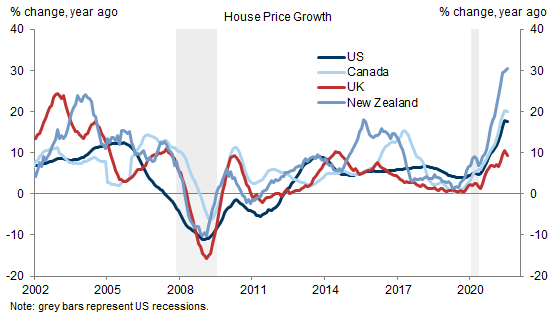

Housing markets in the US, Canada, the UK, and New Zealand are on fire, and surging home prices have caused some concern among central banks.

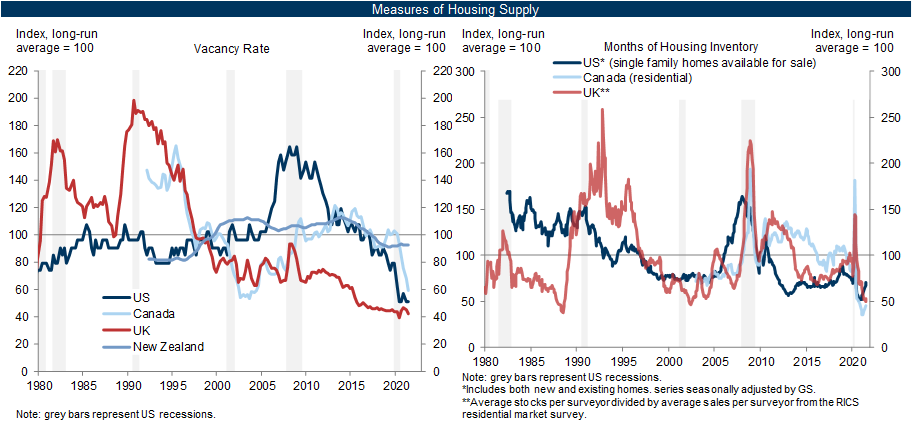

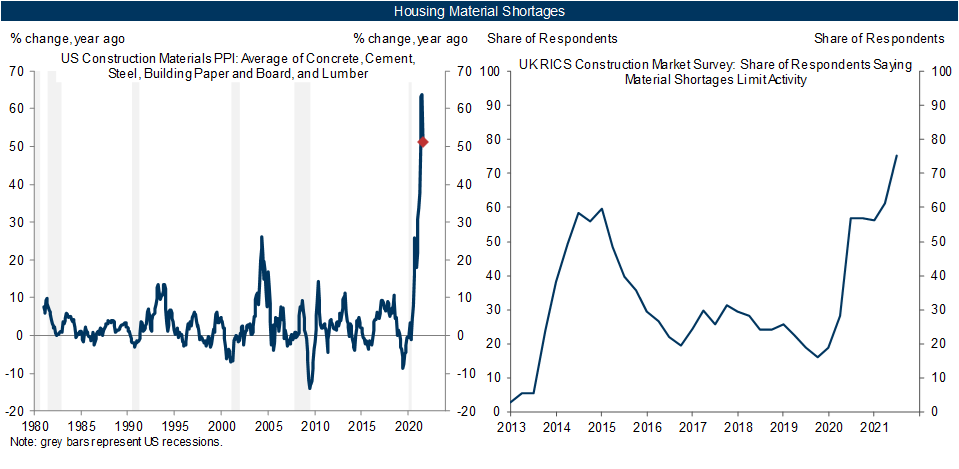

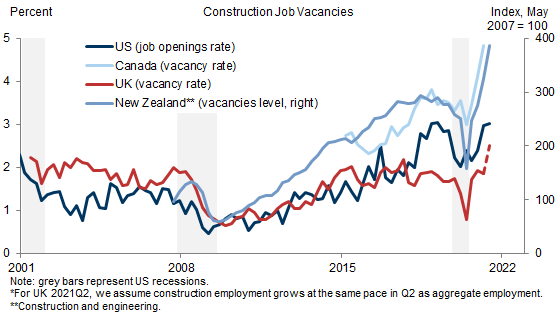

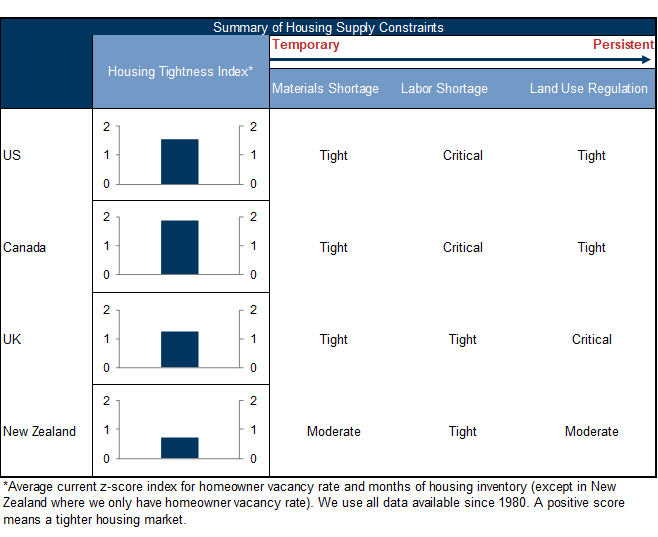

While low interest rates and the shift to working from home are fueling housing demand, one underappreciated reason for the house price boom is that housing supply is very tight. Vacancy rates were trending down even before the pandemic, and pandemic-triggered material and labor shortages are weighing on construction activity, further exacerbating the housing shortage.

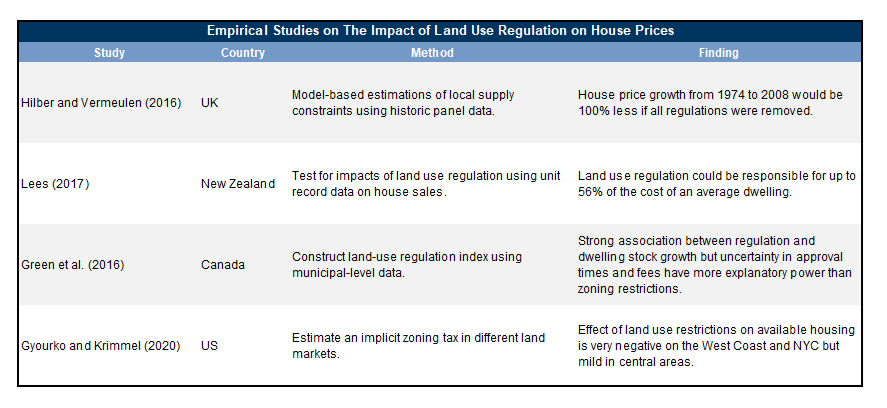

While the easing of temporary bottlenecks, such as material shortages, should support an eventual recovery in supply, historically tight housing supply and more persistent constraints, such as land use regulations, should continue to push home prices up in coming quarters, especially in the US, Canada, and UK.

The Global Housing Shortage

Exhibit 1: House Prices Have Risen by 30% Year-Over-Year in New Zealand, 20% In the US and Canada, and 10% In the UK

Exhibit 2: Vacancy Rates and Months of Housing Inventory Are at or Near Record Low Levels in the US, Canada and UK

Sid Bhushan

Yulia Zhestkova*

- 1 ^ Furthermore, aggregate vacancies understate the tightness in supply because of the pandemic related spatial mismatch.

- 2 ^ For example, the National Policy Statement on Urban Development.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.