Worrying news in corporate earnings calls and downside surprises in the May survey data have led some investors to worry that a recession is arriving ahead of schedule. We review the latest signals and fundamental drivers of the growth outlook across four dimensions: momentum, consumer demand, business activity, and the labor market.

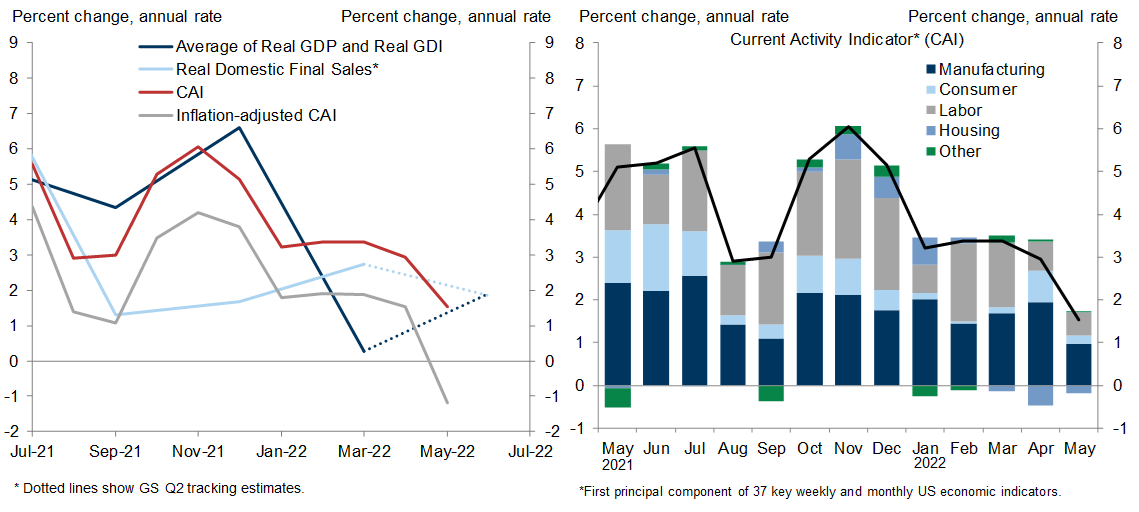

