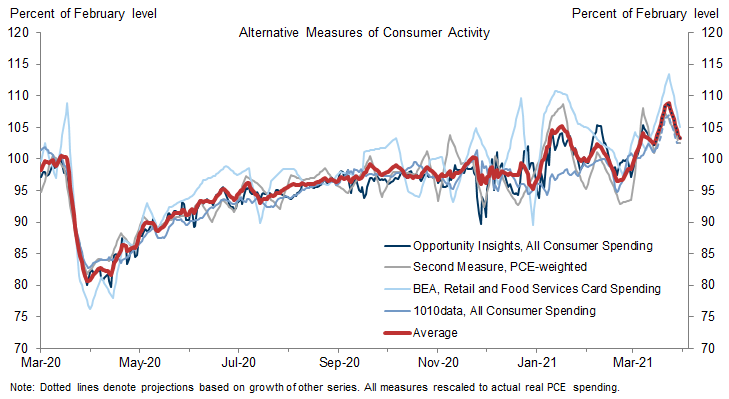

The spending response to the large amount of fiscal stimulus paid out in 2021H1 and post-pandemic spending from pent-up savings will be major determinants of the size and speed of the consumption rebound in 2021. In this US Daily we check in on both of these key growth impulses.

We find a strong spending response to the arrival of stimulus checks, with over 30% of the January checks spent in the first month and about 10% of the March checks spent in the two weeks after receipt. These marginal propensities to consume are broadly in line with those we’d expect under normal economic conditions, and the strong spending response to the March checks is one reason we expect a 9% increase in the retail sales report on Thursday.

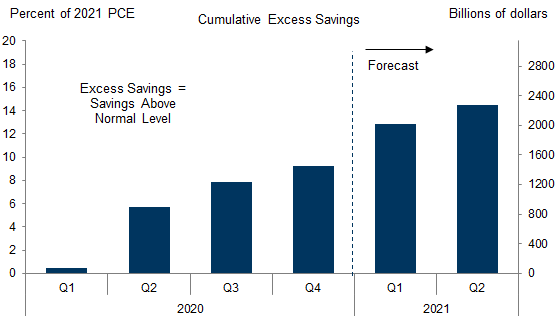

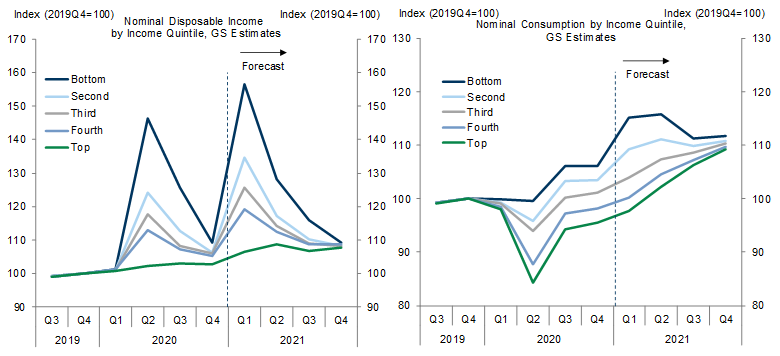

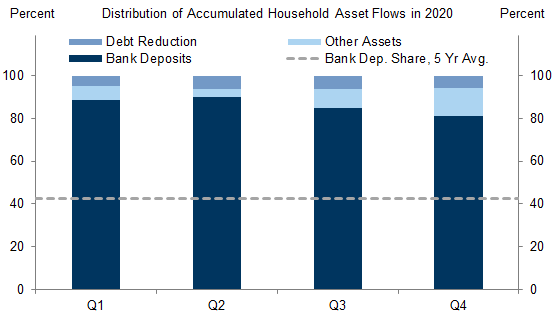

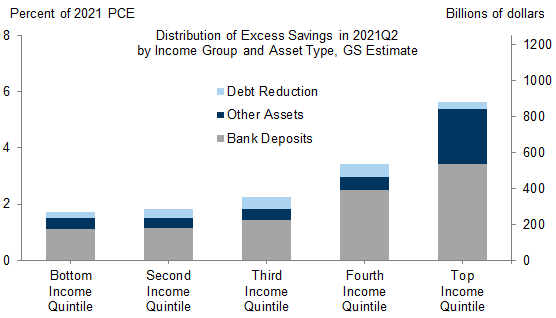

We also update our estimate of the post-pandemic spending boost from pent-up savings. Stronger spending growth and an earlier reopening boost should reduce the total amount of pent-up savings, but a somewhat larger share of the savings have remained in liquid bank deposit accounts than we anticipated. We now estimate that 22% of the excess savings will be spent in the first year after reopening, a bit above our earlier estimate, but still expect spending from pent-up savings to contribute roughly 2pp to GDP growth over this timeframe.

These patterns are broadly consistent with our overall consumption outlook, and we continue to expect annualized real consumption growth of +11.0% in Q1, +12.5% in Q2, +7.0% in Q3, and +7.0% in Q4. However, the strong spending response and large share of savings in liquid assets suggest some upside risk to our medium-term spending forecast.

An Update on Spending From Stimulus Checks and Pent-Up Savings

Exhibit 3: We Now Expect More Frontloaded Boosts to Income and Spending

Joseph Briggs

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.