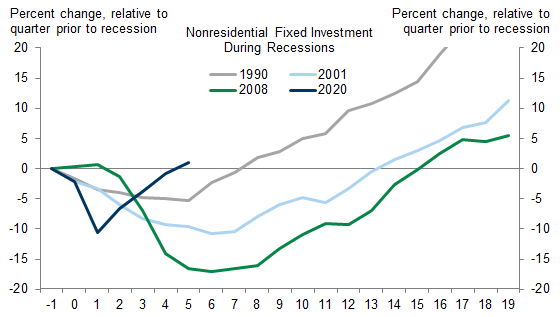

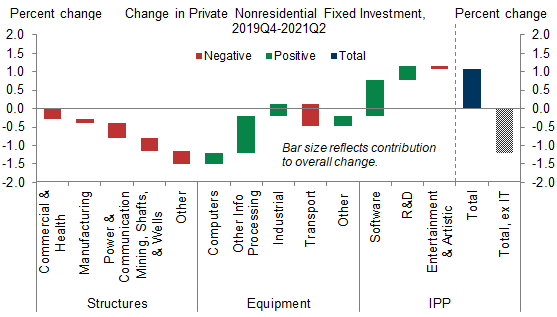

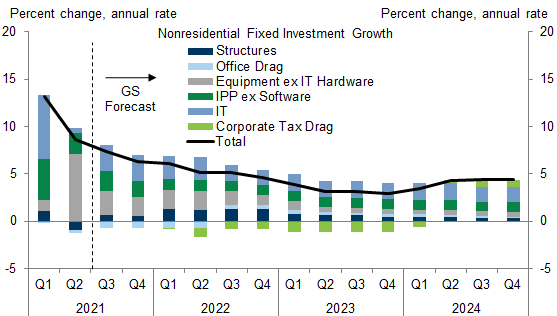

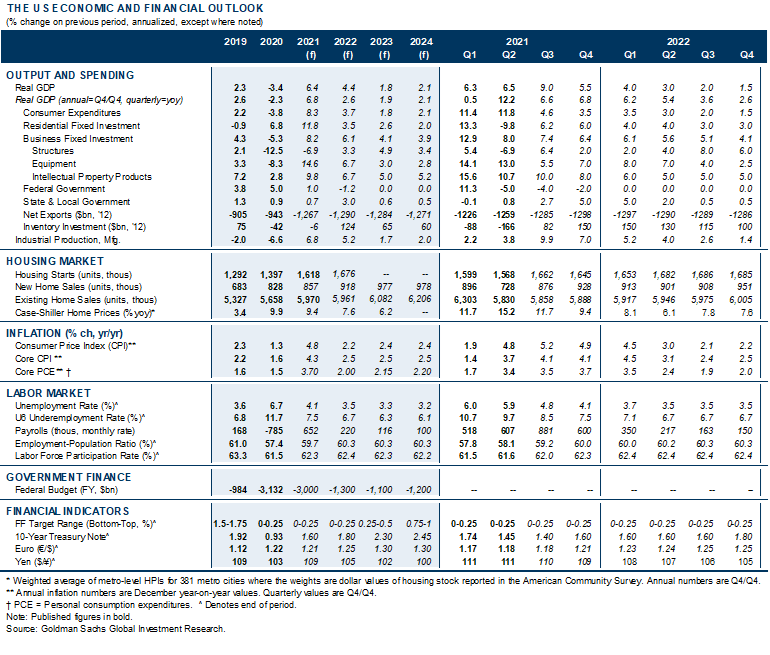

Business fixed investment surpassed its pre-recession level in 2021Q2, a much quicker recovery than after other recent downturns. But the recovery has been very imbalanced and mostly driven by information technology spending so far. In this week’s US Economic Analyst we update our capex outlook.

