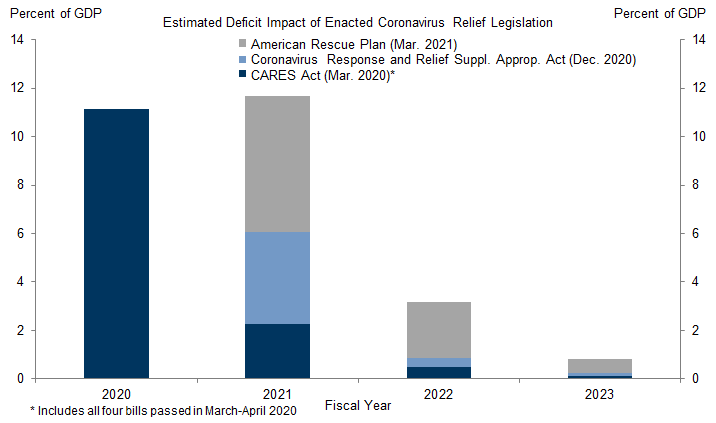

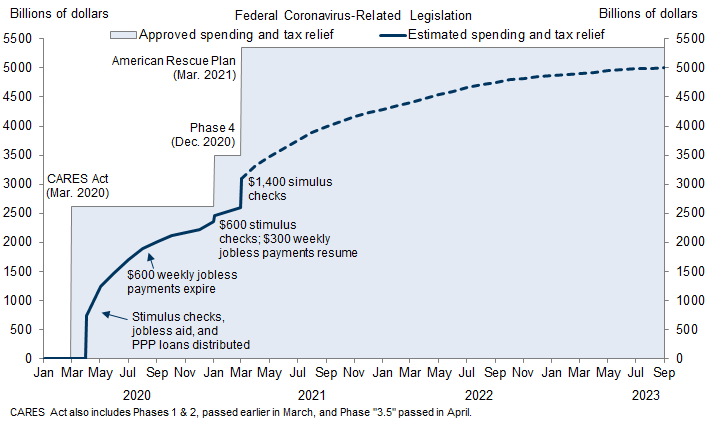

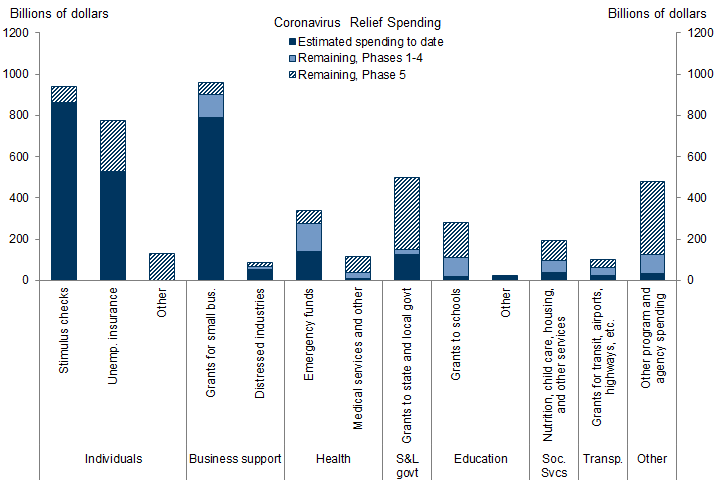

With last month’s enactment of the American Rescue Plan Act (ARP), Congress has likely passed its last emergency coronavirus relief bill. Over the course of a year, Congress enacted six laws that provided over $5 trillion in pandemic-related funding. We estimate $4 trillion of this has or will be spent by the end of 2021, reflecting the front-loaded nature of many of the provisions like stimulus checks, jobless aid, and grants for small and distressed businesses.

The remaining funds will likely take years to spend. Congress set aside hundreds of billions of dollars for state governments, schools, and other non-emergency programs where spending will occur more gradually. As a result, the slowdown in coronavirus-related spending will likely be sharp this year even if Congress renews certain provisions like jobless aid and the expanded child tax credit, which our forecast assumes. This slowdown likely adds pressure on congressional Democrats to enact additional fiscal measures later this year beyond infrastructure spending, which we think will take some time to ramp up once passed.

The US Fiscal Response to COVID-19: One Year and $5 Trillion Later

Blake Taylor

- 1 ^ The Congressional Budget Office allocates the entire effect of state and local government aid on the deficit in 2021. However, this accounting only reflects when the federal government transfers funds to states and localities, not when they spend the funds. The Treasury must make at least half of the $350bn in payments by May, but states are likely to take much longer to spend the funds.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.