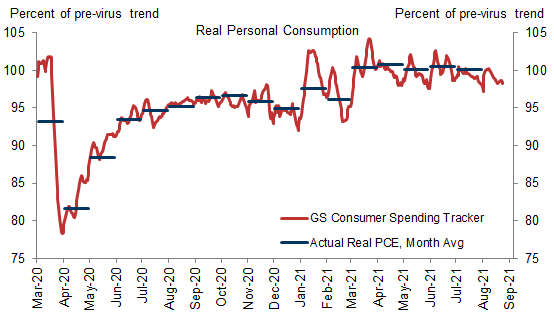

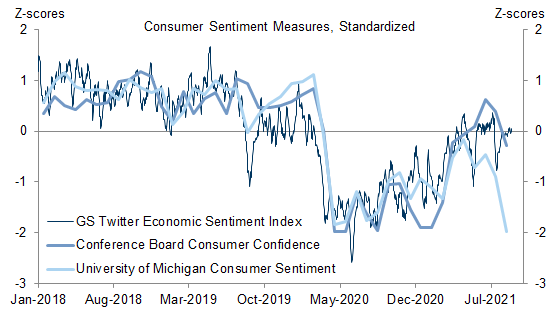

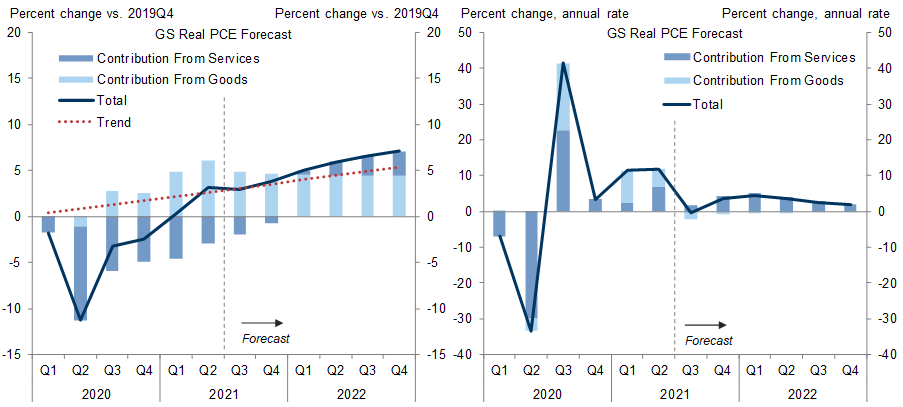

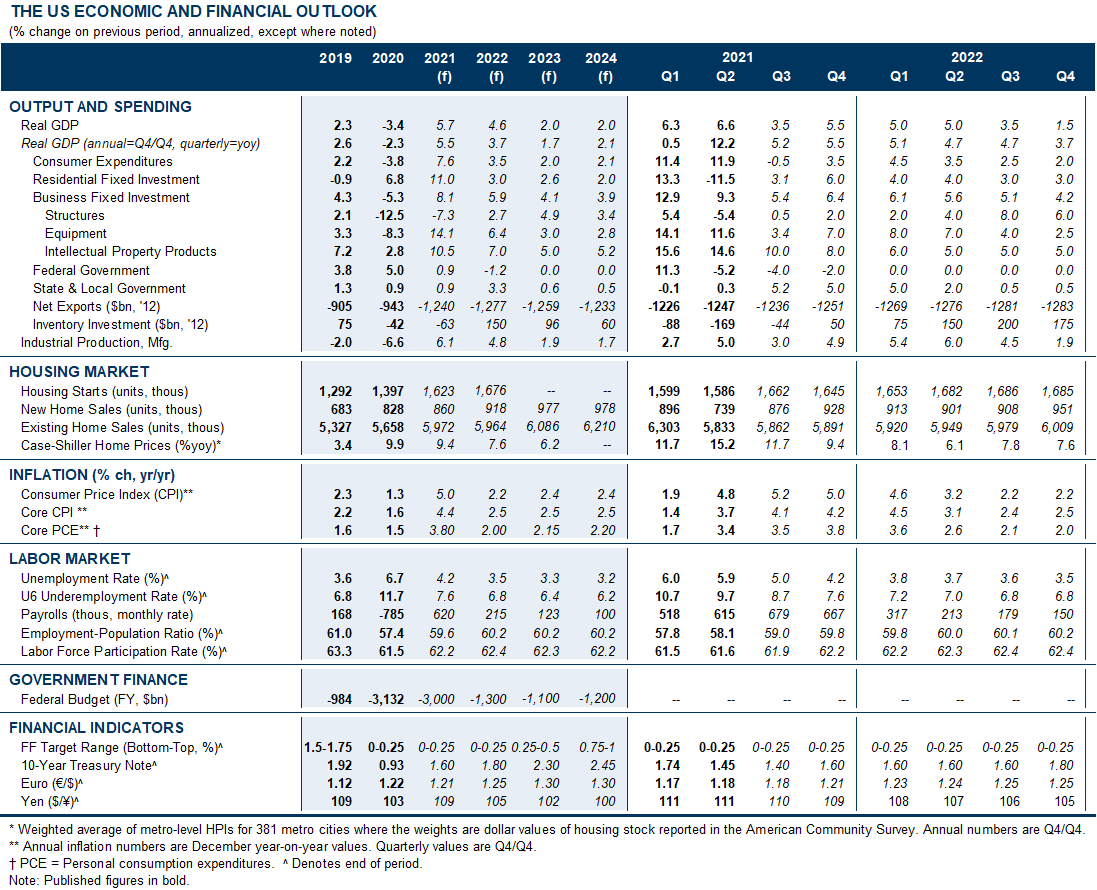

We recently downgraded our Q3 consumption growth forecast to -0.5% annualized to reflect a larger effect of the Delta variant on services spending. Although we expect the Delta setback to be brief, two longer-standing concerns pose challenges for consumption growth over the next few quarters.

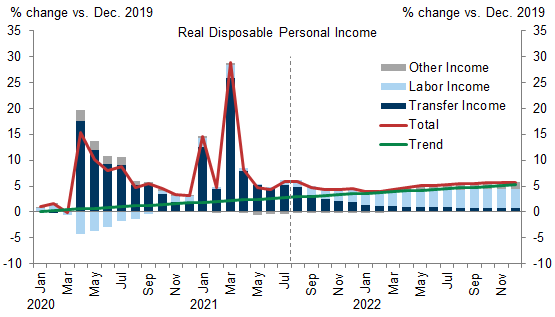

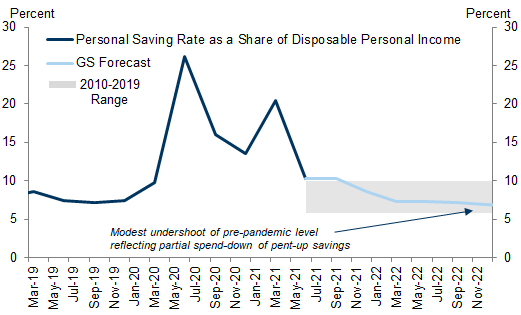

First, we have long highlighted that the fiscal impulse will fade sharply from its Q2 peak through end-2022. Fiscal support boosted disposable income to 9% above the pre-pandemic trend on average in 2021H1, but has already dropped off substantially. This decline will weigh on spending, though the impact should be offset by strong gains in labor income—which should keep disposable income modestly above its pre-pandemic trend—and by spending of excess savings built up during the pandemic, which amount to 18% of a year’s consumption.