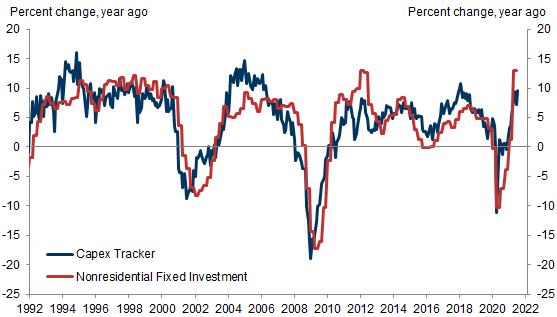

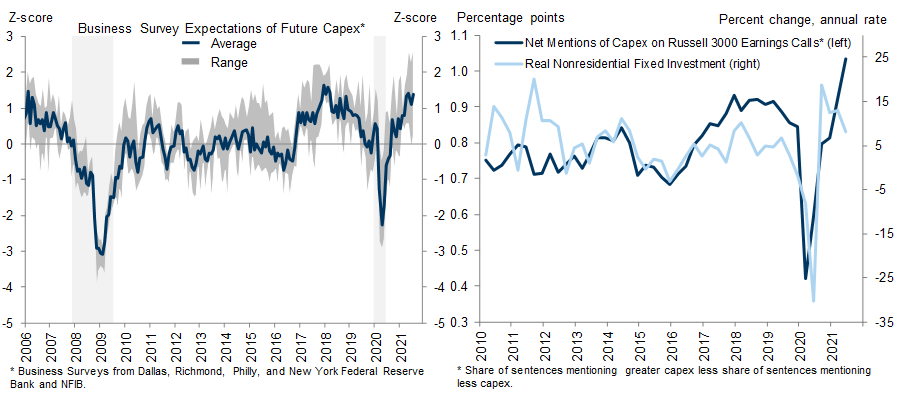

In the near-term, we expect the capex rebound to continue at a brisk pace. Our capex tracker, investment expectations from business surveys, and a new measure of capex plans from company earnings calls have all surged to very high levels.

