Global Views: Why the Economy Won’t Overheat

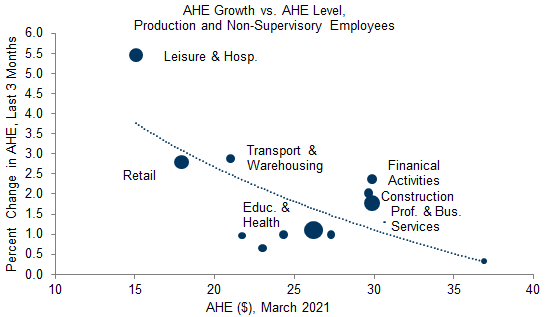

1. We would attribute the modestly disappointing 559k (seasonally adjusted) US jobs gain in May to the same two factors as the much bigger miss in April. First, there may be some constraints on the number of (seasonally unadjusted) net hires that firms can process in a given month, which then translates into a weaker seasonally adjusted number in months that normally see strong seasonal net hiring. This idea is consistent with the fact that the seasonally unadjusted job gain has hovered around 1m—near the very top end of the pre-2020 range—for each of the past four months. Second, labor supply is clearly constrained in the short term. Labor force participation has been treading water since last summer at levels 1.5-2pp below the pre-pandemic peak, job vacancies have surged, and Friday’s report saw a further 0.5% rise in average hourly earnings that was again concentrated in the low-paid leisure and hospitality sector, where the disincentive effects of the $300/week unemployment benefit top-up are most pronounced.

2. The big wage increase comes on the heels of a 3.06% year-on-year core PCE reading in April, a 29-year high. Part of this increase was widely expected because of the base effects and the post-pandemic normalization in service sectors such as travel, entertainment, and hotel accommodation. The surprise came from supply shortages in the industrial sector which drove a big pickup in prices of durable goods, especially used cars. Together with the increase in wage growth in recent months, this has reinforced concerns among some commentators that the US economy may be set for a damaging overheating on the back of excessive fiscal stimulus and an excessively accommodative monetary policy.

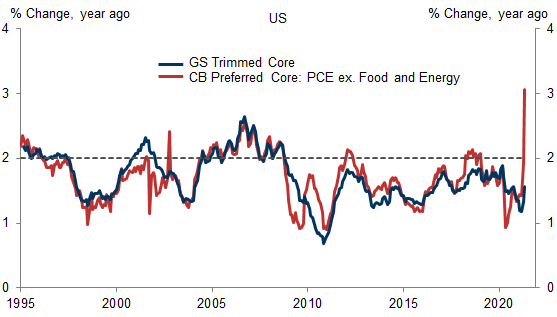

3. But there are strong reasons to believe that the inflation pickup will indeed remain transitory. On the wage side, labor supply should increase dramatically over the next 3-6 months as fear of the virus diminishes further and the $300/week benefit top-up expires—over the next few weeks in most Republican-controlled states and on September 6 in the remaining states. On the price side, our GS trimmed core PCE—which systematically excludes the one-third most extreme month-to-month price changes—remains at just 1.56% year-on-year, half the standard core PCE rate. This gap illustrates the unprecedented role of outliers in the recent inflation pickup.

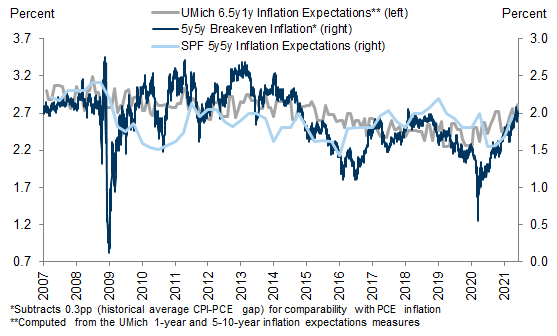

4. One would expect a price surge driven by outliers to have only limited effects on longer-term inflation expectations. And this is indeed what we are seeing, at least so far. The three main measures—consumer surveys, forecaster surveys, and TIPS breakevens—have all moved higher in recent months, but in each case the increase is far more pronounced at shorter horizons than longer ones. For both the Survey of Professional Forecasters and TIPS breakevens, the 5-year 5-year forward inflation rate remains at 2% in PCE terms. For the University of Michigan survey, we can calculate a forward rate using the 5-10 year expectation corrected for the 1-year expectation. This also looks broadly consistent with a 2% longer-term PCE expectation once we adjust (roughly) for the historical gap between consumer expectations and reality. We conclude that consumers, forecasters, and bond traders still seem to expect PCE inflation of around 2% in the longer term, consistent with the speech by Fed Governor Lael Brainard last week.

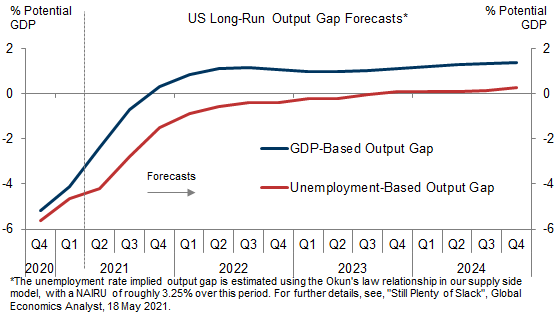

5. Ultimately, the biggest question in the overheating debate remains whether US output and employment will rise sharply above potential in the next few years. If the answer is yes, then inflation could indeed climb to undesirable levels on a more permanent basis. But our answer continues to be no. Even though real GDP is nearly back to the pre-pandemic level, we still see significant slack in the economy based on the remaining jobs shortfall of nearly 8 million and the pandemic-driven productivity gain of 4.1% year-on-year in Q1. Moreover, we think sequential GDP growth has probably already peaked in monthly terms and will trend down from here as the fiscal impulse wanes, modestly at first and then more sharply in late 2021 and 2022.

