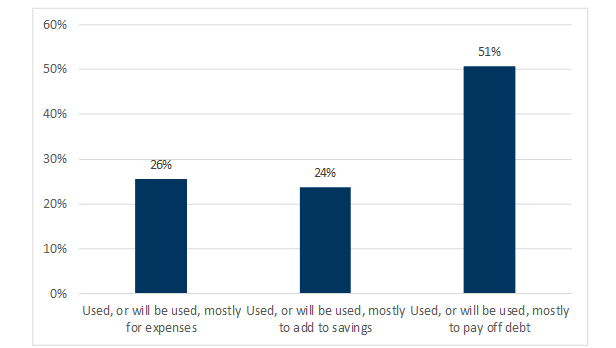

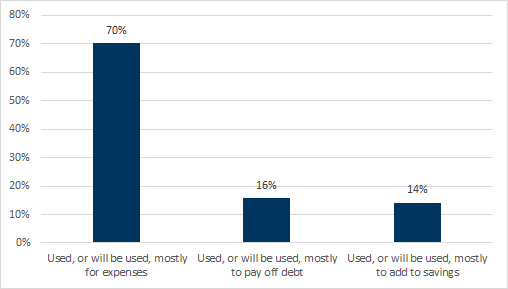

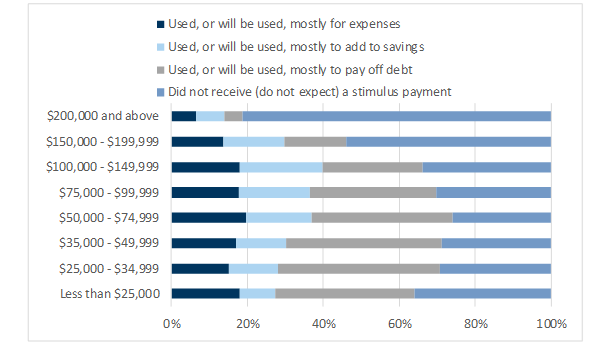

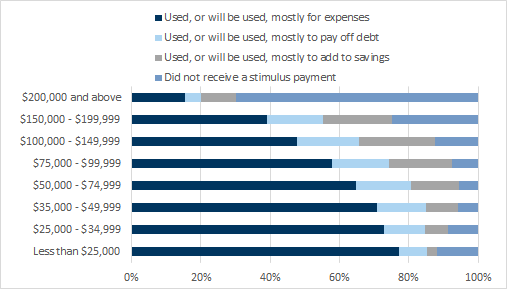

More consumers are saving their second stimulus checks / paying off debt compared to their first stimulus payments.

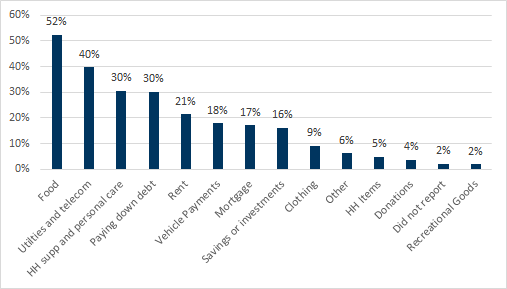

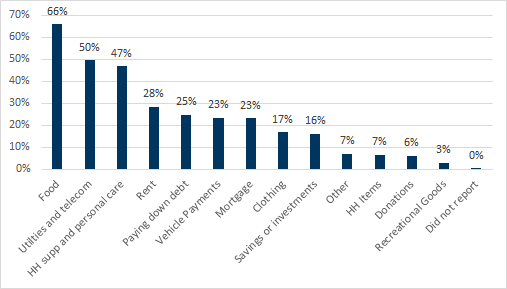

For those who received a check in the second round (or expected to receive), food remained the biggest category of spending, followed by utilities and HH supplies and personal care. Interestingly, fewer individuals noted spending their proceeds on apparel vs the last time.

Lower income households noted intention to use the proceeds to mostly pay down debt, versus the first round of payments when they mostly intended to spend it.

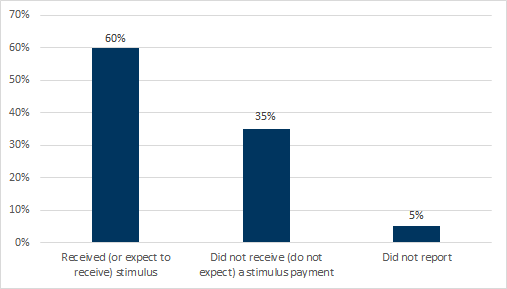

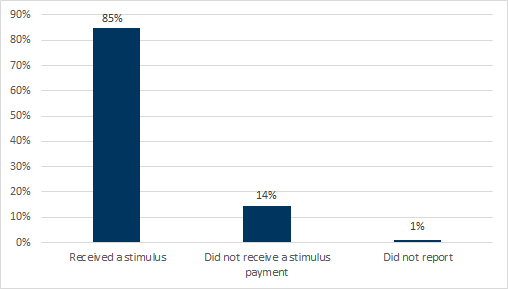

Finally, according to the survey results, fewer individuals received (or expected to receive) a stimulus payment in the second round versus the first round. That said, according to the IRS, the number of payments released were comparable — 147mn in round 2 vs 153 million in round 1.

More consumers are saving their stimulus checks / paying off debt

Essential spending remains top of mind for households

Exhibit 3: Food, Utilities and household supplies remain top of mind in Round 2...

Exhibit 4: ...although apparel moves lower vs Round 1 in the summer

Lower income households intend to pay down debt this time

Fewer individuals noted expectations to receive a second check

Exhibit 7: Round 2 - ~60% of respondents polled noted that they either received a payment, or expected to receive one

Exhibit 8: Round 1 - ~85% of respondents polled noted that they either received a payment, or expected to receive one

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.