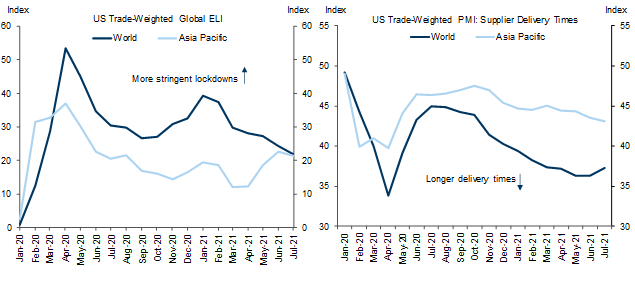

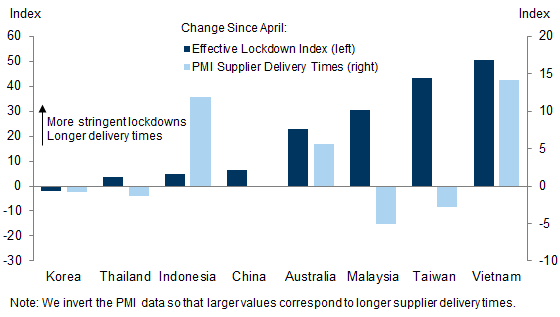

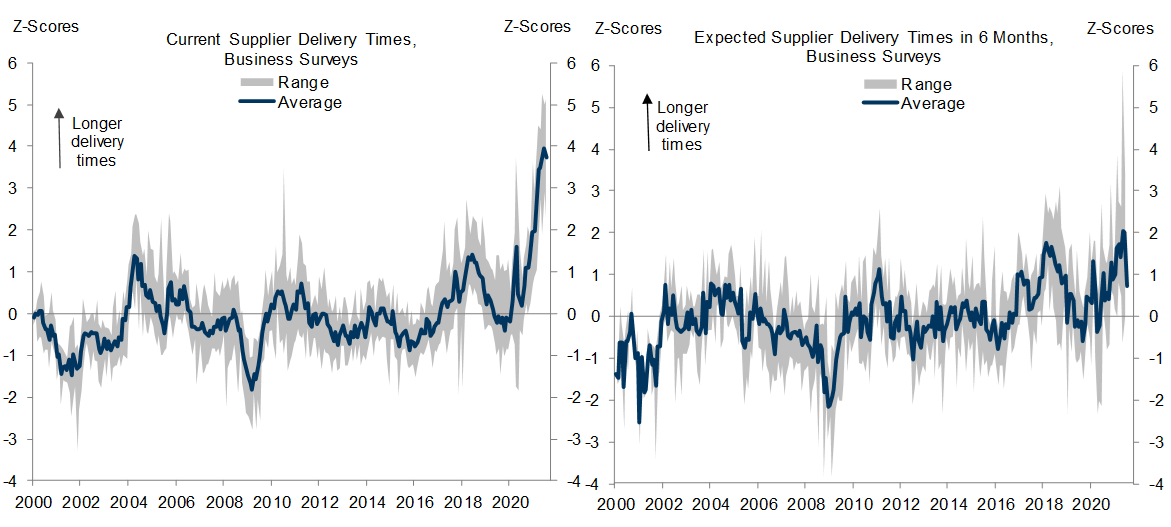

We expect the direct impact of the Delta variant on the US economy to consist mainly of a delay in the final steps of reopening, rather than a major reversal. But many Asia Pacific economies have imposed tighter restrictions that in some cases have included factory closures, raising the risk of negative spillovers at a time when supply chain disruptions are already at record levels.

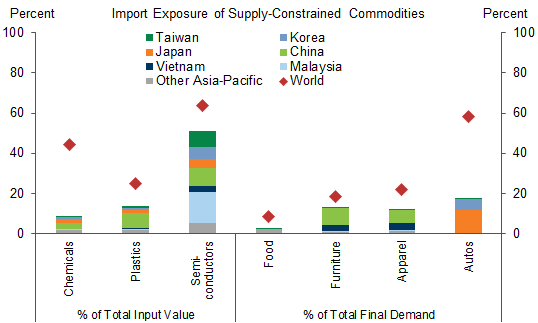

Past increases in our Effective Lockdown Index for Asia Pacific countries have been associated with only modest increases in US supplier delivery times. However, larger downside risks are possible if new restrictions constrain semiconductor or auto production in the region, or if China adopts tighter restrictions that affect exports to the US of several currently constrained goods.

Any setbacks in the Asia Pacific region could also pose upside inflation risk, especially for autos and other goods that require semiconductors. Port closures or stricter control measures at ports could also put further upward pressure on shipping costs, which are already very high.

The Economic Impact of the Delta Variant: Risks from Global Supply Chain Spillovers

Joseph Briggs

David Mericle

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.