Global Views: Where Russia Matters Most

1. Russia’s invasion of Ukraine—and the Western response to it—will exacerbate the supply-demand imbalance that lies at the heart of the global inflation surge. Reducing trade with a current account surplus country via sanctions and boycotts means that the rest of the world needs to produce a larger share of what it consumes. The potential shift is fairly small at an aggregate level, as Russia accounts for less than 2% of global goods trade and GDP. It is considerably larger in oil, where Russia supplies 11% of global consumption. And it is huge in natural gas, where Russia supplies 17% of global consumption and as much as 40% of Western European consumption as of 2021.

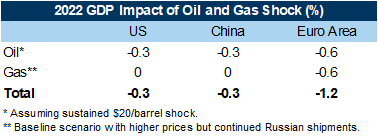

2. If Western countries buy less Russian oil, China and India could in principle buy more Russian oil and correspondingly less Saudi and other oil, which can then flow to the West. But this “rearrangement of the deck chairs” isn’t perfect, not only because of increased transport costs and other technical frictions but also because China and India may be reluctant to increase their imports and corresponding payments sharply at a time when Russia is becoming a global pariah. In fact, it is possible that any Western oil sanctions—which are gaining increasing support in Congress—would also apply to third countries. Reflecting these concerns, the crisis has already pushed up Brent and WTI benchmark crude prices by more than $20/barrel, and our commodity strategists see a potential for further gains. We estimate that a sustained $20 shock will lower real GDP by 0.6% in the Euro area, where consumers are hit by another cost of living blow, and a more modest 0.3% in the US, where consumers also lose out but increased domestic production and investment in shale provides a partial offset.

3. The Euro area is likely to see a double whammy from both oil and natural gas prices. In a baseline scenario where Russian gas keeps flowing and the issue is merely one of higher prices, our European economics team estimates another 0.6% GDP hit from natural gas in 2022, for a total negative energy impact of 1.2%. A more adverse scenario in which Russian gas shipments through Ukraine are curtailed could cut Euro area GDP by around 1% for gas alone, with Germany and Italy most affected. And if Russian gas stopped flowing entirely, the area-wide gas hit could rise to 2.2% for the year as a whole.

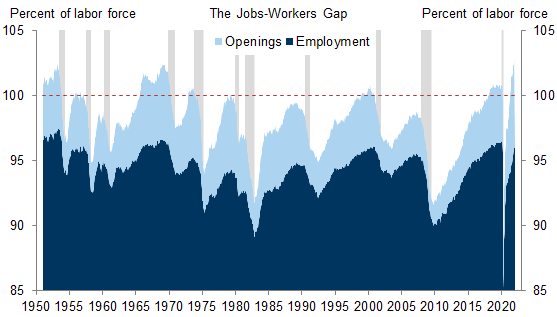

4. The oil price increase is hitting a US economy that is already overheating. As of December, the total number of jobs (both filled and unfilled) stands 2.8% above the total number of workers, the biggest gap in postwar history. The 678k increase in nonfarm payrolls in February, upward revisions to prior months, and another cycle low for the unemployment rate at 3.8% suggest that the labor market has tightened further since then. Hence, the surprising weakness in average hourly earnings—though welcome news in light of the unsustainable wage gains visible in other recent indicators—is unlikely to set the stage for a return of wage growth from the current 5-6% pace to the 3.5-4% pace that would be consistent with the US economy’s 1.5-2% productivity trend and the Fed’s 2% inflation target.

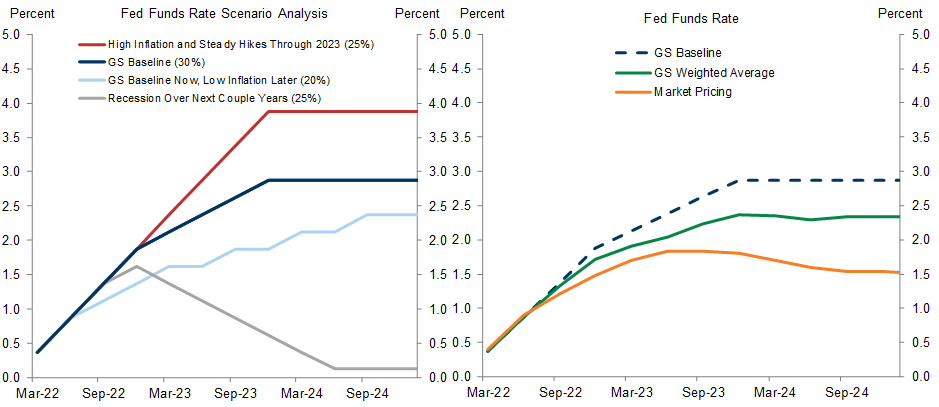

5. We have made no changes to our baseline forecast that the FOMC will deliver seven hikes in 2022—almost certainly starting with a 25bp move on March 16—and have nudged up our terminal funds rate estimate by 25bp to 2¾-3% on the back of an upward revision to core PCE inflation in 2022 and 2023. In this baseline forecast, the growth and inflation effects of the Russian invasion broadly cancel out, leaving the FOMC with an acute need to rein in the overheating in the labor market. However, the risks around our baseline funds rate path have grown. There is some risk that the fresh price shock will unanchor inflation expectations and force the FOMC to tighten in larger 50bp increments down the road. But there is an even bigger risk that the adverse shock to the global economy will trigger a large tightening in financial conditions that persuades Fed officials to pause (or even reverse) the hikes before too long. Thus, we now view the risks to our baseline funds rate forecast as more clearly tilted to the downside than before the invasion.

6. Relative to the US, the fundamental economic shock to the Euro area—especially in a downside scenario where natural gas becomes physically scarce—is more clearly interest rate negative. If factories have to shut down because scarce gas is used to heat houses at stabilized rates, the GDP impact could be much larger than the inflation impact. The potential tightening in European financial conditions is also greater, not only because of the natural gas exposure but also because of increased political risk. Finally, the pre-invasion case for tighter monetary policy was more finely balanced to begin with, as labor markets are less tight, wage growth is lower, and the core inflation overshoot relative to the 2% target is much smaller than in the US. Thus, we now see a greater risk that the ECB will delay liftoff until 2023.

7. China is less vulnerable to the shock because it lacks both Europe’s exposure to Russian natural gas and America’s labor market overheating. However, the oil price increase reinforces our below-consensus 4.5% economic growth forecast, a full point below the official GDP target. One key reason for our cautious view is that we expect policymakers to maintain significant covid restrictions for most of 2022, despite increased speculation about a transition to a “living with covid” policy. The dramatic recent escalation of cases and deaths in Hong Kong is likely to reinforce this mindset. Another reason is the ongoing stress in the property sector, though as policymakers gain confidence the excesses in this sector have been curbed, we are seeing further easing in credit and housing policy.

8. Financial markets have processed the shock fairly rationally so far. The moves have been extreme in Russia and several commodity markets but more moderate elsewhere, especially in core US assets. We think some of the moves—especially in the commodity markets—have room to extend further. We also think that the repricing of the 2022 funds rate path to 5½ hikes looks broadly reasonable on a probability-weighted basis. However, the funds rate path beyond 2022 is too low, in our view. Although the risk of an early reversal by the FOMC has clearly risen, so has the risk of a more lasting inflation increase that lifts the nominal funds rate back to the 4-5% average of the 1990s and early 2000s on a sustained basis. After several decades in which economic, financial, or political shocks invariably caused interest rates to fall, markets may have to re-learn that the opposite can also be true.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.