Global Views: A Favorable Midyear Report

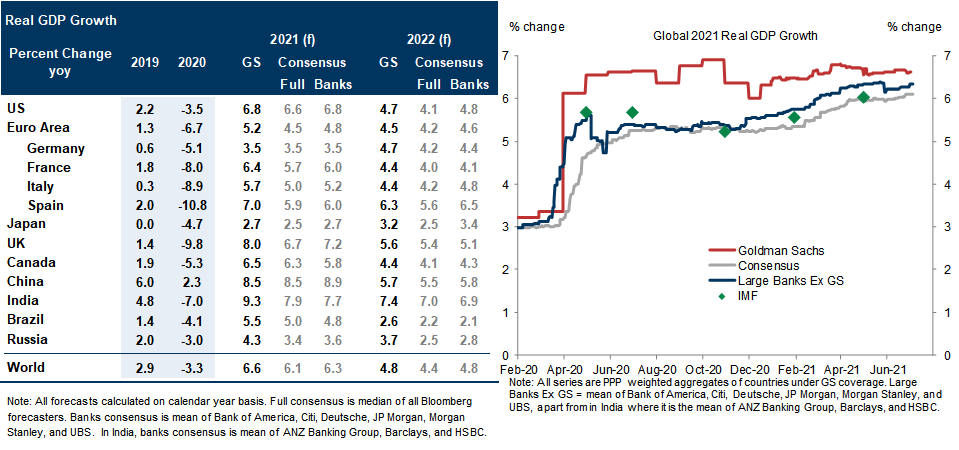

1. Our global GDP growth forecasts of 6.6% in 2021 and 4.8% in 2022 remain optimistic in absolute terms, but are now closer to the consensus than at any point since April 2020. This is especially true if we restrict the comparison to economists at major banks, who have raised their numbers by even more than other participants in the Bloomberg survey. Consistent with our less out-of-consensus view, the fundamental growth news has turned more mixed recently. On the positive side, the US job market recovery is accelerating, the European PMIs continue to make new highs, and the global vaccination campaign has pushed covid fatalities to the lowest levels of 2021 despite widespread reopening. On the negative side, US demand growth has slowed since the March/April surge, post-pandemic labor and goods sector shortages are weighing on output, and the spread of the Delta variant is offsetting vaccination-related progress on new infections.

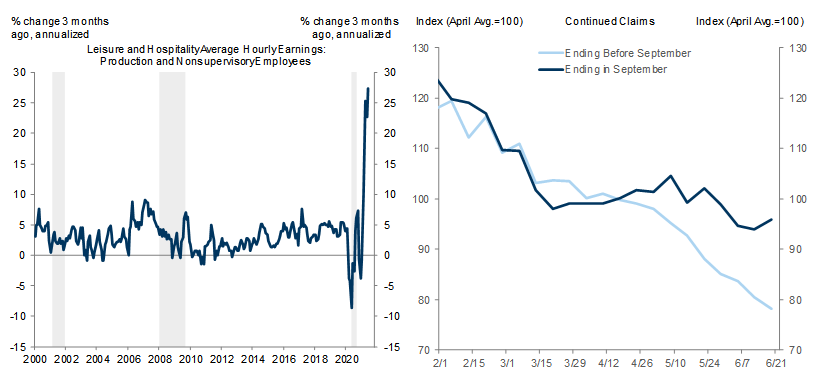

2. We have attributed the US payroll misses in April/May to adverse seasonals and benefit-related labor supply shortages at the bottom end of the payscale. The somewhat stronger-than-expected 850k jobs gain in June supports this interpretation, as both of these drags are now diminishing. Over the next few months, the seasonal factors will add to seasonally unadjusted job growth and the normalization of benefits should trigger a sharp pickup in labor supply (as illustrated by the declines in continuing jobless claims in Republican-controlled states where the $300/week top-up is already expiring). This should set the stage for seasonally adjusted payroll gains averaging around 1mn in the next 3-4 months, a notable decline in the unemployment rate, and a rebound in labor force participation.

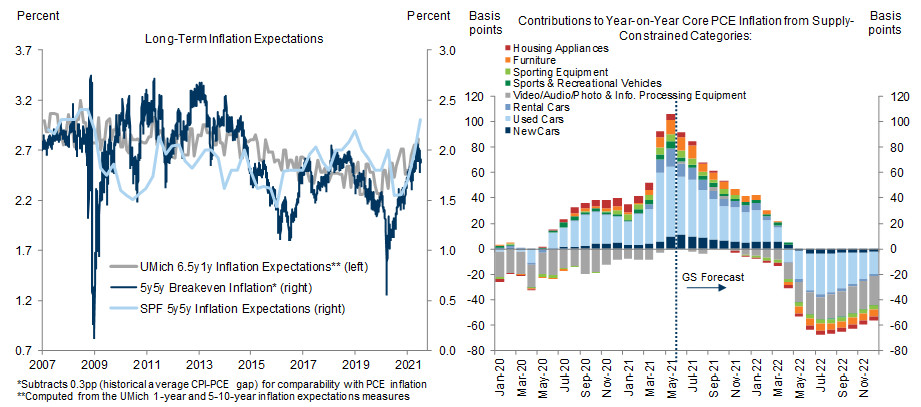

3. In coming months, US growth should benefit not only from stronger job creation but also from a positive inventory cycle, following a likely large drawdown in Q2. Subsequently, however, we expect a sizable slowdown as reopening concludes and the fiscal impulse turns negative, with spending out of pent-up savings providing only a partial offset. In fact, our growth forecast of 2.6% in 2022 and 1.9% in 2023 (measured on a Q4/Q4 basis) is now ½-¾pp below the median FOMC projection, despite the fact that we incorporate a $3trn spending increase over 10 years that is partially offset by a $1½trn tax increase (i.e. we assume that President Biden manages to pass most of his longer-term fiscal agenda). The likely growth slowdown on the back of a negative fiscal impulse remains an important reason why we disagree with the view that the 2021 stimulus will overheat the economy and keep inflation above target on a sustained basis. We also take comfort from the stability of longer-term expectations and the extremely concentrated nature of the recent price increases, which are likely to reverse before too long and should temporarily push core PCE inflation well below 2% in mid-2022.

