Market worries about a global growth slowdown have increased following virus resurgence, uncertainty about US fiscal stimulus, and China growth concerns. At the same time, the spending of "excess" savings households have accumulated during the pandemic once normal economic life returns could in principle sustain rapid growth. We estimate the growth boost from running down these “excess” savings in large economies.

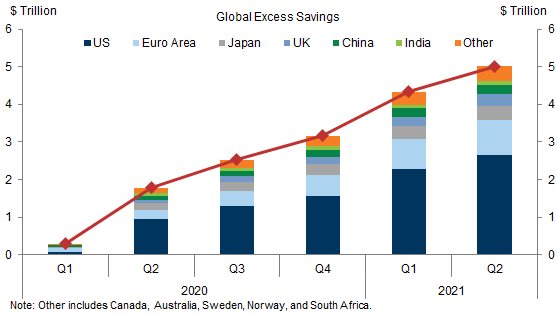

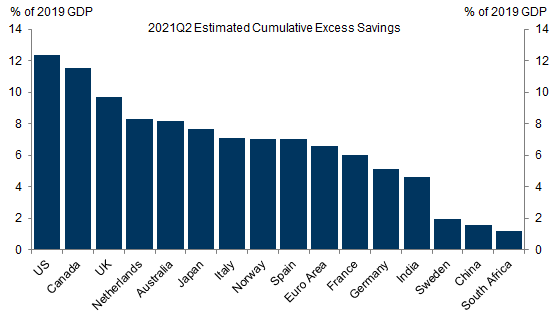

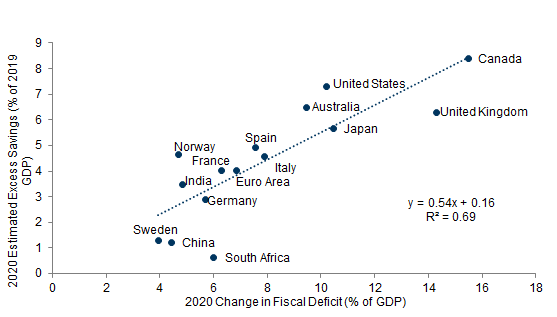

Households have accumulated $5tn in excess savings globally, concentrated among advanced economies, led by the US and Canada with 12% of 2019 GDP, and the UK with 10%. Excess savings are generally smaller in the emerging world but do account for 5% of GDP in India. Not surprisingly, countries with the most fiscal support in 2020 also have the highest excess savings.

