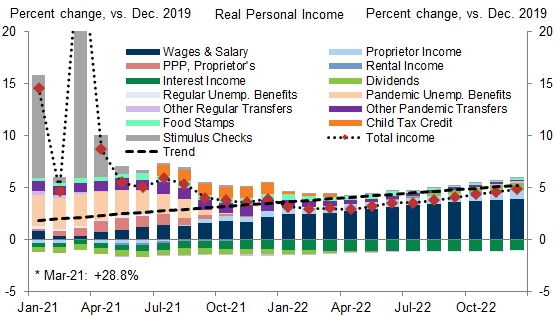

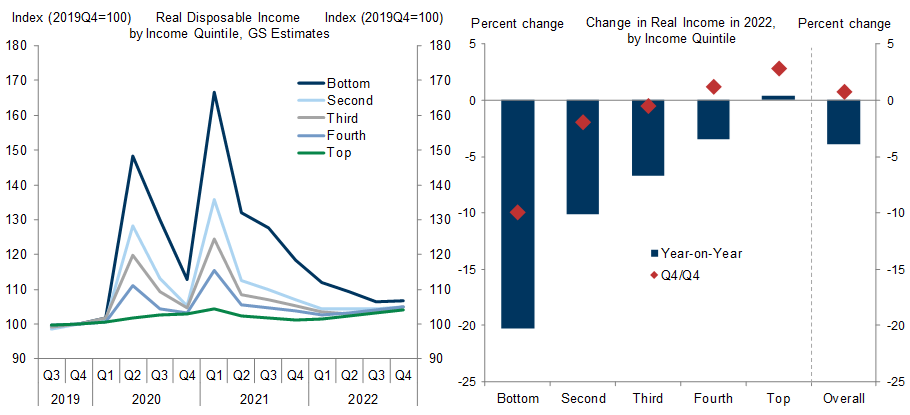

In December we updated our economic forecasts to remove the assumption that President Biden’s Build Back Better (BBB) legislation will become law. This change implies a bigger step down in household income in 2022Q1 due to the lapse of the child tax credit, and we now expect overall disposable personal income will remain a bit below its pre-pandemic trend in 2022.

The removal of the child tax credit and other support will predominantly weigh on income for households in lower income quintiles. Although we expect that income for the bottom income quintile will benefit from firm wage growth and a persistent boost in food stamp benefits, real income for the bottom income quintile is set to step down sharply in 2022H1.

We expect that other positive growth impulses—including further reopening of the economy, a spending boost from pent-up savings, and inventory restocking—will offset the pullback in fiscal transfers and keep growth above potential in 2022, but the significant stepdown in household income—particularly among lower-income households—is one reason why we expect growth will decelerate from 5.4% (Q4/Q4 basis) in 2021 to 2.4% in 2022.

Updating Our Distributional Disposable Income Forecasts to Remove the Expanded Child Tax Credit

Joseph Briggs

- 1 ^ The boost to food stamps reflects a large permanent increase in benefit amounts related to re-evaluation of the Thrifty Food Plan that went into effect on October 1, as well as temporary benefit expansions that were passed during the pandemic and that will remain in place in most states while the US remains in a public health emergency.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.