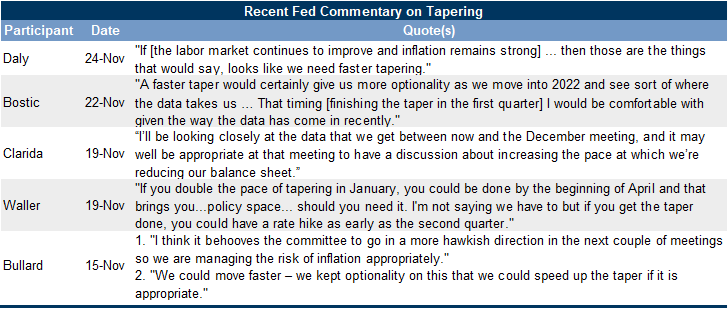

Several FOMC participants have signaled over the last couple of weeks that they are open to accelerating the pace of tapering, including Vice Chair Clarida and most recently San Francisco Fed President Daly. The increased openness to accelerating the taper pace likely reflects both somewhat higher-than-expected inflation over the last two months and greater comfort among Fed officials that a faster pace would not shock financial markets.

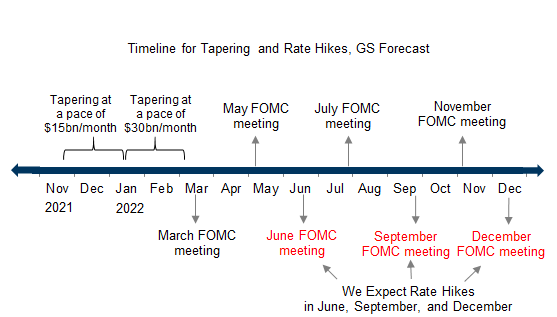

We now expect the Fed to announce at its December meeting that it is doubling the pace of tapering to $30bn per month starting in January. In that scenario, the FOMC would announce the final two tapers at its January meeting and implement the final taper in mid-March, several days before the March FOMC meeting.

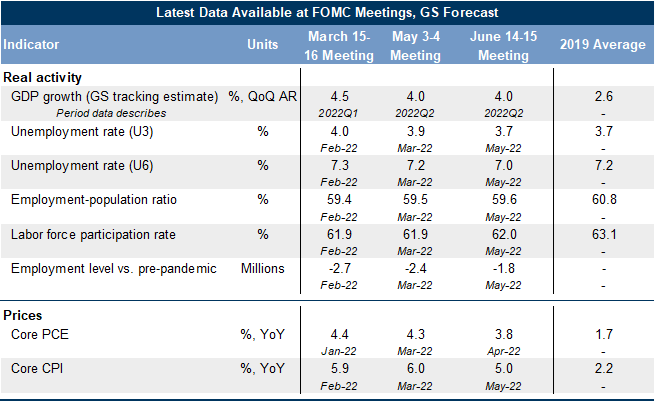

While this faster pace of tapering would allow the FOMC to consider a rate hike as early as March, our best guess is that it will wait until June, when a few additional employment reports will be available. We now expect hikes in June, September, and December, for a total of three in 2022 (vs. two in July and November previously), followed by two hikes per year starting in 2023. We see an alternative path of hikes at the May, July, and November meetings as a realistic possibility too. The largest risk to our expectation of an early liftoff is that some participants might find it hard to square a still-large employment gap relative to the pre-pandemic level with the guidance that the FOMC will not hike until the labor market reaches maximum employment.

A Faster Taper and a Slightly Earlier Liftoff

David Mericle

Jan Hatzius

Ronnie Walker

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.