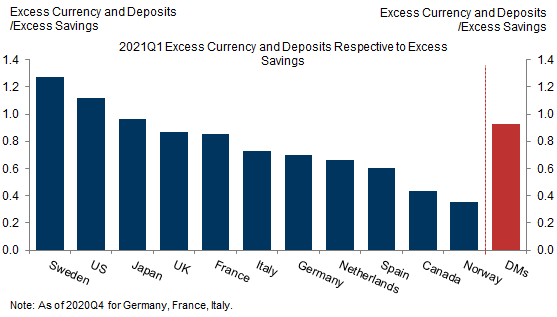

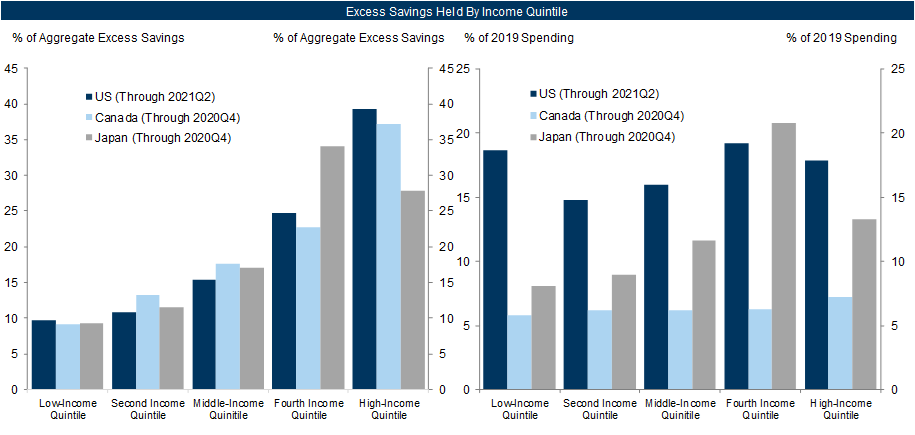

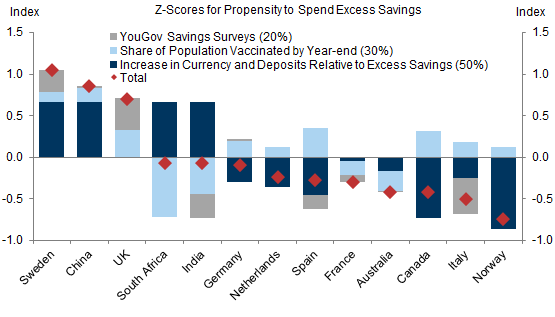

Both the form in which excess savings are held and their distribution across households suggest that the propensity to consume out of savings will be larger than the typical propensity to spend out of wealth. We estimate that liquid currency and deposits have increased by an amount corresponding to 90% of excess savings across DMs. Although most of the excess savings in the US, Japan, and Canada are held by top income earners, when viewed as a share of consumption, they are distributed more equally.

