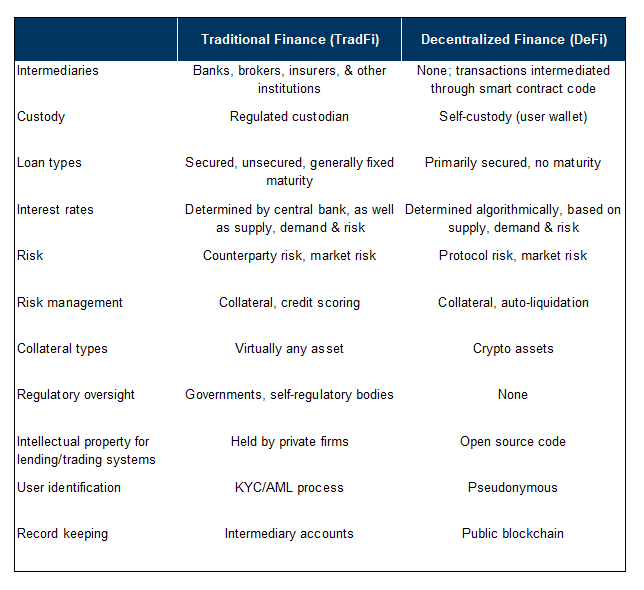

Decentralized finance (DeFi) is an experimental and unregulated alternative financial system, grounded in cryptocurrency technology. The DeFi ecosystem includes many of the same products and services found in the traditional financial system—including credit and lending, trading and exchange, derivatives, and insurance—but no centralized intermediaries. It can be considered both a suite of financial technology with the potential to disrupt existing market structures, as well as a compelling use case of blockchains that is helping drive value for crypto assets.

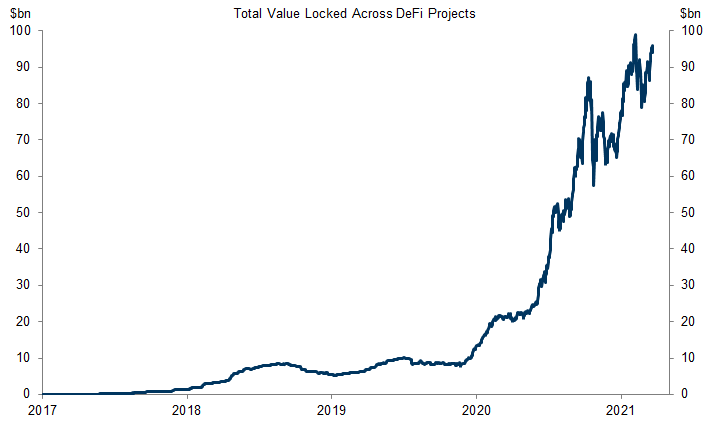

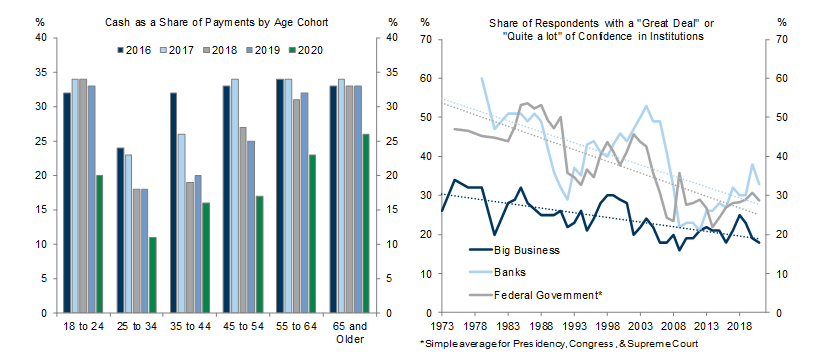

The DeFi marketplace has expanded dramatically since the middle of 2020—roughly 10x on the most common summary measure. Part of this growth very likely reflects yield: stablecoin yields are typically around 5% on established platforms, much higher than yields on insured bank deposits. Speculative activity likely also plays a role. But user adoption may also relate to longer-running trends including digitization, globalization, and declining trust in centralized institutions.