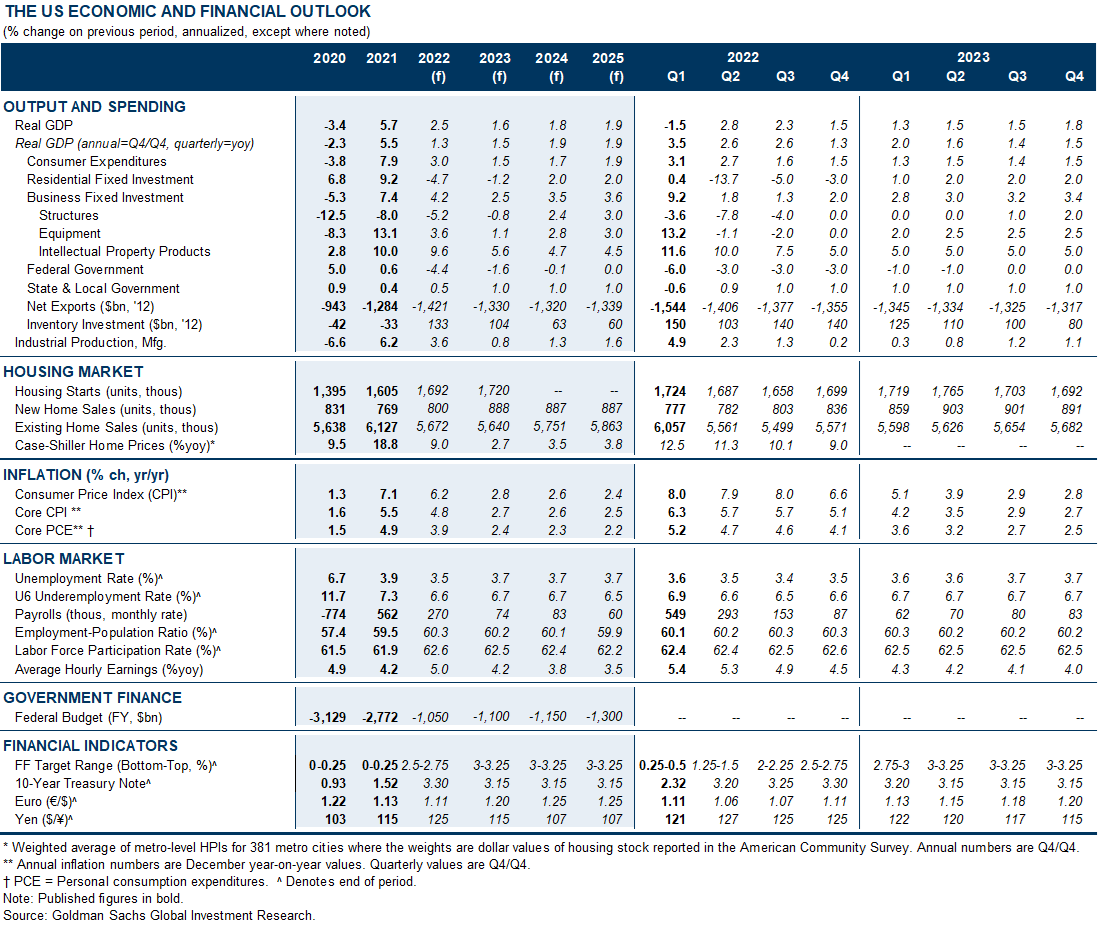

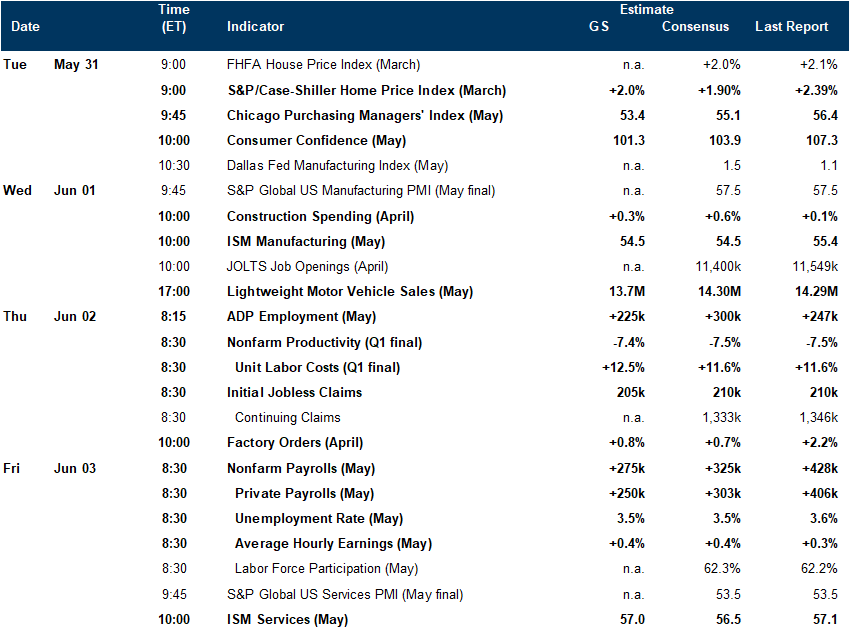

Growth Momentum: Realized growth had already slowed by the winter, with domestic demand, gross domestic income, and our CAI together suggesting a pace of 2-3%--down from +5.6% on average during 2021. The +1.5% preliminary May CAI reading suggests that growth has slowed further but nonetheless remains positive.

