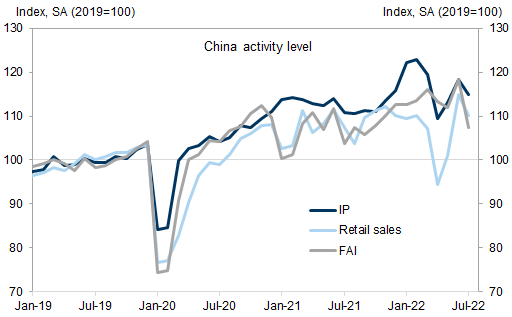

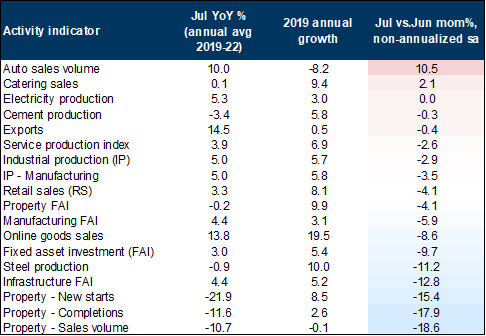

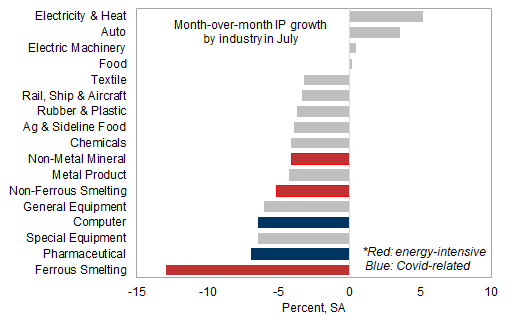

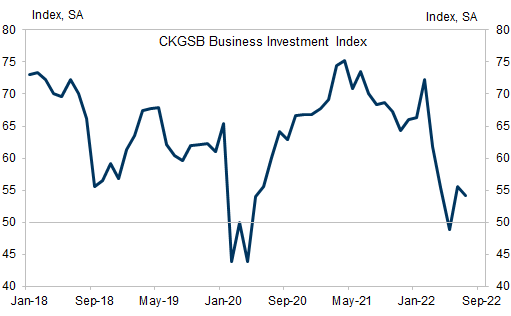

A clear picture of weak domestic demand: Combined with muted inflation and weak credit growth, July activity data confirmed the lack of domestic demand. With a few exceptions, most indicators showed sequential decline from June to July. For housing construction, infrastructure investment and steel production, the sequential declines were double-digit.

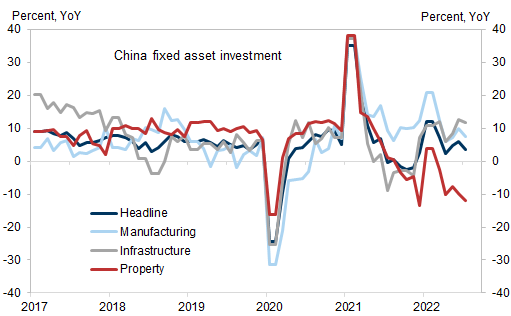

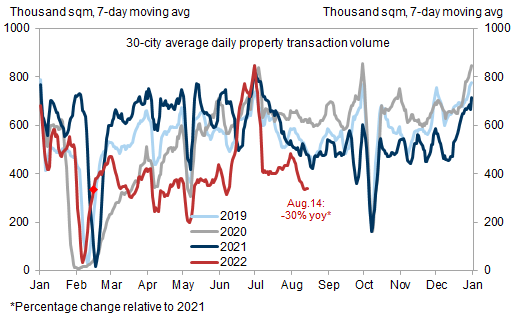

Negative impact of property slump permeating: Property investment contracted further in July, dragging down total investment. Retail sales of property-related items such as furniture and building materials significantly underperformed other items. And real estate services fell sharply, weighing on overall service output. High-frequency data suggest property sales dipped further in early August.