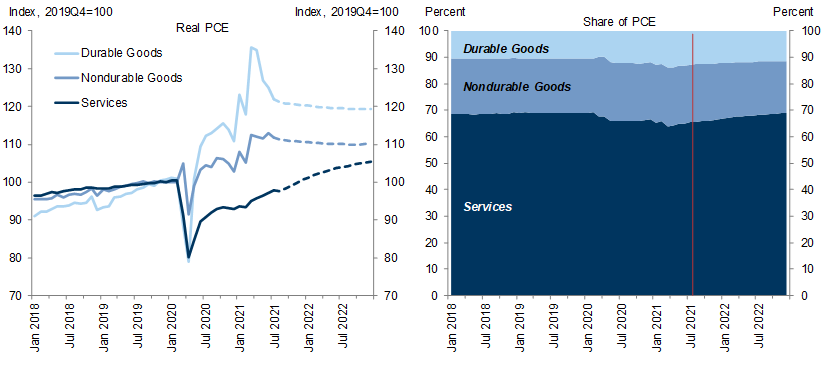

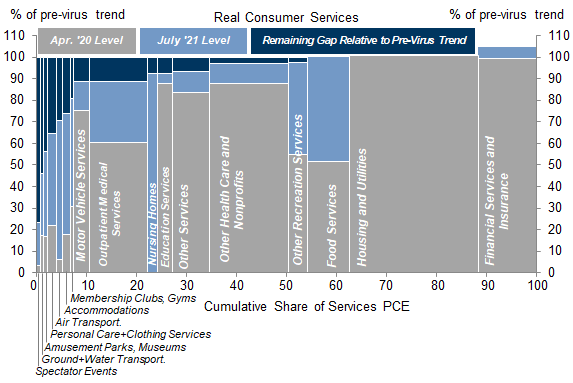

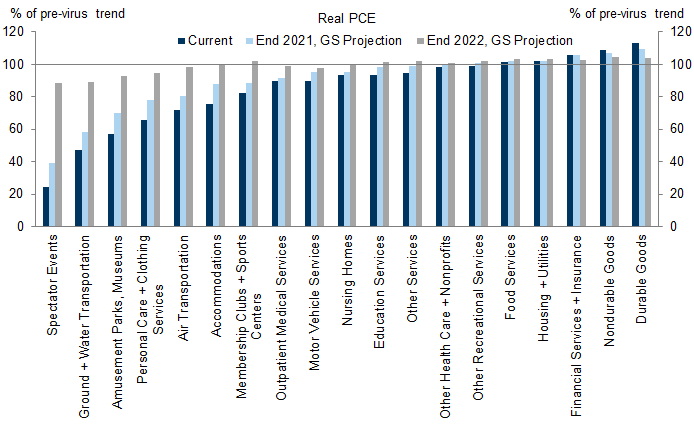

Second, consumers will need to rotate from a very elevated level of spending on goods back to a normal level of spending on services. Spending on goods is likely to continue falling, though delayed purchases due to shortages of items such as new cars should slow the decline. But the rest of the service sector recovery will be much slower than the easy phase that followed vaccination, and with Covid fears likely to persist through the winter virus season, it might take a while for spending to recover in still-depressed categories such as very high-contact and office-adjacent services.

Based on our new analysis, we have lowered our forecast for 2021Q4 consumption growth by 2.5pp to 3.5% but offset most of this downgrade by boosting each quarter of 2022 by 0.5pp. Our forecast of 2.6% (annualized) consumption growth from 2021Q2 to 2022Q4 consists of a 3.7pp boost from services spending offset in part by a 1.1pp drag from goods spending.

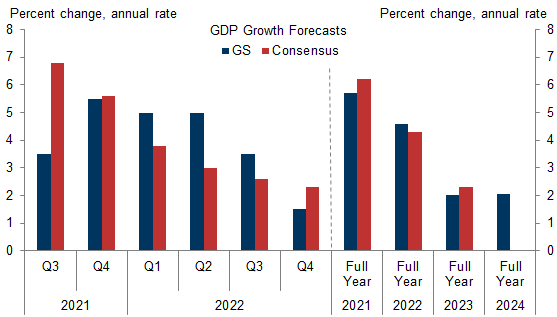

One offset to this slower consumption growth is that the need for inventory restocking has grown larger as supply chain disruptions have hit production again in Q3. We now expect GDP growth of 3.5% in Q3, 5.5% in Q4 (previously 6.5%), and 3.7% in 2022 Q4/Q4 (previously 3.0%). On an annual average basis, our GDP growth forecast is now 5.7% (vs. 6.2% consensus) in 2021 and 4.6% (vs. 4.3% consensus) in 2022, but the annual average masks a sharp deceleration to below trend by end-2022.

Consumer Spending: A Harder Path Ahead

The Consumption Setback from the Delta Wave

Fiscal Fuel Running Out

The Goods-to-Services Rotation

Exhibit 7: We Expect Most Consumption Categories to Revert to Near-Trend by End-2022, but Do Not See Imminent Catalysts to Substantially Boost Virus-Sensitive Services in the Near-Term; Goods Spending Should Normalize but Could Benefit from Pent-Up Savings

A Steeper Climb for the Consumer Recovery

Ronnie Walker

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.