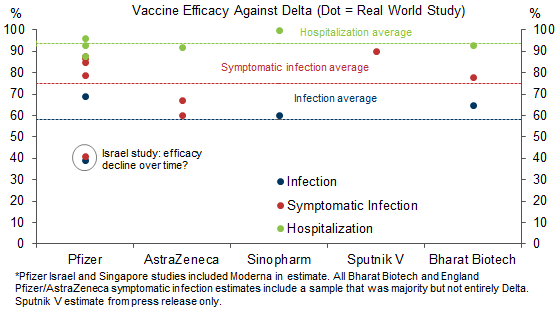

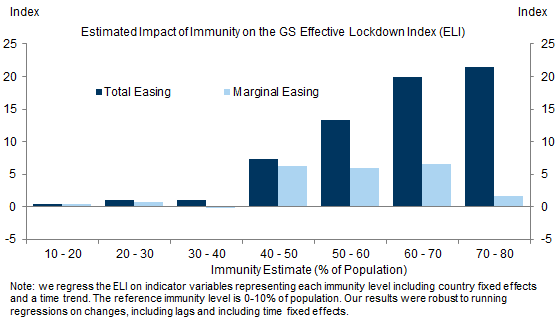

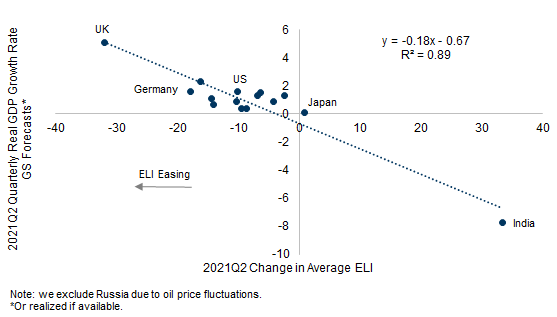

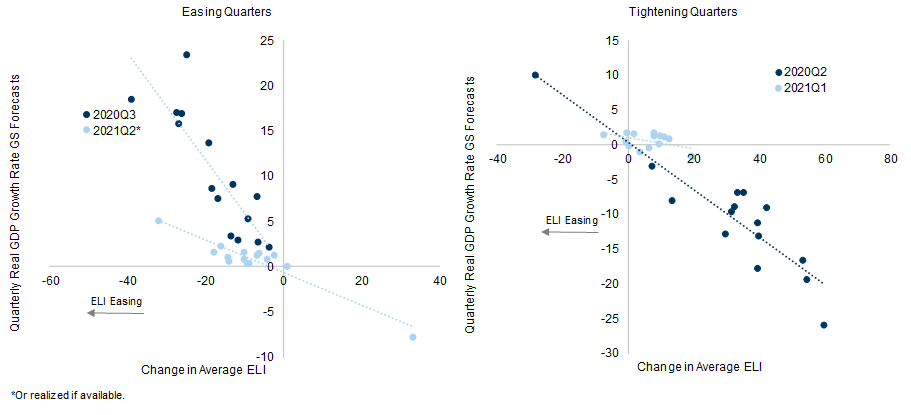

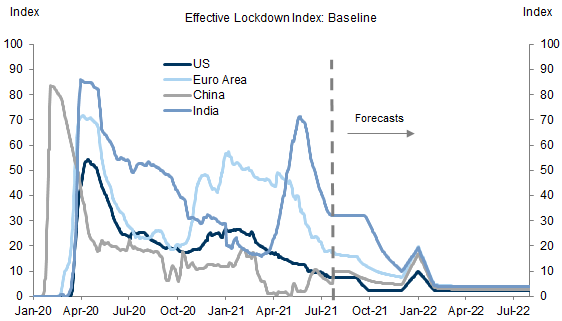

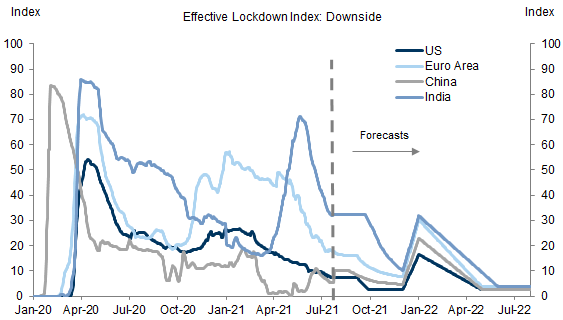

The three pillars underlying our view that vaccinations will further drive a strong global recovery remain intact. First, we expect the world to produce 13bn vaccine doses this year, all providing solid protection against severe disease. Second, rising immunity leads to substantial easing in our GS Effective Lockdown Index (ELI)—a combination of official restrictions and actual mobility data. Third, ELI easing continues to predict GDP growth well.

