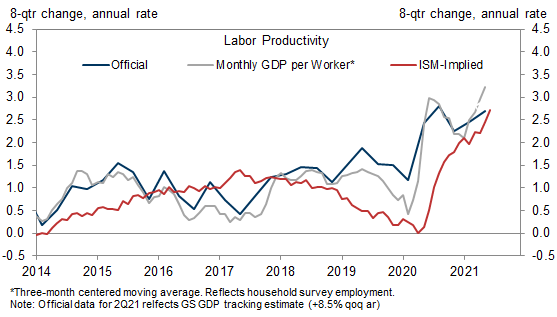

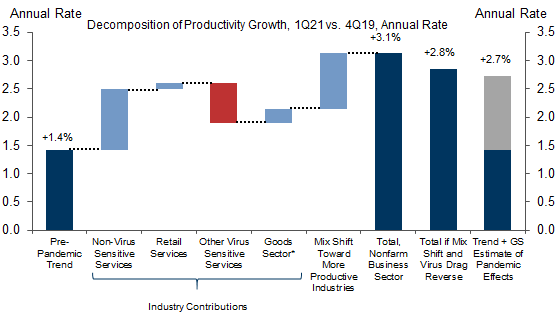

Stronger productivity growth has been one of the silver linings of the pandemic, with 3.1% annualized growth in output per hour since the start of the crisis (vs. +1.4% in the previous business cycle). Higher-frequency measures indicate further gains in the middle of the year. In this Analyst, we explore the composition of the productivity acceleration to better understand its drivers and sustainability.

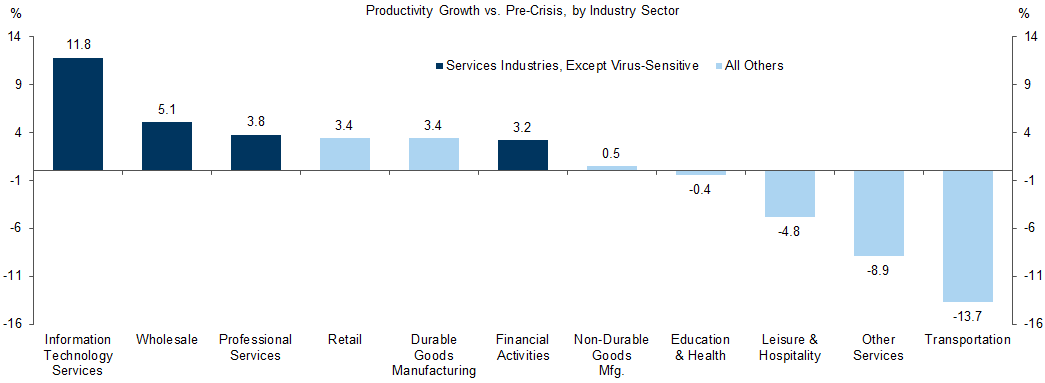

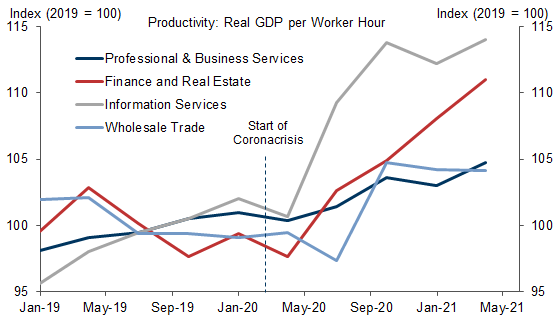

We find that productivity gains since 4Q19 are most pronounced in industries where virtual meetings are feasible and in-person expenses like travel & entertainment have scope to decline, for example information technology services, professional services, and product development/wholesale trade. These efficiency improvements from digitization continued in Q1 despite the reopening of the in-person economy and the partial return to corporate office buildings.

