Today’s comment looks back at the 10 questions for 2021 that we posed at the end of last year, what we predicted, and what actually happened.

As we expected, the economy kept growing through last winter’s virus wave and ultimately recovered much more quickly than consensus expected. Our above-consensus GDP growth forecast and below-consensus unemployment rate forecast both proved directionally right.

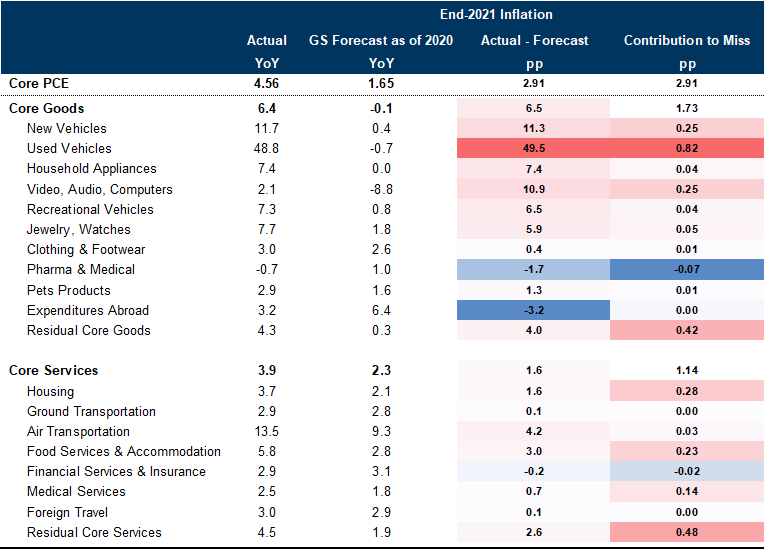

The major surprise to our expectations was the inflation surge, which has lasted much longer than we expected and reached a much higher peak. As a result, the Fed started tapering earlier than we expected and is on track to complete the taper much earlier than we expected.

We expect 2022 to be a year of moderation, with both growth and inflation coming down sharply by the end of the year. But we think inflation is likely to remain high for a while, high enough for the FOMC to deliver three rate hikes and begin balance sheet runoff next year.

A Retrospective on “10 Questions for 2021”

David Mericle

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.