Two surprises from the December FOMC meeting reinforced our relatively hawkish Fed views. First, the FOMC revised its statement to drop its previous intention to maintain an accommodative policy stance in order to keep inflation above 2 percent for some time. This implies that the goals of the new average inflation targeting framework have been met, and that the reaction function will look more traditional and prescribe a steadier pace of tightening. Second, Chair Powell sounded hawkish on inflation and the labor market, suggesting that he might conclude that the maximum employment requirement for liftoff has been met even earlier than we thought.

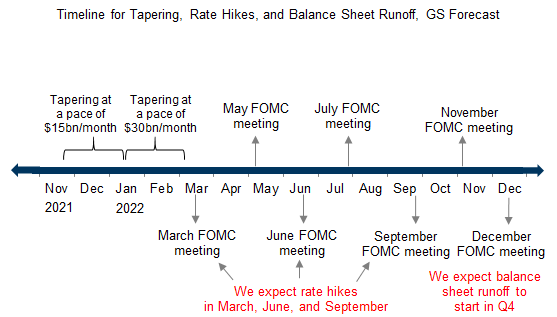

We continue to expect three rate hikes in 2022. We have pulled forward our forecast of the timing of liftoff slightly from May to March, though we see it as a close call, and we expect this to be followed by hikes in June and September. In light of this slightly earlier timing of hikes and Powell’s comments about balance sheet runoff, we now expect that runoff will begin in 2022Q4 (vs. 2023H1 previously) and will substitute for a hike that quarter, though that is not assured.

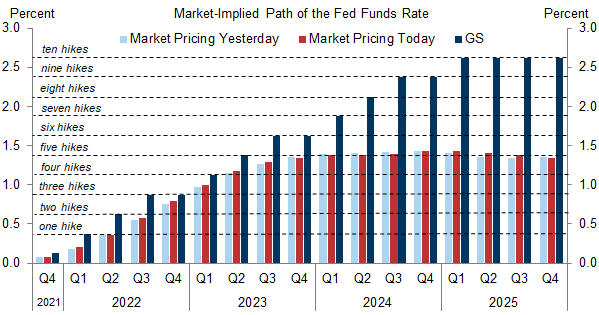

We also continue to expect a terminal rate of 2.5-2.75%, though we now expect the FOMC to get there a bit more quickly with three hikes per year in 2023 and 2024 (vs. two previously). We had inferred from the September dots that the Fed leadership envisioned hiking two times per year for reasons related to the new framework, but the changes to the statement imply that the framework is no longer a reason for a slow pace. We forecast three hikes per year instead of last cycle’s default pace of four because we continue to expect growth and inflation to moderate by the end of 2022, which should reduce the urgency to raise the funds rate. Our medium-term Fed call was already more hawkish than market pricing, and these changes have widened the gap.

December FOMC Recap: Hawkish Signals Point to March Liftoff and Earlier Start to Balance Sheet Runoff

David Mericle

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.