Global Views: Earlier Runoff, Four Hikes

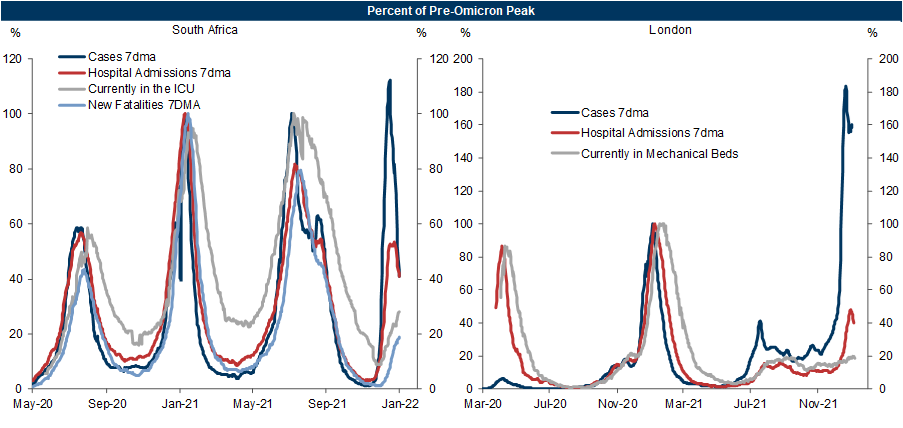

1. When the first reports about the Omicron variant emerged from South Africa in November, we cut our global GDP forecast moderately on the assumption that its economic impact would resemble that of the Delta variant earlier in the year. On balance, this still looks about right, as Omicron is even more transmissible than we had expected but also less severe. Moreover, both confirmed cases and hospital admissions are now on a downward trend not only in South Africa but also in London, the first place in the Northern Hemisphere to see a major outbreak. If this pattern holds up elsewhere, the economic impact should be largely behind us by the end of Q1, at least in the advanced economies.

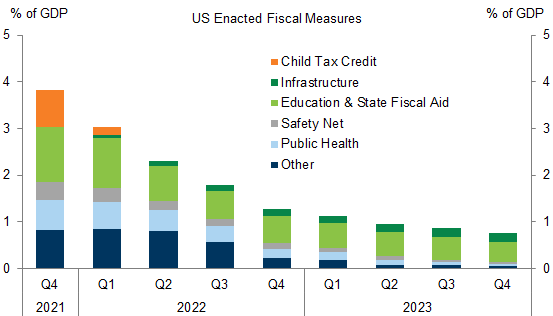

2. Over the past month, we have made bigger downward revisions to our growth forecast in the US than elsewhere because we recently dropped our assumption of a comprehensive fiscal package. The most tangible shift is that we now expect the refundable child tax credit of up to $3,600 per child—worth $180bn in annualized personal income, or 0.7% of GDP—to lapse in 2022. This is a meaningful negative impulse to aggregate demand because the lump-sum nature of the tax credit means that it represents a sizable budget share for lower-income households, whose spending propensities are generally higher. More broadly, the normalization of fiscal policy after the unprecedented stimulus of the last two years is a key reason why we expect US growth to slow to a pace that is only modestly above potential by late 2022/early 2023.

3. The US labor market continues to make rapid progress. Although the 199k nonfarm payroll print for December fell far short of expectations, we once again expect an upward revision, as already seen for 10 out of the first 11 months of 2021. This reflects not only statistical considerations—i.e. adverse seasonal adjustment and an unusually low survey response rate—but also the fact that the household survey once again showed a stronger jobs gain than the establishment survey. The unemployment rate fell 0.3pp to 3.9%—just below the FOMC’s median estimate of its longer-term level—and broader measures such as U6 and the prime-age employment/population ratio improved further as well. Other indicators of short-term labor market utilization such as job openings, quits, and household perceptions of job availability remain near all-time highs, suggesting that the remaining employment shortfall relative to February 2020 mostly reflects labor supply shortages, not inadequate demand.

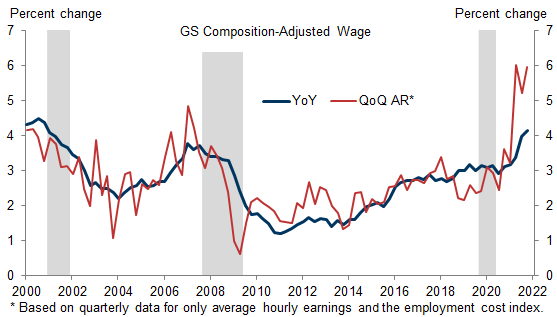

4. The strength of wage inflation also points to growing labor scarcity. Average hourly earnings clocked an outsized 0.6% month-to-month gain in December, bringing our composition-adjusted wage tracker for Q4 to a preliminary 6.0% in quarter-on-quarter annualized terms and 4.1% year-on-year. Although the evidence continues to support our view that the expiration of pandemic jobless benefits has increased labor supply, the more important factor for overall wage growth is clearly the strength of labor demand. Price inflation also remains firm. Following the broad-based 0.5% month-to-month increase in the core PCE for November, we forecast an above-consensus 0.6% in the core CPI for December (released on Wednesday).