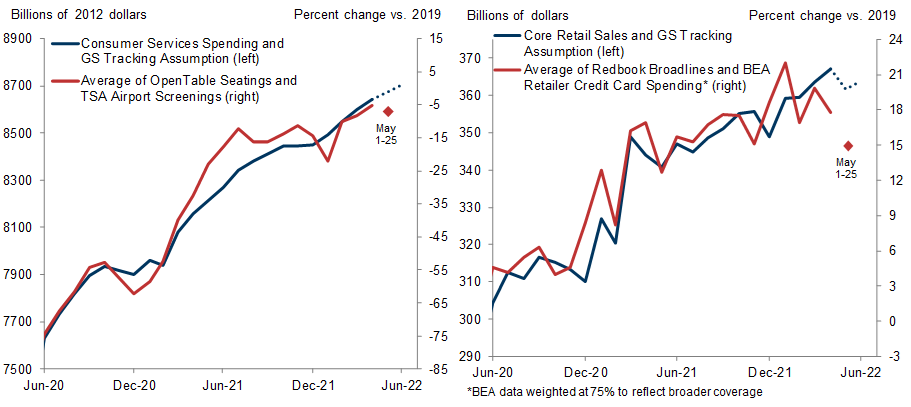

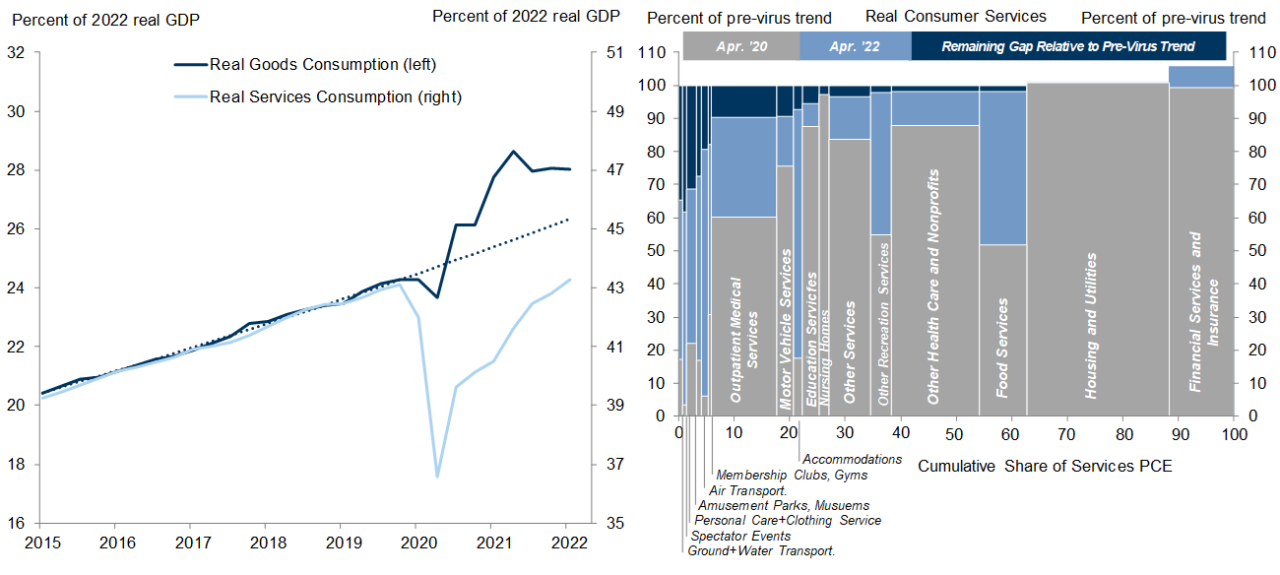

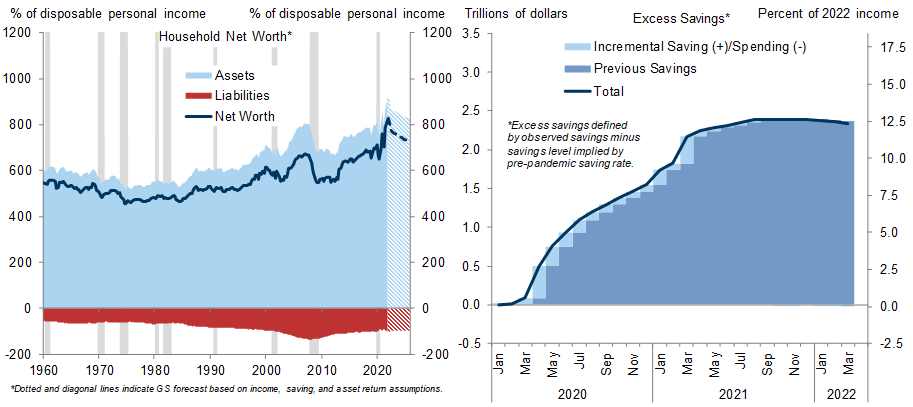

Consumer demand: Alternative data indicate consumer weakness in May that is not yet visible in the official data—perhaps in response to tighter financial conditions and higher consumer prices. This sequential weakness appears more pronounced for retail goods, consistent with a reopening-related demand shift back toward services. Services spending remains 5% below trend because of virus-sensitive categories like spectator events and travel, and coupled with very healthy household balance sheets and moderating headline inflation, we expect the early-summer lull in consumption growth will prove short-lived.

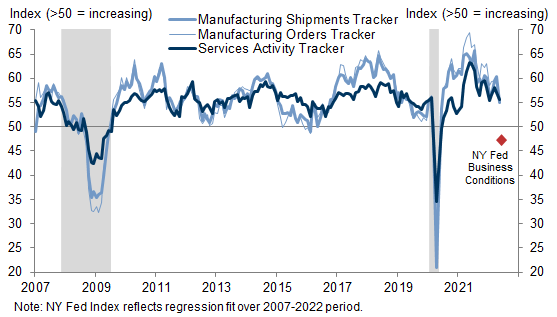

