We discuss four potential scenarios for the Omicron variant and the macro outlook.

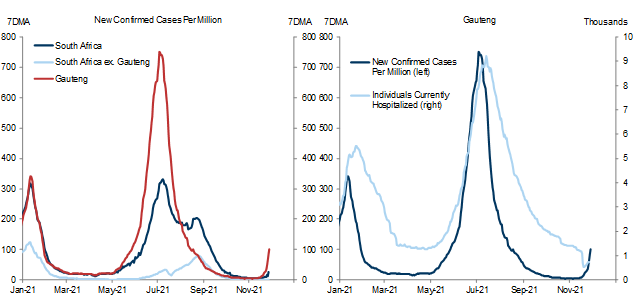

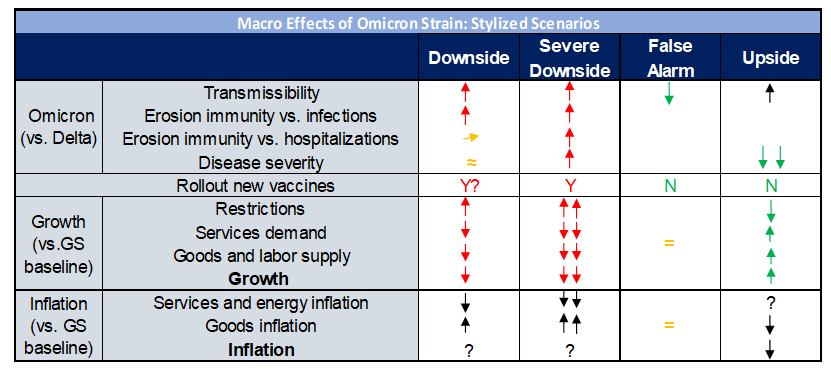

In a first “downside” scenario, Omicron transmits more quickly than Delta and also evades immunity against infections more, but evades immunity against hospitalizations only slightly more, and causes similarly severe disease.

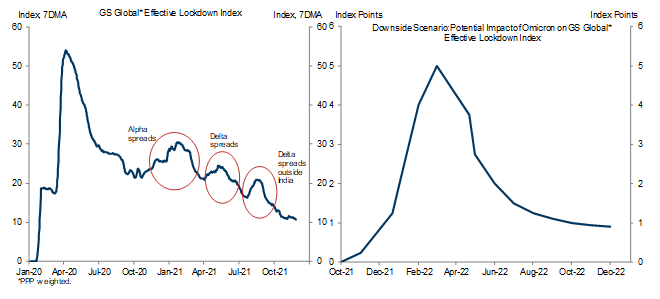

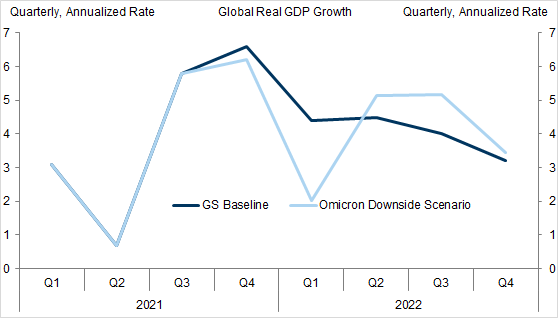

In this “downside” scenario, another large Q1 infection wave leads to a tightening in our global GS Effective Lockdown Index (ELI) that looks similar to the “Delta” tightening but then gradually abates with the distribution of new vaccines and antivirals. Global growth in Q1 slows to a 2% quarter-on-quarter annual rate, 2½pp below our current forecast, and growth in 2022 as a whole is 4.2%, 0.4pp below our current forecast. In contrast, growth in 2023 is 3.8%, 0.3pp above our current forecast. Inflation in 2022 is probably below our current forecast in services and energy (because of weaker demand) but above our current forecast in goods (because of weaker supply), with an ambiguous net impact on overall CPI inflation.

In a second and less likely “severe downside” scenario, both disease severity and immunity against hospitalizations are substantially worse than for Delta. In this scenario, global growth is substantially lower than in the first downside scenario, while the inflation impact is again ambiguous.

In a third “false alarm” scenario, Omicron spreads less quickly than Delta, and has no significant effect on global growth and inflation.

In a fourth “upside” scenario, Omicron is slightly more transmissible but causes much less severe disease. In this speculative “normalization” scenario, a net reduction in disease burden leaves global growth higher than in our baseline, and inflation likely lower as the rebalancing of demand, and the recovery in goods and labor supply accelerate.

We are not making Omicron-related changes to our forecasts until the likelihood of these scenarios has become somewhat clearer.

Omicron and Global Growth

Four Scenarios

Quantifying Growth in the Downside Scenario

- 1 ^ The estimated effects of strains on the ELI fully attribute monthly ELI deviations from the gradually declining trend in November 2020-January 2021 to Alpha, and in May and August 2021 to Delta.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.