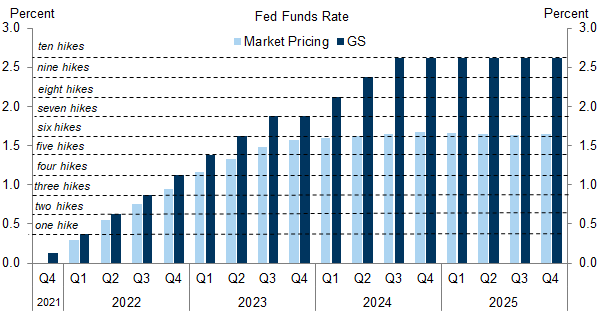

5. Declining labor market slack has made Fed officials more sensitive to upside inflation risks and less sensitive to downside growth risks. Although the FOMC minutes mostly confirmed the message sent by Chair Powell in the December 15 press conference, the committee’s discussion around normalization of the balance sheet did convey a greater sense of urgency than we had expected. Subsequently, San Francisco Fed President Mary Daly—whose hint in late November that the FOMC might accelerate tapering proved to be a signal worth heeding—suggested that the runoff process might start after just 1-2 hikes. We are therefore pulling forward our runoff forecast from December to July, with risks tilted to the even earlier side. With inflation probably still far above target at that point, we no longer think that the start to runoff will substitute for a quarterly rate hike. We continue to see hikes in March, June, and September, and have now added a hike in December for a total of four in 2022. Our forecast for the terminal funds rate remains 2½-2¾%.

6. Even with four hikes, our path for the funds rate is only modestly above market pricing for 2022, but the gap grows significantly in subsequent years. Our rates strategists recently discussed two potential explanations for why longer-dated funds rate pricing is so low: a) an extremely low market estimate of nominal r* and b) a supply-demand imbalance resembling the pre-2008 bond market conundrum. We think both play a role, but neither is likely to keep the funds rate from ultimately rising well above the 1.6% now discounted in market pricing. Nominal r* is probably higher than in the last cycle, in part because of larger long-run fiscal deficits and in part because of the Fed’s higher effective inflation target. And the supply-demand balance is likely to shift in favor of higher interest rates, as global central banks go from growing their balance sheets to shrinking them while government deficits remain above pre-pandemic norms.

7. Once the Euro area gets through the near-term challenges from surging infections and surging energy prices, we expect it to outperform the US. At the simplest level, this is because Europe has more room to grow. The level of GDP is further below the pre-pandemic trend, the labor market looks much less tight, and underlying inflation is much lower. Both fiscal and monetary policy are therefore likely to remain expansionary. The NGEU Recovery Fund will ramp up financing projects this year, which should help especially Southern Europe, and the ECB Governing Council is likely to keep the deposit rate at -0.5% for a long time to come, almost certainly through 2022 and probably also through 2023.

8. By contrast, we remain cautious on China and see downside risks to our below-consensus growth forecast of 4.8% in 2022. This partly reflects the weakness in the property sector, which we expect to subtract meaningfully from growth in 2022 after a large positive contribution in the prior decade. In addition, Omicron's much greater transmissibility and vaccine evasion could significantly raise the economic costs of upholding Beijing’s zero-covid policy. Our China team estimates that, all else equal, our 2022 GDP forecast may need to come down by 0.9pp in a downside scenario that involves rolling regional lockdowns and by as much as 3.3pp in a severe downside scenario that involves a full national lockdown. (However, all else isn’t equal as the government would likely seek to offset part of the hit via easier macro policies, which are already visible to some degree).

9. The combination of lower growth forecasts, rising inflation, and hawkish monetary policy signals has hit the equity market, modestly at the index level and more significantly in the highly valued technology sector. If the uptrend in bond yields slows in coming weeks, as our rates strategists expect, this might allow stock prices—which are often more sensitive to changes in bond yields than to their level—to recover some of their lost ground. In contrast to equities, spread markets have remained resilient to the greater market volatility so far, but our credit strategists remain broadly cautious and have, more specifically, moved to an underweight recommendation for agency MBS in view of the Fed’s upcoming balance sheet runoff. Finally, our FX strategists recommend longs in the Canadian dollar and shorts in the Japanese yen and Australian dollar, while our commodity strategists remain bullish on oil prices as fuel demand is set to recover from the recent Omicron-induced hit.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.