Last week, President Biden announced vaccine requirements for 100mn workers, with mandates for all federal employees and most healthcare workers, and a vaccine or testing requirement for all workers at large private firms with 100+ employees.

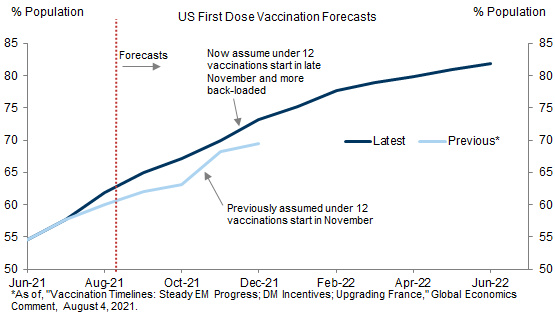

We estimate that the requirements will apply to about 25mn currently unvaccinated individuals, and boost the number of vaccinated individuals by 12mn (or 3.6% of the total population) through March next year, based on surveys and France’s experience with vaccine requirements. We now expect 82% of the total population (and 90% of adults) to be vaccinated with a first dose by mid-2022.

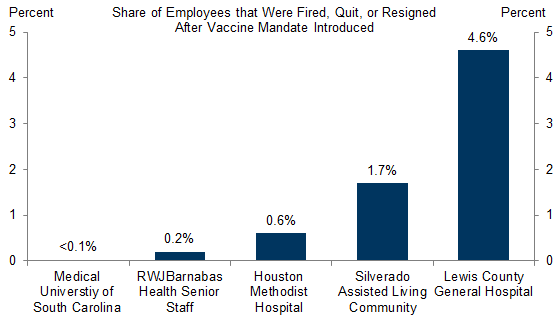

We see some downside employment risk in the near term, as 7mn affected workers report that they will definitely not get the vaccine, and vaccine mandates imposed by health care providers earlier this summer caused some workers to leave their jobs. The mandate’s testing option should dampen negative employment effects, however, and many workers that do decide to quit should be able to find jobs at smaller firms not subject to the mandate.

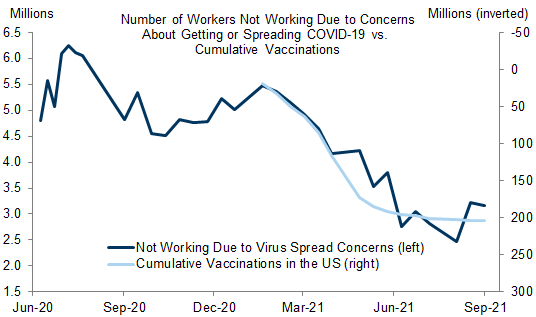

The medium-run net employment impact is likely positive since higher full vaccination rates will reduce virus spread, which should boost labor demand in high-contact services and labor force participation among some of the 3mn people who currently aren’t working due to virus-spread concerns.

The Effect of the Biden Vaccine Mandate on Vaccination and Employment

Joseph Briggs

Daan Struyven

Sid Bhushan

- 1 ^ OSHA will issue an Emergency Temporary Standard (ETS) to implement this requirement.

- 2 ^ We assume that France’s vaccination pace would have followed the German pace in the absence of the requirements.

- 3 ^ 42% of Washington Post/ABC survey respondents, 44% of Qualtrics survey respondents, and 45% of San Diego police officers report they would quit rather than get vaccinated if their employer imposed a vaccine mandate.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.