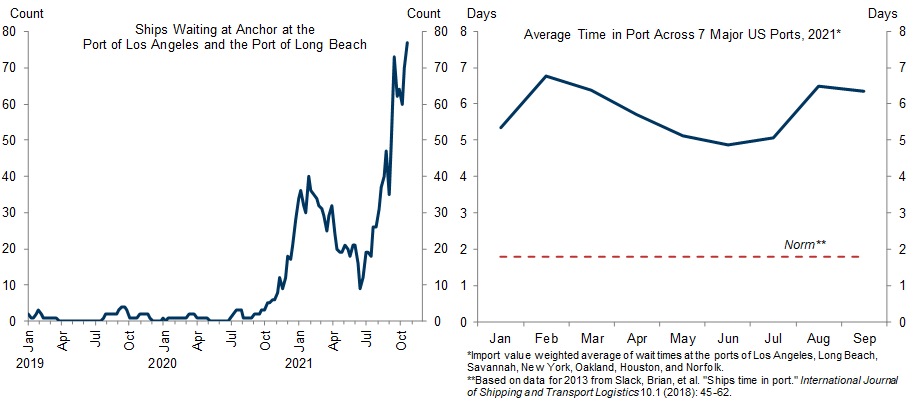

The media is awash in anecdotes of congestion at US ports, with particular focus on the 77 ships at anchor outside of the ports of Los Angeles and Long Beach. With an estimated $24bn in goods sitting outside those two ports alone, resolving the bottlenecks at US ports could help ease the shortage of goods that has contributed to substantially higher prices over the last year.

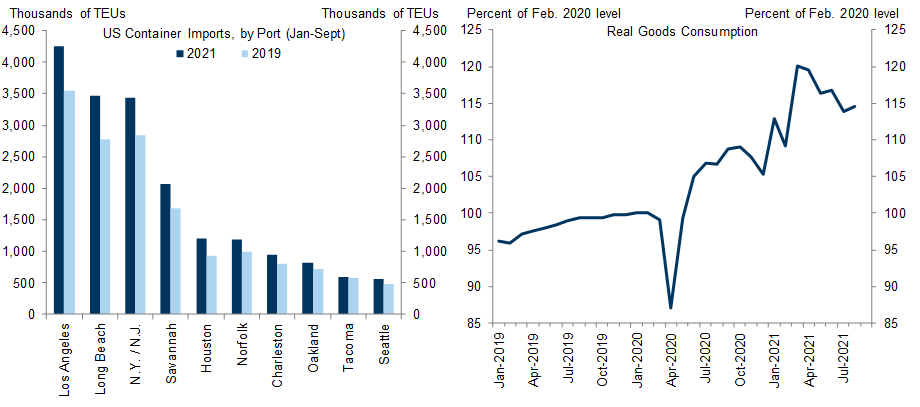

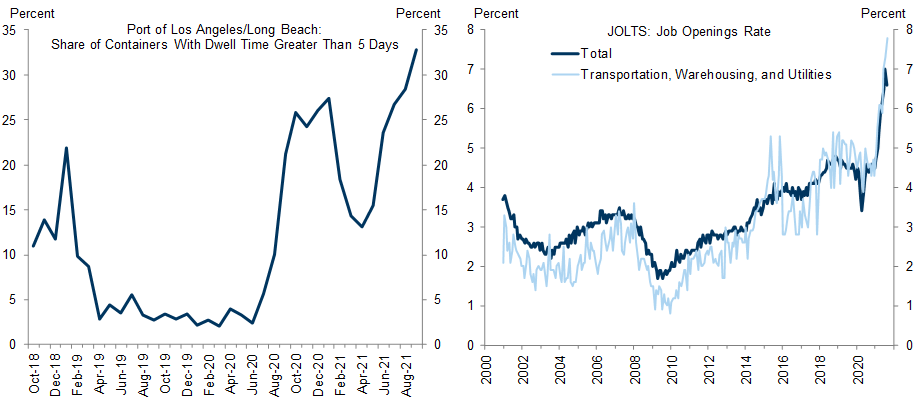

The backlog of ships is the result of both extremely elevated demand for goods — as imports have surged to keep up with goods consumption that is 14% above the pre-pandemic level — and constraints on inland shipping capacity — including shortages of labor, warehousing, and equipment — that have limited the industry’s ability to expand.

Commentary from both our analysts and industry leaders suggests that backlogs and elevated shipping costs are likely to persist at least through the middle of next year because no immediate solution for the underlying supply-demand imbalance at US ports is available. But pressures should soon begin to ease slightly as we pass the ongoing seasonal peak in shipping demand ahead of the holiday season, and should ease more meaningfully after Chinese New Year when the number of inbound shipping containers is historically near its seasonal low for a couple months.

US Port Backlogs: A Story of High Demand and Stretched Supply

Exhibit 1: The Backlog of Ships at the Ports of Los Angeles and Long Beach Has Worsened Substantially over the Last Few Months; Turnaround Times at Major US Ports Are Three Times the Historical Norm

Ronnie Walker

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.