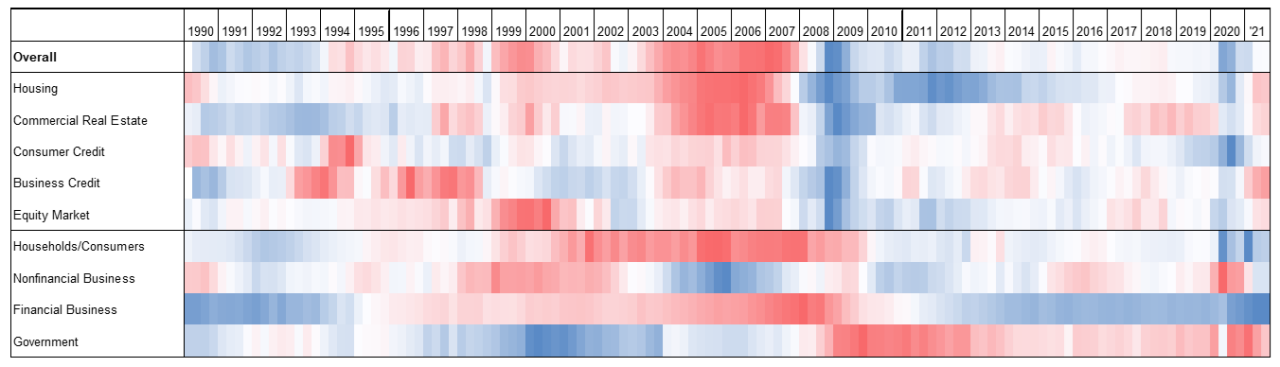

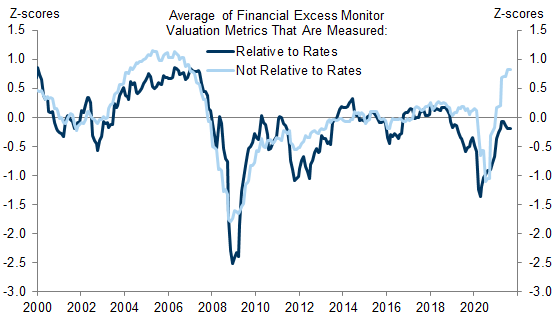

Our GS financial excess monitor — a tool for assessing macro risks from stretched valuations and sectoral imbalances — now indicates modestly greater risk than in our last update at the start of 2021, though the overall risk level remains moderate. Risks from financial imbalances remain low, at least in the private sector. Some valuation metrics now look more stretched — in particular for corporate credit, commercial real estate, and housing — though with long-term real rates now negative, other valuation metrics that are calculated relative to interest rates look less worrisome.

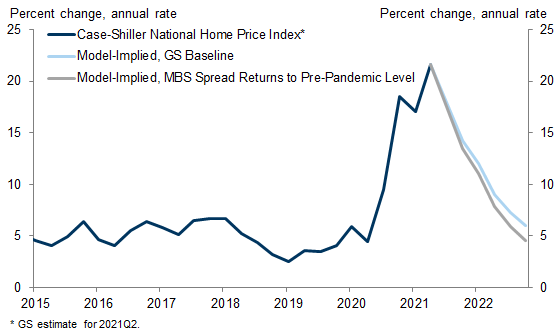

Some Fed officials have expressed concern that their MBS purchases are adding fuel to the flames of a red-hot housing market where prices have already risen 17% over the last year. While the financial excess monitor now provides a gentle warning about the level of home prices, we see little risk of a crash in the near-term and only a very modest negative impact ahead from the eventual end of the Fed’s MBS purchases.

Our Financial Excess Monitor Indicates Moderate Concern About Valuations

Ronnie Walker

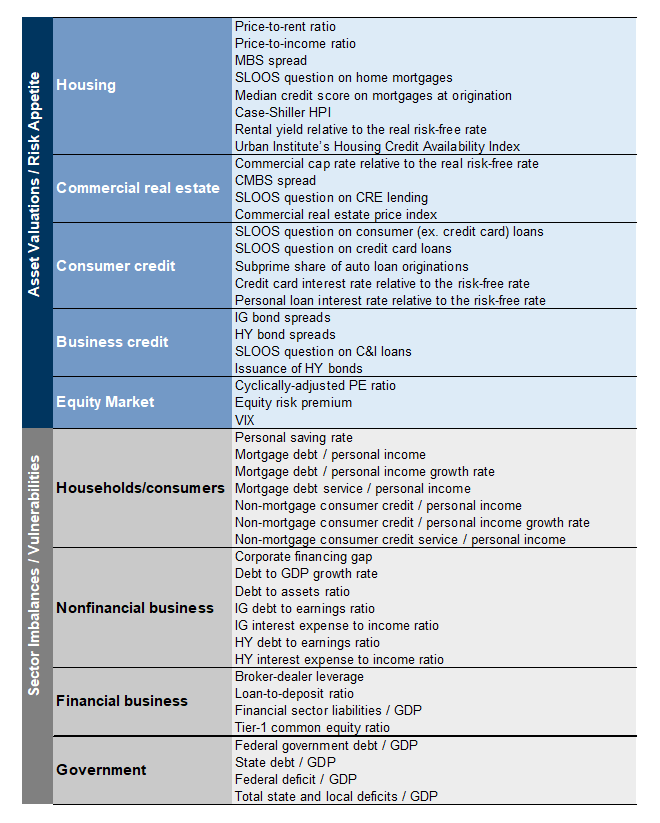

- 1 ^ Our financial excess monitor focuses on major asset classes. For an asset class to constitute a macro risk, potential losses have to represent a major threat to either spending or lending. Price declines in giant asset classes held largely by households like housing and equities pose the first risk, while losses on mortgage assets by highly levered banks during the financial crisis are an example of the second. For further details on the methodology and the series included, see David Mericle, Avisha Thakkar, and Marty Young, “US Economics Analyst: Monitoring Macro Risk from Financial Excess in the US Economy,” 2018.

- 2 ^ That said, the composition of the high yield market has improved over the last year (as documented by our credit strategists here) reflecting the wave of 'fallen angel' downgrades and material uptick in defaults.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.