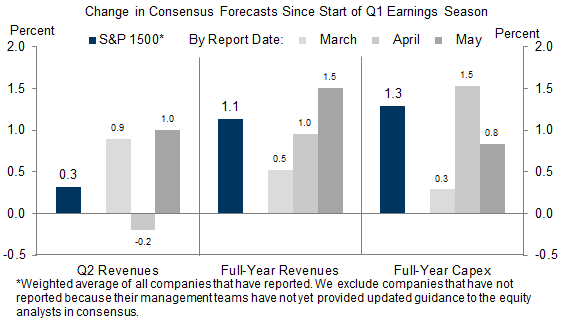

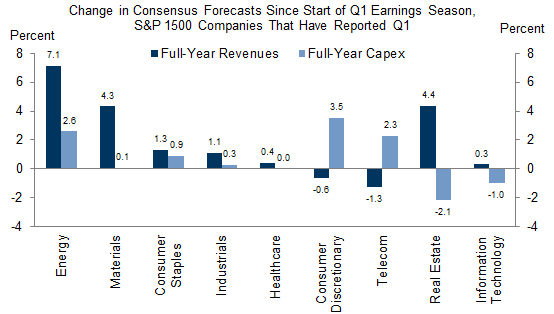

Business activity: Despite declining business confidence and high-profile earnings misses from retail and tech bellwethers, we find that business activity is outperforming sentiment. The much-maligned Q1 earnings season was actually better than expected overall, with S&P EPS growth 6pp above consensus on the back of 17% year-on-year revenue growth. And equity analyst forecasts for revenue and capex actually improved following the financial results and conference calls of the S&P 1500 firms that have reported. Relatedly, while the shipments, orders, and business activity measures of the May business surveys declined, they still indicate a solid pace of growth.