6. All this suggests that Fed officials can stick with their plan to exit only very gradually from the easy current policy stance. We still expect QE tapering to start in early 2022, with a ramp-up in guidance in August/September and a formal announcement at the December FOMC meeting. At the margin, our confidence in this call has risen slightly in the past month as the disappointing April/May job gains probably outweigh the higher inflation numbers, given Vice Chair Clarida’s remark on May 17 that the tapering decision will have “more of a focus on the labor market.” The timing of the first rate hike is much more uncertain because it largely depends on the behavior of inflation 2-3 years down the road, but our baseline forecast remains early 2024.

7. The longer-term outlook for where rates will settle is even more uncertain, and not only because the more distant future is always harder to forecast. Despite the long-standing love affair of macroeconomists with the notion of a “neutral”, “natural”, or “equilibrium” real interest rate, we don’t find r* a very helpful concept. Beyond the econometric issues with popular models such as Holston-Laubach-Williams, the key economic problem is that the impact of the real interest rate on GDP is economically small, statistically insignificant (at least in recent decades), and too easily disturbed by shocks to financial conditions. This means that backing out the “neutral” rate from the behavior of the economy is challenging, to say the least. What we can say is that real rates during the 2009-2020 expansion look like a low-side outlier relative to the longer-term cross-country norm of about 1%. This makes the 5-year 5-year forward TIPS yield of about 0% look too low in a probabilistic sense, although a large increase may require actual Fed hikes that push real rates into meaningfully positive territory without large adverse economic effects—and we don’t expect that test case to occur for another 4-5 years.

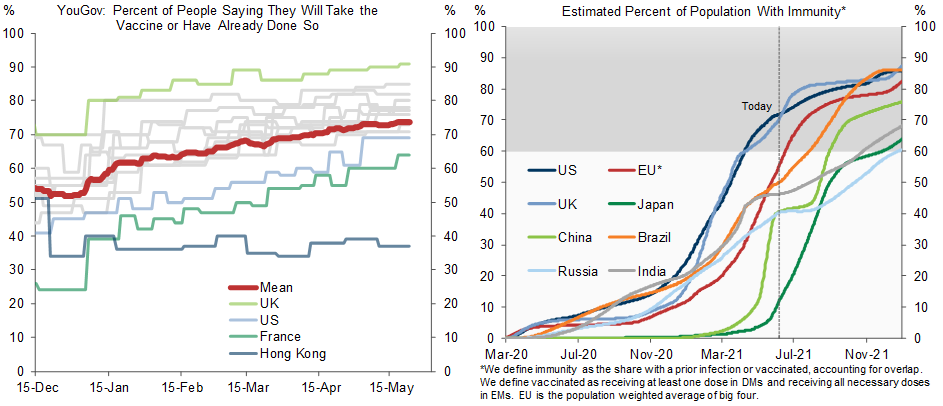

8. A friendly Fed supports our optimistic forecasts for global GDP growth of 6.6% in 2021 and 5.0% in 2022, both 0.6-0.7pp above the latest Bloomberg consensus. But the even more important driver is the continued pickup in global vaccinations, which are now running at 35 million or nearly 0.5% of the global population per day. Further acceleration from here will become more difficult because China is now close to its interim target of vaccinating 40% of the population. Nevertheless, we remain optimistic that 60-90% of the population in all of the world’s major economies will have some degree of immunity by yearend, through vaccination, prior infection, or a combination of the two. This should allow for a dramatic improvement in service sector activity and above-consensus GDP growth almost everywhere, with China—where the virus isn’t as much of a constraint on current activity—the only major exception.

9. Europe continues to record the sharpest near-term growth improvements, with manufacturing PMIs at all-time highs and service PMIs not far behind. The room for further acceleration from here looks more limited and we expect sequential GDP growth to peak in Q3 on a quarterly basis. But Europe has even further to run than the US before strong growth might raise any serious overheating concerns. While the ECB is likely to signal a marginally lower Q3 PEPP purchase pace at Thursday’s meeting, we think the program will run for another year and the first 10bp rate hike won’t occur until 2025 (versus market pricing of 2023). Across the English Channel, the gap between our views and market expectations is even greater, both in terms of our above-consensus growth forecast (8.1% vs. 6.1%) and in terms of our later-than-discounted liftoff (2025 vs. 2022); note that the latter gap reflects, in part, our expectation that the BoE will run assets off the balance sheet before hiking rates.

10. Our market views remain levered to a broadening of the global recovery at a time of friendly Fed policy and only gradually rising longer-term US Treasury yields. This should help a broad range of non-dollar currencies, most prominently the Euro. We still like commodities not only from a cyclical perspective, but also as an expression of longer-term views on underinvestment and—in the case of copper—climate change mitigation. We also maintain moderately positive views on credit and equities, though with less conviction than previously both in terms of overall direction and—in light of the peaking of US growth—in terms of our preference for cyclical sectors.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.