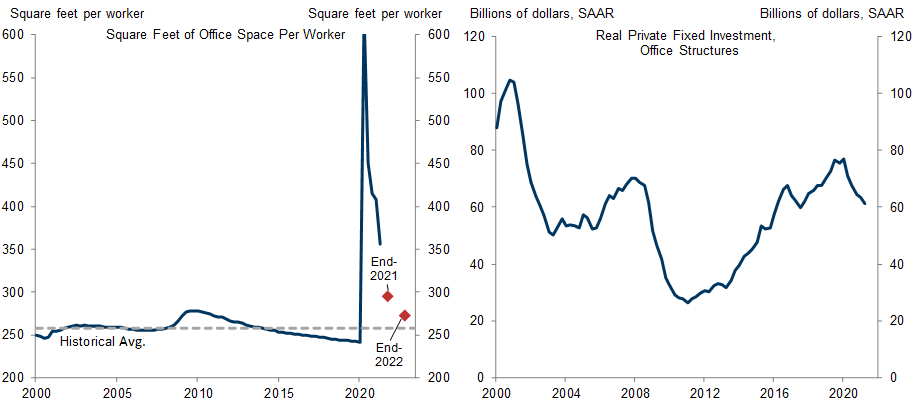

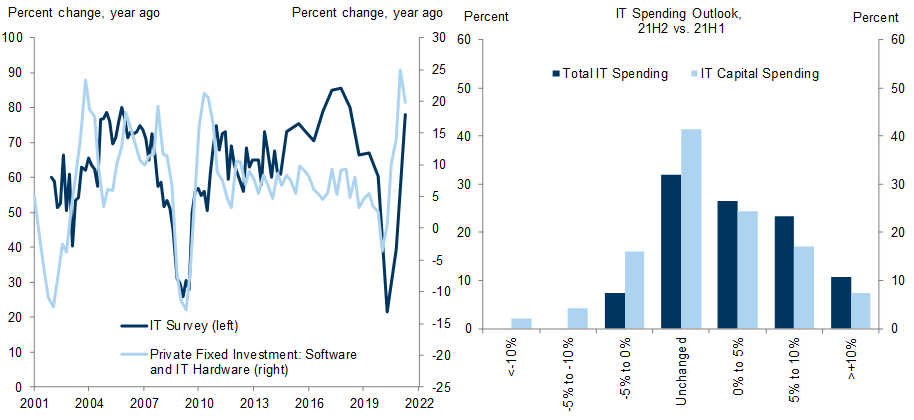

In the medium-term, three factors will shape the capex outlook. First, the shift to remote work has led to an oversupply of office space, causing a 20% decline in office structures investment that is unlikely to reverse until 2022. However, the shift to remote work has led to strength in IT investment that will likely continue. We expect spending on hardware to grow strongly in 2022H1 as office attendance increases and supply chains normalize.

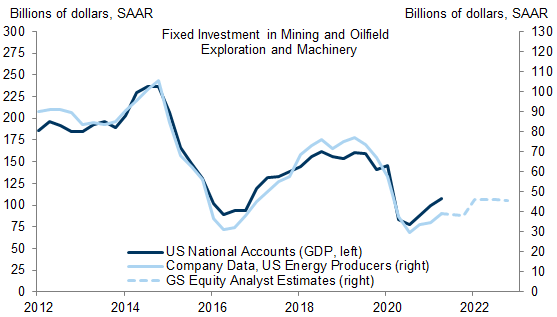

Second, oil and gas capex—a volatile category that has historically been a main driver of changes in overall business investment—looks set for a lackluster recovery, although the rise of clean energy could provide a tailwind later in our forecast horizon.

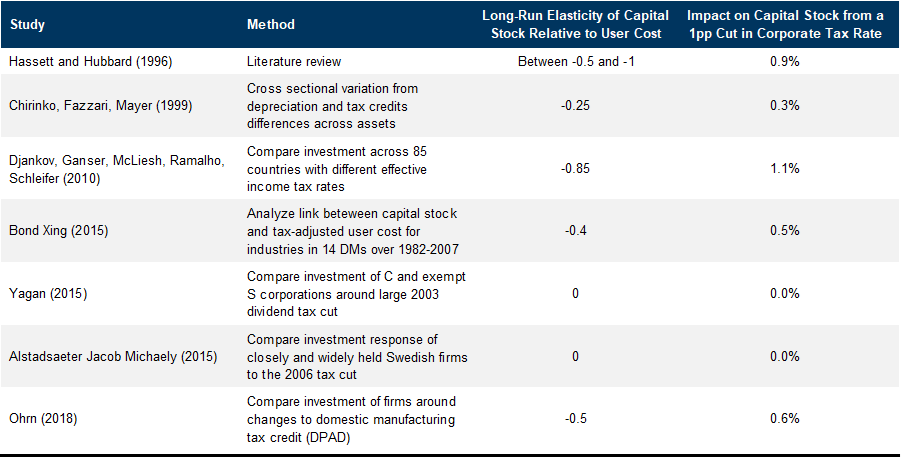

Third, we expect the current budget reconciliation bill will increase corporate taxes by more than $900bn over 10 years, corresponding to a 3pp increase in the effective corporate tax rate. Although prior academic studies suggest that such an increase could create a moderate drag on investment, we expect any impact will be small because capex has been relatively insensitive to recent tax changes and investment incentives included in the bill should dampen its impact.

After incorporating these factors into our updated business investment model, we expect that capex will grow at a roughly +7% annualized rate in 21H2 and a +6% rate in 2022, before decelerating to +4% in 2023 and 2024.

The Capex Reset: New Investment for the New Work Environment

The Near-Term Capex Outlook: A Continued Rebound

The Medium-Term Capex Outlook: Three Factors

The Post-Pandemic Work-From-Home Economy

A Lackluster Outlook For Oil and Gas

A Fiscal Drag on Capex from Corporate Tax Increases

Updating Our Business Investment Forecast

Joseph Briggs

- 1 ^ Atanassov, Julian, and Xiaoding Liu. "Can corporate income tax cuts stimulate innovation?" Journal of Financial and Quantitative Analysis 55.5 (2020): 1415-1465.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.