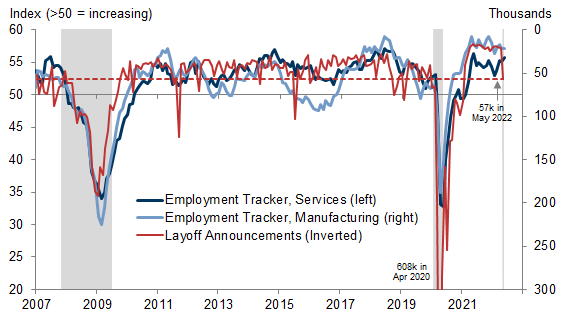

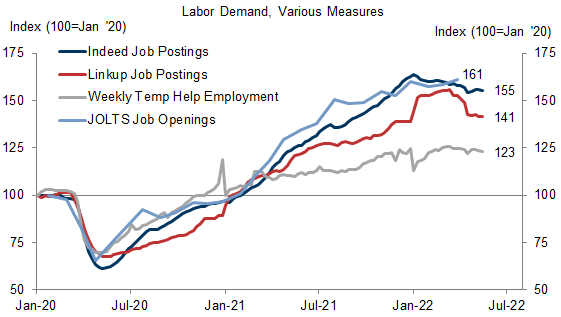

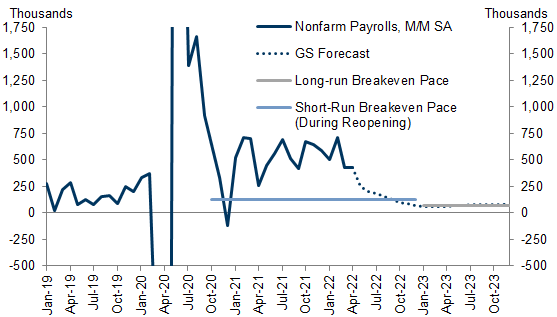

Labor market: Employment indicators also indicate deceleration rather than contraction. The employment measures in the April and May business surveys generally outperformed the headline and activity components. And while jobless claims and layoff announcements have increased, both moves so far look like normalization from the abnormally depressed levels of 2021. Job openings also moderated somewhat in late spring but remain 40-60% above 2019 levels, depending on the measure.

These facts suggest a growing disconnect between perceptions of the economy and actual business activity. Relatedly, a May survey of CEOs found that a majority now expect a recession. However, the same survey indicated that nearly two thirds of CEOs nonetheless plan to expand their workforce.

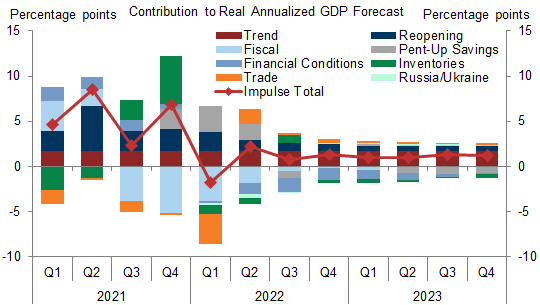

While our growth forecast has long been below consensus, we believe fears of declining economic activity this year will prove overblown unless new negative shocks materialize. We continue to forecast slower but not recessionary growth, with a trade-related rebound to +2.8% in Q2 followed by +1.6% average growth over the following four quarters (qoq ar).

Private-Sector Growth: Down but Not Out

Temperature Check

Consumption Growth: Soft in May, Not Going Away

Business Activity Outperforming Sentiment

Job Growth to Slow but Remain Positive

Spencer Hill

Manuel Abecasis

- 1 ^ Additionally, our version of the CAI that adjusts for nominal bias in business surveys now stands at -1.0% annualized (vs. +1.7% on average in Q1), and we expect real domestic final sales growth to decelerate from +2.7% annualized in Q1 to +1.9% in Q2.

- 2 ^ We assume real consumption growth of -0.6% in May and +0.3% in June following the 0.7% gain reported for April.

- 3 ^ At +2.0% and +1.8% above consensus, respectively. The increase in discounting resulted from rapid inventory restocking ahead of a surprisingly rapid shift in the composition of consumer demand towards reopening categories like luggage and beauty.

- 4 ^ During their post-earnings conference calls, reporting firms provide quantitative or qualitative guidance on business activity and their expectations for the subsequent quarter.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.