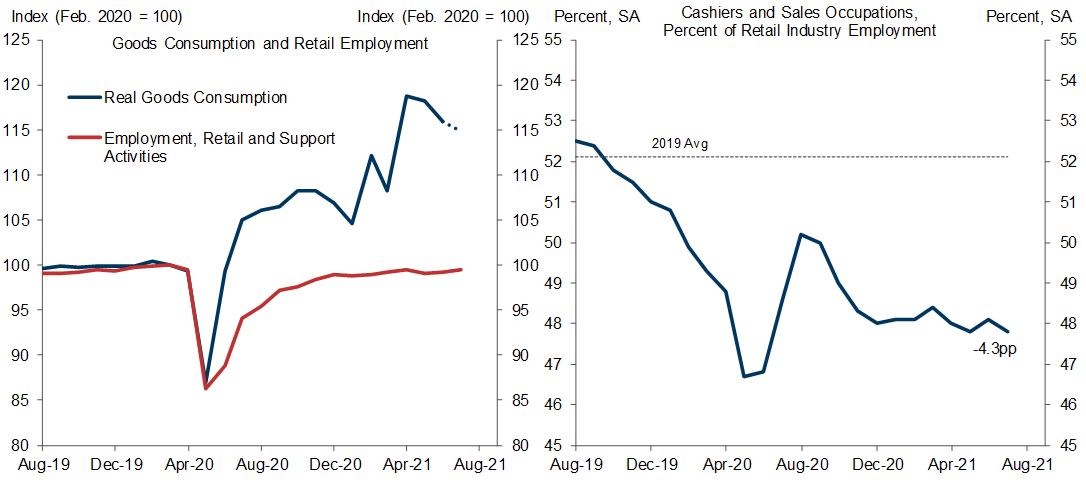

The retail sector ranks fourth across industries in terms of pandemic productivity performance, consistent with a boost from ecommerce and from evolving brick-and-mortar business models (expanding curb-side pickup, “Buy Online Pickup In Store”). Timely data indicate these gains persisted in Q2 even as malls reopened and the stimulus boost faded. The composition of retail employment is also consistent with efficiency gains from digitization, with four fewer cashiers and salespeople for every hundred workers (June 2021 vs. 2019).

