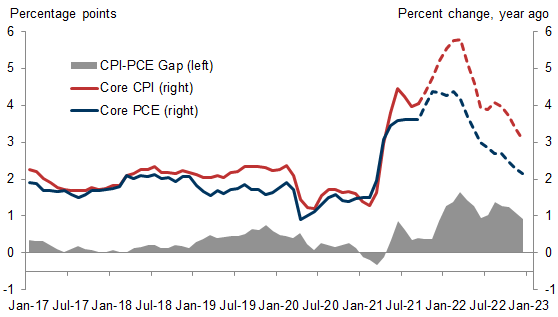

We recently bumped up our 2022 PCE inflation forecasts on an expectation that it will take longer to overcome supply chain challenges and in particular to boost auto production enough to replenish depleted inventories and exert downward pressure on prices. We now expect core PCE inflation to stand at 4.3% at end-2021, 3% in June 2022, and 2.15% at end-2022.

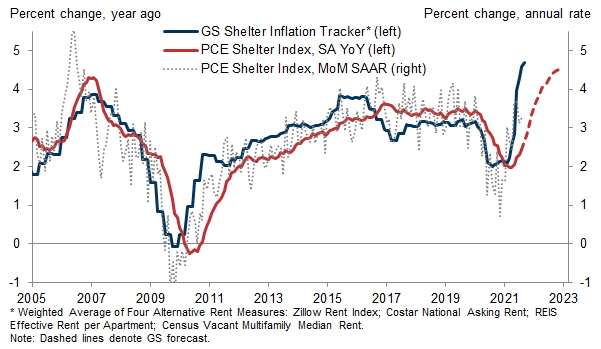

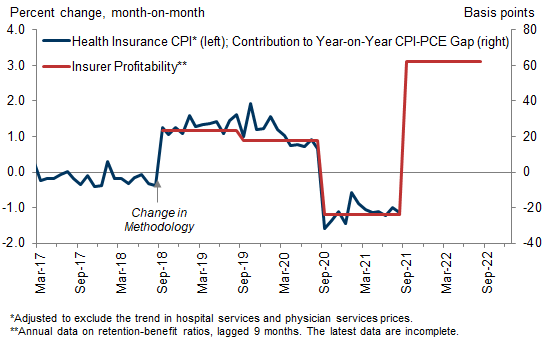

We also expect CPI inflation to exceed PCE by more than usual over the next year, for three main reasons. First, durable goods such as cars have a higher weight in the CPI, and it now appears that it will take longer for their very elevated inflation rates to come down. Second, shelter inflation also has a much larger weight in the CPI and is likely to rise sharply. Third, the source data used to calculate the health insurance component that is unique to the CPI point to a spike over the next year. We expect these factors to push year-on-year core CPI inflation to the mid-5’s in 2022Q1, 4% in June 2022, and 3.1% at end-2022, a roughly 100bp gap with PCE. The first and third issues should reverse in 2023, which would then compress the CPI-PCE gap.

While the PCE index is the Fed’s preferred inflation measure, Fed officials look at many measures, and it increasingly appears that the full set of inflation data will look quite hot on a year-on-year basis around the middle of next year when tapering ends. As we noted recently, this increases the risk of an earlier hike in 2022.

A Wider CPI-PCE Gap and a Hotter Inflation Dashboard in 2022

David Mericle

Spencer Hill

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.