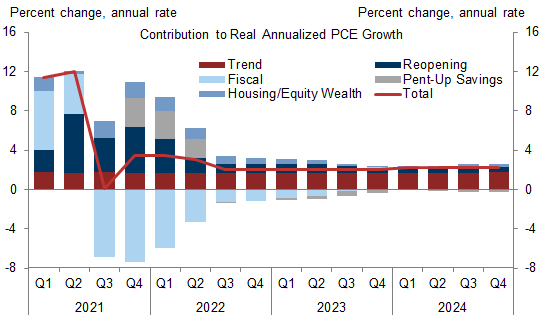

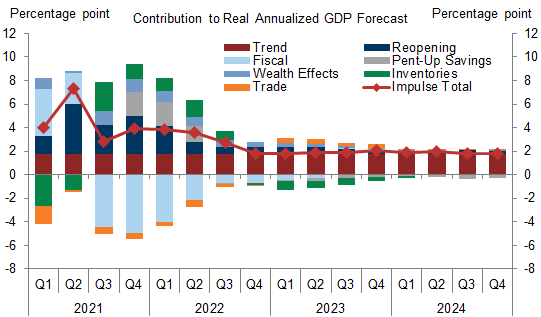

We see two main challenges to medium-term growth. First, fiscal support is set to step down significantly through the end of next year. Second, consumer services spending will need to recover quickly to offset a decline in goods spending as it normalizes from its current elevated level.

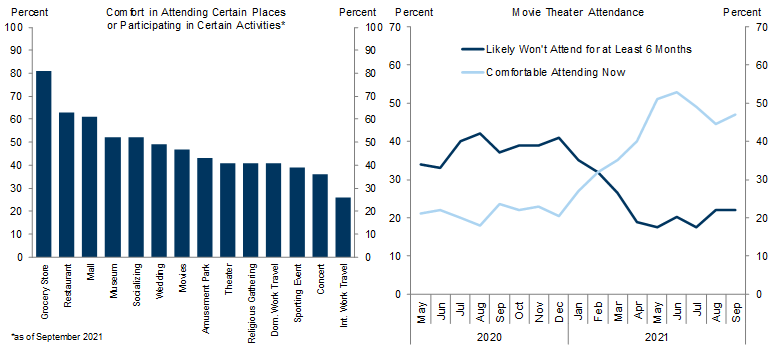

After updating our estimates of the key growth impulses that drive our consumption forecast—reopening, fiscal stimulus, pent-up savings, and wealth effects—and incorporating a longer-lasting virus drag on virus-sensitive consumer services spending, we now expect a more delayed recovery in consumer spending. This pattern, combined with our expectation that semiconductor supply likely won’t improve until 2022H1 and inventory restocking will therefore be delayed until next year, argues for a less front-loaded recovery from here than we had expected.

We have therefore cut our growth forecast for 2021Q4 to 4.5% (vs. 5.0% previously) and revised our growth forecast for 2022Q1-Q4 to 4.5%/4%/3%/1.75% (vs. 5.0%/4.5%/3.5%/1.5%). These changes imply a downgrade to 2021 GDP growth to 5.6% on an annual basis (vs. 5.7%) and 5.2% on a Q4/Q4 basis (vs. 5.3%), and a downgrade in 2022 growth to 4.0% on an annual basis (vs. 4.4%) and 3.3% on a Q4/Q4 basis (vs. 3.6%). These changes are mostly offset by upgrades to our growth forecast in 2023 and 2024, however.

Following Friday’s employment situation report, we have left our unemployment rate forecast unchanged. We continue to expect that the unemployment rate will fall to 4.2% by end-2021 and 3.5% by end-2022.

Updating Our Growth Impulses and GDP Forecast

Joseph Briggs

- 1 ^ Mark Aguiar and Erik Hurst. "Consumption versus expenditure." Journal of Political Economy 113.5 (2005): 919-948.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.