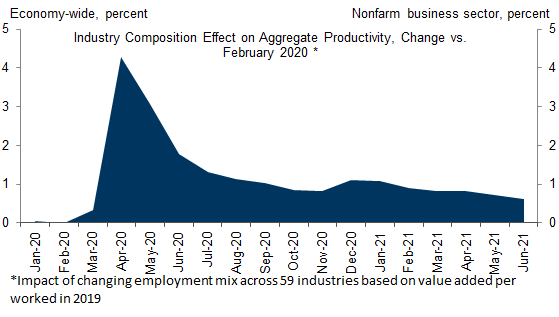

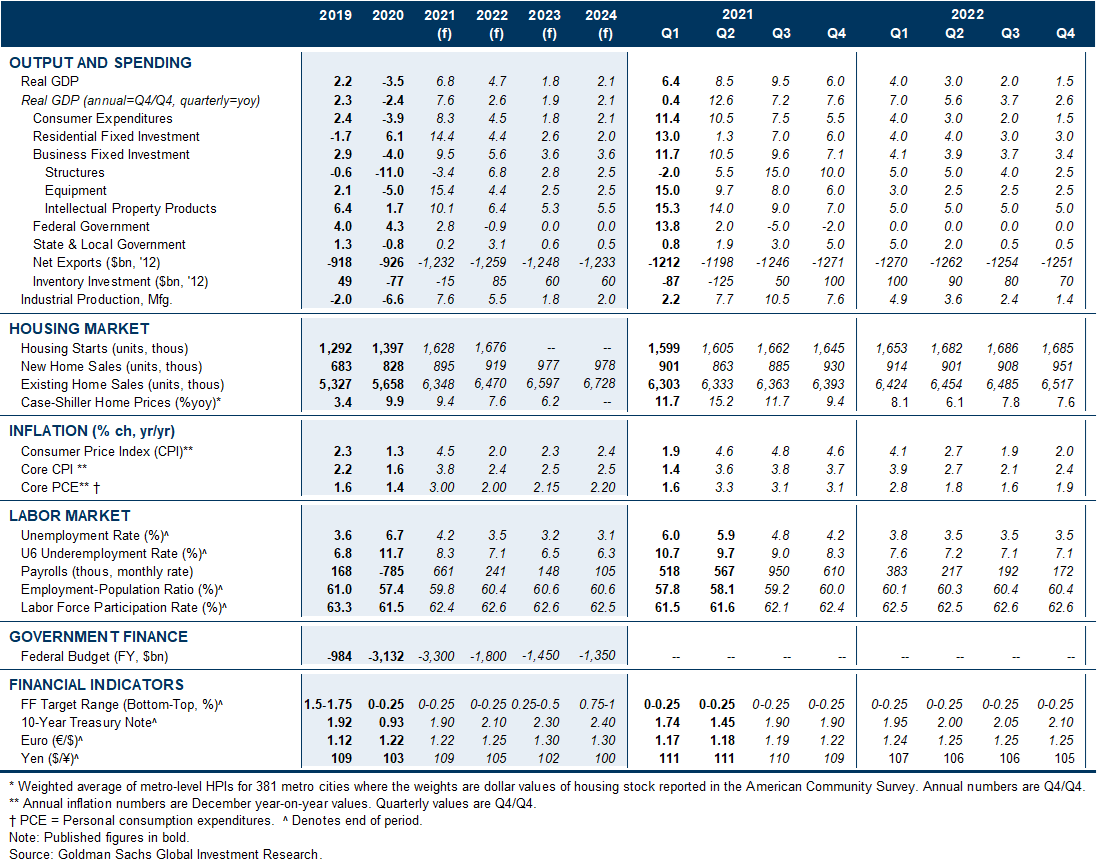

Decomposing the 1.7pp acceleration in the productivity trend, we find that non-virus-sensitive services account for more than all of the within-industry acceleration (+1.1pp), with retail (+0.1pp) and goods production (+0.3pp) also contributing. We also find that the offsetting drag from still-depressed virus-sensitive categories (-0.7pp) itself has been roughly offset by the temporary boost from industry composition (+1.0pp). A full reversal of the final two effects would bring the annualized productivity trend to +2.8%, double its pre-crisis pace and within a tenth of our fundamental estimates of pandemic efficiency gains.

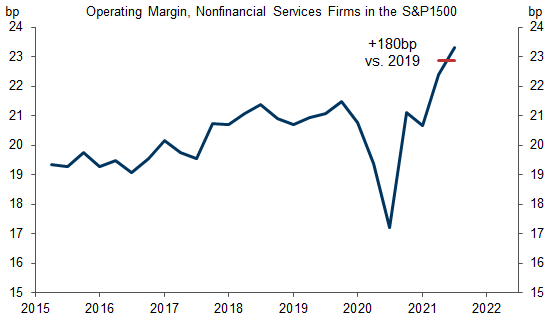

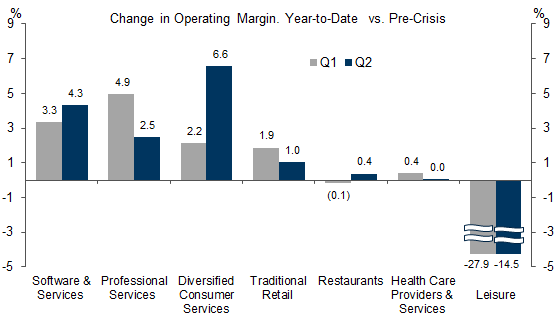

Company data mirror the productivity growth rebound in the GDP statistics and suggest that it continued into Q2. Operating margins for S&P 1500 nonfinancial services firms are tracking 180bp higher than pre-crisis, with even larger gains in industries where gains from digitization are clear-cut: technology services, professional services, and non-virus-sensitive consumer services.

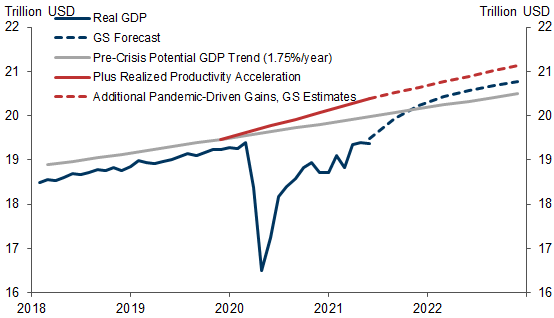

We continue to expect the evolution of business models and gains in worker efficiency to boost the level of productivity in the nonfarm business sector by around 4% by 2022—or a +1.3pp boost to annual productivity growth over three years. The productivity acceleration to date and our fundamental-based estimates suggest that the output gap is roughly twice as large as the pre-crisis trend would imply (at 4-4.5% in Q2). This would lengthen the runway for expansion as the business cycle matures.

A Persistent Productivity Pickup

Exhibit 5: Retailer Productivity Gains Haven’t Reversed Despite the End of Stimulus Checks and the Reopening of Brick & Mortar; Digitization of the Consumer Experience Could Mean Fewer In-Person Sales Staff

Exhibit 8: Corporate Margins Also Consistent with a Productivity Boost in the Service Sector

Exhibit 9: Margin Improvement Is Particularly Impressive Among Remote Work-Friendly Industries; Brick & Mortar Retailers Also Benefiting

Exhibit 10: Pandemic-Driven Productivity Gains Imply a Longer Runway for Expansion

Spencer Hill

- 1 ^ Over three-quarters of the lockdown-period distortions to productivity levels have unwound alongside the normalization in the jobless rate itself (5.9% in June, down from 14.8% in April 2020).

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.