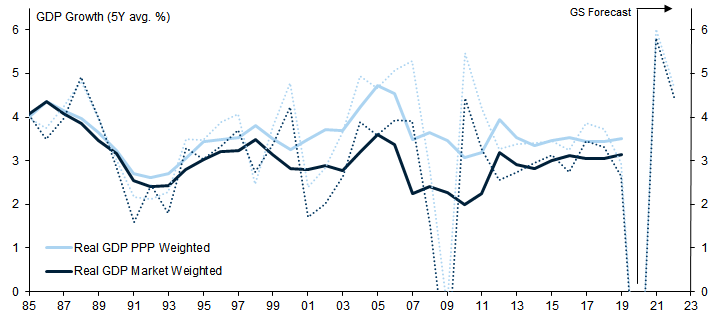

How fast does the world grow? The most common method of measuring global GDP growth is to weight each country’s growth rates together using purchasing power parity (PPP) exchange rates. On this basis, global real GDP growth averaged 3.2% in the 1990s, 3.7% in the 2000s, and 3.5% in the 2010s.

The logic of using PPP exchange rates rather than market exchange rates is that they adjust for the fact that goods and services are typically cheaper in relatively poor economies than in rich economies. For this reason, PPP-based weights are better at capturing the welfare implications of global growth.

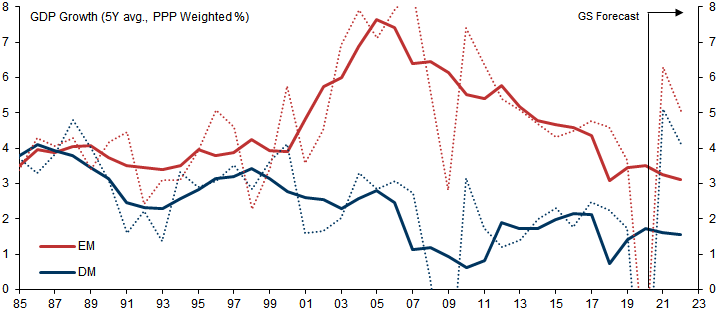

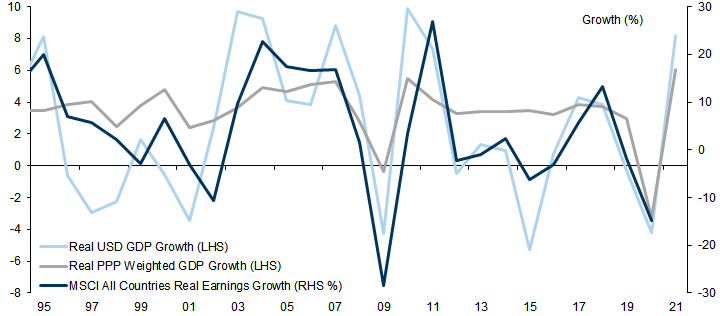

However, from the perspective of financial markets, using market-based exchange rates is arguably a more appropriate methodology. On this basis, global GDP growth averaged 3.0% in the 1990s, 2.6% in the 2000s, and 3.0% in the 2010s. This is lower than the growth rates recorded using PPP weights, because the latter give a larger weighting to EM economies and EMs typically grow faster than DMs. The gap between the two measures increased to more than 1pp per year during the BRICs boom period (2000-2010) and has since fallen back to a little under 0.5pp on average. For 2021, the gap between PPP- and market-weighted global GDP growth appears likely to be small (6.0% vs. 5.9% on our estimates), because we expect the EM-DM growth differential to be unusually low this year.

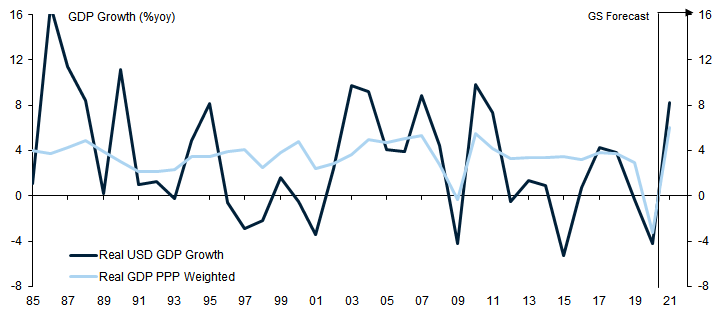

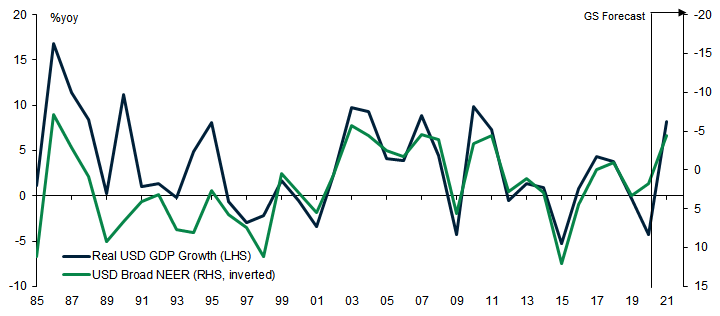

Both of these approaches weight the growth rates of individual countries. A separate approach is to calculate the value of global GDP denominated in a common currency (typically the US Dollar), by converting the levels of each country’s GDP at current market exchange rates, before adjusting for inflation. Real USD global GDP captures both economic growth and FX revaluation effects and is therefore more volatile than standard measures. However, for investors trading in global equity indices quoted in USD, aggregating global GDP in this way more closely matches the reality that they face (e.g., earnings growth for the MSCI All Country World Index is more closely correlated with global GDP calculated by aggregating levels rather than growth rates). Reflecting the weakness of the US Dollar this year vs. its 2020 average, we expect the real USD value of global GDP to rise by 8.2% this year, vs. 6.0% using PPP weights.

In 2022, we will start publishing global growth forecasts for market-weighted and USD GDP, in parallel with our existing PPP-weighted forecasts.

How Fast Does the World Grow?

Calculating Global GDP Growth

The most common approach is to use purchasing power parity (PPP) exchange rates, which calculate the rate at which the currency of one country would have to be converted into that of another country to buy the same amount of goods and services in each country. PPP-based weights adjust for the fact that goods and services are typically cheaper in relatively poor economies than in rich economies. For this reason, PPP-based weights are better designed to capture the welfare implications of global growth.

The second approach is to use market exchange rates to convert each country’s GDP into a common currency. This approach makes no adjustment for differences in spending power across economies but the weights accurately reflect the Dollar value of each economy’s GDP. For this reason, market FX weights are arguably the more appropriate methodology from the perspective of financial markets.

Market-Weighted Global GDP Growth Typically Weaker than PPP-Weighted Growth

Dollar-Denominated Global GDP — More Volatile, But Closer to the Experience of Equity Market Participants

Exhibit 4: Dollar-Denominated GDP Fluctuations Closely Correlated with Broad Dollar Exchange Rate Index

Exhibit 5: Earnings Growth More Closely Linked to Real USD Growth than Real PPP GDP Growth

Dollar Decline vs. 2020 Contributing to Exceptional USD Global Growth in 2021

- 1 ^ In addition to convergence due to growth differentials, the differences between PPP-based weights and market-based weights are now somewhat less than they were in the 2000-2010 period.

- 2 ^ To calculate real USD global GDP, the series can be deflated with US CPI. To calculate global GDP denominated in other currencies, the CPI deflator of the relevant currency should be used.

- 3 ^ One could go further and match the weights of each country to the country weights of the index. But this would necessitate a different set of weights for each index and many different measures of ‘Global GDP’.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.