatory changes, such as delays to bankruptcy filings, have likely also weighed on bankruptcies in several countries.

- 4 ^ See David Choi, “The Surprising Surge in Business Formation,” US Daily, September 28, 2020.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.