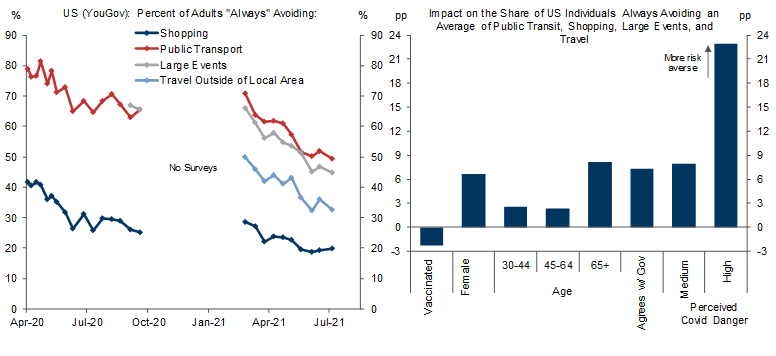

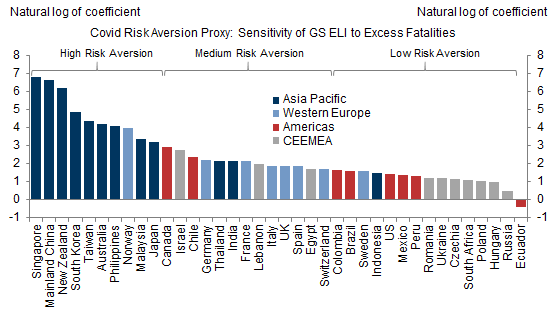

However, we expect the remaining part of the service sector recovery to be less rapid than the early stages. Delta outbreaks are weighing on growth, and we see a fairly high probability that either winter seasonality, some reduction in natural or vaccine-induced immunity, or a somewhat more transmissible/evasive future strain lead to another temporary episode of moderate ELI tightening. Moreover, the concentration of the remaining weakness in services spending among individuals, sectors, and countries with a higher exposure or aversion to virus risk suggests that the remainder of the recovery will be more gradual.