Compared to traditional finance DeFi may offer certain advantages, including easier access for underbanked populations and faster settlement times. But despite its promise, DeFi is still very much a work-in-progress—with plenty of hacks, bugs, and outright scams—and will pose a challenge for policymakers concerned about consumer protection and other social goals.

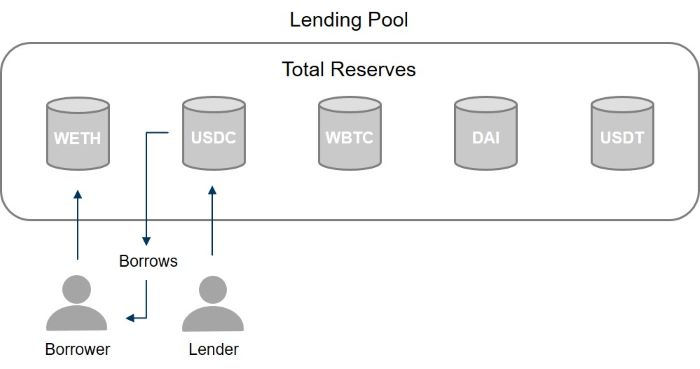

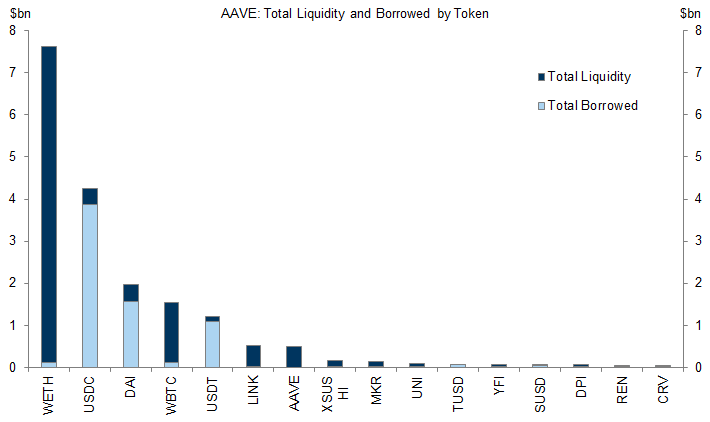

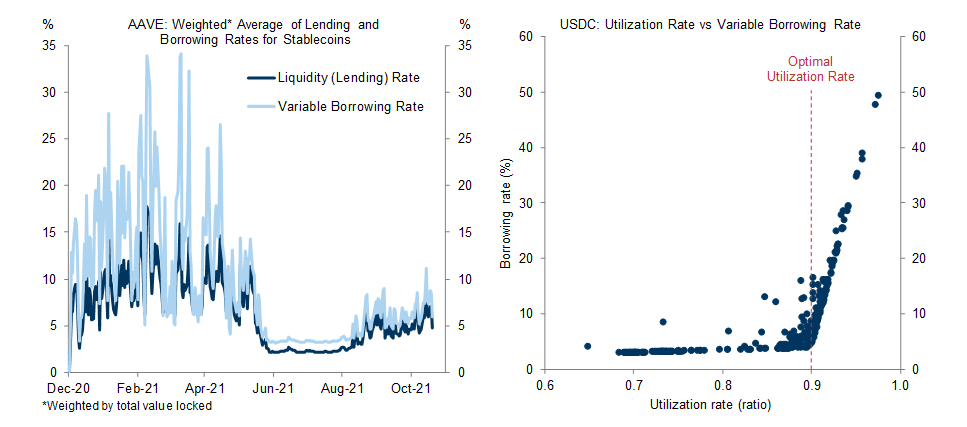

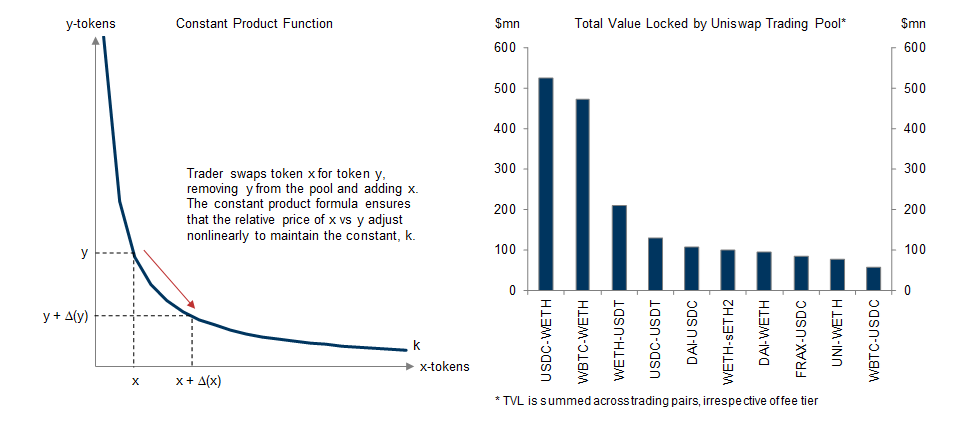

The structure and activities of two key protocols, Aave and Uniswap, demonstrate the main applications of DeFi—lending and trading/exchange. Aave connects lenders and borrowers through a pooled structure and algorithmically-determined interest rates. Uniswap uses an automated market maker structure and is the dominant decentralized exchange.

