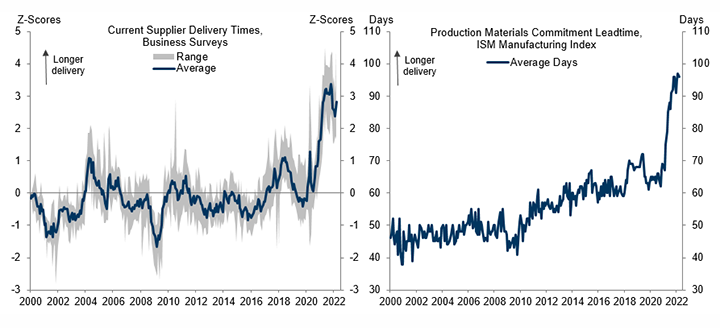

Core goods prices surprised to the downside in the March CPI report, with a notable decline in used car prices. Unfortunately, our aggregate measure of supplier delivery times has worsened for the first time in five months, suggesting the good news on goods prices might be short-lived. In today’s note, we provide an update on the impact of the latest global supply chain disruptions on our US GDP and inflation forecasts.

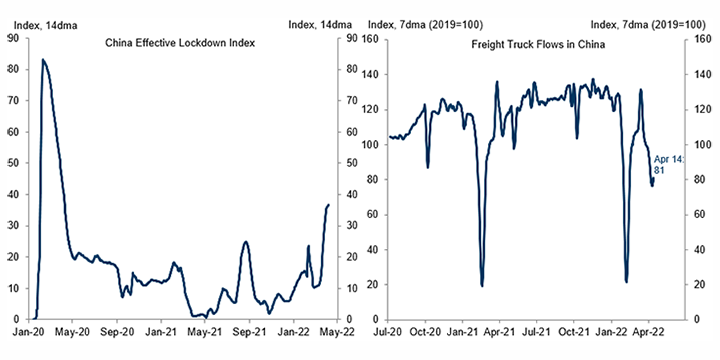

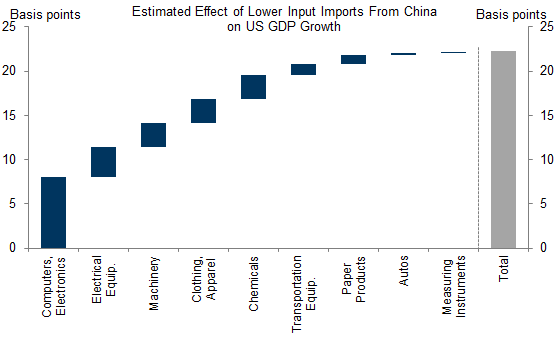

The renewed supply-side deterioration has three main causes. First, the Omicron wave in China has led to factory shutdowns and shipping delays. So far the impact looks roughly consistent with what we have allowed for in our inflation forecast since Omicron first appeared, but more prolonged disruptions would pose upside risk.

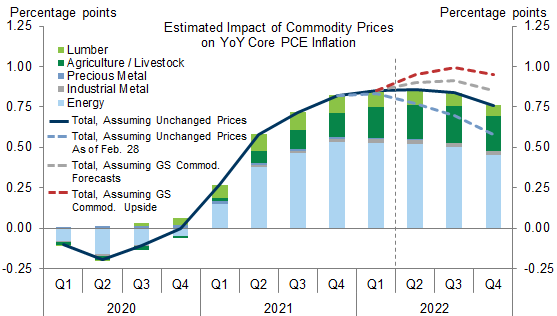

Second, the Russian invasion of Ukraine has raised food, energy, and metals prices. Our estimate of the impact of commodity price changes on year-on-year core PCE inflation is now 10bp higher for 2022Q4 than when the invasion began, and we recently tweaked our inflation forecast accordingly. Here too, the possibility of further sanctions and trade disruptions between the West and Russia remains an upside risk to inflation.

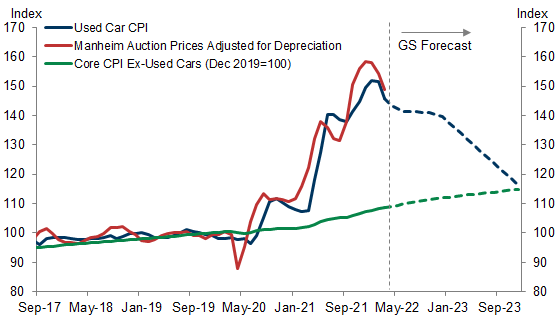

Third, disruptions to raw materials supplies and a slower pickup in semiconductor production recently led our autos analysts to cut their global auto production forecast by 3.4mn units. We had already assumed a delayed normalization of auto inventories and prices in our forecasts, and we expect used car prices to stop falling or even rebound a bit this spring before starting to fall again later this year and in 2023.

These supply chain setbacks have been somewhat worse than we anticipated, and we have adjusted our growth and inflation forecasts slightly in response in recent weeks. Even so, Omicron in China and the war in Ukraine still pose additional risk. We expect below-consensus GDP growth of 1.9% Q4/Q4 in 2022, but further spikes in consumer prices or production disruptions pose downside risk. We also expect core PCE inflation to fall from 5.2% to 4.0% by end-2022, driven entirely by a 150bp decline in the contribution from goods categories, but further supply problems could hinder this.

An Update on Supply Chain Disruptions and the US Economy

Manuel Abecasis

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.