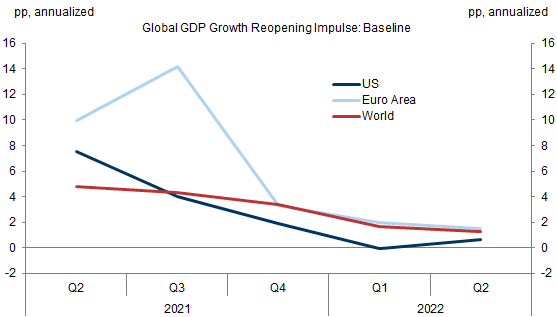

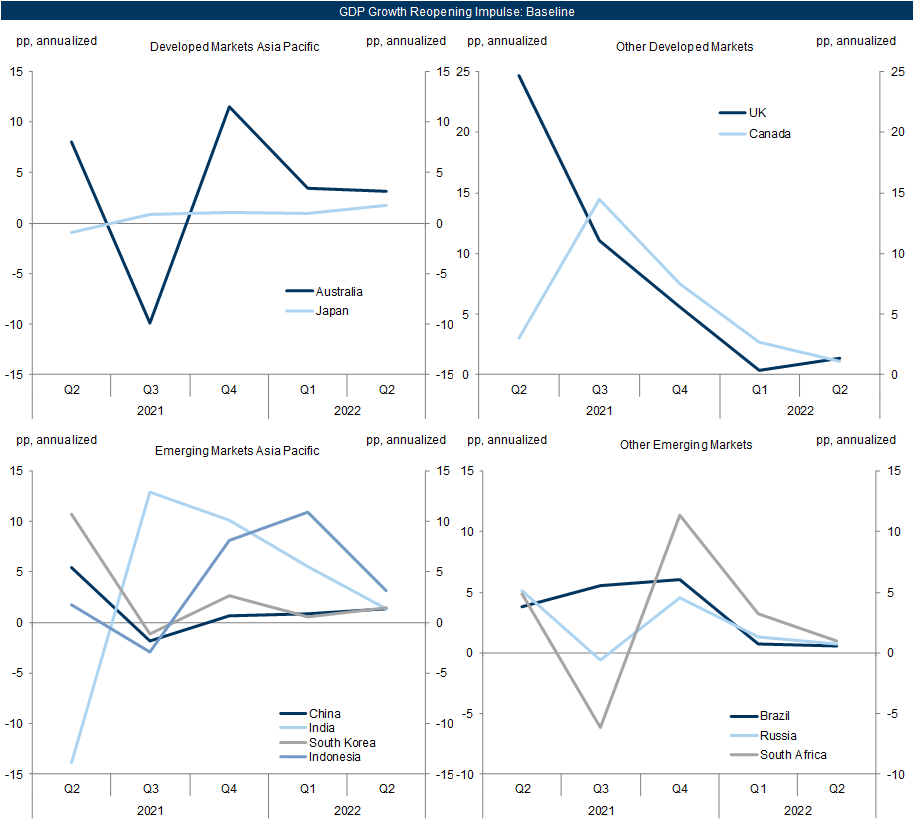

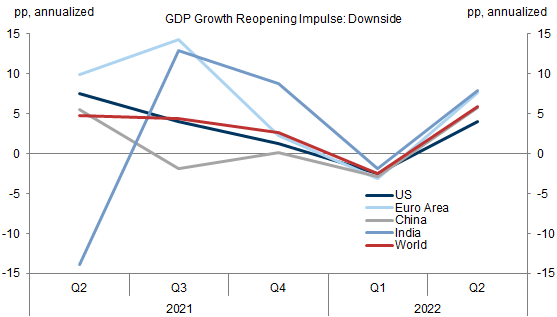

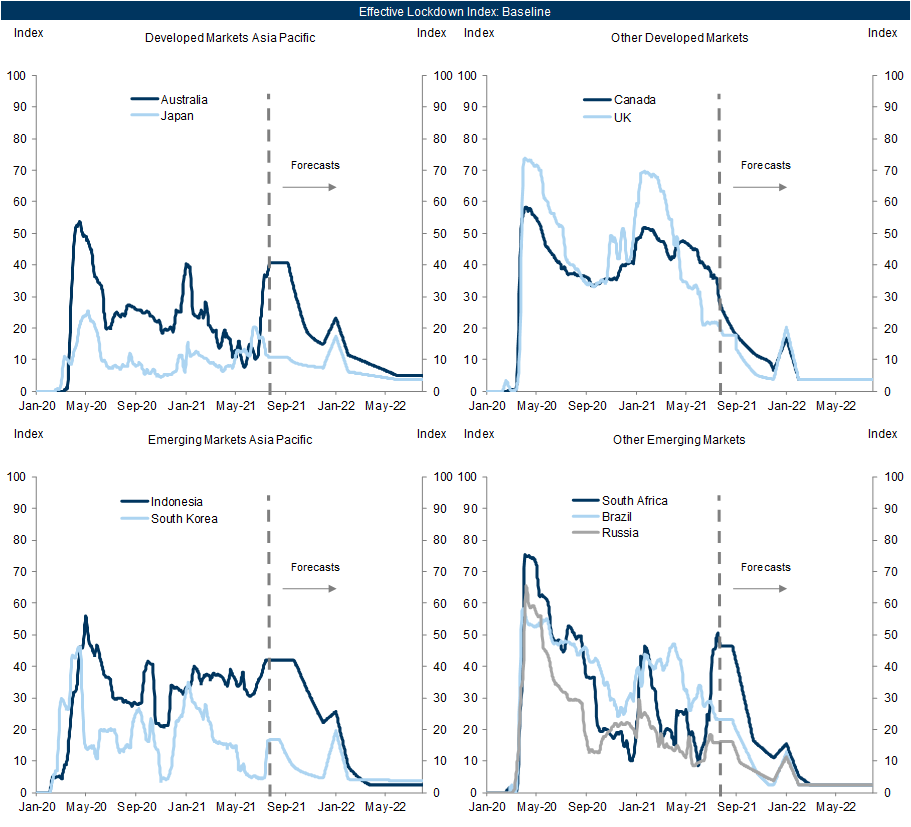

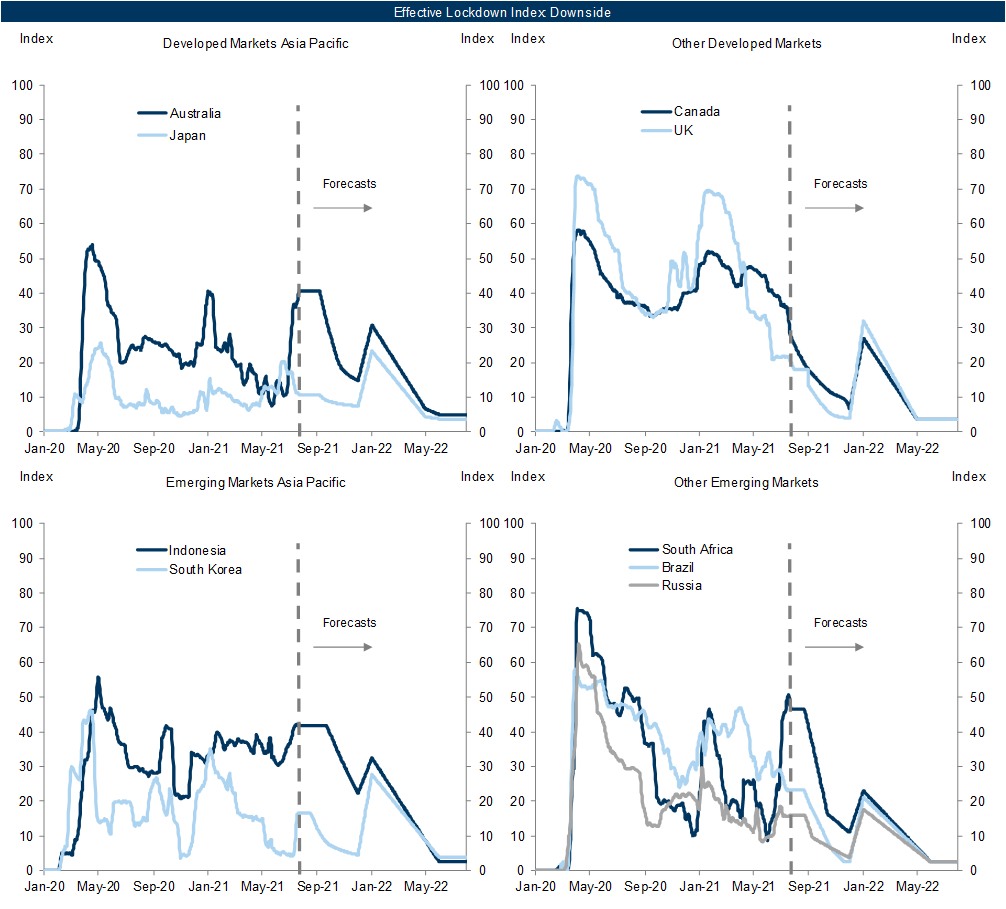

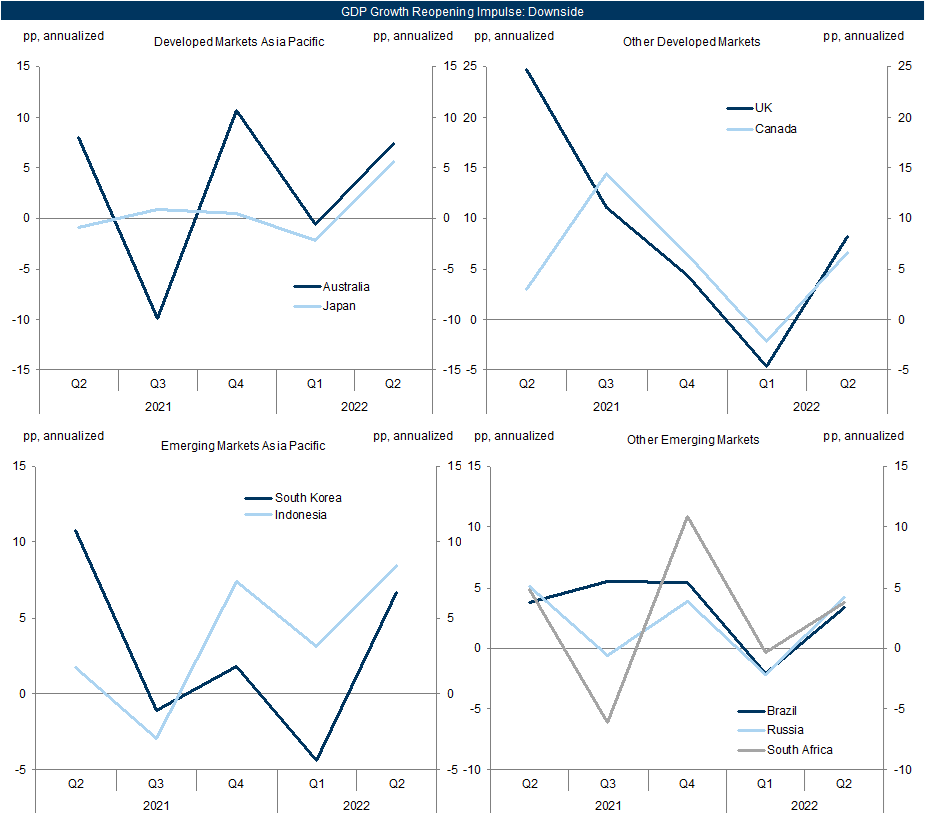

We next estimate reopening growth impulses under baseline and downside ELI scenarios. In the base case, the ELI eases further, except for a year-end tightening episode. Our baseline reopening impulse to global growth slows from 5pp annualized in Q2-Q3 to 3pp in Q4, and 1pp in 2022H1. We estimate the largest impulses in Q3 in India, Canada, and the Euro Area, but smaller gains in the US and China. In a downside scenario, substantial ELI tightening around year-end, for instance due to some vaccine escape or waning immunity, reduces the global reopening impulse to -2pp in Q1.

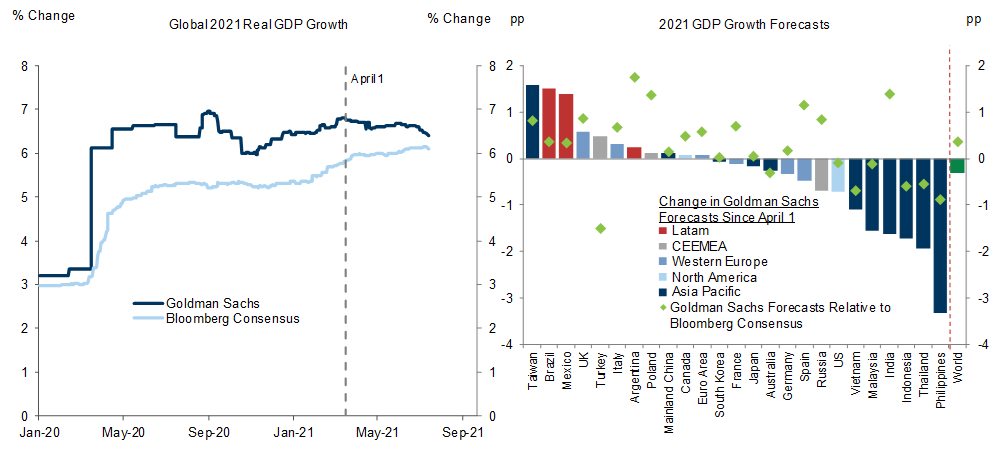

Since the emergence of the Delta strain in early April, the gap between our 2021 global growth forecast and the median consensus forecast has narrowed from 1pp to 0.3pp, reflecting consensus upgrades and GS downgrades. We have made larger 2021 growth downgrades in low-vaccination Asian