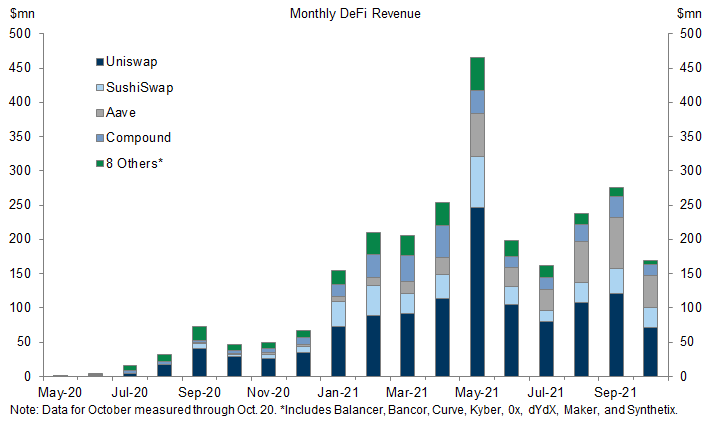

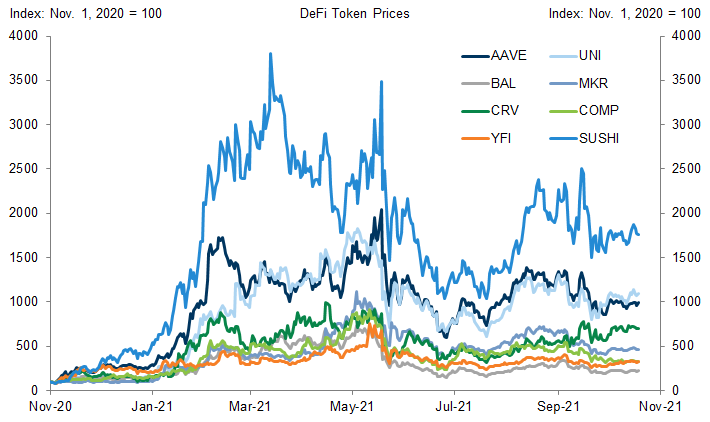

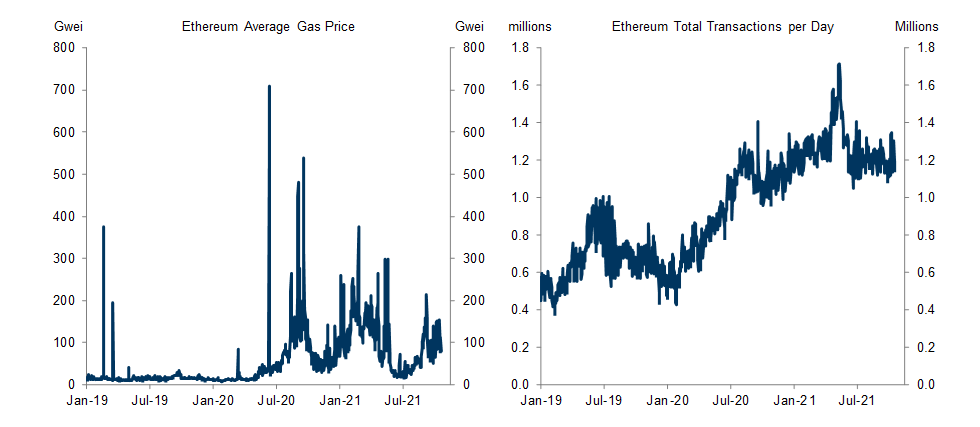

DeFi activity generates value for crypto assets both directly and indirectly. Users pay various fees and spreads when using DeFi protocols, similar to the traditional financial system, and a portion of this revenue can be directed to the protocol “owners”—typically the token holders of decentralized autonomous organizations (DAOs). Network transaction fees also create demand for the blockchain’s native asset or “currency”, like Ethereum’s Ether.

Opportunities and Risks in Decentralized Finance

DeFi Foundations[1]

You say you want a revolution

Easier access for the underbanked: Anyone with an internet connection can participate in DeFi; there is no need for a bank or exchange to be present in the local market.

Unique products: DeFi protocols are open and interoperable[6], which means developers can create certain products which do not exist in traditional finance (e.g. automated yield harvesting strategies and user-created algorithmic portfolio benchmarks).

Faster pace of innovation: Open source code and permissionless networks allow developers to copy and tweak existing protocols and quickly launch competitors.

Higher transparency: All DeFi transactions are observable on the blockchain, and much of the protocol-specific data is available through free and open APIs.

More efficiency: Protocols have relatively little operating expenses once deployed, so may provide more value to users in certain circumstances (although protocols do generate revenue which can be distributed to “owners”, as discussed below).

Lower cost cross-border payments: Blockchains provide a mechanism for secure and low-cost cross-border payments, which should help lower transaction fees for remittances.

