The Biden administration announced on Monday that it will lift travel restrictions for fully-vaccinated visitors from 33 countries who have so far been banned from entering the US, starting in November.

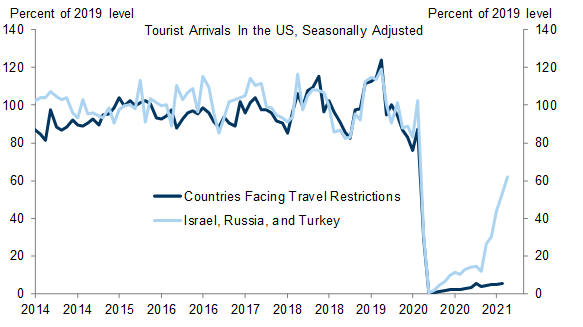

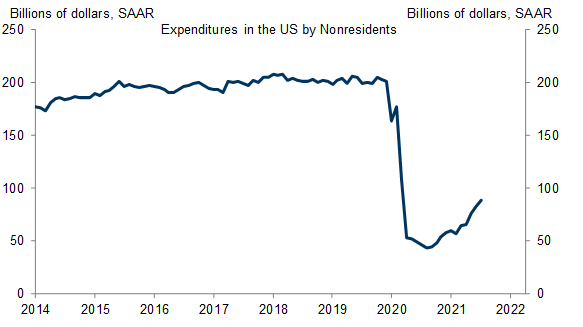

Based on the partial recovery in arrivals to the US from a few countries not subject to restrictions, we estimate that the end of the travel ban will restore another 10-15% of the pre-pandemic spending by tourists and other nonresidents by the end of 2022Q1, which would add about 0.2pp to GDP growth in 2021Q4 and 2022Q1. If most of the remaining gap in tourist spending then closes by the end of 2023, the remaining rebound would boost quarterly annualized growth by another 0.1pp in each quarter from 2022Q2 through 2023Q4.

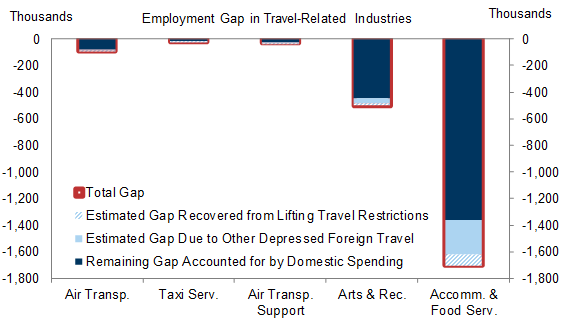

Using the empirical relationship between spending and employment in travel-related industries and our estimate of the share of travel-related spending that is typically supported by international tourists, we estimate that lifting travel restrictions will generate about 100k jobs, or 15-20k jobs per month. Assuming most of the remaining gap from depressed tourist spending then closes by the end of 2023 would imply a further gain of about 300k jobs in these industries, or 10-15k jobs per month.

Coming to America: The Effect of Lifting Travel Restrictions on Spending and Employment

- 1 ^ The administration has indicated that it will accept vaccinations approved for emergency use by WHO. Since this includes China’s Sinovac vaccine, but not the Covaxin or Sputnik V vaccines used in India, and since only 15% of adults in India are fully vaccinated, we include China but exclude India in the analysis that follows.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.