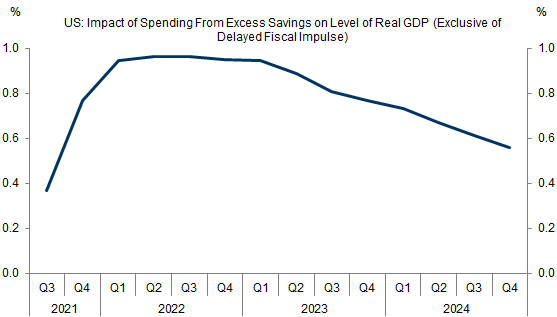

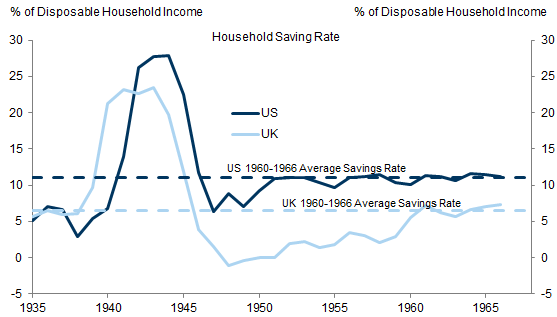

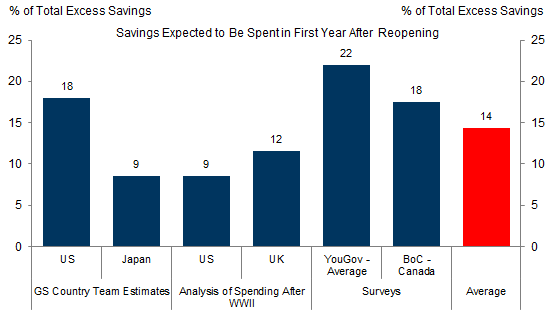

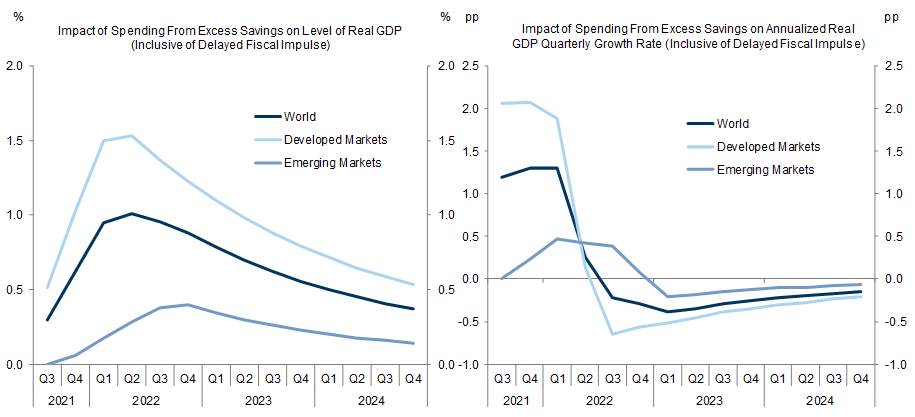

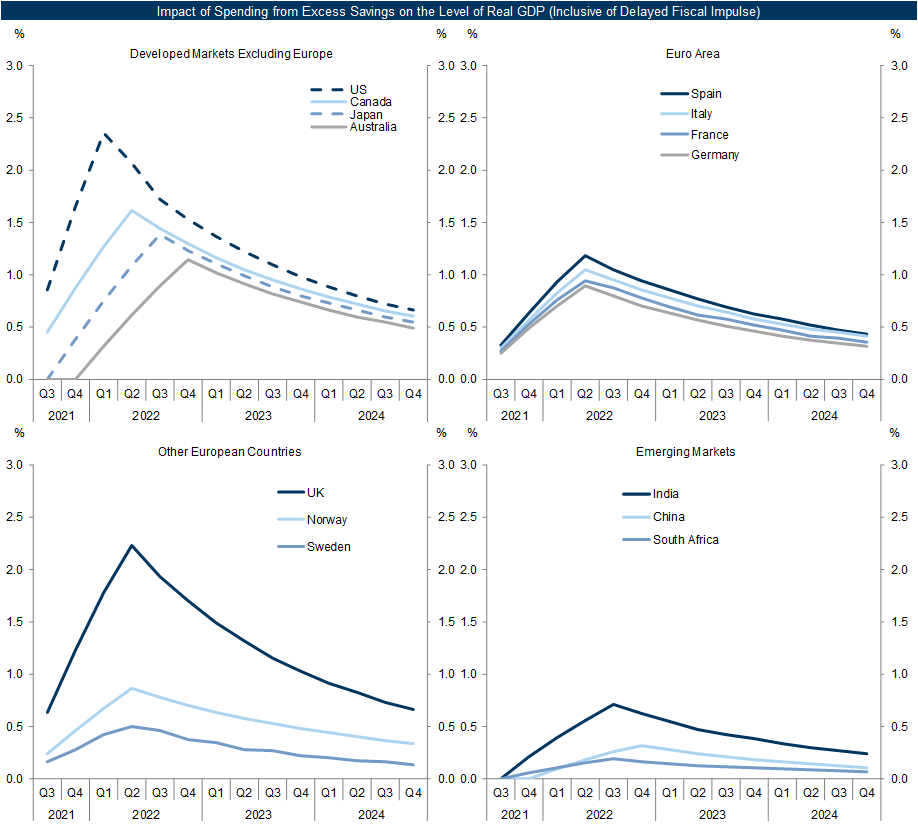

We estimate that 14% of excess savings will be spent within a year of reopening, on average, based on estimates from our US and Japan teams, the US and UK WW2 experience, and surveys. We estimate a peak boost from the run-down in excess savings, and inclusive of delayed effects of fiscal support to households, to the level of global GDP of 1% in mid-2022, and to global growth of 1¼pp at the start of next year. The GDP boost is the largest in the US and UK, peaking at 2¼%, followed by Canada, Japan, and Australia. The impact is more moderate in the Euro Area, and smaller in emerging markets, except for India.

Overall, our analysis of pent-up savings supports our still above consensus global GDP growth forecasts of 6.5% in 2021 and 4.8% in 2022, along with our optimistic view on global vaccinations.

The Boost From Pent-Up Savings

$5tn of Excess Savings

Who Saved During the Pandemic and How?

How Much Will Be Spent: A Global Approach

Step 1: Estimation of the International Average Spending Propensity

Step 2: Estimation of Country Spending Propensities

Step 3: Estimation of the Growth Impulse

Sid Bhushan

Daan Struyven

- 1 ^ See Joseph Briggs and David Mericle, “Pent-Up Savings and Post-Pandemic Spending”, US Economics Analyst, 15 February 2021; Christian Schnittker, “The Great Post-Pandemic Savings Unwind”, European Economics Analyst, 17 January 2021; Nikola Dacic, “Consumer Spending After the Saving Windfall”, European Economics Analyst, 12 July 2021; Naohiko Baba, “Pent-Up Demand – How Much Will Be unlocked, and By Whom?”, Japan Economics Analyst, 28 April 2021; Maggie Wei, “China: Households’ excess savings around the pandemic”, Asia in Focus, 15 March 2021.

- 2 ^ For Japan and India, where we do not have 2021Q1 savings data, we estimate savings based on consumption growth during the quarter.

- 3 ^ Our Europe team has estimated that restrictions drove much of the excess savings. See Christian Schnittker, “The Great Post-Pandemic Savings Unwind”, European Economics Analyst, 17 January 2021 and Nikola Dacic, “Consumer Spending After the Saving Windfall”, European Economics Analyst, 12 July 2021.

- 4 ^ See Laura Nicolae, “Pent-Up Savings and inflation After World War 2”, US Daily, 25 February 2021.

- 5 ^ For our range, we take the second highest and second lowest of the five estimates in step 1.

- 6 ^ YouGov surveys are the average of 1) how much of pandemic savings do you expect to spend by the end of the year, 2) has your household been able to save more, and 3) how has your household’s financial situation changed since the start of the pandemic. For missing values, we assume the sample average, apart from emerging markets which are missing data on currency and deposits, where we assume the maximum because other financial markets (e.g. equity) are likely less developed than in advanced economies.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.