Faster trade settlement: Final trade settlement typically occurs in seconds or minutes rather than days.

Sources and uses of funds: Aave & Uniswap

Value creation: direct and indirect

TradFi 2.0

Zach Pandl

Isabella Rosenberg

- 1 ^ For more comprehensive background on the technologies underpinning DeFi, we recommend as a starting point: (i) The Basics of Bitcoins and Blockchains, Antony Lewis, Mango Publishing, 2018; (ii) Mastering Ethereum, Andreas Antonopoulos and Gavin Wood, O’Reilly Media, 2019; and (iii) Blockchain and the Law, Primavera De Filippi and Aaron Wright, Harvard University Press, 2018.

- 2 ^ Source: Defi Llama.

- 3 ^ Each token of the type is the same, in contrast to non-fungible tokens (NFTs), which use the ERC-721 standard.

- 4 ^ Source: Dune Analytics.

- 5 ^ For another comparison, see “DeFi Beyond the Hype: The Emerging World of Decentralized Finance”, University of Pennsylvania Wharton Blockchain and Digital Asset Project.

- 6 ^ However, interoperability also creates dependencies and a type of “interconnectedness risk” also present in the existing financial system.

- 7 ^ Excluding AMM liquidity provider tokens.

- 8 ^ Aave also provides fixed-rate loans, which operate slightly differently. The spread captured by the protocol is a function of both fixed and variable borrowing rates and their respective shares of borrowers.

- 9 ^ Source: Dune Analytics.

- 10 ^ Not all DeFi protocols are structured as DAOs, and in practice the degree of decentralization differs.

- 11 ^ Specifically, 10-9 ETH.

- 12 ^ Technically the product of the gas units and a base fee plus a “tip” which serves to prioritize transactions.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.