economies, including India and South East Asia, but also the US. Our growth forecasts now differ from consensus expectations by above-consensus 2021 views in economies with lots of room for reopening, such as India and Spain, and the sharpness of the US deceleration over the next year and a half on the back of a declining reopening impulse and a negative fiscal impulse.

Global Reopening: Slower, but Not Slow (Struyven/Bhushan)[1]

Still Constructive on Vaccine-Driven Recovery

A Less Rapid Next Leg of the Recovery

A Diminishing Reopening Boost

End point. We assume that the steady state ELI level and the time to get there depend on a country’s immunity and Covid risk aversion (Exhibit 6). To illustrate, we assume the US will reach an ELI of 2.5 in September this year, but that Australia will only come down to 5 in 2022Q2.

Shape. We model the ELI trajectory between its current level and the end point using our immunity timelines and the immunity-ELI relationship from Exhibit 2.[5]

Year-end wave. We incorporate another episode of modest-to-moderate ELI tightening through the turn of the year, where the peak ELI depends on historical ELI tightening, a country’s immunity, and its risk aversion.

Downside Risks to Reopening

Still Constructive but More Selectively Bullish

Daan Struyven

Sid Bhushan

- 1 ^ We thank Dan Milo and Rina Jio for their contributions to this report.

- 2 ^ These Israeli and trial data make booster shots this year likely, slowing down distribution in low income economies.

- 3 ^ We focus on the large economies distinguishing between economies with a current first shot vaccination population rate above 40% (US, Euro Area, China, UK, Canada, and Brazil) and below 40% (India, Japan, Russia, Australia, South Africa, Indonesia, South Korea).

- 4 ^ Full theoretical herd immunity is unlikely to be reached based on the very high basic reproduction rate, vaccine hesitancy, and protection levels against infections from vaccines or prior infections that are not very elevated and diminish over time.

- 5 ^ We also incorporate adjustments for countries where cases are currently rising (e.g. a flat ELI for the next 45 days in the US in Exhibit 7) and based on inputs from our country economists (e.g. a flat ELI for the next 60 days in India).

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.