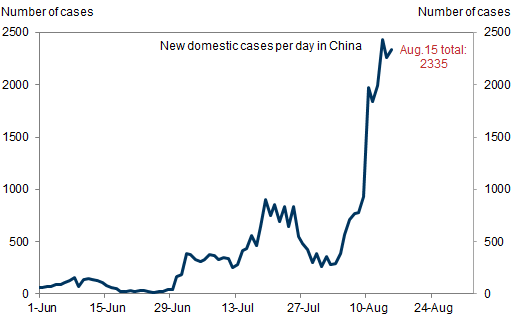

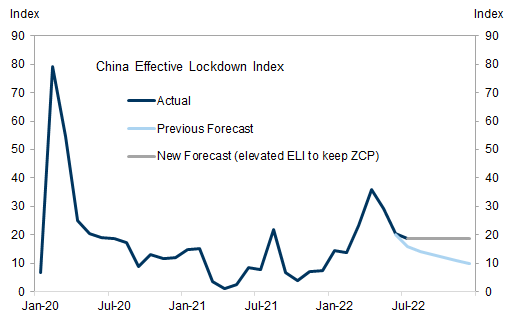

Covid and other near-term headwinds: Covid cases are on the rise and our China Effective Lockdown Index may need to stay elevated for the rest of 2022 under the zero-Covid regime. In addition, an unusually hot and dry summer has been stressing power supply and leading to production cuts in certain provinces and some energy-intensive sectors, although we are unlikely to see a repeat of last year’s power outages and severe production disruptions.

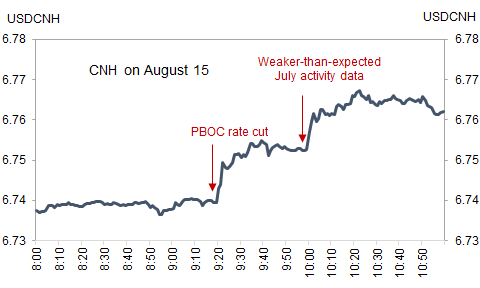

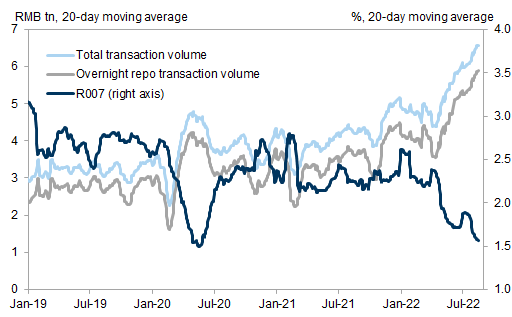

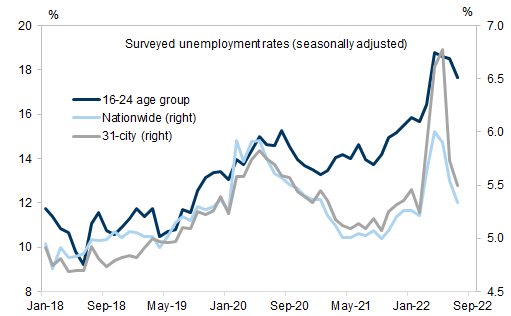

Major stimulus unlikely despite the PBOC rate cut: The PBOC surprised the market by cutting policy rates by 10bp. We do not think the rate cut signals the beginning of more aggressive easing. Policymakers face many constraints at present, some economic but others political. Their current focus is likely to be on stemming further downside risks and ensuring employment and social stability ahead of the 20th Party Congress.

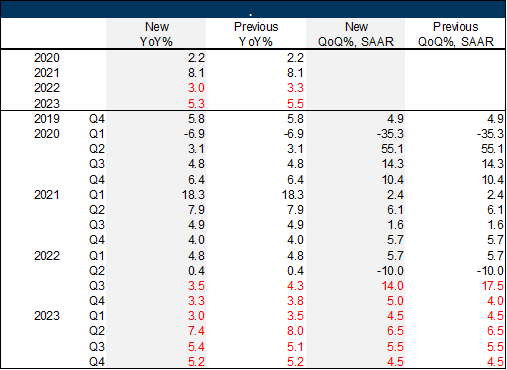

Lowering our Q3 GDP forecast: Taking into account the weaker-than-expected July data as well as near-term energy constraints, we cut our Q3 real GDP growth forecast from 17.5% (qoq annualized) to 14.0%, but lift our Q4 forecast from 4.0% (qoq annualized) to 5.0% on the assumption of easing energy constraints in Q4. These adjustments imply 3.5% yoy growth in Q3 and 3.3% yoy in Q4 (previously 4.3% and 3.8%, respectively). Our 2022 full-year forecast falls even further below consensus, to 3.0% (from 3.3% previously).

Weakness in demand and constraints to stimulus

A weak batch of data

Larger-than-expected drag from the property sector

Covid and other growth headwinds

PBOC rate cut through the lens of risk control

Constraints to major stimulus

Lowering Q3 and full-year GDP forecast

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.