4. Based in part on Chair Powell’s “a ways off” comment at the June FOMC press conference, we still think a Fed tapering announcement is unlikely until the December meeting. The higher-than-expected dots in the face of a broadly unchanged 2023 inflation forecast did suggest that Fed officials are interpreting the new average inflation targeting (AIT) framework in a slightly more mechanical and backward-looking fashion than we had thought; thus, we pulled forward our modal forecast for the first hike from 2024 Q1 to 2023 Q3. That said, we think the probability that the first hike will come before 2024 is still only modestly above 50%, as our forecasts for both growth and inflation in 2022-2023 are already below the FOMC median and any further slippage could take higher rates off the table for considerably longer.

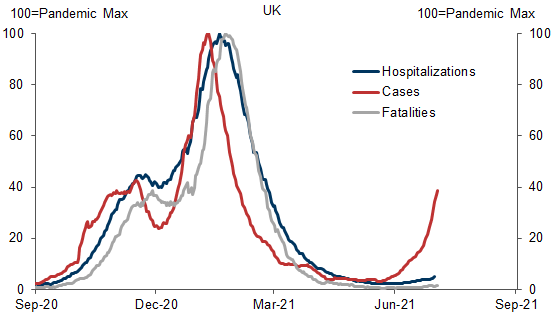

5. The sharp rebound in infections in the UK and the spread of the Delta variant across much of Europe have led us to shave our growth forecasts slightly, not only in the UK but also in Spain and Italy, where renewed restrictions could weigh on the remainder of the summer tourist season. The good news is that both the medical evidence and the aggregate UK data show that the vaccines remain highly effective against the variant, especially as far as hospitalizations and deaths are concerned. With the most vulnerable European populations now largely vaccinated, this should keep the human and economic toll much more limited than in past outbreaks, even if infections rebound more notably in coming weeks. We therefore continue to project above-trend growth in both the Euro area and the UK in coming quarters, albeit at a gradually declining pace.

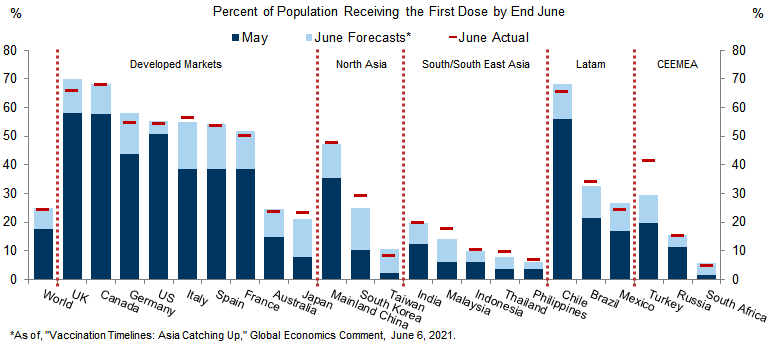

6. We remain relatively optimistic on EM growth, mainly because we expect continued improvement in the vaccination outlook to offset the spread of the Delta variant. Not only is the pace of EM vaccinations coming in above our (relatively upbeat) forecasts, but we have once again lifted our global vaccine production estimate and now expect 13.1bn doses by yearend. With DM demand likely to become increasingly saturated in coming months, the ongoing improvement in the supply outlook should disproportionately benefit the emerging world, especially Latin America and CEEMEA, where infection levels are generally higher and output is therefore more depressed. Although interest rate hikes on the back of sharply higher (headline) inflation in EM economies such as Brazil, Mexico, and Russia could weigh on near-term growth, they should help anchor expectations for the long term. Moreover, we think rising vaccination will ultimately turn out to be more important than near-term rate hikes because it should boost GDP significantly from both the demand side and the supply side.

Exhibit 5: EM Vaccinations Mostly Coming in Above Our Forecasts

To estimate the share of the world population vaccinated with a first dose, we take the Our World in Data estimate and then add our internal estimates for China and Saudi Arabia, as these countries do not provide a regular first dose split.

Source: Our World in Data, Goldman Sachs Global Investment Research

7. Our market views retain a constructive tilt. Although we see less upside to consensus growth forecasts than before, we also worry less about downside scenarios—e.g. another large covid-related shutdown or much higher and more persistent inflation—than many market participants. That said, with valuations now quite high, our views across the major asset classes have become more nuanced. In rates, we think the duration rally has gone too far and expect yields to rise in the second half of 2021. In credit, we recommend moving up in quality because valuations—especially in the riskiest part of the market—are now very high. In equities, we remain broadly constructive but see the best opportunities outside the US, especially in emerging markets. In FX, we have scaled back our forecasts for dollar downside against the euro but also like EM currencies. And finally, we remain bullish on commodities, not only for cyclical but also structural reasons, most importantly the long period of underinvestment following the 2008 crisis.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.